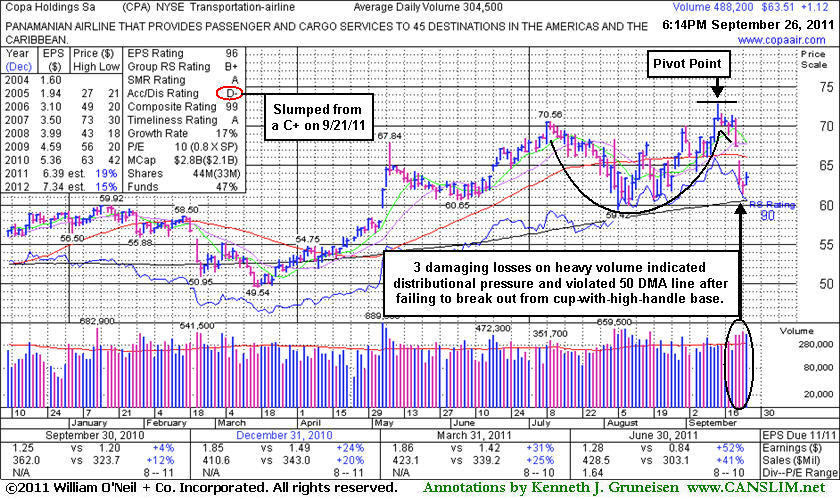

Distributional Damage Followed Recent Mid-Day Report Appearance - Monday, September 26, 2011

Copa Holdings Sa (CPA +$1.12 or +1.80% to $63.51) posted a gain today with above average volume. An annotated weekly graph was included as it was highlighted in yellow in the 9/21/11 mid-day report (read here) while forming a cup-with-high-handle type base pattern with a pivot point based on its 9/14/11 high. However, it finished that session on a sour note with a loss that was the first in a streak of 3 consecutive losses with above average volume including a 9/22/11 gap down that violated its 50-day moving average (DMA) line raising concerns.

It is normally best if the volume totals are light while a "handle" is formed, so it was noted that the distributional loss it immediately suffered may not bode well. Additionally, as it was noted - "Confirming gains with heavy volume for a new high close are needed before disciplined investors might consider this high-ranked Panama-based airline a legitimate buy candidate." It reported earnings +52% on +41% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Sales revenues and earnings have improved in the 3 most recent quarterly comparisons (Dec '10, Mar and Jun '11) after a streak of negative or weak comparisons. Annual earnings (the A criteria) growth has been good, and increasing institutional ownership (the I criteria) is an encouraging sign.

It may again find support above its 200 DMA line and prior highs in the $59 area like it did during its recent consolidation. The Accumulation/Distribution rank has slumped from a C+ when last shown in this FSU section on 9/21/11 to a D- today (see red circle). It obviously has some work to do before it might reach a new 52-week high and rally again within close striking distance of its 2007 all-time high ($73.33). In the meanwhile, any fundamental disappointment could hurt its chances of becoming an action-worthy buy candidate. A poor market environment (M criteria) also argues for now against new buying efforts until there is a new confirmed rally.