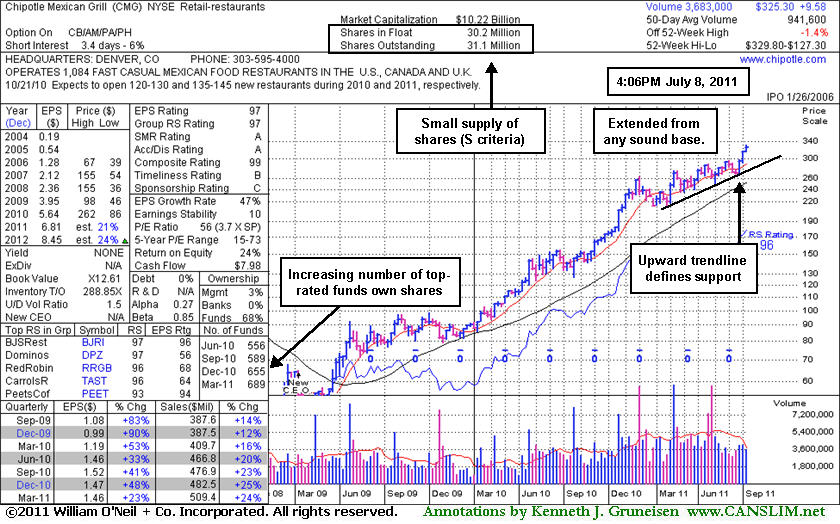

Wedged To New Highs Without a Sound Base or Great Volume - Friday, July 08, 2011

Chipotle Mexican Grill, Inc. (CMG -$3.19 or -0.97% to $325.30) pulled back today from its all-time high after 9 gains on near average volume in the span of 10 sessions. It has been repeatedly noted as extended from prior highs that define initial chart support to watch. It was last shown in the FSU section on 6/15/11 with an annotated daily graph under the headline, "Quiet Consolidation; Latest Earnings Increase Under +25%", when consolidating near its 50-day moving average (DMA) line. It did not form a sound base pattern before then wedging to new high territory without especially great volume conviction. An upward trendline connecting its prior lows defines a near-term technical support level to watch illustrated on the weekly graph below. It is perched just -1.4% off its 52-week and all-time high with no resistance due to overhead supply.CMG currently has an A rating for Accumulation/Distribution. Ownership by top-rated funds rose from 530 in Mar '10 to 689 in Mar '11, a nice reassurance concerning the I criteria of the investment system. Sales revenues increases have been strong, however the quarter ended March 31, 2011 showed earnings +23%. That was the first increase under the +25% guideline for the C criteria in years, raising some concerns. It has a good annual (A criteria) earnings history.

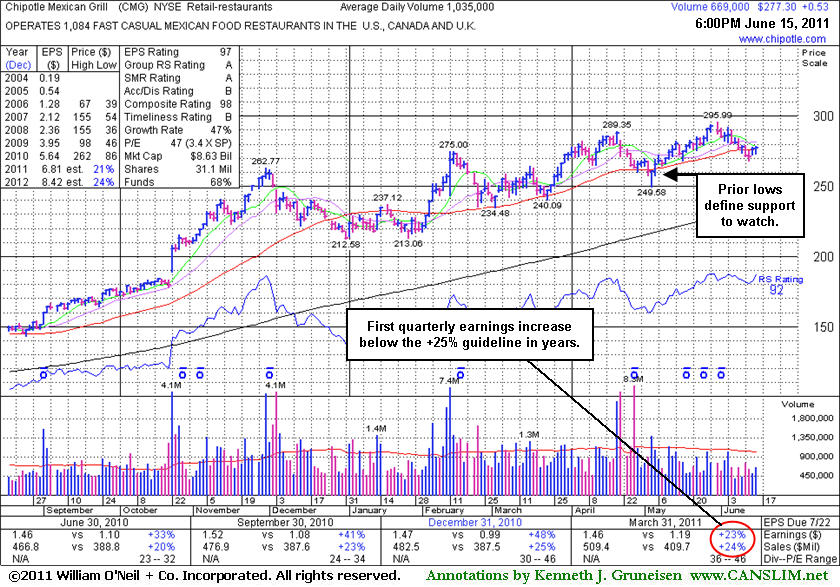

Quiet Consolidation; Latest Earnings Increase Under +25% - Wednesday, June 15, 2011

