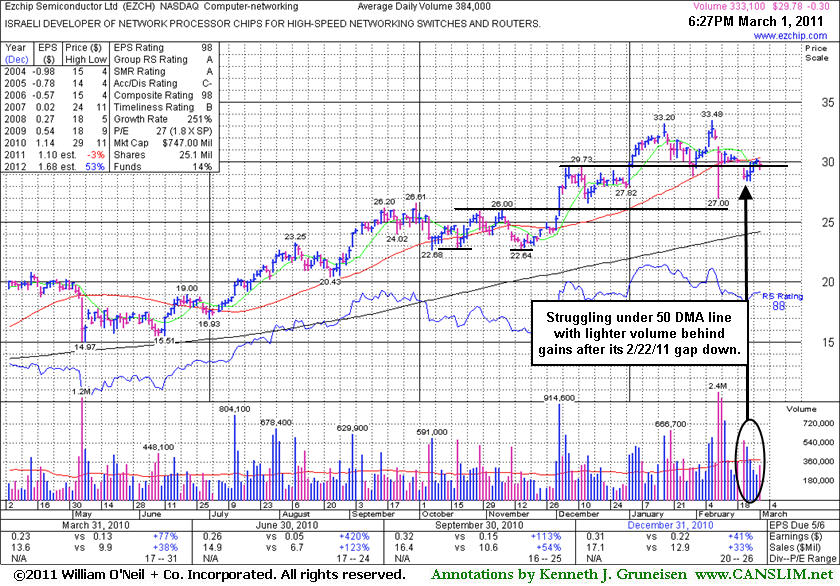

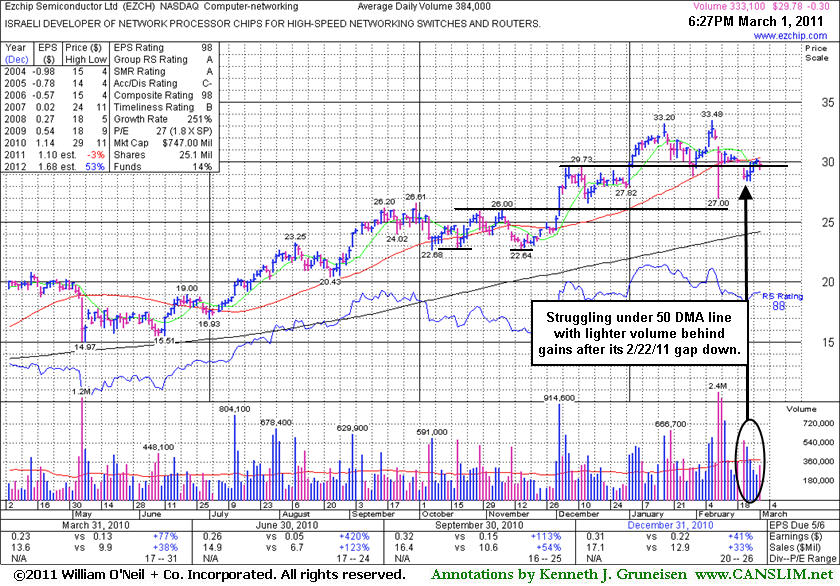

Ezchip Semiconductor Ltd (EZCH -$0.30 or -1.00% to $29.78) has been struggling under its 50-day moving average (DMA) line with small gains on below average volume after its 2/22/11 gap down on above average volume. Its 50-day moving average (DMA) line has been acting as resistance. A convincing rebound above its short-term average would help its outlook, meanwhile it faces overhead supply now up through the $33 area which may hinder its ability to rally. Time is needed for it to potentially form a sound new base.

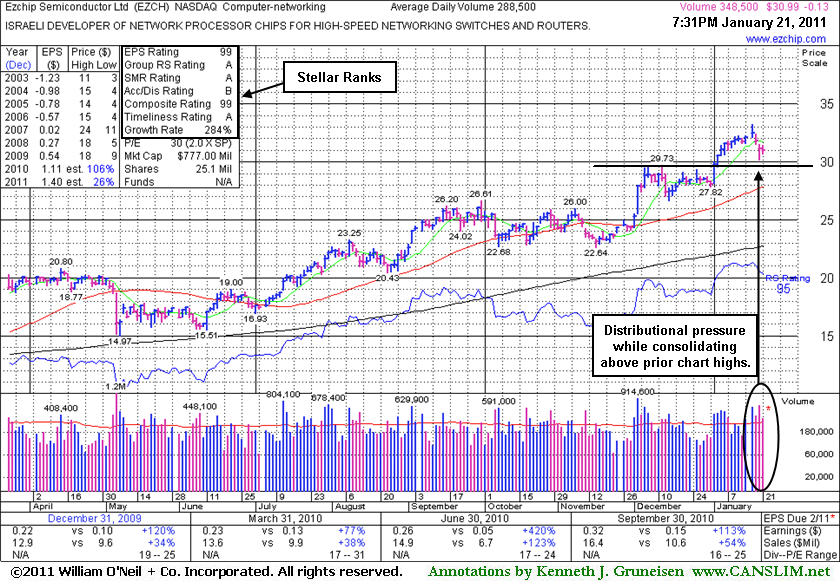

Leadership in the Computer - Networking group is a nice reassurance concerning the L criteria. The number of top-rated funds owning its shares rose from 29 in Jun '10 to 42 in Dec '10, a reassuring sign concerning the I criteria. Since its last FSU section appearance with detailed analysis and an annotated graph on 1/21/11 under the headline "Strong Tech Leader Consolidating Above Prior Highs" it had rallied to barely claim another new 52-week high. What soon followed, however, was damaging losses on heavy volume undercutting its prior chart highs in the $29 area that defined initial support to watch. Since first featured in yellow in the 12/02/10 mid-day report at $27.53 it had traded up as much as +21.6% in just over 2 months.

