In recent weeks we have taken the opportunity to use this section to revisit some of the previously featured stocks that were dropped some time ago based on technical and fundamental weakness. Studying what happened afterwards should hopefully allow investors to get a better understanding of the importance of having a sell discipline. If you are a new investor, or simply forgot how ugly the last Bear Market was for most stocks; the current Bear Market is offering everyone another lesson on how it works. Those who might otherwise still be tempted to say, "But its a good company", and hold a losing stock after it falls more than 7-8% from their buy price have an opportunity to learn why limiting losses while they are small is so important. These well-known, high-profile companies serve now as perfect examples that will hopefully allow investors in the future to recognize the warning signs and technical sell signals so they will know when it is time to lock in profits or minimize losses per the investment system's sell rules.

Garmin Ltd. (GRMN -$1.40 or -6.85% to $19.04) fell this week to its lowest level since August of 2004. It now faces a tremendous amount of resistance due to overhead supply, making the stock unlikely to be a market leader in the near term. Based on the weak action it was dropped from the Featured Stocks list on 11/7/07 after it had gapped down twice in the prior week triggering technical sell signals including a violation of its 50-day moving average (DMA) line and violation of its October chart lows with considerable losses on high volume. Its last appearance in the 7/30/07 CANSLIM.net After Market Update with an annotated graph included many details about prior coverage of this long-time leader (read here). GRMN had traded up as much as +309% since first featured on Thursday, December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here).

Sell signals prompted investors to unload GRMN shares long, long ago, and the stock has actually fallen an amazing -79.85% since it was dropped from the Featured Stocks list. Quarterly reports that have followed show decelerating sales growth and earnings falling below year-earlier comparisons. In this case, like we have often seen, fundamental deterioration followed an earlier technical sell signal.

Other articles this year have pointed out GRMN as an example including: Sunday, November 02, 2008 "Lessons Must Be Learned Or It Won't Get Any Easier", Sunday, March 02, 2008 "Titanic Losses Are Usually No Accident", and Tuesday, January 29, 2008 "Putting Some Recent High-Profile Breakdowns In Context".

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

Is there a previously featured stock you would like to see revisited in this section? Members are welcome and encouraged to write in and request that we take another detailed look at any of CANSLIM.net's previously featured stocks (click here).

Through the daily market commentaries provided at CANSLIM.net, we believe there has been a very clear message communicated to investors concerning the M criteria. Hopefully, you got it! If so, you reduced exposure and avoided being set back badly, saving yourself more than enough to justify the cost of your membership. The good news for all of us is that another bull market will eventually begin, offering us the opportunity to do an even better job of following the investment system's guidelines and generate above average returns. During the first few months of a new bull market, members who continue reading the daily CANSLIM.net reports will notice the next crop of market leaders capable of producing the greatest gains. The most important thing to do, for the time being, is stay out of harm's way, preserving your capital and your confidence. We welcome your praise, criticism, suggestions, or feedback in general (simply click here) about the job we are doing.

A very important technical tool that savvy investors have learned to incorporate in their technical analysis is the 50-day moving average (DMA) line. The 50 DMA line plays a pivotal role relative to a stock's price. If the price of a stock is above its 50 DMA then odds are that its 50 DMA will act as formidable support. Conversely, if the price is below its 50 DMA then the moving average acts as resistance. Healthy stocks sometimes trade under their 50 DMA lines briefly, but usually a strong candidate will promptly bounce and repair a 50 DMA violation. When a stock has violated its 50 DMA line and then lingers beneath it, the stock's outlook gets worse and worse as it spends a greater period of time trading under that important short-term average line. Once the 50 DMA line starts sloping downward it should also be acknowledged that the stock has been struggling for a while, and it might be time to reduce exposure and look for places to put that money to work in stronger buy candidates.