Chipotle Mexican Grill, Inc. (CMG +$0.53 or +0.19% to $277.30) has been consolidating near its 50-day moving average (DMA) line, but it has not formed a sound base pattern. An upward trendline connecting its July 2010 and May 2011 lows (not shown) defines a near-term technical support level to watch that comes into play just above prior lows which are illustrated on the graph below. It is still perched just -6.3% off its 52-week high with very little resistance due to overhead supply. It was last shown in the FSU section on 5/17/11 with an annotated graph under the headline, "Latest Earnings Increase Under Guidelines", yet it went on to inch up even higher for a new all-time high without great volume conviction behind its gains. None of its recent losses has been on heavy volume either, which is a somewhat encouraging sign. Subsequent deterioration to new low closes would raise greater concerns and a violation of its recent low ($249.58) would trigger a more worrisome technical sell signal.CMG currently has a B rating for Accumulation/Distribution. Ownership by top-rated funds rose from 530 in Mar '10 to 689 in Mar '11, a nice reassurance concerning the I criteria of the investment system. Sales revenues increases have been strong, however the quarter ended March 31, 2011 showed earnings +23% (see red circle). That was the first increase under the +25% guideline for the C criteria in years, raising some concerns. It has a good annual (A criteria) earnings history.

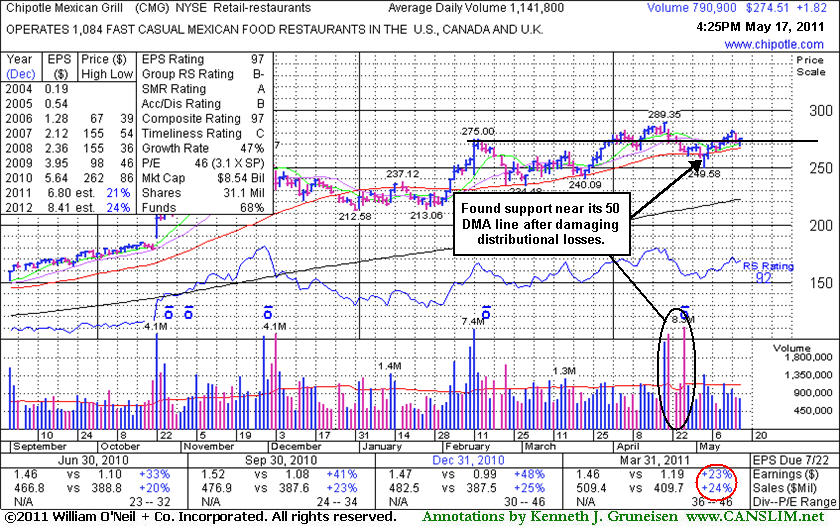

Latest Earnings Increase Under Guidelines - Tuesday, May 17, 2011

Chipotle Mexican Grill, Inc. (CMG +$1.82 or +2.56% to $274.51) posted a small gain on light volume today, closing -5.1% off its 52-week high. Little resistance remains due to overhead supply, however it has not formed a sound new base pattern. It recently found support near its 50-day moving average (DMA) line after it negated its latest technical breakout.

CMG currently has a B- rating for Accumulation/Distribution. Ownership by top-rated funds rose from 530 in Mar '10 to 689 in Mar '11, a nice reassurance concerning the I criteria of the investment system. Sales revenues increases have been strong, however the quarter ended March 31, 2011 showed earnings +23% (see red circle), just under the +25% guideline for the C criteria, raising some concerns. It has a good annual (A criteria) earnings history.

It was last shown in the FSU section on 4/13/11 with an annotated graph under the headline, "Fresh High Close Lacking Great Volume Conviction". It went on to hit a new all-time high on 4/20/11 with a considerable gain on heavy volume, but then it promptly reversed and soon slumped back under its old highs, technically closing back in its prior base. Subsequent violations of its 50 DMA and recent low ($249.58) would raise greater concerns and trigger more worrisome technical sell signals.

