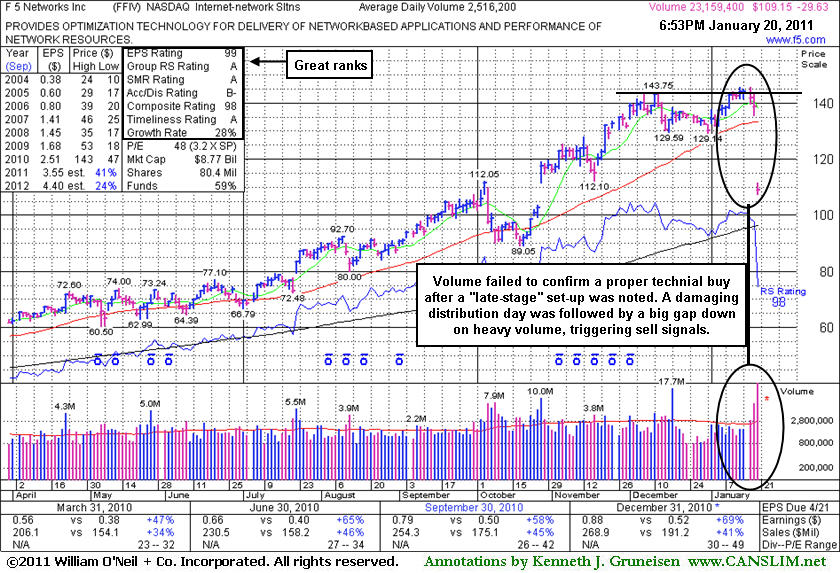

Late-Stage Base Never Produced New Buy Signal - Thursday, January 20, 2011

F5 Networks Inc.'s (FFIV -$29.63 or -21.35% to $109.15) suffered a damaging gap down today and violated its 50-day moving average (DMA) line and prior chart lows in the $129 area, triggering technical sell signals. Yesterday its color code was changed to green after a small but damaging loss with heavier volume on the prior session was noted - "The loss is a sign of more serious distributional pressure while slumping below its pivot point after not breaking out with volume conviction from a late-stage base." Disciplined investors resist the urge to get in "early", and this demonstrates the risk of doing so when considering any leader during a "late-stage" base.

In its last FSU appearance on 12/28/10 the analysis included under the headline "Recent Lows Define Support Above 50-Day Average" stated - "Its recent low ($129.59 on 12/16/10) defines initial chart support well above its 50-day moving average (DMA) line. Violations leading to technical damage may trigger technical sell signals prompting investors to lock in profits. It is extended from any sound base and disciplined investors would avoid chasing it, while it still could go on to produce more climactic gains, or it might eventually form a new base we can identify." A late-stage base never produced a valid new buy signal.

The number of top-rated funds owning its shares rose from 914 in March '10 to 967 as of Dec '10, a reassuring sign with respect to the I criteria. The company currently sports a very healthy Earnings Per Share (EPS) rating of 99 and a Relative Strength (RS) rating of 98. It resides in the Internet- Networking Solutions group which is an Industry Group showing lots of leadership, satisfying the "L" criteria. Its latest quarterly sales and earnings results showed impressive growth satisfying the C criteria. The company has maintained a good annual earnings (A criteria) history. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. During the past 6 years, FFIV has built several bases, and it has also been through some tough consolidation periods. It has rallied up as much as +94% since returning to the Featured Stocks list when it was highlighted in yellow in the June 16th, 2010 mid-day report and its breakout above $74 was shown that evening (read here).