Garmin Ltd. (GRMN -$3.58 or -3.58% to $96.52) triggered another sell signal as it closed below its 50 DMA line for a third consecutive loss on above average volume after suffering a violent gap down earlier this week. On Monday, GRMN gapped down on its second highest volume day in history after Nokia Corp. (NOK -1.69%) announced that they are going to acquire Navtaq Corp. (NVT -0.53%), one of the largest digital map manufactures in the country. This led many investors to sell shares of competing portable GPS manufacturers on concerns that consumers will not need to purchase handheld GPS devices if they can begin using the same functions on their mobile phones. Technically, gaps are often signs of immense insitutional pressure, so gaps up are a good sign, and gaps down are obviously a bad sign. There is not a lot of chart support since GRMN had not spent much time basing, and it steadily advanced +100% since its 5/23/07 breakout above $60. The high volume losses in GRMN have triggered multiple sell signals as it violated its 50 DMA line and upward trendline. It will be interesting to see if this stock can find support near or above its August lows (near $86) and avoid a trip down to support at its longer term 200 DMA line over the next few weeks and months.

Garmin's shares have surged four fold since it was first featured on December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report and in the January 2005 issue of CANSLIM.net News (read here). Along the way GRMN went through some deep consolidations which included dips under its 50-day moving average (DMA) line, however the stock continually found support above its longer term 200 DMA line - a key moving average that healthy stocks typically stay trading above.

C A N S L I M | StockTalk | News | Chart | ![]()

![]()

![]() SEC | Zacks Reports

SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Garmin Ltd. (GRMN +$5.1701 or +6.47% to $85.07) jumped to a new all-time high close with considerable gains on above average volume on Monday. The stock held up very well considering last week's massive sell off. One of the easiest ways to isolate strength in a weak market is to look at stocks that hold up well while most of their peers get hammered. GRMN is up an impressive +41.66% since its late May 2007 breakout.

As of Monday's close, GRMN is trading +174% higher than when GRMN was first featured as a noteworthy stock appearing highlighted in yellow in the Thursday, December 23, 2004 CANSLIM.net Mid Day Breakouts Report (read here). Along the way GRMN went through some deep consolidations which included dips under its 50-day moving average (DMA) line, however the stock continually found support above its longer term 200 DMA line - a key moving average that healthy stocks typically stay trading above. It may be worth watching for a pullback to test chart support near its 50 DMA line, which could possibly be considered a secondary buy point for patient investors, however buying a stock while it is too far extended from a sound base or during a market correction is not prudent.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

A classic example of the success enjoyed by many CANSLIM.net readers usually starts when an investor reads a CANSLIM.net report and buys a featured stock before it has risen above the pivot point by greater than 5%. After a stock breaks out above its pivot point, there is only a +5% window that investors have to purchase the stock under the proper guidelines. Once a stock rises above the "maximum buy price" the risk of a shake out balloons, meaning that even a normal retracement in the stock might force you to employ the 7-8% loss cutting rule. Much can be told by the stock's daily action in the weeks and months that follow a breakout. Typically, a light volume and orderly pullback suggests that the bulls remain in control. However, high volume pullbacks that violate support paint a totally different picture.

Garmin Ltd. (GRMN +$1.80 or +2.45% to $71.57) surged today for a fourth straight all-time high close with gains on above average volume. GRMN triggered its latest technical buy signal on May 23, 2007 when it vaulted above its latest pivot point ($59.80) with a gain on heavy volume - and the technical buy signal and bullish action was summarized that evening in the "Featured Stock Update" section of the CANSLIM.net After Market Update with an annotated DailyGraph(R) (read here). A few days later, on May 30, 2007, the stock was featured in yellow in the CANSLIM.net Mid Day Breakouts Report (read here) as it was exploding higher. It has hardly looked back since, trading up nearly +20% in just a few weeks. Disciplined investors know that buying the stock now would be considered reckless, since it is trading well above its +$62.79 "maximum buy" price that is +5% beyond its latest pivot point from a sound base pattern.