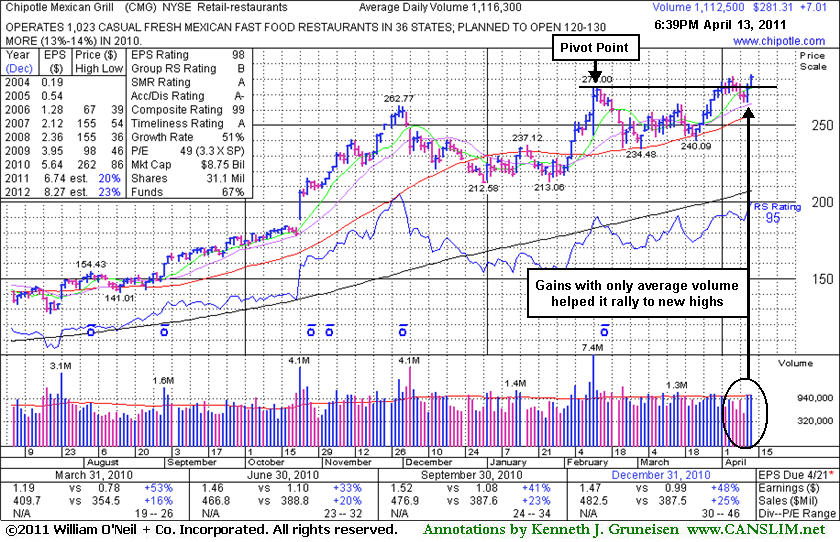

Fresh High Close Lacking Great Volume Conviction - Wednesday, April 13, 2011

Chipotle Mexican Grill, Inc. (CMG +$7.01 or +2.56% to $281.31) was up today with average volume for a new all-time high. It recently stalled after reaching a new all-time high without triggering a proper new technical buy signal. Disciplined investors know that gains above its pivot point with well above average volume are needed to trigger a proper new (or add-on) technical buy signal.

It could get too extended above prior highs before sufficient volume backs up its gains. Do not be frustrated by that if it ever happens in any strong leader. Know that a truly bullish market environment (M criteria) offers investors many great opportunities to buy stocks within the proper guidelines. Many of the market's best winners gave investors multiple opportunities to buy their shares within the system's guidelines during an ongoing rally. Patience and discipline are critical to your success.

CMG currently has an A- rating for Accumulation/Distribution. Ownership by top-rated funds rose from 530 in Mar '10 to 660 in Dec '10, a nice reassurance concerning the I criteria of the investment system. Sales revenues increases have shown acceleration while up +12%, +16%, +20%, +23%, and now +25% in the streak of latest quarterly comparisons while the C criteria is satisfied by ongoing earnings increases above the +25% guideline. It also has a good annual (A criteria) earnings history.

It eventually formed a new flat base that was noted on 4/01/11 as a new pivot point was cited and its color code was changed to yellow after an orderly 7-week base pattern. It may now look like a cup-with-handle pattern after the latest light volume pullback, but without powerful volume-driven gains it is questionable whether a sustained advance is very likely. Fresh proof of heavy institutional buying demand is usually important, and fact-based investors know that a confirmation of it is worth waiting to see even if that means paying a little higher price. It was last shown in the FSU section on 3/14/11 under the headline, "Correction Also Hurts Stocks With Strong Fundamentals". Subsequent to that appearance, it was a very reassuring sign that it found support above its 50-day moving average (DMA) line and was resilient near prior highs in the $237 area. As previously noted, subsequent violations and damaging losses would have raised greater concerns and triggered more worrisome technical sell signals.

