Smartheat Inc. (HEAT +$1.27 or +8.00% to $17.14) posted a solid gain today with average volume, helping repair recent technical damage. It rallied to its third highest close ever. It is currently consolidating well above prior chart lows and its 50-day moving average (DMA) line coinciding in the $14.00 area as important support levels. Its latest breakout from a short "ascending base" type pattern was noted, however distributional action last week promptly negated its bullish 1/12/10 gain as it slumped back into its prior base. The weak action suggested that profit taking pressure was to blame. After getting off to a strong start, HEAT traded as much as +55.0% higher in the more than 8 week period since first featured in yellow in the 11/17/09 mid-day report (read here). While it could make a stand and go on rallying, time is needed to allow for a sound new base to form.

The number of top-rated funds owning an interest in its shares rose from 3 in Jun '09 to 26 in Dec '09, which is reassuring concerning the I criteria. The 3 latest quarters show sales revenues and earnings increases well above the +25% guideline, satisfying the C criteria. There is limited history for this small Chinese firm in the Pollution Control - Equipment group, however its reported annual earnings (A criteria) history has been strong.

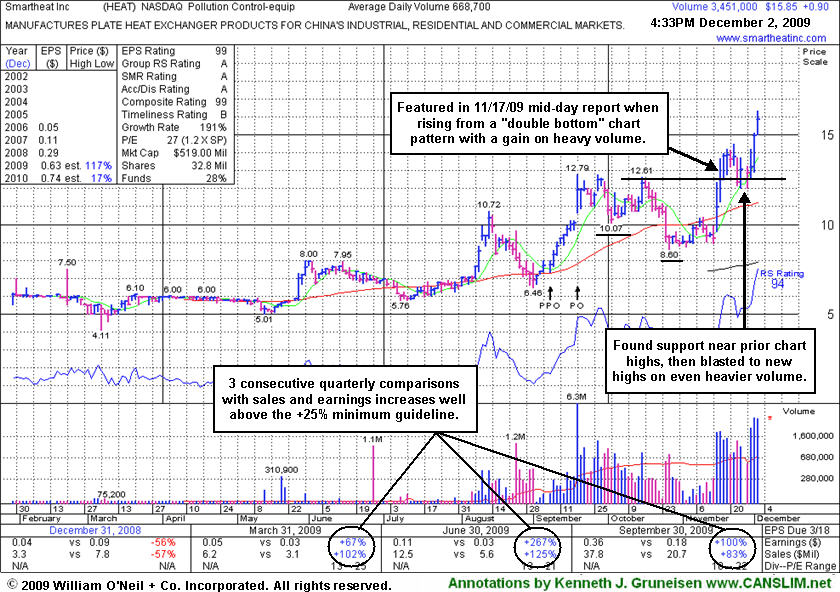

Smartheat Inc (HEAT -$0.16 or -1.09% to $14.52) is consolidating well above prior chart highs and its 50-day moving average (DMA) line coinciding in the $12.60 area as important support levels. The investment system rules say a stock should be held a minimum of 8 weeks after rising more than +20% in the first 2-3 weeks from being bought. HEAT traded as much as +43.9% higher since first featured in yellow in the 11/17/09 mid-day report (read here) when technically rising from a "double bottom" base, reaching a new all-time high.

The number of top-rated funds owning an interest in its shares rose from 3 in Jun '09 to 27 in Sept '09, which is reassuring concerning the I criteria. The 3 latest quarters show sales revenues and earnings increases well above the +25% guideline, satisfying the C criteria. There is limited history for this small Chinese firm in the Pollution Control - Equipment group, however its reported annual earnings (A criteria) history has been strong.

Smartheat Inc (HEAT +$0.07 or +0.42% to $16.59) has risen well beyond its "may buy" level after enduring some distributional pressure last week including negative reversals on 12/04/09 and 12/08/09. A steep upward trendline connecting recent chart lows helps define an initial support level to watch. It rose more than 20% in the first 2-3 weeks, so an investment system rule designed to help investors capture exceptional gains from the market's biggest winners now suggests to hold for a minimum of 8 weeks.

The number of top-rated funds owning an interest in its shares rose from 3 in Jun '09 to 26 in Sept '09, which is reassuring concerning the I criteria. The 3 latest quarters show sales revenues and earnings increases well above the +25% guideline, satisfying the C criteria. There is limited history for this small Chinese firm in the Pollution Control - Equipment group, however its reported annual earnings (A criteria) history has been strong. HEAT was first featured at $12.00 in yellow in the 11/17/09 mid-day report (read here) when technically rising from a "double bottom" base, reaching a new all-time high.

Smartheat Inc (HEAT +$0.92 or +6.15% to $15.87) posted a 3rd consecutive gain today on very heavy volume leaving it well beyond its "may buy" level at all-time highs. It found support near its pivot point during its recent consolidation, giving investors an opportunity to accumulate shares without chasing it and buying it "extended" from its latest base. Healthy stocks commonly retrace and test support before continuing higher, but they rarely fall under their pivot point by more than 7%. If ever a stock falls moire than 7% from your buy price, the investment system's rules say you should always limit the damage and sell the stock.

Since it rose more than 20% in the first 2-3 weeks there is another investment system rule which could now apply to investors who may have made recent buys within proper guidelines. The rule is designed to help investors capture exceptional gains from the market's biggest winners, and it says to hold a stock for a minimum of 8 weeks if it rises more than 20% from your buy price in the first 2-3 weeks.

The 11/17/09 Featured Stock Update write-up with an annotated graph under the headline "Close Near Pivot Point Equaled Best Ever" suggested that, "Pyramiding into the stock might allow careful investors to accumulate shares methodically without paying more than the $13.24 "max buy" price, which is 5% above its $12.61 pivot point." HEAT was first featured in yellow in the 11/17/09 mid-day report (read here) when technically rising from a "double bottom" base, reaching a new all-time high.

Note that on 9/18/09 it completed an additional share offering. There is limited history for this small Chinese firm in the Pollution Control - Equipment group, however its reported annual earnings (A criteria) history has been strong. The 3 latest quarters show sales revenues and earnings increases well above the +25% guideline, satisfying the C criteria.

Smartheat Inc (HEAT + 1.50 or +13.65% to $12.49) matched its best ever close to the penny, and volume was almost 4 times average behind its big gain. It ended near the middle of its intra-day range after reaching a new all-time high, closing the session just under its pivot point. In today's mid-day report it was highlighted in yellow and noted when technically rising from a "double bottom" base pattern (read here). The second consecutive big gain on heavy volume helped it blast further above its 50-day moving average line. The action could be a sign it is encountering resistance as it tries to move into new high ground. To convincingly clinch a technical buy signal one would like to see more definitive proof of institutional buying demand. Pyramiding into the stock might allow careful investors to accumulate shares methodically without paying more than the $13.24 "max buy" price, which is 5% above its $12.61 pivot point.

As is proper for a double bottom base, the consolidation took place over a period of at least an 8 week span, and the second low undercut the first low. The lower low is the crucial "shakeout" during which weaker hands decide to unload their shares, helping exhaust selling pressure. That kind of price action makes it an ideal set-up for a more powerful breakout, but a buy signal should be confirmed by a gain with at least +50% above average volume and a solid close above a stock's pivot point. Note that on 9/18/09 it completed an additional share offering. There is limited history for this small Chinese firm in the Pollution Control - Equipment group, however its reported annual earnings (A criteria) history has been strong. The 3 latest quarters show sales revenues and earnings increases well above the +25% guideline, satisfying the C criteria.