Patience & Discipline Are Paramount With Stocks on Your Watch List - Friday, April 26, 2013

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

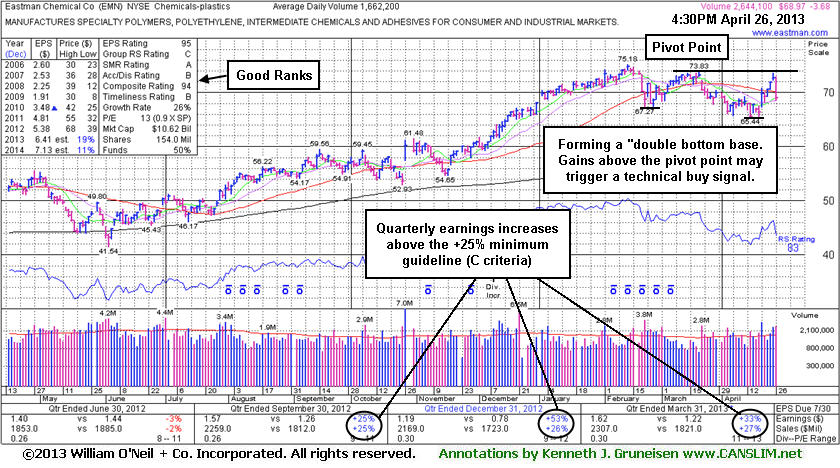

Eastman Chemical Co (EMN -$3.68 or -5.07% to $68.97) pulled back below its 50-day moving average (DMA) line today after volume-driven gains helped it nearly challenge its 52-week high on the prior session. It was highlighted in yellow in the earlier mid-day report (read

here) with pivot point cited based on its 3/20/13 high mid-point in an 11-week "double bottom" base pattern. Little resistance from overhead supply remains to hinder its progress. Subsequent volume-driven gains above the pivot point are needed to trigger a proper technical buy signal before disciplined investors may consider taking action. Another overriding concern that remains is that the market (M criteria) has not yet confirmed the latest rally attempt with a solid follow through day from at least one of the major averages since the recently noted market correction began. Because 3 out of 4 stocks tend to go in the same direction as the major averages, investors' odds are best when buying stocks while the market is in a confirmed rally.The high-ranked Chemicals - Plastics firm reported earnings +33% on +27% sales revenues for the Mar '13 quarter, marking its 3rd consecutive quarter above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) have been improving since a downturn in FY '09. The number of top-rated funds owning its shares rose from 1,045 in Jun '12 to 1,131 in Mar '13, a reassuring sign concerning the I criteria.

Patience and discipline are paramount. Only time will tell if the market correction might worsen or if another confirming day of gains known as a "follow-through" day will signal that the market is acting more favorably for investors following the fact-based investment system.