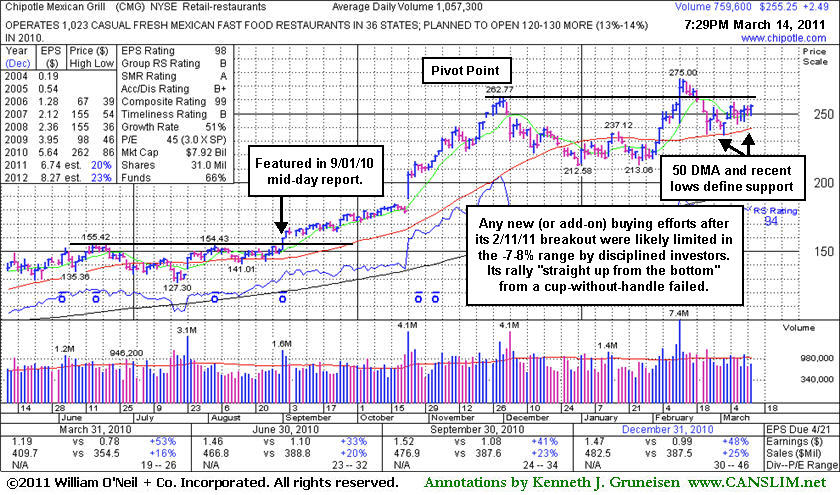

Correction Also Hurts Stocks With Strong Fundamentals - Monday, March 14, 2011

Chipotle Mexican Grill, Inc. (CMG +$2.49 or +0.99% to $255.25) managed to make a positive reversal today after initially gapping down. It was a reassuring sign that it found support above its 50-day moving average (DMA) line and prior highs in the $237 area recently. Subsequent violations and damaging losses would raise greater concerns and trigger technical sell signals. Meanwhile, it may eventually form a new flat base or other bullish pattern. An overriding concern to worry more about now may be the M criteria, which recently has argued against new buying efforts, since 3 out of 4 stocks follow the direction of the major averages.

Any new (or add-on) buying efforts after its 2/11/11 breakout were likely limited to fresh losses in the -7-8% range by disciplined investors. Its rally "straight up from the bottom" from a cup-without-handle failed. In the stock's last appearance in this FSU section under the headline "A 'Straight Up From The Bottom' Breakout " an annotated graph showed it rising from an 11-week cup-shaped base without a handle. That article also discussed the tactic of properly pyramiding into a position with multiple purchases per the investment system guidelines. It also reminded investors - "The usual sell rules apply, as disciplined investors know to alway limit losses by selling if a stock falls -7% or more from your buy price."

CMG currently has an B+ rating for Accumulation/Distribution. Ownership by top-rated funds rose from 530 in Mar '10 to 639 in Dec '10, a nice reassurance concerning the I criteria of the investment system. Sales revenues increases have shown acceleration while up +12%, +16%, +20%, +23%, and now +25% in the streak of latest quarterly comparisons while the C criteria is satisfied by ongoing earnings increases above the +25% guideline. It also has a good annual (A criteria) earnings history. Despite a stock's strong fundamentals, investors must always be cautious not to let losses accumulate or grow out of control, and they should never average down by buying more shares at a lower price than an initial buy point.

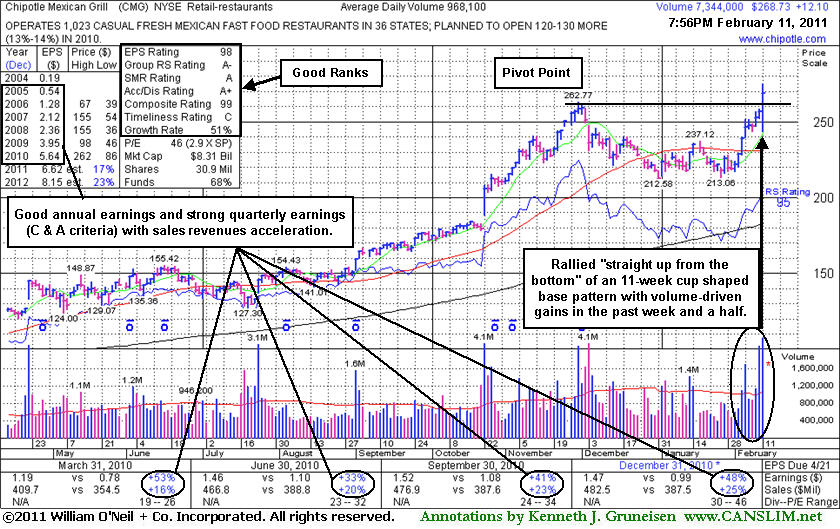

A "Straight Up From The Bottom" Breakout - Friday, February 11, 2011

Chipotle Mexican Grill, Inc. (CMG +$12.10 or +4.71% to $268.73) hit a new 52-week high today with a considerable gain backed by heavy volume after reporting earnings +48% on +25% sales revenues for the quarter ended December 31, 2010 versus the year ago period. Its rebound above its 50-day moving average (DMA) line recently helped its outlook improve and it has rallied "straight up from the bottom" of an 11-week cup-shaped base without a handle. Based on its technical strength it was highlighted in yellow as it returned to the Featured Stocks list while featured in the mid-day report today with a new pivot point cited based on its 11/30/10 high plus ten cents.