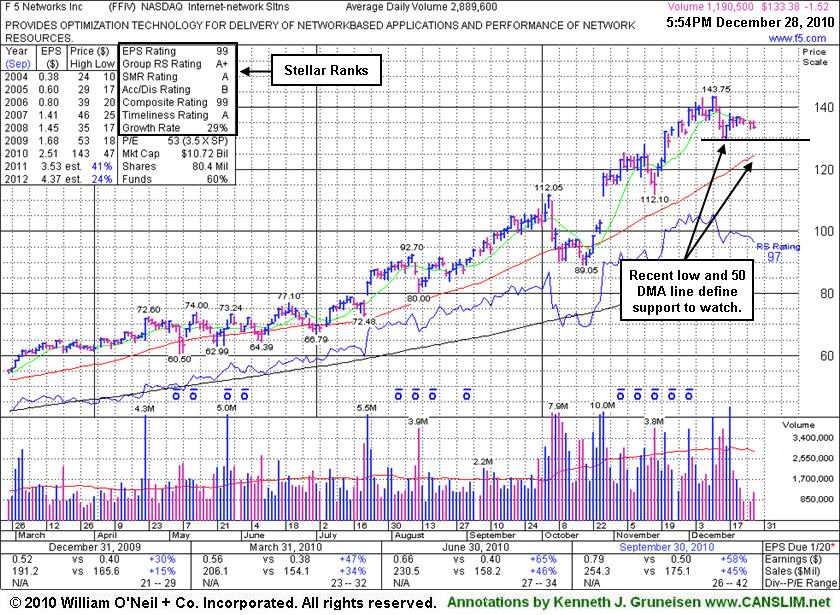

Recent Lows Define Support Above 50-Day Average - Tuesday, December 28, 2010

F5 Networks Inc.'s (FFIV -$1.52 or -1.13% to $133.38) volume totals have been cooling while consolidating in a tight range, and it finished today's session only -7% off its all-time high. Its recent low ($129.59 on 12/16/10) defines initial chart support well above its 50-day moving average (DMA) line. Violations leading to technical damage may trigger technical sell signals prompting investors to lock in profits. It is extended from any sound base and disciplined investors would avoid chasing it, while it still could go on to produce more climactic gains, or it might eventually form a new base we can identify.

The number of top-rated funds owning its shares rose from 900 in Dec '09 to 957 as of Sept '10, a reassuring sign with respect to the I criteria. The company currently sports a very healthy Earnings Per Share (EPS) rating of 99 and a Relative Strength (RS) rating of 97. It resides in the Internet- Networking Solutions group which is an Industry Group showing lots of leadership, satisfying the "L" criteria. Its quarterly sales and earnings results showed impressive growth satisfying the C criteria. The company has maintained a good annual earnings (A criteria) history. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. During the past 6 years, FFIV has built several bases, and it has also been through some tough consolidation periods. It has rallied up as much as +94% since returning to the Featured Stocks list when it was highlighted in yellow in the June 16th, 2010 mid-day report and its breakout above $74 was shown that evening (read here).

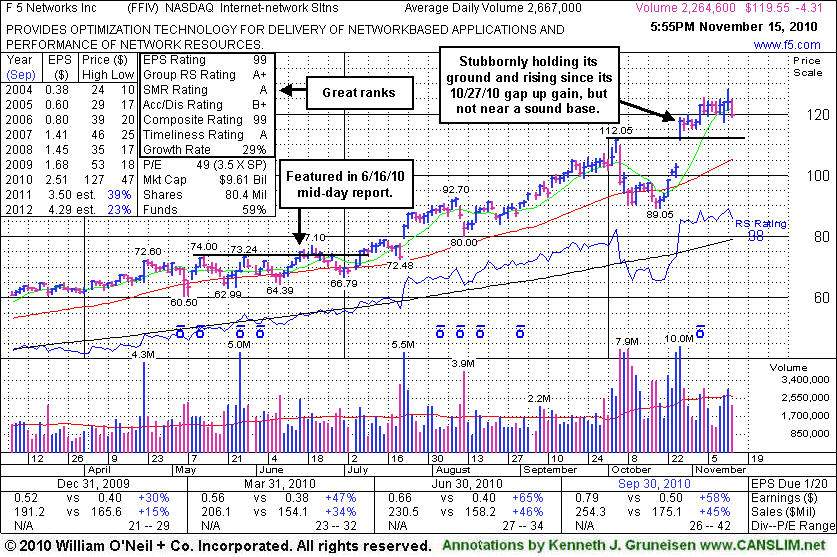

Top-Rated Funds Accumulated Shares During Rally - Monday, November 15, 2010

F5 Networks Inc. (FFIV -$4.31 or -3.48% to $119.55) has been hovering near all-time highs. Prior highs in the $112 area define initial chart support above its 50-day moving average (DMA) line. It is now a bit extended from any sound base after recent volume-driven gains, and disciplined investors would avoid chasing it, while it still could go on to produce more climactic gains.

The number of top-rated funds owning its shares rose from 899 in Dec '09 to 948 as of Sept '10, a reassuring sign with respect to the I criteria. The company currently sports a very healthy Earnings Per Share (EPS) rating of 99 and a Relative Strength (RS) rating of 98. It resides in the Internet- Networking Solutions group which is an Industry Group showing lots of leadership, satisfying the "L" criteria. Its quarterly sales and earnings results showed impressive growth satisfying the C criteria. The company has maintained a good annual earnings (A criteria) history. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. During the past 6 years, FFIV has built several bases, and it has also been through some tough consolidation periods.

