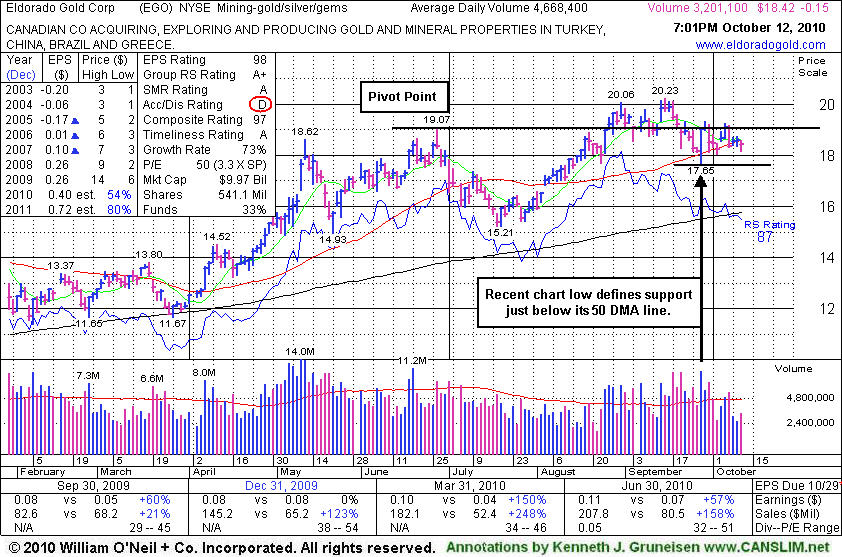

Relative Strength Waning as Mining Firm Sputters - Tuesday, October 12, 2010

Eldorado Gold Corp's (EGO -$0.15 or -0.81% to $18.42) volume totals have been cooling while consolidating near its 50-day moving average (DMA) line. Its recent low ($17.65) defines an important chart support level. It has been consolidating for about 4 weeks and could be forming a sound new base, while in due time a subsequent breakout above its prior chart highs in the $20 area might be encouraging. Meanwhile it may spend more time basing, and it is an ideal candidate for disciplined investors' watchlists.

This a Canada-based mining firm's Accumulation/Distribution rank has slumped to a D (see red circle) while it has sputtered since featured in the mid-day report on 8/19/10 (read here) in yellow with a pivot point based on its 52-week high plus ten cents. Its Relative Strength line has also been slumping for several weeks. EGO reported great sales and earnings increases in Mar and Jun '10 quarterly comparisons and it has a very impressive earnings growth rate in recent years.

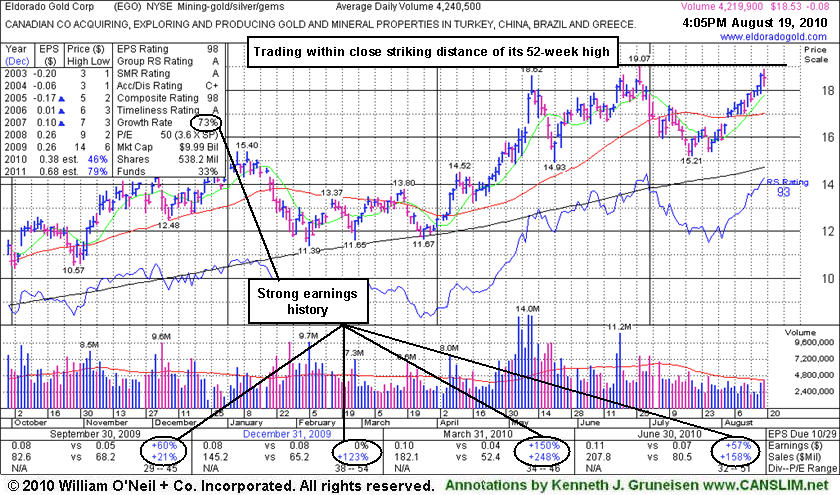

High-Ranked Canada-Based Mining Firm - Thursday, August 19, 2010

Eldorado Gold Corp (EGO -$0.08 or -0.43% to $18.53) is a Canada-based mining firm that has built a longer base-on-base type pattern and is trading within close striking distance of its 52-week high. It was featured in the mid-day report today (read here) in yellow with a pivot point based on its 52-week high plus ten cents. EGO reported great sales and earnings increases in Mar and Jun '10 quarterly comparisons and it has a very impressive earnings growth rate in recent years. Subsequent gains above its prior chart highs with at least +50% above average volume are needed to trigger a proper technical buy signal. Meanwhile it may spend more time basing, and it is an ideal candidate for disciplined investors' watchlists.