Today the stock is trading about +133% higher than when GRMN was first featured as a noteworthy stock appearing highlighted in yellow in the Thursday, December 23, 2004 CANSLIM.net Mid Day Breakouts Report (read here). Along the way GRMN went through some deep consolidations which included dips under its 50-day moving average (DMA) line, however the stock continually found support above its longer term 200 DMA line - a key moving average that healthy stocks typically stay trading above. It may be worth watching for a pullback to test chart support near its 50 DMA line, which could possibly be considered a secondary buy point for patient investors, however buying a stock while it is too far extended from a sound base is not usually prudent.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Volume is a vital component of technical analysis. Prudent investors that incorporate volume into their stock analysis have often benefited several fold. Ideally, healthy stocks will more often tend to rise on higher volume and pullback on lighter volume. Volume is a great proxy for institutional sponsorship. Conversely, high volume declines can be an ominous, as this usually signals distribution and further price deterioration are more likely to follow.

Garmin Ltd. (GRMN $1.79 or +2.89% to $60.13) jumped to a fresh new 52-week high today with a considerable gain on two times average volume, triggering a technical buy signal that suggests higher prices are now more likely to follow. The fact that volume surged as this stock blasted above prior chart highs, where for months GRMN had encountered resistance in the $59 level, suggests that the institutional (the "I" criteria) crowd was accumulating shares. The company sports a very healthy Earnings Per Share (EPS) rating of 98, however, after a long period of consolidation its Relative Strength (RS) rating had slipped to 72, below the 80+ guideline. GRMN resides in the Telecom-Wireless Equip group which is currently ranked 82nd of out the 197 Industry Groups covered in the paper, placing it outside the much preferred top quartile. As it has formed a choppy flat base in recent months, its April 30th, 2007 high can now be used to arrive at a new $59.80 pivot point and $62.79 "max buy" price 5% above the pivot. Ideally its RS rank would improve along with confirming gains on above average volume in the days to follow. Avoid chasing the stock beyond the guidelines, and as always, limit losses by selling whenever a stock falls 7% below your purchase price to protect your capital.

GRMN's action was summarized in the Monday April 23, 2007 edition of the CANSLIM.net After Market Update (read here) as it was most recently fighting back above its 50-day moving average (DMA) line. In that detailed summary we said, "This candidate serves as a great example of how a stock can re-appear months after its first technical breakout is triggered. Before adding shares or making any initial purchases, it is of the utmost importance to see a new pivot point emerge and for this stock to eventually breakout above that level on at least +50% above average volume which will trigger a new technical buy signal. Without such a reassurance that the stock is being accumulated aggressively by institutional investors (the "I" criteria) its chances of making a sustained advance are looked at as questionable."

GRMN was first featured on Thursday, December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here) and, after a deep consolidation in the first half of 2005, it went on to enjoy a very impressive rally.

C A N S L I M | StockTalk | News | Chart |View all notes | Alert me of new notes | CANSLIM.net Company Profile

An upward trendline, by definition, develops as a stock steadily appreciates over an extended period of time. During that period the stock vacillates between the lower and upper boundaries of trendlines which can be drawn connecting a series of recent highs or lows. In order to ensure the overall health of the stock, the lower boundary should not be violated. Technically, if the lower boundary is violated this signals that the trend is deteriorating and bears are gaining control, making the odds start to favor the possibility of further downside testing.

For the past several weeks, Garmin Ltd. (GRMN +$0.11 or +0.20% to $55.12) has been generally finding support above its 50-day moving average (DMA) line, but it keeps running into resistance near prior chart highs. This stock was first featured on Thursday, December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here) and, after a deep consolidation in the first half of 2005, it went on to enjoy a very impressive rally. More recently, this featured stock's action was summarized in the Monday March 12, 2007 edition of the CANSLIM.net After Market Update (read here) as it was finding support near the lower boundary of its upward trendline and its 50 DMA line. Since then the volume totals have remained quieter than average, day after day, week after week, while it contiunes to finding support near its 50 DMA and at the lower boundary of its upward trendline.

During the long base building process, some of its ranks (which were once more compelling) have weakened. GRMN's Relative Strength (RS) rating is currently at 70, which is below the 80+ guideline. The stock's Relative Strength line (the jagged blue line) has also not confirmed any rally attempts by charging to new high territory. Ideally, it would rise to new highs, as a sign that the stock was showing better leadership. GRMN resides in the Telecom - Wireless Equip Group, which is currently ranked 69th out of the 197 groups covered in the paper, placing it outside of the preferred top quartile of industry groups for now.