Investors may not recognize the phrase "straight up from the bottom" but it applies to an advanced chart pattern covered in the Certification course. It applies to cases like this, when a sound looking candidate quickly climbs from the bottom of a cup-shaped consolidation, without much if any pause, with gains on heavy volume as it rises and breaks out, rather than forming a rounded cup that would be typical of an ideal cup-with-handle base pattern. The stock can be accumulated with the usual discipline of not chasing it too extended (more than +5% above its prior high).

Properly pyramiding into a position with multiple purchases per the investment system guidelines (see "Ken's Mailbag" in today's After Market Update for more on "pyramiding"), investors should be able to avoid chasing the stock too extended. Of course, the usual sell rules apply, as disciplined investors know to alway limit losses by selling if a stock falls -7% or more from your buy price.

It currently has an A+ rating for Accumulation/Distribution. Ownership by top-rated funds rose from 530 in Mar '10 to 608 in Dec '10, a nice reassurance concerning the I criteria of the investment system. Sales revenues increases have shown acceleration while up +12%, +16%, +20%, +23%, and now +25% in the streak of latest quarterly comparisons while the C criteria is satisfied by ongoing earnings increases above the +25% guideline. It also has a good annual (A criteria) earnings history

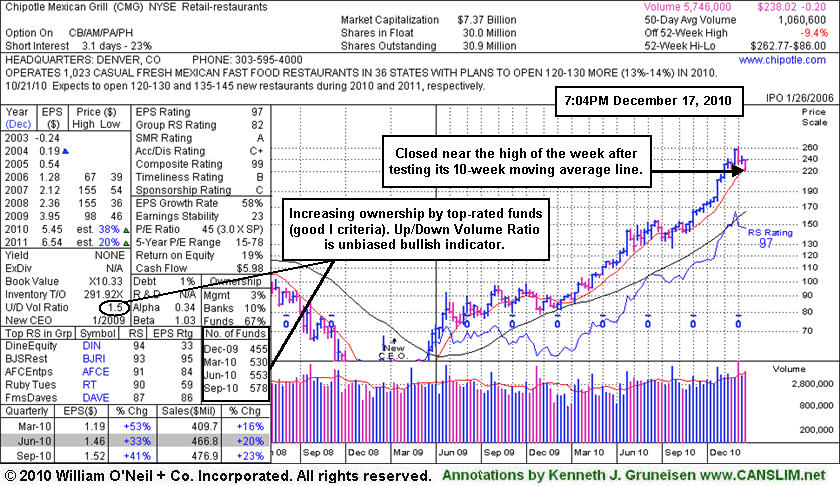

Pullback to 10-Week Average A Secondary Buy Point - Friday, December 17, 2010

Chipotle Mexican Grill, Inc. (CMG +$3.25 or +1.38% to $238.02) closed near the high of the week after dipping down to its 10-week moving average (WMA) line, an important chart support level to watch. As a secondary buy point following an earlier technical breakout, it is suggested in the Certification course that a stock can be accumulated after its first pullback to its 10 WMA line, and it may be bought all the way up to as much as +5% above its latest peak.

CMG's color code is changed to yellow, however no new pivot point is being cited because it has not formed a sound new base pattern. In this case, if properly pyramiding into a position with multiple purchases per the investment system guidelines, investors should be able to avoid chasing the stock so far extended from its current level. Of course, the usual sell rules apply, as disciplined investors know to alway limit losses by selling if a stock falls -7% or more from your buy price.

Its last appearance in this FSU section with an annotated graph was on 10/28/10 under the headline, "Holding Its Ground After Volume-Driven Gains To All Time Highs", it was shown while getting extended from its earlier 9/01/10 breakout. After a great sprint higher, this week marked its first time testing the 10 WMA line. Its Up/Down Volume ratio of 1.5 currently provides an unbiased bullish read that shares have been under accumulation even though it currently has a C+ rating for Accumulation/Distribution. Ownership by top-rated funds rose from 455 in Dec '09 to 578 in Sep '10, a nice reassurance concerning the I criteria of the investment system.

Sales revenues increases have shown acceleration while up +12%, +16%, +20%, and +23% in recent quarterly comparisons while the C criteria is satisfied by ongoing earnings increases above the +25% guideline. It also has a good annual (A criteria) earnings history.

