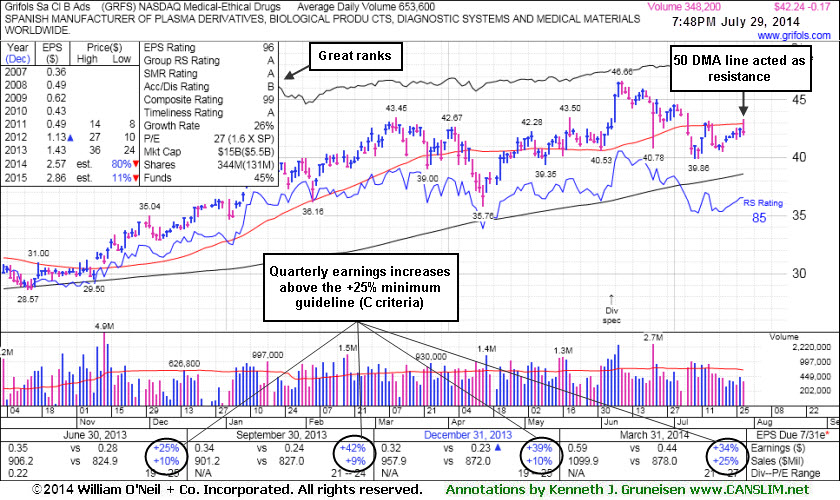

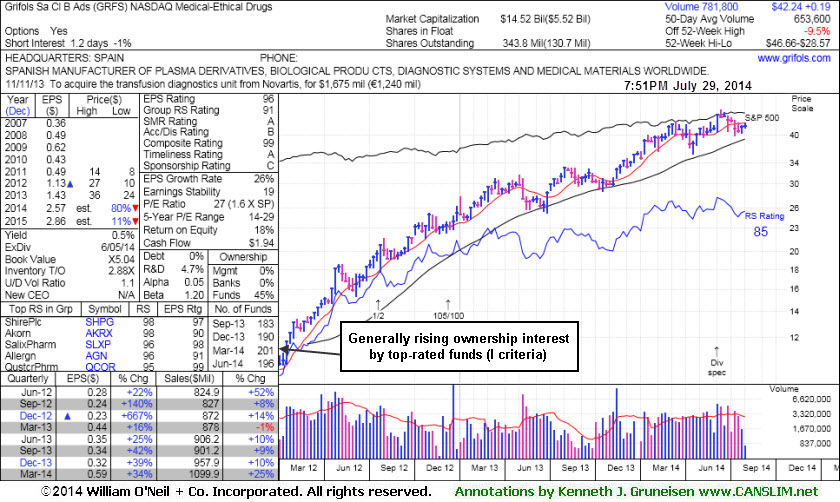

Encountered Resistance at 50-Day Moving Average Line - Tuesday, July 29, 2014

Grifols Sa Ads (GRFS -$0.17 or -0.40% to $42.24) encountered resistance again today at its 50-day moving average (DMA) line. A rebound above that important short-term average is still needed for its outlook to improve. A subsequent violation of its recent low ($39.86 on 7/10/14) would raise more serious concerns and trigger more worrisome sell signals. Meanwhile it faces resistance due to overhead supply up through the $46 area.

GRFS was last shown in this FSU section on 7/09/14 with annotated graphs under the headline, "Violation of 50-Day Moving Average Triggered Technical Sell Signal", after it had slumped below its 50 DMA line with damaging losses on higher volume. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price.