This candidate serves as a great example of how a stock can re-appear months after its first technical breakout is triggered. Before adding shares or making any initial purchases, it is of the utmost importance to see a new pivot point emerge and for this stock to eventually breakout above that level on at least +50% above average volume which will trigger a new technical buy signal. Without such a reassurance that the stock is being accumulated aggressively by institutional investors (the "I" criteria) its chances of making a sustained advance are looked at as questionable. As always, stocks should be sold if they violate support or drop 7-8% below your purchase price to prevent the possibility of greater losses which can be damaging both psychologically and financially.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

A very important technical tool that savvy investors have learned to incorporate in their technical analysis is the 50-day moving average (DMA) line. The 50 DMA line plays a pivotal role relative to a stock's price. If the price of a stock is above its 50 DMA then odds are that its 50 DMA will act as formidable support. Conversely, if the price is below its 50 DMA then the moving average acts as resistance. Healthy stocks sometimes trade under their 50 DMA lines briefly, but usually a strong candidate will promptly bounce and repair a 50 DMA violation. When a stock has violated its 50 DMA line and then lingers beneath it, the stock's outlook gets worse and worse as it spends a greater period of time trading under that important short-term average line. Once the 50 DMA line starts sloping downward it should also be acknowledged that the stock has been struggling for a while, and it might be time to reduce exposure and look for places to put that money to work in stronger buy candidates.

Garmin Ltd. (GRMN $1.00 or +1.84% to $53.48) managed to close today's session above its 50 DMA line, the first close on the right side of that important moving average in over a week. This stock was first featured on Thursday, December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here) and, after a deep consolidation in the first half of 2005, it went on to enjoy a very impressive rally. More recently, this featured stock's action was summarized in the Friday February 16, 2007 edition of the CANSLIM.net After Market Update (read here) after its breakaway gap! Since then, negative market action has contributed to the stock's pullback, and it sliced under its 50 DMA line before finding support near $50, still above its longer term 200 DMA line.

The stock still has a some technical "damage" that needs to be repaired before it can be free to surge unhindered into new high ground. Prior chart highs in the $57-59 range are important hurdles that still need to be cleared with conviction. Hovering less than -10% below its 52-week high, with its fundamental ranks remaining solid, GRMN is a worthy candidate to keep on your watch list for when the next follow-through day emerges. Meanwhile, any weakness under the latest chart lows would prompt greater concerns and produce a technical sell signal.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Statistically, about 40% of winning stocks will pull back after breaking out. In other words, it is not uncommon for stocks to pullback and retest support near their pivot point after breaking out. It is important to see the bulls show up and offer support at or above the pivot point. This may offer investors a chance to increase their exposure before the stock continues advancing. However, an important caveat is that volume should contract as the stock pulls back towards its pivot point. Heavy volume behind losses can be cause for concern, especially if the stock does not find support at its pivot point. Whenever a recent breakout is completely negated by a loss that leads to a close back in the prior base, this is construed as a technical sell signal and a sign that the bears are regaining control.

Garmin Ltd. (GRMN -$0.73 or -1.29% to $55.77) continued pulling back Friday, retreating after its recent bullish break-away gap. This stock was first featured on Thursday, December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here) and, after a deep consolidation in the first half of 2005, it went on to enjoy a very impressive rally. More recently, this featured stock's action was summarized in the Wednesday November 1, 2006 edition of the CANSLIM.net After Market Update (read here) as it gapped down, slicing under its 50-day moving average (DMA) line with a considerable loss on monstrous volume! The resilient stock steadily advanced and repaired the damage. However, as soon as this stock reached new all-time high territory it again encountered heavy distribution. On December 29, 2006, GRMN negatively reversed from a new high and began moving lower. A few weeks later, after again falling under its 50 DMA line, it found support just above its longer term 200 DMA line.