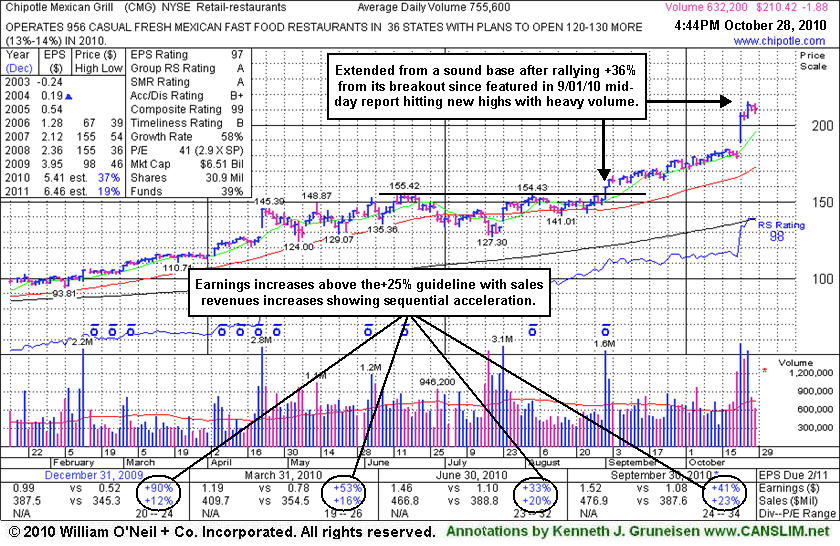

Holding Its Ground After Volume-Driven Gains To All Time Highs - Thursday, October 28, 2010

Chipotle Mexican Grill, Inc. (CMG -$1.88 or -0.89% to $210.42) is holding its ground after considerable volume-driven gains on 10/22/10 and 10/26/10 for a new all-time highs. It is extended from any sound base, and disciplined investors know that it is usually best to avoid chasing stocks more than +5% above their pivot point. Its 50-day moving average (DMA) line defines chart support above its prior highs in the $155 area.

Its last appearance in this FSU section with an annotated graph was on 9/01/10 under the headline "Mexican Food Chain Has Ingredients of Past Great Winners" as it rallied to multi-year highs with a considerable gain backed by 2 times above average volume. It has traded up as much as +36% higher since we observed - "The casual Mexican restaurant's shares are free to rise unhindered by overhead supply now. The market (M criteria) also is in better shape based on the broader strength, bullish action meeting the definition of a follow-through day (FTD). The FTD confirmed a new rally with large gains on higher volume, coupled with an increase in fresh technical breakouts."

Sales revenues increases have shown acceleration while up +12%, +16%, +20%, and +23% in recent quarterly comparisons while the C criteria is satisfied by ongoing earnings increases above the +25% guideline. It also has a good annual (A criteria) earnings history. As it returned to the Featured Stocks list it was noted that it -"Rebounded considerably after a very deep correction, falling from $123 when it was dropped from the Featured Stocks list 1/7/08, to as low as $36 in November '08."

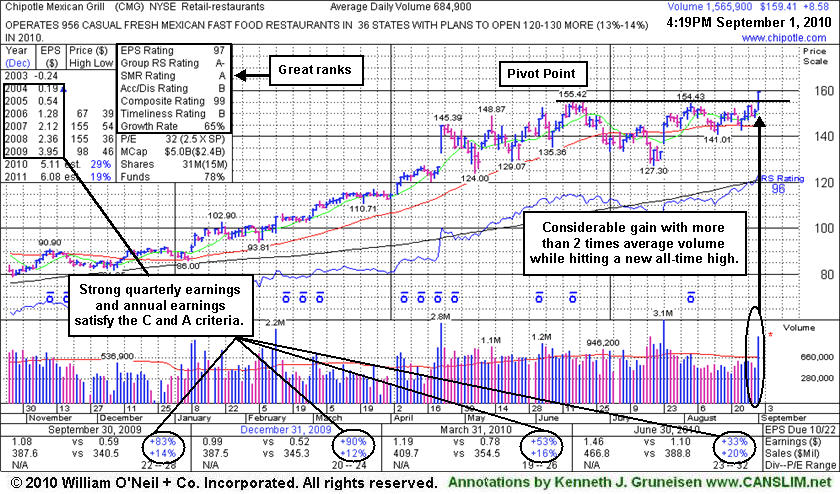

Mexican Food Chain Has Ingredients of Past Great Winners - Wednesday, September 01, 2010

