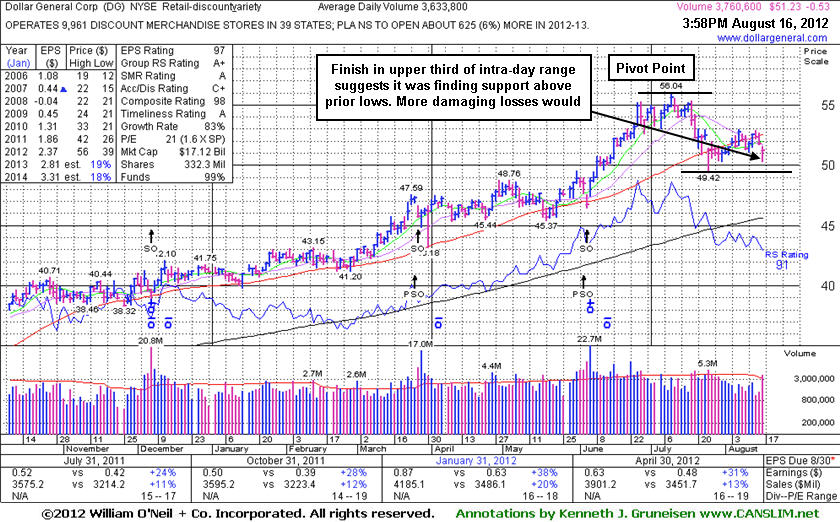

Slump Further Below 50-Day Moving Average Raises Concerns - Thursday, August 16, 2012

Dollar General Corp (DG -$0.54 or -1.04% to $51.22) slumped below its 50-day moving average (DMA) line with a higher volume total behind its loss today. The weakness raised some concerns, however its finish in the upper third of its intra-day range was an encouraging indication that it was attracting some support. Prior lows near $49 define important near-term support to watch while it may be forming a new base. More damaging losses would raise greater concerns.

It failed to trigger a new (or add-on) technical buy signal after its last appearance in this FSU section with an annotated graph on 7/12/12 under the headline, "Advanced '3-Weeks Tight' Base Pattern Possibly Forming." The high-ranked Retail - Discount/Variety firm completed a Secondary Offering on 6/05/12, its 4th Secondary Offering since September '11. It recently reported earnings +31% on +13% sales revenues for the quarter ended April 30, 2012 versus the year ago period. Its fundamentals (C & A criteria) have been noted as resembling past great winners. The number of top-rated funds owning its shares rose from 377 in Jun '11 to 784 in Jun '12, a reassuring sign concerning the I criteria. As previously noted, often times companies attract additional institutional interest with the help of underwriters when such offerings are completed.

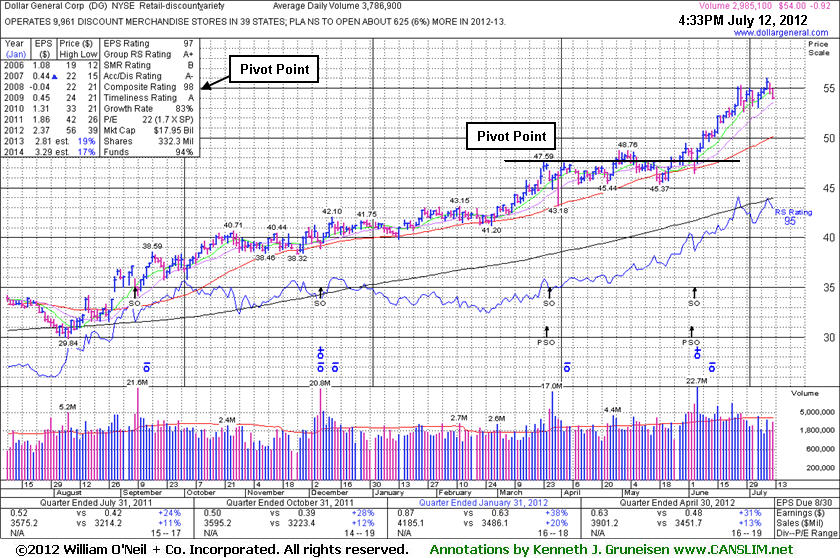

Advanced "3-Weeks Tight" Base Pattern Possibly Forming - Thursday, July 12, 2012

Dollar General Corp (DG -$0.92 or -1.68% to $54.00) is still hovering near its all-time high, extended from its prior base. It found support near its 50-day moving average (DMA) line again during the last pullback. It may be forming an advanced "3-weeks tight" base if it ends the week with little net change. The high-ranked Retail - Discount/Variety firm completed another Secondary Offering on 6/05/12, its 4th Secondary Offering since September '11. It recently reported earnings +31% on +13% sales revenues for the quarter ended April 30, 2012 versus the year ago period. Its fundamentals (C & A criteria) have been noted as resembling past great winners. Its last appearance in this FSU section with an annotated graph on 6/12/12 came under the headline, "Four Secondary Offerings in Past Year for Discount Retailer". The number of top-rated funds owning its shares rose from 377 in Jun '11 to 670 in Mar '12, a reassuring sign concerning the I criteria. As previously noted, often times companies attract additional institutional interest with the help of underwriters when such offerings are completed.

