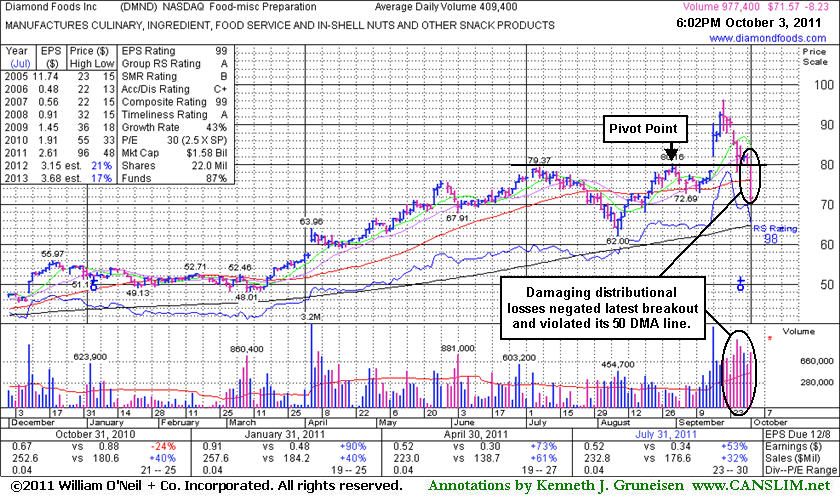

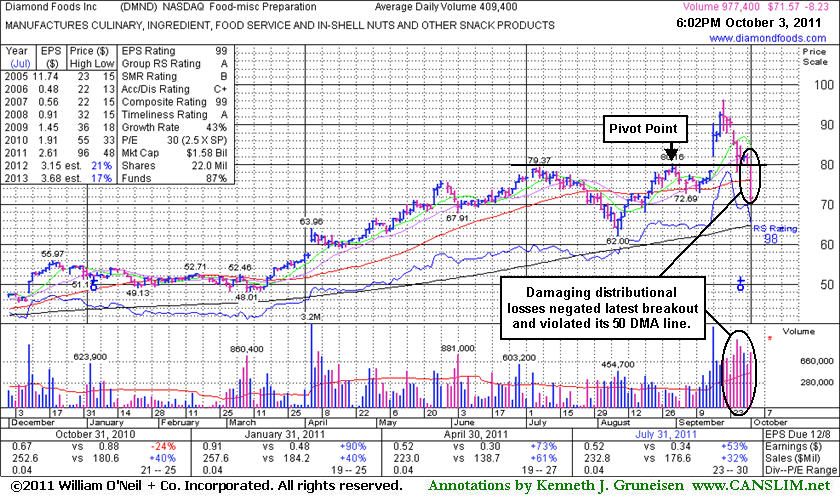

Diamond Foods Inc (DMND -$8.23 or -10.31% to $71.57) violated prior highs in the $80 area previously noted as initial chart support to watch on pullbacks, and also violated its 50-day moving average (DMA) line today raising more serious concerns while triggering technical sell signals and finishing near the session low. Its small supply of only 22 million outstanding shares (S criteria) could contribute to greater volatility in the event of any institutional maneuvering.

Its last appearance in this FSU section was on 9/13/11 with an annotated graph included under the headline, "Set-Up Has Bullish Characteristics Yet Requires Patience" after highlighted in yellow earlier that day in the mid-day report (read here). On 9/16/11 it reported earnings +53% on +32% sales revenues for the quarter ended July 31, 2011 versus the year ago period. On that session a considerable "breakaway gap" with heavy volume cleared its pivot point and triggered a technical buy signal. It tallied additional volume-driven gains, but as quickly as it got extended from its prior base, it soon came falling back. A streak of losses was marked by above average volume indicative of distributional pressure. Its slump back into its prior base has completely negated its latest breakout. Based on weak action it finished -25.5% off its 52-week high, and it will be dropped from the Featured Stocks list tonight. A prompt rebound above its 50 DMA line could help its outlook improve, but it faces resistance due to overhead supply up through the $96 area now. Meanwhile, its 200 DMA line and earlier chart lows in the $62 area define the next nearest support level that may come into play.

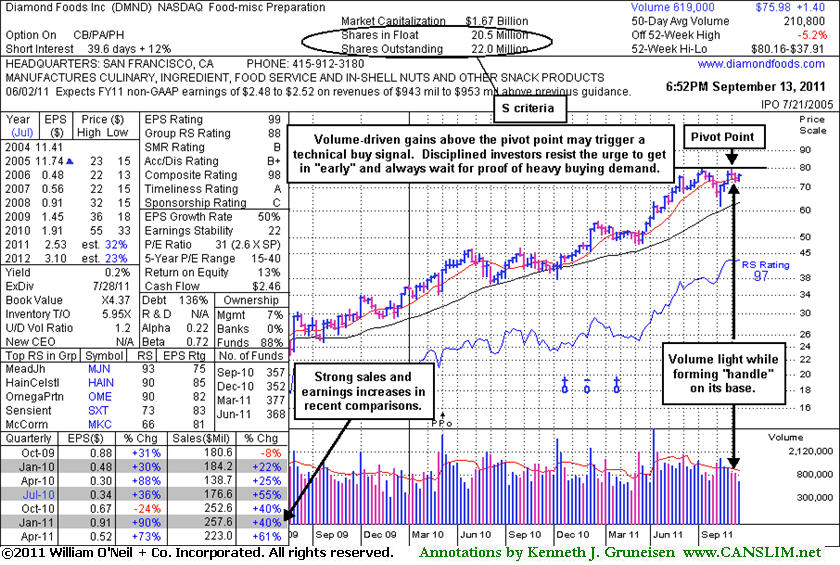

A proper technical buy signal under the investment system's guidelines requires a gain above the pivot backed by more than +40-50% above average volume. Most big winners in market history, in fact, blasted off with very heavy volume, they did not barely limp over their pivot points. Volume is a critical component to a sound technical breakout, as the intense burst of trading activity is what gives investors evidence of serious institutional buying demand - which is needed for a sustained advance!

Diamond Foods Inc (DMND +$0.53 or +0.70% to $75.98) was highlighted in yellow earlier today in the mid-day report (read here). Its color code was changed to yellow while perched -5.8% off its 52-week high. Subsequent gains with heavy volume above the new pivot point cited based on its 8/31/11 high may trigger a technical buy signal. It has been recently consolidating above support at its 50-day moving average (DMA) line and volume totals were light while forming a "handle" on its latest base. It found support well above its 200 DMA line as it formed a cup-with-handle type base following its ascent since previously noted 4/05/11 news it was buying Procter & Gamble's Pringles. It has demonstrated a strong earnings history in recent years (A criteria). Earnings rose +73% on +61% sales revenues in the quarter ended April 30, 2011 versus the year ago period. The Dec '10 quarter also showed strong increases, but quarterly earnings were reported at -24% for the Oct '10 period, a flaw in its otherwise impressive earnings history. Small supply of only 22 million outstanding shares (S criteria) could contribute to greater volatility in the event of any institutional maneuvering.