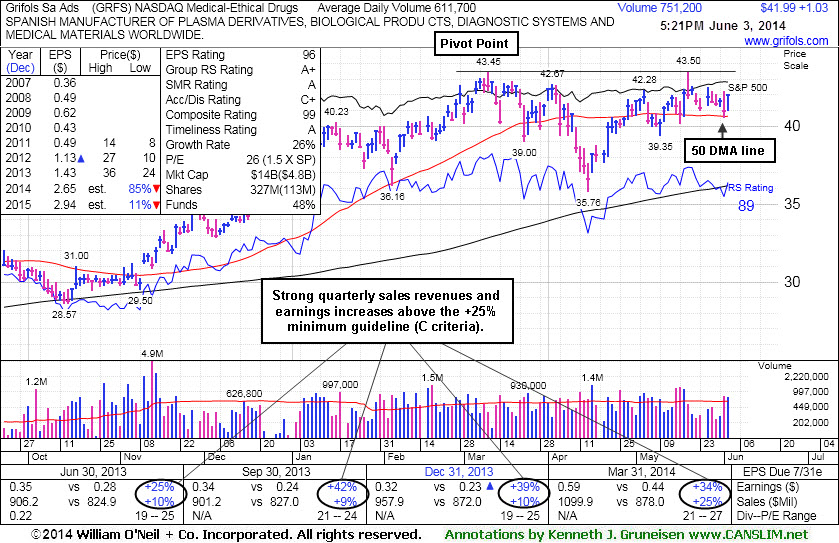

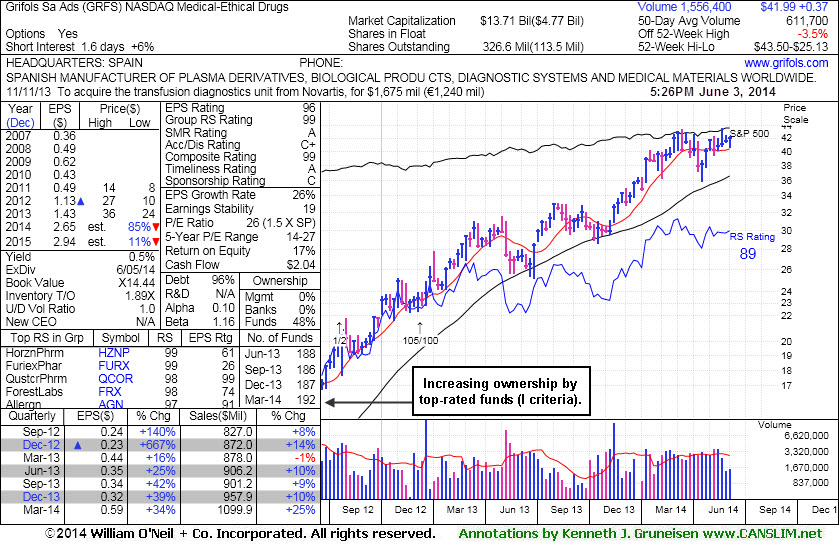

This Spanish firm from the Medical- Ethical Drugs industry was first highlighted in yellow at $41.14 with pivot point cited based on its 3/11/14 high plus 10 cents in the 5/15/14 mid-day report (read here). Technically, it triggered a buy signal with a volume-driven gain on 6/06/14 but stalled soon thereafter.

Keep in mind that volume and volatility often increase near earnings news and its Jun '14 quarterly report is due soon. It reported earnings +34% on +25% sales revenues for the Mar '14 quarter, marking its 4th consecutive quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings history (A criteria) has also been strong. The number of top-rated funds owning its shares rose from 186 in Sep '13 to 196 in Jun '14, a reassuring sign of institutional buying demand (I criteria). Its current Up/Down Volume Ratio of 1.1 is an unbiased indication that its shares have been under very slight accumulation over the past 50 days.

