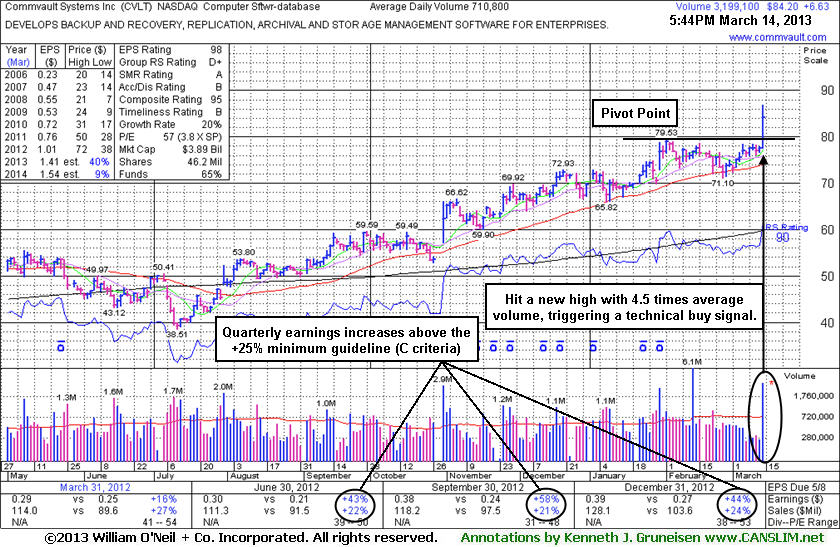

Hit New High With 4.5 Times Average Volume Behind Gain - Thursday, March 14, 2013

Often, when a leading stock is breaking out of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors. After doing any necessary backup research, the investor is prepared to act. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Commvault Systems Inc (CVLT +$6.63 or +8.55% to $84.20) was highlighted in yellow with pivot point cited based on its 2/01/13 high plus 10 cents in the earlier mid-day report (read here). It hit new 52-week highs (N criteria) with 4.5 times average volume behind today's considerable volume-driven gain while quickly rising well above its pivot point triggering a technical buy signal. It found support at its 50-day moving average (DMA) line during its orderly consolidation since last noted in the 1/30/13 mid-day report - "Reported earnings +44% on +24% sales revenues for the Dec '12 quarter, its 3rd consecutive quarter with earnings above the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been improving since a minor downturn in FY '09. It made a choppy ascent after sputtering when dropped from the Featured Stocks list on 7/13/10."

The high-ranked Computer Software - Database firm's annual earnings (A criteria) history includes a slight downward turn in FY '09, yet it has an impressive history and recent quarters showed accelerating sales revenues and earnings increases with +25% earnings increases or greater in the past 3 comparisons versus the year ago period. The number of top-rated funds owning its shares rose from 459 in Mar '12 to 516 in Dec '12, a reassuring sign concerning the I criteria. Its current Up/Down volume ratio of 1.5 is an unbiased indication that its shares have been under accumulation over the past 50 days. The Computer Software - Database industry group's low Group Relative Strength Rating is a concern, however leadership from at least one other stock in the group is a somewhat reassuring sign concerning the L criteria. Disciplined investors avoid chasing stocks more than +5% above their prior highs and always limit losses by selling if any stock falls more than -7% from their purchase price.

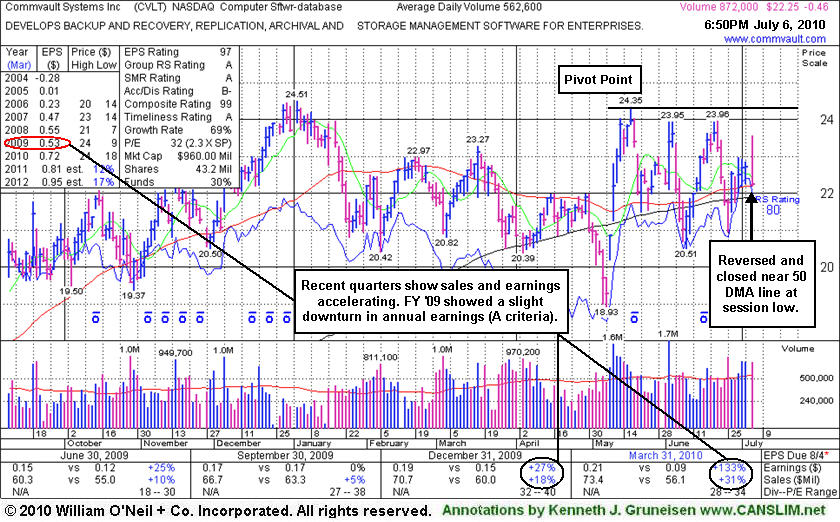

Weak Finish Today After Mid-Day Report Appearance in Yellow - Tuesday, July 06, 2010

Commvault Systems Inc (CVLT -$0.46 or -2.03% to $22.25) gapped up today and then negatively reversed, closing near the session low and near its 50-day moving average (DMA) line. It is still building on the right side of a 6-month flat base, perched within close striking distance of its 52-week high and all-time high. It was featured in the mid-day report today (read here) as its color code was changed to yellow with its pivot point based on its 5/18/10 high plus ten cents.

The high-ranked Computer Software - Database firm's annual earnings (A criteria) history includes a slight downward turn in FY '09, yet it has an impressive history and recent quarters showed accelerating sales revenues and earnings increases with +25% earnings increases or greater in 3 out of the past 4 comparisons versus the year ago period. It is an ideal candidate for disciplined investors' watch lists while they are awaiting a new confirmed rally with a proper follow-through day from at least one of the major averages (M criteria). Years ago it was featured as an ideal candidate, but due to weakness on 1/31/07 it was removed from the CANSLIM.net Featured Stocks list.