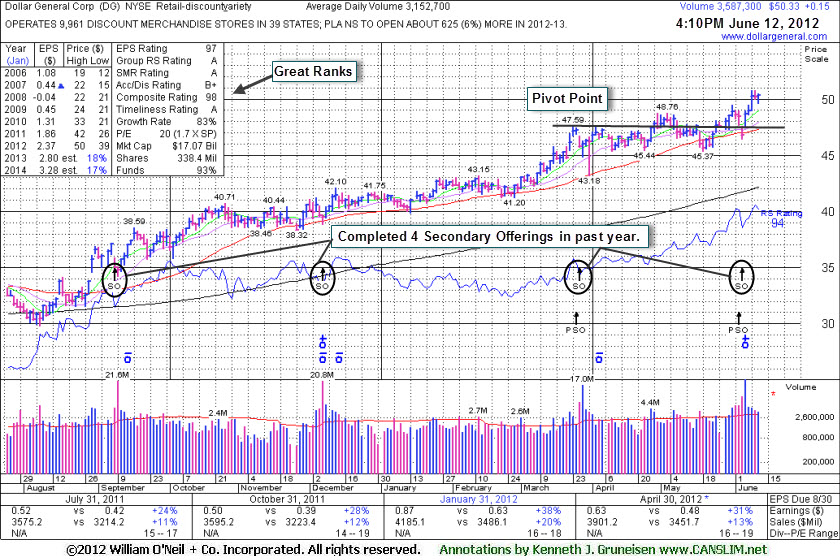

Four Secondary Offerings in Past Year for Discount Retailer - Tuesday, June 12, 2012

Dollar General Corp (DG +$0.15 or +0.30% to $50.33) finished the session at a best-ever close today. It found support near its 50-day moving average (DMA) line again during the last pullback. It completed another Secondary Offering on 6/05/12, its 4th Secondary Offering since September '11. It recently reported earnings +31% on +13% sales revenues for the quarter ended April 30, 2012 versus the year ago period.

Poor action in the major averages (M criteria) has been an overriding concern that argued against new buying efforts since its last appearance in this FSU section with an annotated graph on 5/09/12 under the headline, "Market Weakness is an Overriding Concern". That appearance came shortly after it was highlighted in yellow in the 5/07/12 mid-day report (read here) with pivot point based on its 3/23/12 high plus 10 cents. It found support near its 50-day moving average (DMA) line and continued higher.

The number of top-rated funds owning its shares rose from 377 in Jun '11 to 662 in Mar '12, a reassuring sign concerning the I criteria. Secondary Offerings were also completed on 9/08/11, 12/07/11, and 3/27/12. As previously noted, often times companies attract additional institutional interest with the help of underwriters when such offerings are completed.It reported earnings +38% on +20% sales revenues for the quarter ended January 31, 2012 versus the year ago period, showing encouraging acceleration in sequential quarterly sales and earnings increases. Its fundamentals (C & A criteria) have been noted as resembling past great winners.

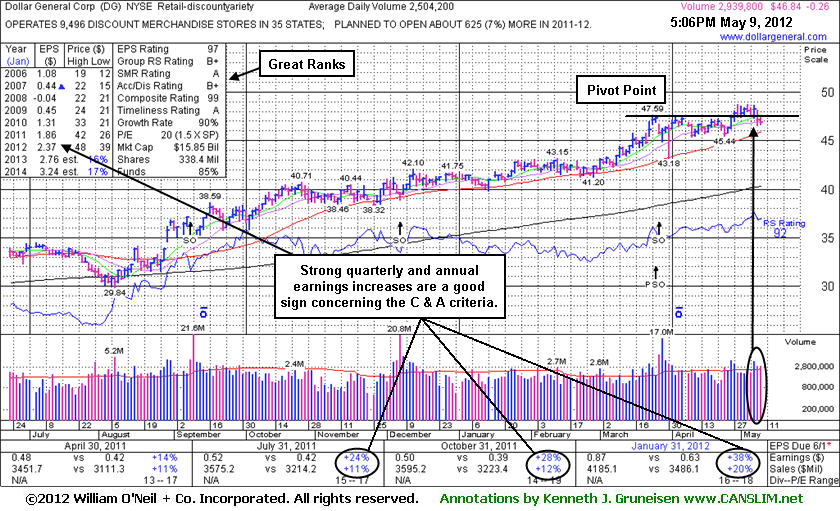

Market Weakness is an Overriding Concern - Wednesday, May 09, 2012

Dollar General Corp (DG -$0.26 or -0.55% to $46.84) has slumped back into its prior base with 2 small losses backed by above average volume since it was highlighted in yellow in the 5/07/12 mid-day report (read here) with pivot point based on its 3/23/12 high plus 10 cents. Technically, volume-driven gains had helped it rally from a 5-week flat base. However, poor action in the major averages (M criteria) is an overriding concern that currently argues against new buying efforts, as 3 out of 4 stocks tend to follow the direction of the major averages. It may find support at its 50-day moving average (DMA) line again and continue higher. Meanwhile, disciplined investors always limit losses if any stock falls more than -7% from their purchase price.The number of top-rated funds owning its shares rose from 377 in Jun '11 to 637 in Mar '12, a reassuring sign concerning the I criteria. On 3/27/12 it completed another Secondary Offering while perched at an all-time high. Secondary Offerings were also completed on 9/08/11 and on 12/07/11. Often times companies attract additional institutional interest with the help of underwriters when such offerings are completed.

It reported earnings +38% on +20% sales revenues for the quarter ended January 31, 2012 versus the year ago period, showing encouraging acceleration in sequential quarterly sales and earnings increases. Its fundamentals (C & A criteria) are now resembling past great winners.