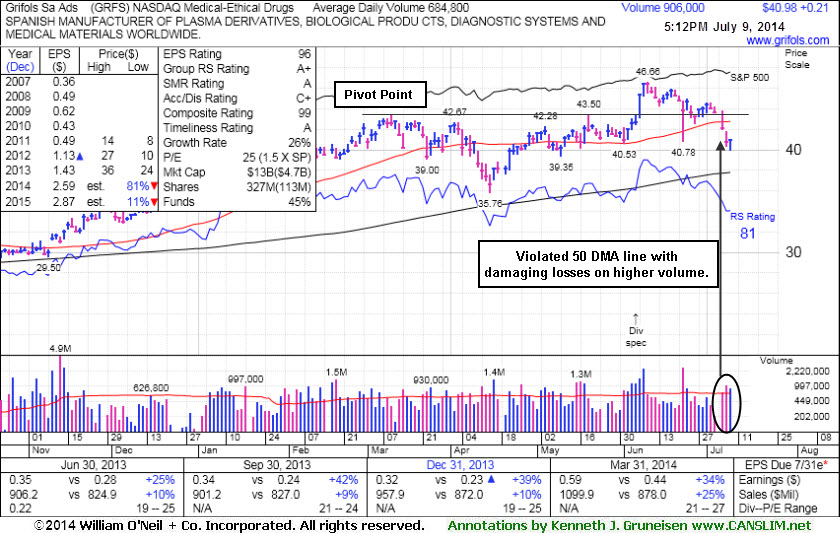

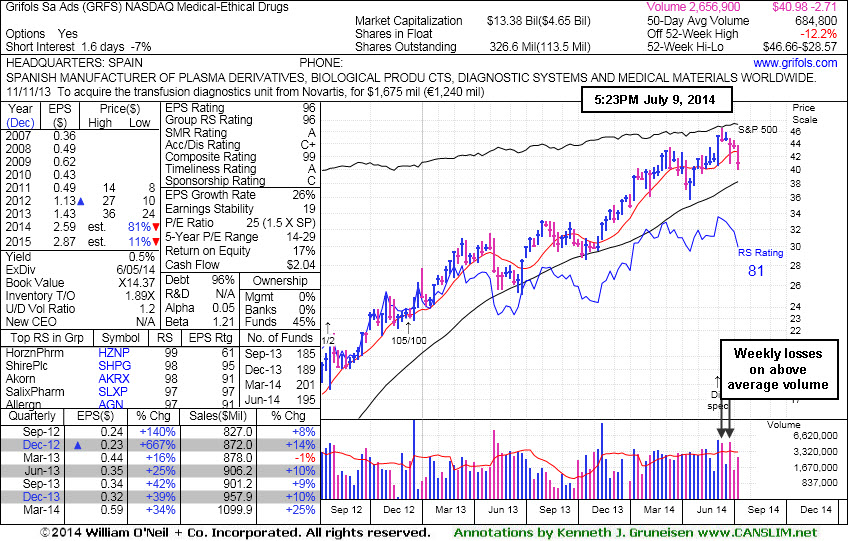

Violation of 50-Day Moving Average Triggered Technical Sell Signal - Wednesday, July 09, 2014

Grifols Sa Ads (GRFS +$0.21 or +0.52% to $40.98) recently slumped below its 50-day moving average (DMA) line with damaging losses on higher volume. A rebound above its 50 DMA line is needed for its outlook to improve. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price. It was last shown in this FSU section on 6/17/14 with annotated graphs under the headline, "Consolidating Just Below 'Max Buy' Level", following its technical breakout.This Spanish firm from the Medical- Ethical Drugs industry was first highlighted in yellow at $41.14 with pivot point cited based on its 3/11/14 high plus 10 cents in the 5/15/14 mid-day report (read here). Technically, it triggered a buy signal with a volume-driven gain on 6/06/14 but stalled soon thereafter.

It reported earnings +34% on +25% sales revenues for the Mar '14 quarter, marking its 4th consecutive quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings history (A criteria) has also been strong. The number of top-rated funds owning its shares rose from 186 in Sep '13 to 195 in Jun '14, a reassuring sign of institutional buying demand (I criteria). Its current Up/Down Volume Ratio of 1.2 is an unbiased indication that its shares have been under accumulation over the past 50 days.