Earlier this week, GRMN gapped up into new high territory. Gaps are often considered as very important indications of substantial institutional buying or selling pressure, depending on the direction of the gap. In this case, considerable gains backed by heavy volume were a result of strong buying demand after it reported impressive fourth quarter financial results, with revenues up +91% and earnings up +105% versus the year ago quarter. However, GRMN closed Friday's session falling back below its prior best high close of $56.25, which has effectively negated the latest bullish breakout. Concerns about how sustainable the rally effort will be have been raised because it has promptly fallen back into its prior base, rather than confirming the breakout with follow-through gains on heavy volume. Healthy stocks will rarely fall back below their prior chart highs or pivot points by more than 7%, so additional declines for GRMN should prompt more serious concerns for anyone owning it.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

It is very important to isolate the noise and pay attention to price and volume as we make our way through yet another earnings season. There are a slew of analysts that come out and set "targets" and who constantly engage in publishing upgrades or downgrades on various securities. An important element in profitably navigating through a busy earnings season is to see how your individual holdings react to their latest earnings news and guidance. While it is a common occurrence to see stocks sell off after a new earnings report, it is healthy to see investors promptly bid the stocks higher after a company reports their quarterly results. Investors that objectively analyze price and volume will likely do better than blindly following a plethora of analysts' upgrades and downgrades.

Garmin Ltd. (GRMN -$8.43 or -15.78% to $44.98) gapped down for a considerable loss and closed near the session's low, falling on more than 10 times its average daily volume! This stock was first featured on Thursday, December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here) and, after a deep consolidation in the first half of 2005, it went on to enjoy a very impressive rally. More recently, this featured stock's action was summarized in the Wednesday September 27, 2006 edition of the CANSLIM.net After Market Update (read here) as it was attempting to rallying above the pivot point of its double bottom pattern. However, that report clearly noted that "...it failed to produce the necessary volume or gain enough ground to trigger a proper technical buy signal."

Since the September 27th summary, GRMN continued rallying and ultimately hit a new high on October 26, 2006. However, once again, volume failed to meet the required +150% guideline to trigger a valid technical buy signal for anyone looking to initiate new buying efforts. And the very next day, October 27, 2006, this issue negatively reversed from new high territory, providing a clear hint that it was encountering resistance as it tried to rally into new high ground. One wouldn't have necessarily expected a such a great failure based on that action, but its inability to make meaningful progress from that level was an obvious disappointment for the bulls. In reaction to its latest earnings report, today it gapped down on monstrous volume, sliced through its 50 DMA, and negated its light volume move above the pivot point at the center of the "W" ($47.94 on 9/5/06) of an earlier double bottom pattern, causing material technical damage.

Some technicians may argue that the recent action in GRMN was a big "double top", which is often an ominous technical pattern. Opposite a double bottom's characteristics, a double top occurs when a stock rallies to a new chart high, then promptly runs out of gas. The second high is always a little higher than the first high in a correct double top pattern, so the stock may actually look like a breakout - then that false breakout promptly fails! When the stock rises above old highs and is in a perfect position to really explode to the upside, but it doesn't, and it falls back into the prior base, ask yourself, "What is wrong with this picture?" Taking action, by reacting to a stock's moves, is imperative to achieving above average results using the CANSLIM(R) investment program. For those who may have owned GRMN, today's action was a strong technical sell signal.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Once again, the "L" criteria in CAN SLIM(TM) tells investors to choose leading companies in leading industry groups, and when we have identified a high-ranked leader with the proper characteristics we should wait and watch for gains on at least +50% above average volume as a confirmation that a breakout is attracting meaningful institutional sponsorship. A classic example of the success enjoyed by many CANSLIM.net readers usually starts when an investor reads a CANSLIM.net report and buys a featured stock before it has risen above the pivot point by greater than 5%. After a stock triggers a technical buy signal and is purchased, it is always important to employ the 7-8% loss cutting rule in the event of a downturn.

Garmin Ltd. (GRMN $2.03 or 4.11% to $47.37) rose above its 50-day moving average (DMA) line and rose above a downward trend line with gains on +35% above average volume today. It nearly attempted to rally above the pivot point of a double bottom pattern, but it failed to produce the necessary volume or gain enough ground to trigger a proper technical buy signal. This stock was first featured on Thursday, December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here) and, after a deep consolidation in the first half of 2005, it went on to enjoy a very impressive rally.