Chipotle Mexican Grill, Inc. (CMG +$8.58 or +5.69% to $159.41) rallied to multi-year highs today with a considerable gain backed by 2 times above average volume. Its color code was changed to yellow with pivot point based on its 52-week high plus 10 cents while it was featured in the mid-day report (read here). Sales revenues increases have shown acceleration while up +12%, +16%, +20% in recent quarterly comparisons while the C criteria is satisfied by ongoing earnings increases above the +25% guideline. It also has a good annual (A criteria) earnings history. It was noted in recent mid-day reports -"Rebounded considerably after a very deep correction, falling from $123 when it was dropped from the Featured Stocks list 1/7/08, to as low as $36 in November '08."

The casual Mexican restaurant's shares are free to rise unhindered by overhead supply now. The market (M criteria) also is in better shape based on the broader strength, bullish action meeting the definition of a follow-through day (FTD). The FTD confirmed a new rally with large gains on higher volume, coupled with an increase in fresh technical breakouts.

A cautious and very selective approach has served investors very well over many different market periods. While today's bullish action is certainly the very reassuring sign we have been specifically waiting to see, it is not an order to immediately buy everything that fits the criteria. There indeed are several high-ranked leaders that appear to be buyable under the strict guidelines now. In the days and weeks ahead, this is exactly the time when we believe experts can prove their true expertise by filtering the buyable candidates down to a carefully selected and managed few that will hopefully be able to outperform the rest of the best.

Bounce At Support Offered By 50 Day Moving Average - Wednesday, November 14, 2007

A very important technical tool that savvy investors have learned to incorporate in their technical analysis is the 50-day moving average (DMA) line. The 50 DMA line plays a pivotal role relative to a stock's price. If the price of a stock is above its 50 DMA then odds are that its 50 DMA will act as formidable support. Conversely, if the price is below its 50 DMA then the moving average acts as resistance. Healthy stocks sometimes trade under their 50 DMA lines briefly, but usually a strong candidate will promptly bounce and repair a 50 DMA violation. When a stock has violated its 50 DMA line and then lingers beneath it, the stock's outlook gets worse and worse as it spends a greater period of time trading under that important short-term average line. Once the 50 DMA line starts sloping downward it should also be acknowledged that the stock has been struggling for a while, and it might be time to reduce exposure and look for places to put that money to work in stronger buy candidates.

Chipotle Mexican Grill, Inc. (CMG +$3.55 or +2.81% to $130.00) continued rallying back above its 50 DMA line, adding to Tuesday's bounce with more gains on about average volume. The casual Mexican restaurant's shares closed -8.4% below their 52-week high. The company has rallied a very healthy +65% since it was first featured in the July 2007 edition of CANSLIM.net News (read here) with a $88.80 pivot point and a $93.24 maximum buy price. After that healthy advance, CMG built a new base and appeared again in the 10/26/07 CANSLIM.net Mid Day Breakouts Report (read here) with the following note: "Y - Solid earnings and sales growth. This high-ranked leader has steadily climbed, forming what may be considered an ascending base pattern. Following considerable gains, its recent climb was marked by three pullbacks of about 10-20%, a characteristic of the less common ascending base pattern. Solid earnings increases of greater than +25% in the 6 latest quarters satisfies the C criteria. A new technical buy signal may be triggered if the stock rallies to fresh all-time highs with heavy volume." The reported identified a new $133.73 pivot point and a $140.42 maximum buy price. Later in that session in triggered a new buy signal which offered investors a chance to add to their existing holdings or initiate new positions. However, regular readers of CANSLIM.net reports were alerted as CMG soon fell back under its pivot point, raising concerns. Then it triggered a technical sell signal as it sliced below its 50 DMA line and the broader market entered a correction. The negative overall action prompted disciplined investors to reduce their exposure, as selling is prudent any time a stock falls more than -7% from your buy price. CMG still sports a very healthy Earnings Per Share (EPS) rating of 99, the highest possible reading. It's Relative Strength (RS) rating is a very strong 97 and its composite rating stands solid at 95. The company resides in the Retail - restaurants group which is currently ranked 89th of out the 197 industry groups listed in the paper, outside the top quartile, however strength in McDonalds Corp (MCD) demonstrates existing leadership in the group that helps satisfy the L criteria.