This Israel-based firm's has demonstrated strong quarterly sales revenues and earnings increases and a good annual earnings history, satisfying the C and A criteria. However, the sales and earnings increases in the quarter ended December 31, 2010 versus the year ago period showed a deceleration in its growth rate, and Street estimates for its FY '11 are calling for -3% earnings from the year before, also giving some cause for concerns.

Ezchip Semiconductor Ltd (EZCH -$0.11 or -0.35% to $31.01) suffered a small loss today following the prior session's gap down loss with more than 2 times average volume. While pulling back from the new 52-week high hit this week, its prior chart highs in the $29 area define initial support to watch well above its 50-day moving average (DMA) line. Time is needed for it to potentially form a sound new base.

This Israel-based firm's shares quickly got extended more than +5% above the pivot point cited, but patient investors may have accumulated shares during a short consolidation that followed. That was not a long enough consolidation period to be considered a sound new base following its last FSU section appearance. On 12/2/2010 our detailed analysis and an annotated graph appeared under the headline "Israel-Based Computer Networking Firm Rises From Double Bottom Base" as it posted a considerable gain with heavy volume more than 3 times average, breaking out of an orderly "double bottom" type base and triggering a technical buy signal. It has demonstrated strong quarterly sales revenues and earnings increases and a good annual earnings history, satisfying the C and A criteria. Leadership in the Computer - Networking group is a nice reassurance concerning the L criteria.

In recent months an increasing number of leading stocks setting up and breaking of solid bases have been highlighted in the CANSLIM.net Mid-Day Breakouts Report. The most relevant factors are briefly noted in the report which allows disciplined investors to place the issue in their custom watch list and receive subsequent notes directly via email immediately when they are published (click the "Alert me of new notes" link). More detailed analysis is published soon after a stock's initial appearance in yellow once any new candidates are added to the Featured Stocks list. Letter-by-letter details concerning strengths or shortcomings of the company in respect to key fundamental criteria of the investment system appear along with annotated datagraphs highlighting technical chart patterns in the Featured Stock Update (FSU) section included in the CANSLIM.net After Market Update each day.

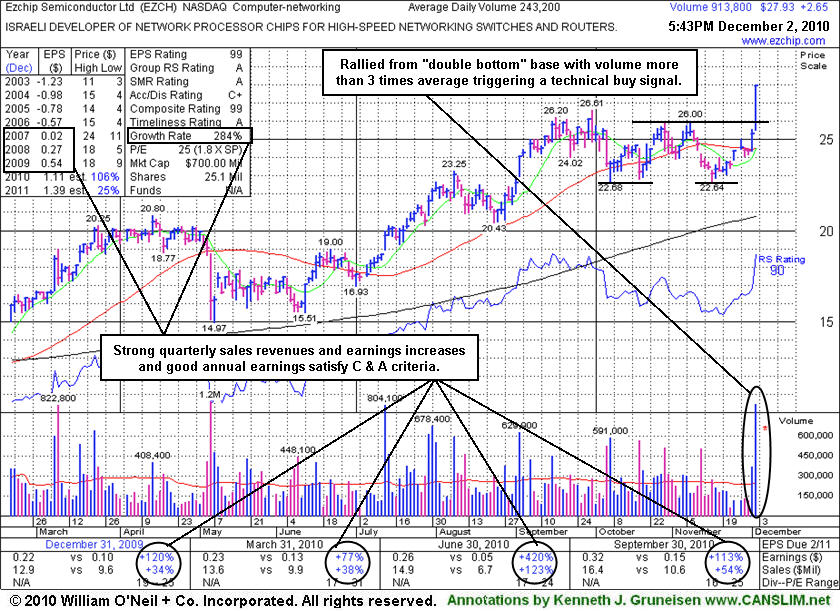

Ezchip Semiconductor Ltd (EZCH +$2.66 or +10.48% to $27.93) posted a considerable gain with heavy volume today more than 3 times average, breaking out of an orderly "double bottom" type base triggering a technical buy signal. Color code was changed to yellow with pivot point cited based on its 11/08/10 high when featured in yellow in today's mid-day report (read here). Strong quarterly sales revenues and earnings increases and good annual earnings satisfy C and A criteria. Leadership in the Computer - Networking group is a nice reassurance concerning the L criteria. This Israel-based firm's shares quickly got extended more than +5% above the pivot point cited. Disciplined investors who avoid chasing stocks may watch for opportunities to accumulate shares on light volume pullbacks toward prior chart highs in the $26 area that define an important chart support level now. Always sell any stock if it falls more than -7% from your purchase price. Keep in mind that the M criteria will play a critical role, as 3 out of 4 stocks go in the same direction of the major averages. Strong stocks deserve the benefit of the doubt, meanwhile a confirming follow-through day of gains on higher volume from at least one of the major averages would be a welcome reassurance that institutional accumulation is significant enough to lead to a sustainable market rally.