More recently, this featured stock's action was summarized in the Friday August 25, 2006 edition of the CANSLIM.net After Market Update (read here). GRMN spent the next few weeks struggling under its 50-day moving average (DMA) line while staying well above its longer-term 200 DMA. The middle of the "W" is now being considered its new pivot point, the $47.94 high it hit on September 5th. Today it hit an intra-day high of precisely $47.94, but it didn't trade one penny above that pivot point. In addition, volume, always a critical component of a technical breakout, failed to meet the +50% above average guideline which is also very important. The gains today were encouraging, and if this stock manages to rise above the $47.94 pivot point on sufficiently heavy volume, then a new technical buy signal will be triggered. As always, keep your losses small by adhering to the 7-8% sell rule.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

An upward trendline, by definition, develops as a stock steadily appreciates over an extended period of time. During that period the stock vacillates between the lower and upper boundaries of trendlines which can be drawn connecting a series of recent highs or lows. In order to ensure the overall health of the stock, the lower boundary should not be violated. Technically, if the lower boundary is violated this signals that the trend is deteriorating and bears are gaining control, making the odds start to favor the possibility of further downside testing.

Garmin Ltd. (GRMN +$0.40 or +0.90% to $44.24) closed modestly higher on one of its lightest trading days of the year. This stock was first featured on Thursday, December 23rd, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here). More recently, the stock's action since it was originally featured was summarized in greater detail in the Wednesday June 28, 2006 edition of CANSLIM.net After Market Update as the stock was surging to new high ground (read here). But it soon encountered heavy distribution, and on July 7th it fell back under chart support near $50 at prior highs into the prior base. As it violated its 50 DMA on July 27, 2006, with a considerable loss on heavier than normal volume, it triggered a technical sell signal. GRMN again appeared in the August 1, 2006 CANSILM.net After Market Report (read here) three days after it sliced through its 50 day moving average (DMA) and began rolling over. On the latest rally attempt its 50 DMA became a clear point of resistance. Until this issue manages to trade back above its 50 DMA with gains on meaningful volume, disciplined investors would wisely refrain from initiating any new positions. For those investors who have not sold GRMN, which could be justified only if it is owned at much lower prices from long ago, it is important to note that this stock is currently resting on a very well defined upward sloping trendline connecting the July '05, December '05, and February '06 chart lows, which is best viewed on a longer-term weekly or monthly chart (not shown). Obviously if this longer-term trendline is violated then technically the bears will have won a decisive victory and the path of least resistance will be more likely to lead to even lower share prices.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports

A very important technical tool that savvy investors have learned to incorporate in their technical analysis is the 50-day moving average (DMA) line. The 50 DMA line plays a pivotal role relative to a stock's price. If the price of a stock is above its 50 DMA then odds are that its 50 DMA will act as formidable support. Conversely, if the price is below its 50 DMA then the moving average acts as resistance. Healthy stocks sometimes trade under their 50 DMA lines briefly, but usually a strong candidate will promptly bounce and repair a 50 DMA violation. When a stock has violated its 50 DMA line and then lingers beneath it, the stock's outlook gets worse and worse as it spends a greater period of time trading under that important short-term average line. Once the 50 DMA line starts sloping downward it should also be acknowledged that the stock has been struggling for a while, and it might be time to reduce exposure and look for places to put that money to work in stronger buy candidates.

Garmin Ltd. (GRMN -$4.99 or -5.25% to $90.00) was first featured at $61.37 on Thursday, December 23rd, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here). The Wednesday June 28, 2006 edition of CANSLIM.net After Market Update (read here) detailed this stock's action since it was originally featured. Since the latter report, however, this stock has placed a near term top and begun rolling over. On July 7th, it gapped down for a considerable loss on heavy volume, falling back into its prior base. Then it sliced under its 50 DMA on July 27th, flashing a clear technical sell signal which was noted during the session and in that evening's report (read here). During the next few days this stock failed to repair the damage, running into resistance at its 50 DMA as its gain came on lighter volume than the damaging losses in two prior session.