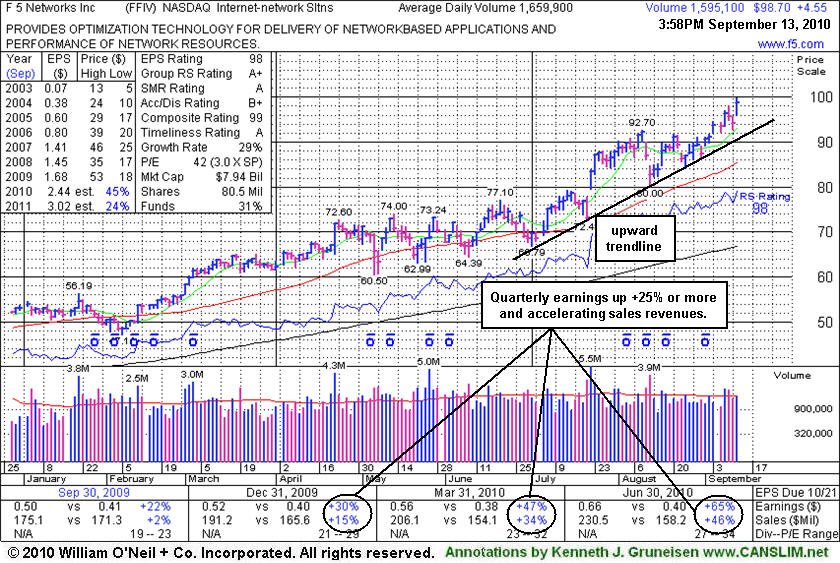

Extended Leader's Initial Support At Upward Trendline - Monday, September 13, 2010

F5 Networks Inc. (FFIV +$4.72 or +5.02% to $98.87) posted a considerable gain after gapping up today, hitting a new all-time high. An upward trendline connecting July-August lows defines an initial chart support level well above its 50 DMA line. Patient investors might wait for new secondary buy points to develop, and disciplined investors avoid chasing stocks extended more than +5% above prior chart highs. It has been recently noted - "Extended from any sound base after recent volume-driven gains, it could go on to produce more climactic gains."

The company currently sports a very healthy Earnings Per Share (EPS) rating of 98 and a Relative Strength (RS) rating of 98 too. It resides in the Internet- Networking Solutions group which is an Industry Group showing lots of leadership, satisfying the "L" criteria. Its quarterly sales and earnings results showed impressive acceleration in the Dec '09, Mar and Jun '10 periods satisfying the C criteria. The company has maintained a good annual earnings (A criteria) history. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. During the past 6 years, FFIV has built several bases, and it has also been through some tough consolidation periods.

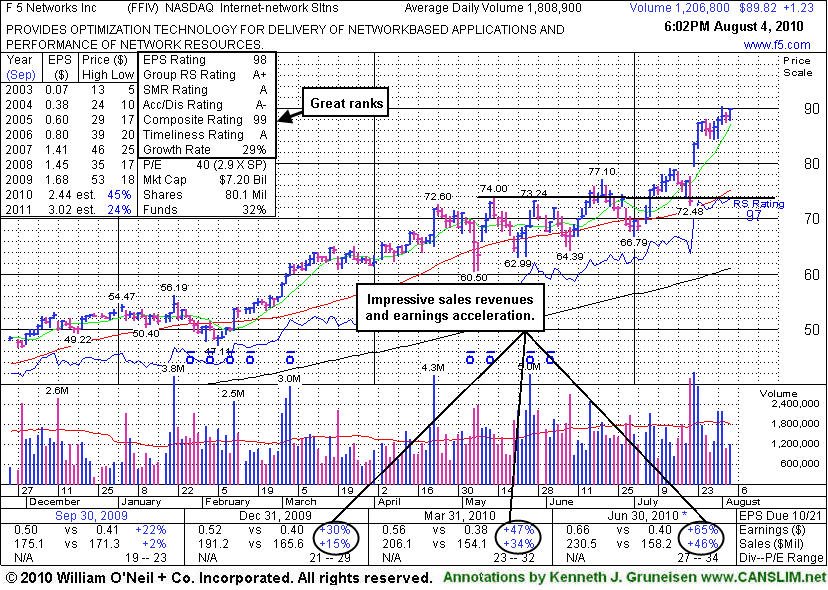

Strong Leader May Be Dangerous To Chase While Extended - Wednesday, August 04, 2010