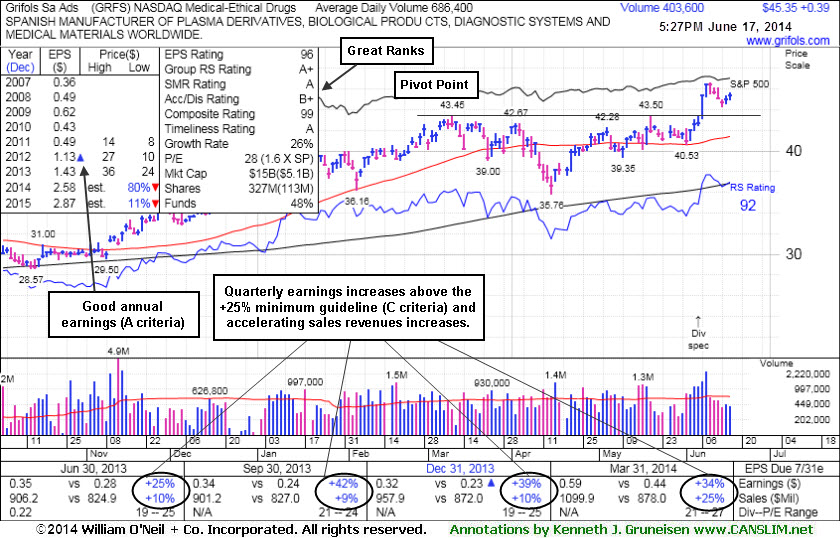

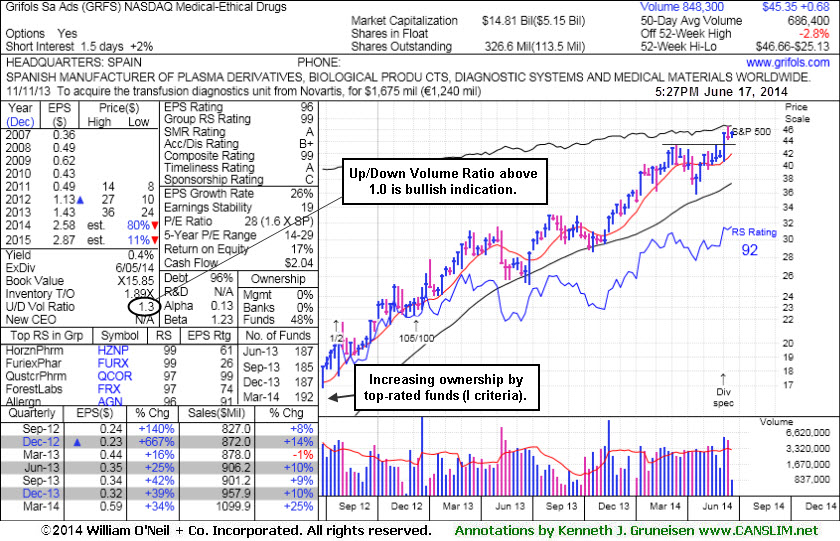

Consolidating Just Below "Max Buy" Level - Tuesday, June 17, 2014

Grifols Sa Ads (GRFS +$0.39 or +0.87% to $45.35) is still consolidating below its "max buy" level with volume totals cooling following its technical breakout. Its old resistance level, prior highs near $43 area, defines important initial support to watch on pullbacks. Disciplined investors avoid chasing stocks extended more than +5% above their prior highs and they always limit losses by selling any stock that falls more than -7% from their purchase price.

This Spanish firm from the Medical- Ethical Drugs industry has no resistance remaining due to overhead supply. It was first highlighted in yellow at $41.14 with pivot point cited based on its 3/11/14 high plus 10 cents in the 5/15/14 mid-day report (read here). Technically, it triggered a buy signal with a volume-driven gain on 6/06/14, shortly after appearing in this FSU section on 6/03/14 with annotated graphs under the headline, "Finding Support Above 50-Day Moving Average".

It reported earnings +34% on +25% sales revenues for the Mar '14 quarter, marking its 4th consecutive quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings history (A criteria) has also been strong. The number of top-rated funds owning its shares rose from 186 in Sep '13 to 192 in Mar '14, a reassuring sign of institutional buying demand (I criteria). Its current Up/Down Volume Ratio of 1.3 is an unbiased indication that its shares have been under accumulation over the past 50 days.

Finding Support Above 50-Day Moving Average - Tuesday, June 03, 2014

Grifols Sa Ads (GRFS +$1.03 or +2.51% to $41.99) has been finding support at its 50-day moving average (DMA) line after enduring distributional pressure. This Spanish firm from the Medical- Ethical Drugs industry needs subsequent volume-driven gains for new highs to trigger a technical buy signal. Little resistance remains due to overhead supply. It was last shown in this FSU section on 5/15/14 with annotated graphs under the headline, "Perched Within Close Striking Distance of New Highs", after highlighted in yellow with pivot point cited based on its 3/11/14 high plus 10 cents in the earlier mid-day report (read here).