Today, GRMN gapped lower for another loss on above average volume. This is the latest example of how difficult the recent market environment has been. It emphasizes the importance of adhering to strict sell rules and always cutting your losses at 7-8% before they have a chance to cause more serious damage to your account equity. Prior chart lows near $80 and the 200 DMA line are distant support that offer little hope for investors now, especially if they are attempting to be at all dilligent about limiting losses per the guidelines.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks ReportsView all notes | Alert me of new notes | CANSLIM.net Company Profile

Once again, the "L" criteria in CAN SLIM(TM) tells investors to choose leading companies in leading industry groups, and when we have identified a high-ranked leader with the proper characteristics we should wait and watch for gains on at least +50% above average volume as a confirmation that a breakout is attracting meaningful institutional sponsorship in a condusive market environment "M" in CAN SLIM(TM). A classic example of the success enjoyed by many CANSLIM.net readers usually starts when an investor reads a CANSLIM.net report and buys a featured stock before it has risen above the pivot point by greater than 5%. After a stock triggers a technical buy signal and is purchased, it is always important to employ the 7-8% loss cutting rule in the event of a downturn.

Garmin Ltd. (GRMN $5.24 or 4.87% to $102.30) surged to a fresh 52-week high on Wednesday on above average turnover. GRMN's story is very interesting. This stock was first featured on Thursday, December 23, 2004 in the CANSLIM.net Mid Day Breakouts Report (read here). However, after two short weeks, this stock turned lower, negated its breakout and sliced under its 50 DMA on above average volume. This breakdown sent GRMN below the 7-8% sell guideline which would have been applicable for anyone who bought it at around that time. This issue spent the first 4 months of 2005 moving lower, and at the time the broader market (the "M" criteria) was also in a slump. After the bulls returned in force and regained control of the market, GRMN blasted to a new 52-week high on above average volume in September of 2005. However, it rose to new highs without stopping to form a handle on what was a long cup-shaped base to buy from. The note in the September 16, 2005 CANSLIM.net's Mid-Day Breakouts Report (read here) summed it up as, "no base." A month later the overall market began correcting, and once again, GRMN pierced its 50 DMA, taking even more time to consolidate after its move up from a low in the $39 range. This time the pullback was shallow as GRMN spent 5 more months building a new base. Ultimately, GRMN broke out of its new "base-on-base" type of pattern during the first week of March 2006. Volume failed to meet the +50% above average volume guideline as it cleared the $70 range so it did not show up as a featured stock until March 3rd, 2006 when GRMN appeared in the CANSLIM.net's Mid-Day Breakout Report (read here) with the following note,"Too extended from a sound base of support at this point to be considered buyable under the guidelines." When the sufficient volume showed up, GRMN had already moved very quickly above its prior highs and pivot point by more than +5% and exceeded the "maximum buy price". That didn't stop it from continuing higher. It has solidly outperformed the major averages and its peers.

Because of its impressive fundamentals and bullish technical trend, GRMN was featured in great detail in the June 2006 issue of CANSLIM.net News (read here). We did not publish a new pivot point of $101.98 ($0.10 above the 5/11/06 high) in that report primarily because at that time the new base was too short to consider that as a legit pivot point. Another reason GRMN was again featured was to suggest the idea of buying/adding based on the bounce at the 50 DMA, or after it built out a longer base and then spiked above a new pivot point. GRMN recently experienced a mild pullback to its 50 DMA, then later it repaired a more serious "shakeout" under its 50 DMA line by promptly rallying back on June 14th and 15th with considerable gains on heavy volume. That gave its chart the look of a potentially bullish "double bottom" pattern. Moreover, the proper pivot point of that double bottom was cleared on June 21st and confirmed on June 22nd as GRMN traded above $98.25 (middle of "W"). It is worthwhile to point out that the major averages have not produced a good confirmed rally, and that is a sign that the market conditions are hurting investors odds right now. However, by moving above a pivot point of $101.98 to new all-time high territory on volume more than +50% above average today GRMN has now cleared a 2-month base. Proper discipline dictates that new purchases should be avoided until a sound follow-through day in the broader market is produced. Be disciplined whenever you decide to buy, and always be disciplined about limiting your downside by selling if any stock falls more than 7-8% from your purchase price.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