F5 Networks Inc. (FFIV +$1.23 or +1.39% to $89.82) finished at a new high close after a gain today with light volume. Patient investors might wait for a secondary buy point to develop, and disciplined investors avoid chasing stocks extended more than +5% above prior chart highs. It has been recently noted - "Extended from any sound base after recent volume-driven gains, it could go on to produce more climactic gains."In its last FSU section appearance on 7/07/10 an annotated graph was included under the headline "Gain Today For New High Close Bodes Well" and further described the action as it - "Posted a considerable gain today with +28% above average volume that helped it rally above its previously cited pivot point for a new high close. Its color code was changed to yellow based on its recent resilience. It is now clear of virtually all resistance due to overhead supply, and the path of least resistance is more likely to lead it even higher."

The company currently sports a very healthy Earnings Per Share (EPS) rating of 98 and a Relative Strength (RS) rating of 97. It resides in the Internet- Networking Solutions group which is an Industry Group showing lots of leadership, satisfying the "L" criteria. Its quarterly sales and earnings results showed impressive acceleration in the Dec '09, Mar and Jun '10 periods satisfying the C criteria. The company has maintained a good annual earnings (A criteria) history. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. During the past 6 years, FFIV has built several bases, and it has also been through some tough consolidation periods.

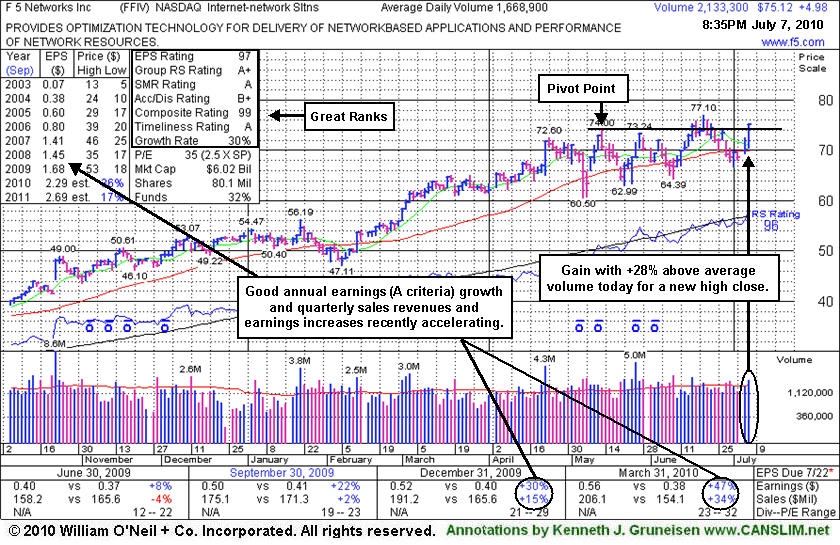

Gain Today For New High Close Bodes Well - Wednesday, July 07, 2010

F5 Networks Inc. (FFIV +$4.98 or +7.10% to $75.12) posted a considerable gain today with +28% above average volume that helped it rally above its previously cited pivot point for a new high close. Its color code was changed to yellow based on its recent resilience. It is now clear of virtually all resistance due to overhead supply, and the path of least resistance is more likely to lead it even higher. Disciplined investors may watch for a more powerful gain backed by heavier volume as a reassurance confirming a proper technical buy signal. Meanwhile, its recent chart low ($66.79 on 7/01/10) defines a near-term support level to watch.

Its last FSU section appearance on 6/16/10 under the headline "Volume Barely Met Guideline Behind Breakout Gain" provided detailed analysis and an annotated graph after it appeared featured in yellow in that day's mid-day report (read here) with a pivot point based upon its 5/13/10 high plus ten cents.

The company currently sports a very healthy Earnings Per Share (EPS) rating of 97 and a Relative Strength (RS) rating of 96. It resides in the Internet- Networking Solutions group which is an Industry Group showing lots of leadership, satisfying the "L" criteria. In recent months FFIV made a number of appearances in the mid-day report as its quarterly sales and earnings results showed impressive acceleration in the Mar '10 and Dec '09 periods, but it was also noted that it had not formed an ideal base pattern and patience was needed. The company has maintained a good annual earnings (A criteria) history. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. During the past 6 years, FFIV has built several bases, and it has also been through some tough consolidation periods.