It reported earnings +34% on +25% sales revenues for the Mar '14 quarter, marking its 4th consecutive quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings history (A criteria) has also been strong. The number of top-rated funds owning its shares rose from 186 in Sep '13 to 192 in Mar '14, a reassuring sign of institutional buying demand (I criteria).

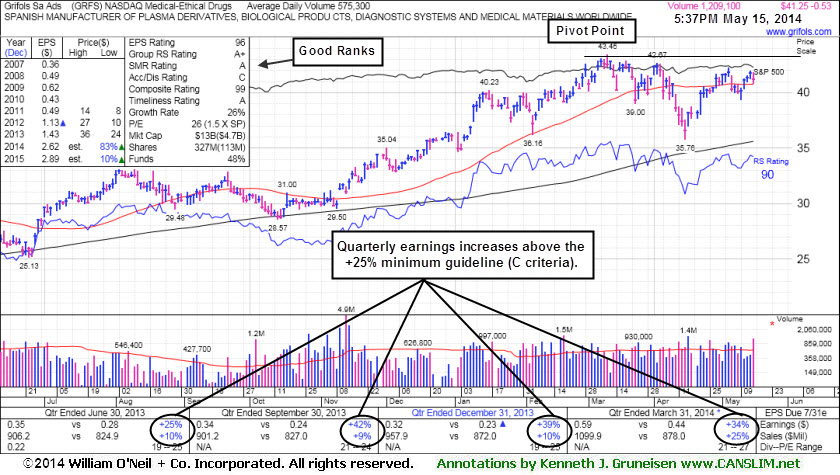

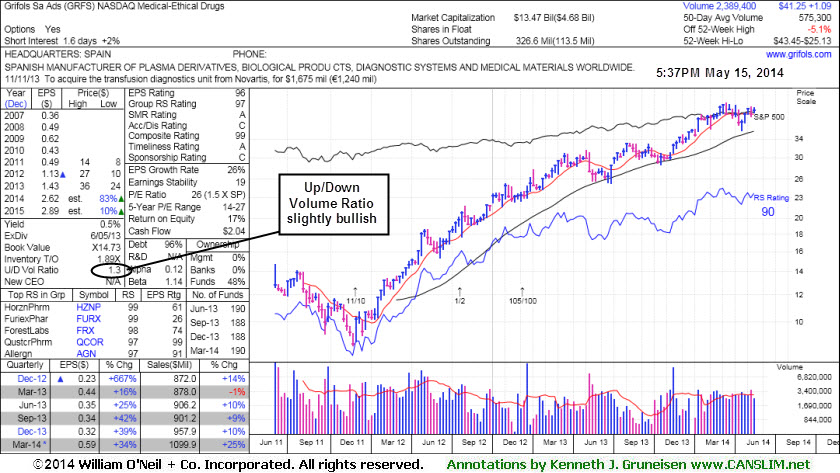

Perched Within Close Striking Distance of New Highs - Thursday, May 15, 2014

Grifols Sa Ads (GRFS -$0.53 or -1.27% to $41.25) was highlighted in yellow with pivot point cited based on its 3/11/14 high plus 10 cents in the earlier mid-day report (read here). This Spanish firm from the Medical- Ethical Drugs industry is consolidating near its 50-day moving average (DMA) line with little resistance remaining due to overhead supply. Subsequent volume-driven gains for new highs (N criteria) are needed to trigger a technical buy signal. Meanwhile, it is an ideal candidate for investors' watch lists.

It reported earnings +34% on +25% sales revenues for the Mar '14 quarter, marking its 4th consecutive quarter with earnings above the +25% minimum guideline (C criteria). Its annual earnings history (A criteria) has also been strong. The current Up/Down Volume Ratio of 1.3 is above the neutral 1.0 reading, an unbiased indication its shares have been under accumulation over the past 50 days.