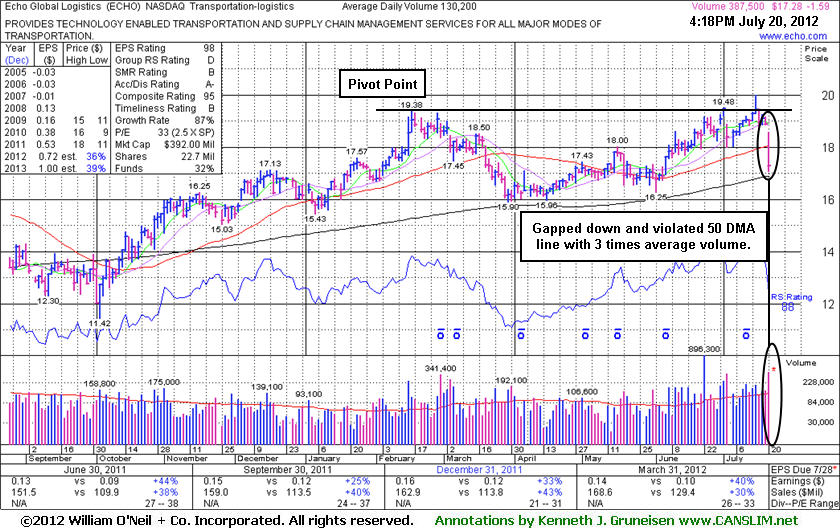

Violated 50-Day Average After Failing to Break Out - Friday, July 20, 2012

Echo Global Logistics (ECHO -$1.56 or -8.27% to $17.31) gapped down today and suffered a damaging distributional loss on heavier volume while it violated its 50-day moving average line triggering a technical sell signal. It was recently noted - "Not quite triggering a proper technical buy signal under the fact-based system", while it was pulling back on lighter volume after only briefly trading above its pivot point. The action is a reminder that getting in "early" can often be a mistake. Waiting for convincing proof of fresh institutional buying demand is very important, yet that is still no guarantee that a stock will go on to produce great gains. As always, disciplined investors limit losses if any stock falls more than -7% from their purchase price.Ownership by top-rated funds rose from 86 in Dec '10 to 138 in Mar '12, a reassuring sign concerning the I criteria. Its fundamentals remain strong with respect to the C and A criteria. Its last appearance in this FSU section was on 6/22/12 with an annotated graph under the headline, "Rebound Near 52-Week High Makes an Ideal Set-Up", after it returned the Featured Stocks list when highlighted in that day's mid-day report in yellow (read here) with a new pivot point cited based on its 2/16/12 high plus 10 cents.

Following its appearance in this FSU section on 2/23/12 with an annotated graph under the headline, "Favorable Characteristics in Another Transportation Issue", it failed to make any further progress. Then it triggered sell signals as damaging losses negated the prior breakout and violated its 50-day moving average (DMA) line. It found support above its 200 (DMA) line.

Recent weakness among other issues in the Transportation - Logistics group is a concern, and group now has a very weak (23) Relative Strength Rating.

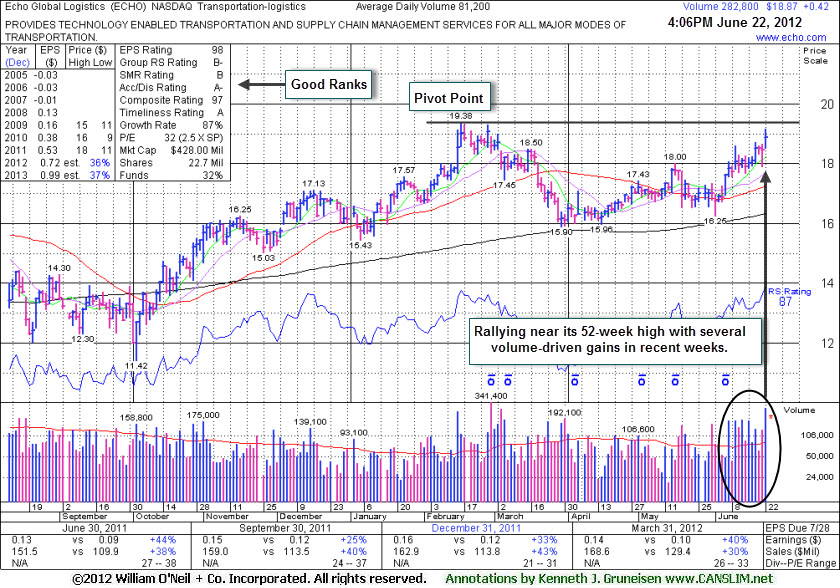

Rebound Near 52-Week High Makes an Ideal Set-Up - Friday, June 22, 2012

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.Echo Global Logistics (ECHO +$0.50 or +2.71% to $18.95) now faces little resistance due to overhead supply after rallying within close striking distance of its 52-week high today with another volume-driven gain. It was highlighted in the mid-day report in yellow today (read here) with a new pivot point cited based on its 2/16/12 high plus 10 cents. A volume-driven gain above its pivot point may trigger a technical buy signal. Its fundamentals remain strong with respect to the C and A criteria.

Following its last appearance in this FSU section on 2/23/12 with an annotated graph under the headline, "Favorable Characteristics in Another Transportation Issue", it failed to make any further progress. Then it triggered sell signals as damaging losses negated the prior breakout and violated its 50-day moving average (DMA) line. It found support above its 200 (DMA) line and rebounded back above its 50 DMA line in recent weeks since 3/28/12 when it was dropped from the Featured Stocks list.

Ownership by top-rated funds rose from 86 in Dec '10 to 141 in Mar '12, a reassuring sign concerning the I criteria. Recent leadership (L criteria) from at least one other high-ranked firm in the Transportation - Logistics group is reassuring, although the group has a weak (54) Relative Strength Rating.

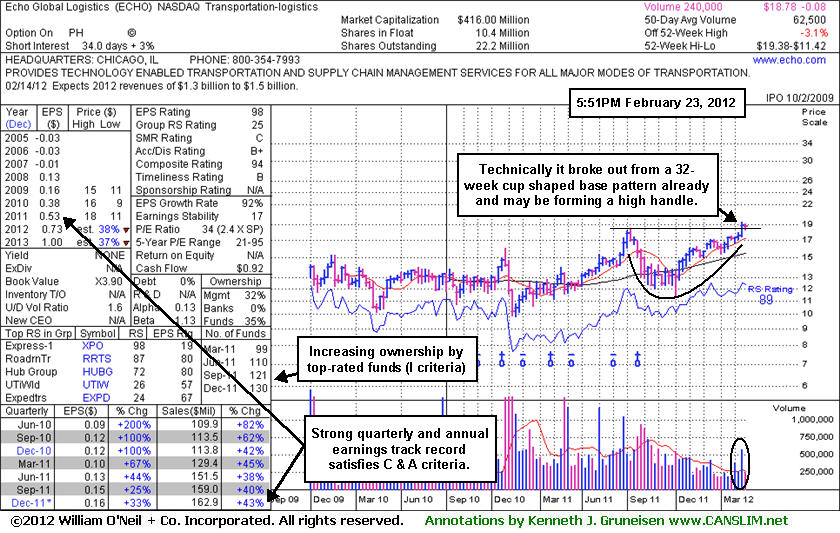

Favorable Characteristics in Another Transportation Issue - Thursday, February 23, 2012

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. Sometimes stocks are highlighted shortly after a technical breakout, yet while the potential buy candidate may still be considered action-worthy. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.Echo Global Logistics (ECHO +$0.28 or +1.51% to $18.78) posted a small gain today with above average volume. It is perched at its all-time high after volume-driven gains last week into new high territory, as can be seen on the weekly graph annotated below. Leadership (L criteria) from at least one other high-ranked firm in the Transportation - Logistics group is reassuring although the group has a weak (25) Relative Strength Rating. Roadrunner Transportation Systems Inc (RRTS) is one of its strong peers from the group which was added to the Featured Stocks list on 2/10/12 and it has subsequently shown bullish action.

ECHO was added to the Featured Stocks list as it appeared in the 2/22/12 mid-day report (read here) highlighted in yellow with a pivot point cited based on its 7/06/11 high plus 10 cents as it was noted - ". Technically it broke out from a 32-week cup shaped base pattern already and may be forming a high handle. Its quarterly and annual earnings increases have been strong, satisfying the C and A criteria. Ownership by top-rated funds rose from 86 in Dec '10 to 130 in Dec '11, a reassuring sign concerning the I criteria."