It would be encouraging for CMG to continue trading above its 50 DMA line, where institutional shareholders typically provide support. However, any breach of its latest chart lows could be a very ominous sign, as such weakness would complete a bearish head-and-shoulders type of pattern - which is a classic example of how stocks commonly top out. Poor market conditions (the M criteria) presently argue against any new buying efforts until there is a proper follow-through day for the at least one of the major market averages.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Fund Managers Are Taking a Bite of This Spicy Leader - Sunday, July 01, 2007

|

Chipotle Mexican Grill, Inc. |

||

|

Ticker Symbol: CMG |

Industry Group: Retail-Restaurants |

Shares Outstanding: 33,000,000 |

|

Price: $85.28 7/01/2007 |

Day's Volume: 1,069,600 (06/29/07 close) |

Shares in Float: 13,900,000 |

|

52 Week High: 88.70 6/01/2007 |

50-Day Average Volume: 562,500 |

Up/Down Volume Ratio: 1.9 |

|

Pivot Point: 88.80 6/01/2007 high plus .10 |

Pivot Point +5% = Max Buy Price: 93.24 |

Web Address: www.chipotle.com |

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes

View all notes | Alert me of new notes

CANSLIM.net Profile: Chipotle Mexican Grill, Inc. engages in the development and operation of fast-casual, Mexican food restaurants in the United States. As of December 31, 2006, it operated 581 restaurants, including 8 franchise restaurants. The company was founded in 1993 and is based in Denver, Colorado. Earnings have topped the year earlier by an impressive +94%, +125%, +154%, and +46% in the past four quarterly comparisons ended Jun, Sep, Dec '06 and Mar '07, with sales revenues up by +31%, +28%, +27%, and +26%, respectively. The number of top-ranked mutual funds that own an interest in this stock has increased from 42 to 85 in the past four quarters, which is a strong sign of increasing institutional sponsorship ("I" criteria). The company hails from the Retail- restaurants group which is presently ranked 149th on the 197 Industry Groups list, which places it way outside of the top quartile of Industry Groups where buying is usually wisest. However, in the CANSLIM Certification program they teach that exceptions can be made when there is at least one other very strong performing leader in the group. Regular CANSLIM.net readers should be able to recall the bullish action in Buffalo Wild Wings (BWLD), which rallied +59.8% in less than 3 month since appearing in the March 25th, 2007 Special Report "8 Stocks That Should Now Be On Your Watchlist" (read here). That example is no indication of what CMG will do for sure, but helps confirm the leadership needed to satisfy the "L" criteria.

What to Look For and What to Look Out For: This stock is currently considered buyable within the guidelines anywhere between its 50 DMA line and its new pivot point of $93.24. Always limit losses if any stock you buy closes 7-8% below your purchase price, and remember that a strict sell discipline may be especially helpful in the event of a market downturn. Look for CMG to continue bouncing off its 50-day moving average (DMA) line and eventually reach new highs to begin its next leg up. However, if it trades below its 50 DMA line and does not promptly find support, technically the violation would be considered a sell signal. Ideally, in the days immediately ahead CMG will follow through with additional gains on high volume to further confirm that serious institutional buying demand (the "I" criteria) is lurking.

Technical Analysis: CMG experienced a break-away gap when it exploded into new high territory on May 2nd, 2007 after reporting strong first quarter financial results. The stock spent the next few weeks advancing before pulling back to test support near its 50-day moving average (DMA) line. It was very encouraging to see volume mostly dry up (stay below average) as this stock pulled back towards its 50 DMA line. It is very healthy to see that institutional investors showed up and clearly defended the stock's 50 DMA line. Now that CMG successfully tested its 50 DMA line it offers investors another chance to accumulate the stock. Strong growth stocks with good institutional sponsorship will often find support around this line. This is the first time CMG is testing its 50 DMA line since it broke out last quarter. The first such pullback offers the next best opportunity to accumulate the stock since a case could have initially been made for buying on the break-away gap. However, the more extended a stock gets from its initial breakout, the greater the odds a sizeable correction occurring.