Outlook Hurt By 50-Day Moving Average Breach and Fundamentals - Thursday, March 30, 2017

Evercore Partners Inc (EVR +$1.00 or +1.30% to $77.70) posted a gain today with higher volume but still below average volume. It halted its slide after triggering technical sell signals and undercutting the prior low ($74.75 on 2/08/17), but a rebound above the 50-day moving average (DMA) line ($78.86) is still needed for its outlook to improve. Subsequent losses below the recent low ($73.75 on 3/27/17) would raise more serious concerns. Recently reported Dec '16 quarterly earnings +17% on +9% sales revenues, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns.

The high-ranked Finance - Investment Banks/Brokers firm was last shown in this FSU section on 2/17/17 with an annotated graph under the headline, "Holding Ground After Latest Earnings Were Below +25% Guideline". EVR rallied as much as+31.6% since featured in the 11/14/16 mid-day report highlighted in yellow with pivot point based on its 11/06/15 high plus 10 cents (read here). The company provides advisory services to multinational corporations on mergers, acquisitions, divestitures and restructurings. Its annual earnings (A criteria) history has been strong and steady.

The number of top-rated funds owning its shares rose from 380 in Jun '16 to 441 in Dec '16, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating and a B sponsorship Rating. Its small supply of only 39.1 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

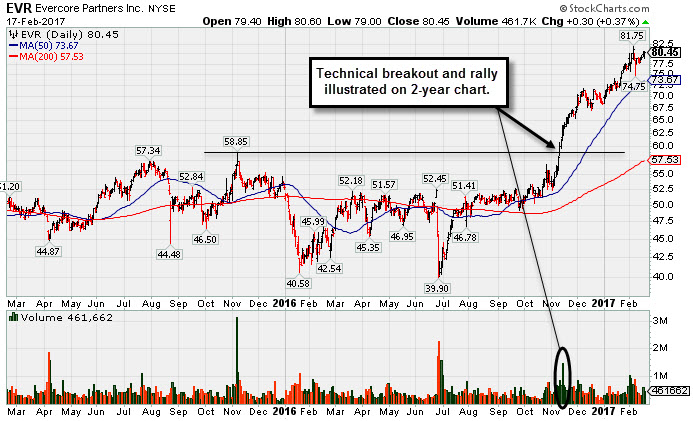

Holding Ground After Latest Earnings Were Below +25% Guideline - Friday, February 17, 2017

Evercore Partners Inc (EVR +$0.30 or +0.37% to $80.45) has been consolidating after getting very extended from its prior base. It has held its ground after recently reporting Dec '16 quarterly earnings +17% on +9% sales revenues, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Its 50-day moving average (DMA) line ($73.67) defines near-term support to watch on pullbacks, and a violation would trigger a technical sell signal.

EVR rallied as much as+29.14% since featured in the 11/14/16 mid-day report highlighted in yellow with pivot point based on its 11/06/15 high plus 10 cents (read here). It was last shown in this FSU section on 1/05/17 with an annotated graph under the headline, "Perched Near All-Time High Building New Flat Base". The high-ranked Finance - Investment Banks/Brokers firm provides advisory services to multinational corporations on mergers, acquisitions, divestitures and restructurings. Its annual earnings (A criteria) history has been strong and steady.

The number of top-rated funds owning its shares rose from 380 in Jun '16 to 421 in Dec '16, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating and a C sponsorship Rating. Its small supply of only 38.9 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

Perched Near All-Time High Building New Flat Base - Thursday, January 5, 2017

Evercore Partners Inc (EVR +$0.20 or +0.28% to $71.40) ended 15 cents off its best-ever close with today's 3rd consecutive gain with light volume, while building on a new flat base. Its color code is changed to yellow with new point cited based on its 12/08/16 high plus 10 cents. A volume-driven gain for new highs may trigger a new (or add-on) technical buy signal.

Its 50-day moving average (DMA) line ($64.96) defines important near-term support above prior highs. It was last shown in this FSU section on 12/05/16 with an annotated graph under the headline, "Hit Another New High Today With Volume-Driven Gain". Insider buying was reported in recent weeks, a reassuring sign, as EVR rallied +12.8% since featured in the 11/14/16 mid-day report highlighted in yellow with pivot point based on its 11/06/15 high plus 10 cents (read here).

The high-ranked Finance - Investment Banks/Brokers firm provides advisory services to multinational corporations on mergers, acquistions, divestitures and restructurings. EVR reported earnings +51% on +25% sales revenues for the Sep '16 quarter. Three of the past 4 earnings increases were above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been strong and steady.

The number of top-rated funds owning its shares fell from 406 in Dec '15 to 390 in Sep '16, a less than reassuring sign concerning the I criteria. However, its current Up/Down Volume Ratio of 2.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating and a B sponsorship Rating. Its small supply of only 38.9 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

Hit Another New High Today With Volume-Driven Gain - Monday, December 5, 2016

Evercore Partners Inc (EVR +$1.90 or +2.77% to $70.50) powered further into new all-time high territory with today's gain backed by +57% above average volume. It has rallied +11.37% since featured in the 11/06/16 mid-day report and it is very extended from its prior base. Disciplined investors avoid chasing extended stocks.

It was last shown in this FSU section on 11/14/16 with an annotated graph under the headline, "Big Volume Driven Gain Extends Winning Streak", after highlighted in yellow with pivot point based on its 11/06/15 high plus 10 cents in the earlier mid-day report (read here).

The high-ranked Finance - Investment Banks/Brokers firm provides advisory services to multinational corporations on mergers, acquistions, divestitures and restructurings. EVR reported earnings +51% on +25% sales revenues for the Sep '16 quarter. Three of the past 4 earnings increases were above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been strong and steady.

The number of top-rated funds owning its shares fell from 406 in Dec '15 to 391 in Sep '16, a less than reassuring sign concerning the I criteria. However, its current Up/Down Volume Ratio of 3.8 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating but a C sponsorship Rating. Its small supply of only 38.9 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com

Big Volume Driven Gain Extends Winning Streak - Monday, November 14, 2016

Evercore Partners Inc (EVR +$2.30 or +3.74% to $63.75) finished strong today after highlighted in yellow with pivot point based on its 11/06/15 high plus 10 cents in the earlier mid-day report (read here). It hit a new high with today's 8th consecutive gain backed by +298% above average volume, finishing near its "max buy" level. Recent gains above its 11/06/15 high backed by more than the +40% above average volume guideline triggered a proper technical buy signal.

The high-ranked Finance - Investment Banks/Brokers firm provides advisory services to multinational corporations on mergers, acquistions, divestitures and restructurings. EVR reported earnings +51% on +25% sales revenues for the Sep '16 quarter. Three of the past 4 earnings increases were above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been strong and steady.

The number of top-rated funds owning its shares fell from 410 in Dec '15 to 380 in Sep '16, a less than reassuring sign concerning the I criteria. However, its current Up/Down Volume Ratio of 2.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating but a D sponsorship Rating. Its small supply of only 38.8 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

Charts courtesy www.stockcharts.com