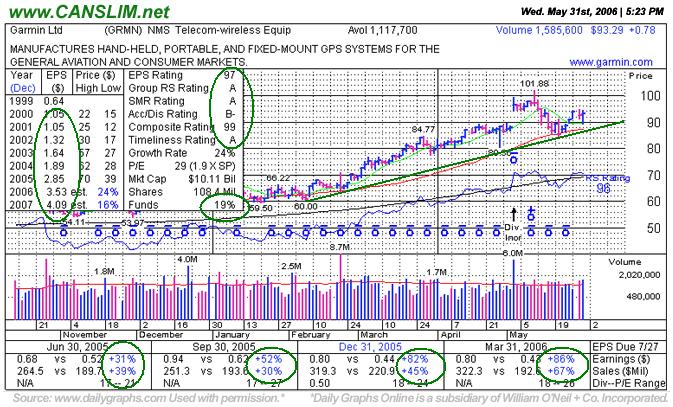

|

Garmin Ltd. |

||

|

Ticker Symbol: GRMN (NASDAQ) |

Industry Group: Scientific & Technical Instruments |

Shares Outstanding: 108,390,000 |

|

Price: $93.29 |

Day's Volume: 1,585,600 5/31/2006 4:00PM ET |

Shares in Float: 75,900,000 |

|

52 Week High: 101.88 |

50-Day Average Volume: 1,117,700 |

Up/Down Volume Ratio: 1.6 |

|

Pivot Point: $70.78 |

Pivot Point +5% = Max Buy Price: $74.21 |

Web Address: http://www.garmin.com |

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports

CANSLIM.net Profile: Garmin, Ltd., through with its subsidiaries, engages in the design, manufacture, and marketing of navigation, communications, and information products, which are enabled by global positioning system (GPS) technology worldwide. The company also develops Web-based applications for GPS devices, as well as operates a Web site, www.motionbased.com. It sells its products to retail outlets and aircraft manufacturers through a network of approximately 3000 independent dealers and distributors in approximately 100 countries. Garmin’s products are used in the aviation, marine, general recreation, land, automotive, wireless, and original equipment manufacturer applications. Its earnings per share have steadily increased by more than +31%, +52%, +82% and +86% respectively in the past four quarterly comparisons (Jun, Sep, Dec '05, Mar '06) versus the year earlier, and its strong annual earnings history help this issue meet the "C" and "A" criteria. Return on Equity is 30%, sharply higher than the +17% guideline. Management owns a +24% stake, keeping them keenly focused on shareholder value. This issue has been a solid leader over the past four months. The Telecom-Wireless Equipment group is now ranked 30th out of 197 Industry Groups, satisfying the "L" criteria.

What to Look For and What to Look Out For: As long as this issue continues trading above its 50 DMA higher prices will likely follow. However, if the bears come after this leader and its 50 DMA is breached then strong defense is in order. After impressive runs, healthy stocks tend to pullback and find support at their 50-day moving average (DMA) lines. GRMN has done exactly that. Savvy investors have learned to use these inevitable pullbacks as buying opportunities, and it is sometimes adviseable to accumulate shares upon the first successful test of the 50 DMA after a stock has gotten off to a great start. The main obstacle at this juncture is that the market direction (the “M” criteria) continues to act poorly, which is very bad for investors' odds since 3 out of 4 stocks move alongside the major averages. Therefore, if the market offers a proper follow through day, GRMN is an impressive candidate that should be kept on your watch list. However, if the market fails to produce a valid follow through day then all bets are off.

Technical Analysis: GRMN blasted out of a solid 7-month base on monstrous volume during the first week of March and has not looked back since. During that time, this issue has vaulted an impressive +40% before its recent pull back. It even gapped higher on May 3rd with a considerable gain on massive volume, however since then it has been working on building out a new base. If a sufficient length base is formed in the $85-100 range, then investors might even consider it closely upon any volume driven breakout to new highs above a new higher pivot point.