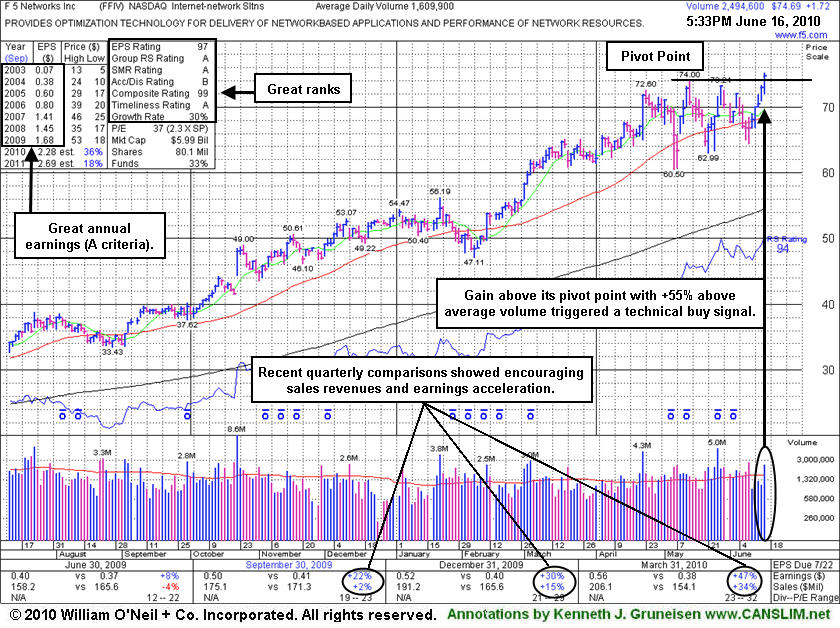

Volume Barely Met Guideline Behind Breakout Gain - Wednesday, June 16, 2010

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

F5 Networks Inc. (FFIV +$1.72 or +2.36% to $74.69) posted a gain today with +55% above average volume that helped it reach a new all-time high and trigger a technical buy signal with its breakout from a flat base of about 5-weeks. It was featured in today's mid-day report (read here) as its color code was changed to yellow with a pivot point based upon its 5/13/10 high plus ten cents. When stocks clear all prior chart highs they are free of resistance due to overhead supply, and then the path of least resistance is more likely to lead them even higher. As always, stocks should be sold if the price ever falls 7-8% below your purchase price, as that is the "max loss" guideline for properly protecting your capital.

The company currently sports a very healthy Earnings Per Share (EPS) rating of 97 and a Relative Strength (RS) rating of 94. It resides in the Internet-networking Solutions group which is an Industry Group showing lots of leadership, satisfying the "L" criteria. In recent months FFIV made a number of appearances in the mid-day report as its quarterly sales and earnings results showed impressive acceleration in the Mar '10 and Dec '09 periods, but it was also noted that it had not formed an ideal base pattern and patience was needed. The high-ranked Internet- Network Solutions industry group leader maintained a good annual earnings (A criteria) history. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. During the past 6 years, FFIV has built several bases, and it has also been through some tough consolidation periods.

Previous Leader Building New Base - Thursday, February 08, 2007

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

F5 Networks Inc. (FFIV -0.37 or -0.49% to $75.01) closed -7.2% below its 52-week high today. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. Since then, this stock has rallied over +300%! During that time, FFIV has built several bases, and it has also been through some tough consolidation periods. In the past few months it has been working on building a new base, trading in a relatively tight price range. This company sports a very healthy Earnings Per Share (EPS) rating of 92 and a Relative Strength (RS) rating of 88. FFIV resides in the Internet-networking Solutions group which is currently ranked 5th out of the 197 Industry Groups covered in the paper, placing it in the much preferred top quartile and satisfying the "L" criteria. If FFIV is setting up to eventually break out of its latest base, a proper technical buy signal would be triggered if it is able to rally and close above its latest pivot point of $80.95 with considerable gains backed by heavier than average volume at least +50% above its normal daily volume. When stocks clear all prior chart highs they are free of resistance due to overhead supply, and then the path of least resistance is more likely to lead them even higher. As always, stocks should be sold if the price ever falls 7-8% below your purchase price, as that is the "max loss" guideline for properly protecting your capital.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile