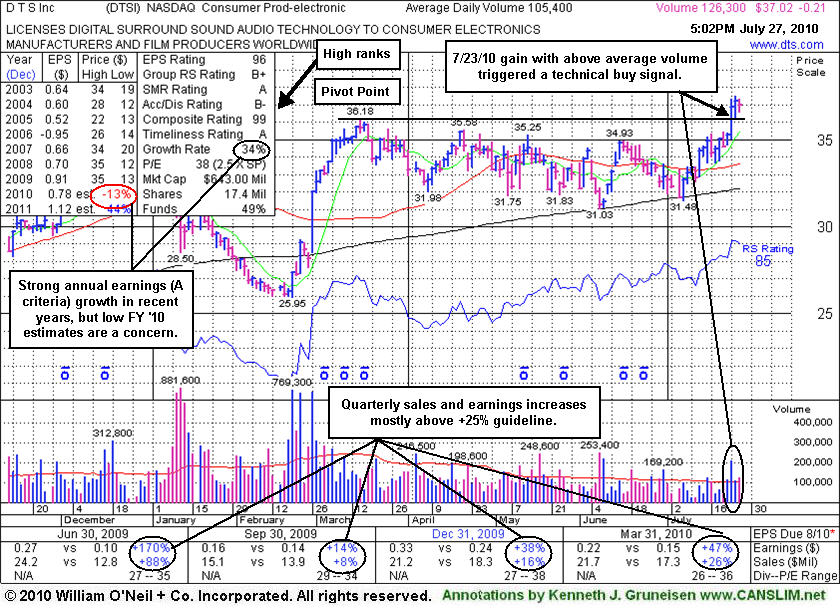

Digital Sound Technology Licensor Faces No Resistance After Breakout - Tuesday, July 27, 2010

D T S Inc (DTSI -$0.29 or -0.78% to $36.94) is holding its ground above prior multi-year highs in the $35-36 area after its 7/23/10 gain with above average volume triggered a technical buy signal by clearing its 3/16/10 high. It was featured in yellow in today's mid-day report (read here). This high-ranked leader hailing from the Consumer Products - Electronics group is due to report earnings after the close on Monday, August 9th. That could be a difficult comparison for it to beat by a healthy margin, and Street estimates calling for lower FY '10 earnings (see red circle) are also of some concern. However, no resistance currently remains to hinder its upward progress. Its small supply (S criteria) of only 17.4 million shares outstanding can lead to greater volatility in the event of institutional accumulation or distribution. Volume and volatility often increase near earnings news. It will be important to stay disciplined about making proper entries and exits, as always. Disciplined investors avoid chasing a stock more than +5% above its prior chart high or pivot point.