The Importance of an Upward Trendline - Friday, September 16, 2005

Break and Close Below 50 DMA - Fundamentals Lackluster -

The Importance of an Upward Trendline - Friday, September 16, 2005

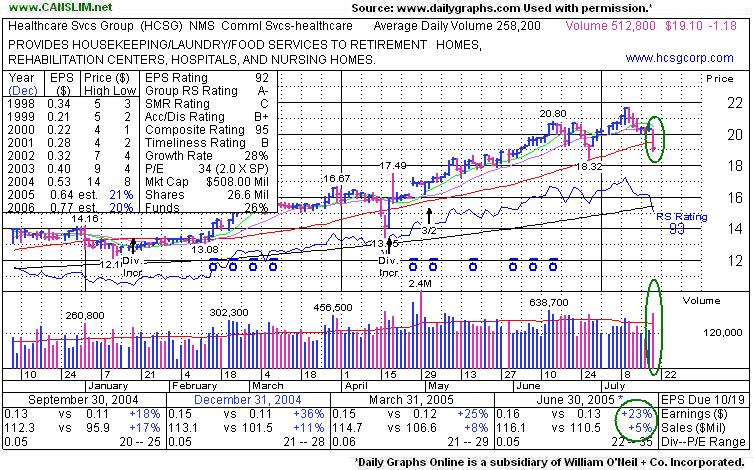

Healthcare Services Group (HCSG +$0.12, or +0.68%, to $17.67) broke below its 50-day moving avergage (DMA) line in the middle of July and failed abruptly on its latest attempt to rally back above it. It spent several sessions receding. The bulls showed up on Friday after a weak start and supported this stock above its intermediate-term upward trendline, and it closed higher on above average volume. However, this stock still has a significant amount of "overhead supply" above its current prices (prior highs and 50 DMA). That resistance is likely to keep it from blasting up in price as quickly as a fresh new breakout could. Also note that Its Relative Strength rank has fallen below guidelines. For those who may have ignored earlier sell signals it would only be encouraging to see this issue find support soon. A longer-term trend line and its 200 DMA (now $16.48) are also key chart support levels to see that it stay above.

Break and Close Below 50 DMA - Fundamentals Lackluster -

Healthcare Services Group (HCSG -$1.18 or -5.82% to $19.10) violated its 50-day moving average today and closed near its session lows. Its recently reported earnings for the quarter ended June 30, 2005 failed to meet the minimum +25% rise that is the minimum guideline for the C in CANSLIM. It still has a high EPS rank, but the lackluster earnings are definitely a concern. Obviously one can find better performing leaders demonstrating more exceptional earnings growth, so why settle? HCSG has been featured as "noteworthy" (yellow) several times since March 31, 2005. A complete note history can be viewed here.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports