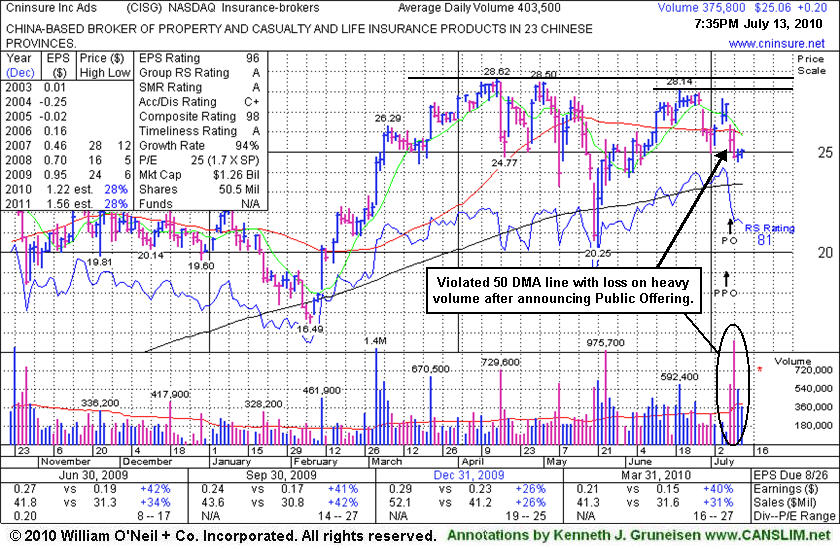

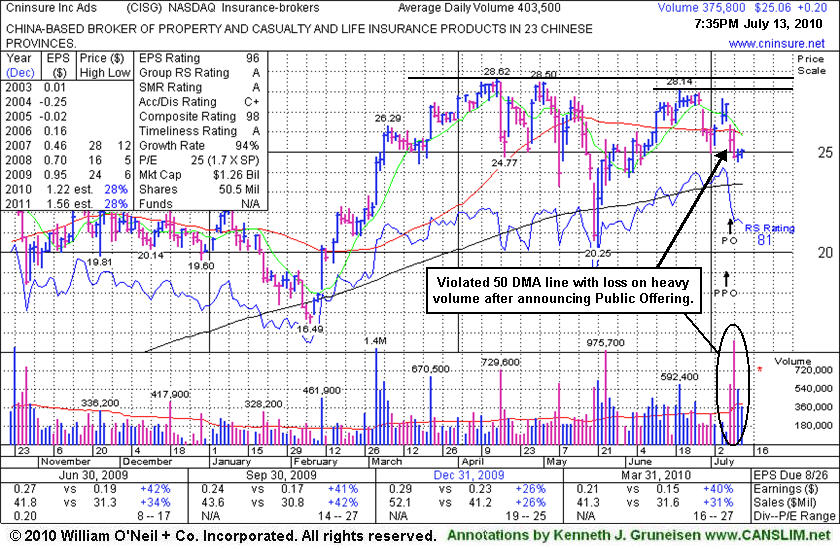

Cninsure Inc (CISG +$0.20 or +0.80% to $25.06) posted a gain with below average volume today. It is now consolidating -12.4% off its 52-week high and below its 50-day moving average (DMA) line after damaging distributional action including a gap down on 7/08/10 after announcing a Public Offering. Offerings commonly hinder the progress in issues for the short-term.

After it was featured again in yellow in the 6/16/10 mid-day report (read here) it was shown in this FSU section with an annotated graph on 6/18/10 under the headline "Strength Helps Insurance Firm Return To Featured Stocks List", however, it soon stalled after challenging prior resistance in the $28 area. It is no longer among the high-ranked stocks listed on the Featured Stocks page after being dropped from the list last evening. Gains above its 50 DMA line are needed for its outlook to improve, and technically, it would need to break out above stubborn resistance near $28 for its outlook to turn very bullish.

This China-based insurance broker has shown strong earnings and sales growth above the +25% guideline. It traded up as much as +17.4% higher after it rose from a 20-week double bottom base with 8 times average volume and was in the 3/03/10 mid-day report (read here).

Cninsure Inc (CISG +$0.49 or +1.84% to $27.09) posted a gain with above average volume to end the week reassuringly, closing just -5% off its 52-week high. It is consolidating above its 50-day moving average (DMA) line after recent gains above that important short-term average helped its outlook improve, technically. Disciplined investors may be wise to continue waiting until a fresh technical buy signal occurs. It was featured again in yellow in the 6/16/10 mid-day report (read here) with new pivot point cited based upon its 5/13/10 high. Based on weak action it was previously dropped from the Featured Stocks list on 5/19/10.

This China-based insurance broker has shown strong earnings and sales growth above the +25% guideline. It traded up as much as +17.4% higher after it rose from a 20-week double bottom base with 8 times average volume and was in the 3/03/10 mid-day report (read here). The lack of any other high-ranked leadership in the Insurance-Brokers industry group also remains a concern with respect to the investment system's L criteria.

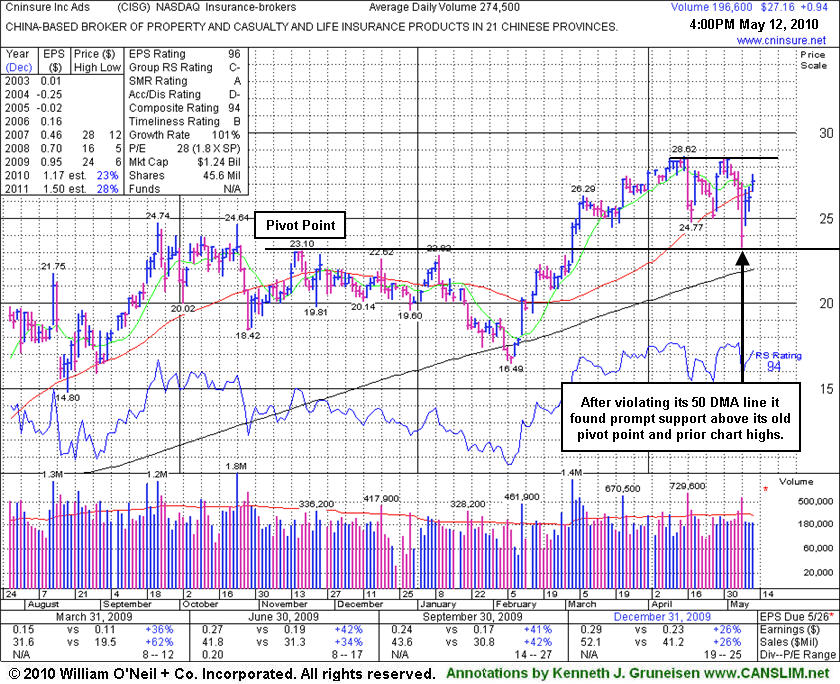

Cninsure Inc (CISG +$0.94 or +3.59% to $27.16) posted a third consecutive gain on lighter than average volume, yet today's rebound above its 50-day moving average (DMA) line has been an encouraging sign of support following last week's technical violation and sell signal. After violating its 50 DMA line it found prompt support above its old pivot point and prior chart highs. Disciplined investors may be wise to continue waiting for another ideal entry point. Meanwhile, it is currently working on the 5th week of a choppy new base, the and the questionable outlook for the broader market (M criteria) would only improve if a solid follow-through-day of gains from at least one of the major averages provides confirmation that the new rally attempt has sufficient buying conviction coming from the institutional crowd.

CISG traded up as much as +17.4% since featured in yellow as it rose from a 20-week double bottom base with 8 times average volume and was featured in the 3/03/10 mid-day report (read here) color coded yellow with pivot point cited based on its 11/18/09 high. This China-based insurance broker has shown strong earnings and sales growth above the +25% guideline but generally decelerating over the course of recent years. The lack of leadership in the Insurance-Brokers industry group also remains a concern with respect to the investment system's L criteria.

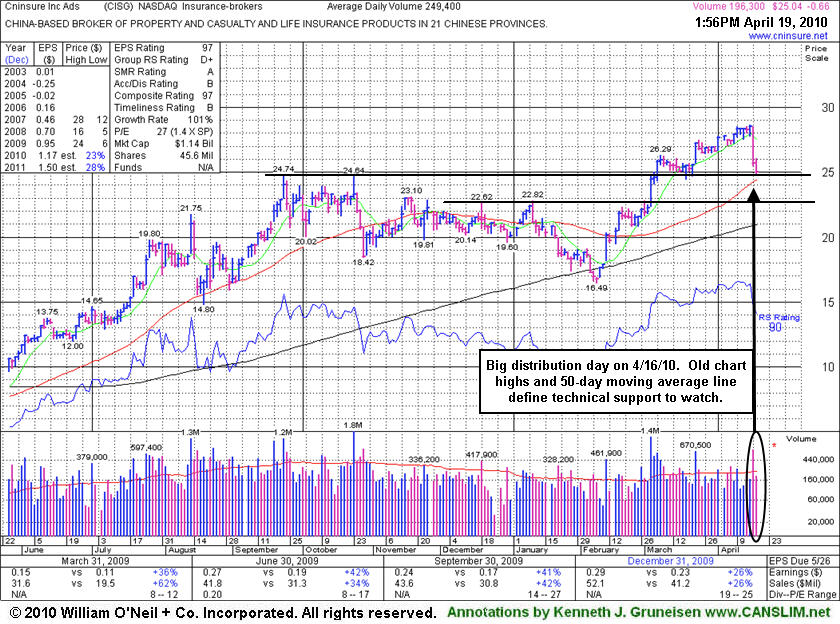

Cninsure Inc (CISG -$0.23 or -0.89% to $25.47) ended with a small loss today. Distributional pressure is weighing on the current rally, and 3 out of 4 stocks tend to follow the direction of the broader market (M criteria). Heavy distributional pressure on 4/16/10 raised concerns as the first ugly action seen in CISG since its appearance with an annotated graph under the headline, "More Extended After Gain Today With Three Times Average", in the Featured Stock Update section of the 3/23/10 After Market Update. Prior chart highs and its 50-day moving average (DMA) line in the $24 area define an important support level.

Some investors might be bold enough to consider accumulating shares, as institutional investors often accumulate shares in healthy companies when they pull back near their short term average lines. An aggressive investor might have courage to "buy the dips" as some patient investors may have been waiting in recent weeks for an opportunity to accumulate shares under its "max buy" level. Disciplined investors may be wise to continue waiting for another ideal entry point, and to see it the broader market (M criteria) improves. Meanwhile, more worrisome damage to the stock's chart and additional distribution in the market would serve as more serious warning signals prompting investors to reduce exposure, rather than accumulate more shares.

CISG traded up as much as +17.4% since featured in yellow as it rose from a 20-week double bottom base with 8 times average volume and was featured in the 3/03/10 mid-day report (read here) color coded yellow with pivot point cited based on its 11/18/09 high. This China-based insurance broker has shown strong earnings and sales growth above the +25% guideline but generally decelerating over the course of recent years. The lack of leadership in the Insurance-Brokers industry group also remains a concern with respect to the investment system's L criteria.

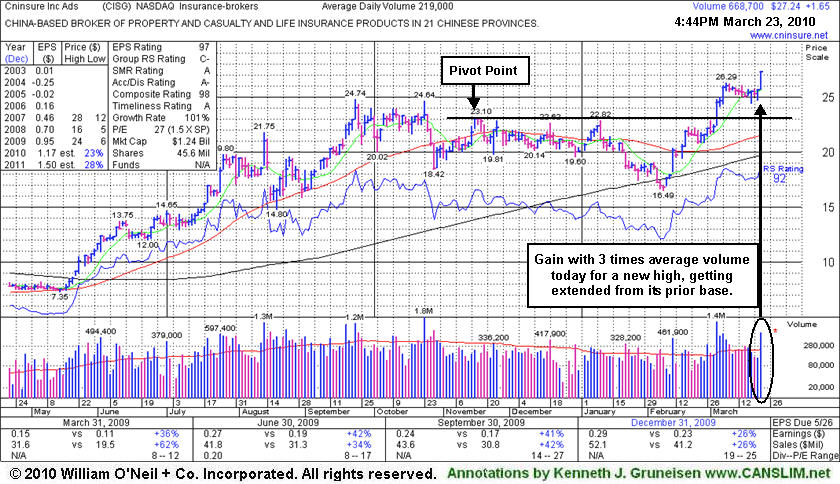

Cninsure Inc (CISG +$1.65 or +6.45% to $27.24) posted a considerable gain today with three times average volume for a new 52-week high. It is getting more extended from its previous sound base, now rising after a brief 2-week consolidation. Its weekly chart resembles a "3-weeks tight" pattern, yet that type of advanced chart pattern normally is considered valid only after a stock has distanced itself more substantially from its prior chart highs. For now, prior chart highs in the $24 area are now an important support level to watch. No overhead supply remains to act as resistance, however, and it could easily get more extended. Patience did not yet allow any opportunity to accumulate shares under its "max buy" level since its last appearance in this Featured Stock Update section on 3/03/10 with an annotated graph under the headline, "Volume Eight Times Average Behind Breakout Gain." Disciplined investors will wait for another ideal entry point without chasing it beyond the investment system guidelines.

It rose from a 20-week double bottom base with 8 times average volume as it was featured in the 3/03/10 mid-day report (read here) color coded yellow with pivot point cited based on its 11/18/09 high. This China-based insurance broker has shown strong earnings and sales growth above the +25% guideline but generally decelerating over the course of recent years. The lack of leadership in the Insurance-Brokers industry group also remains a concern with respect to the investment system's L criteria.

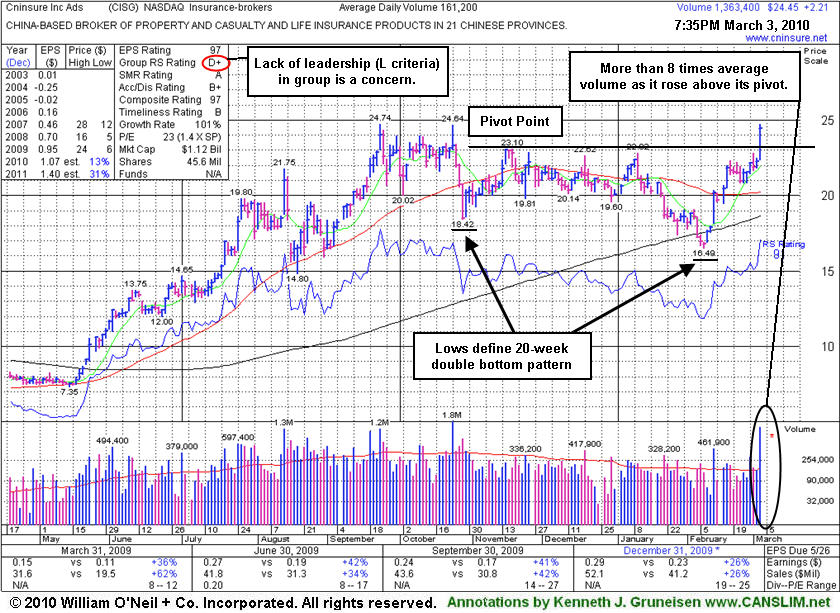

Cninsure Inc (CISG +$2.21 to $24.45) spiked higher with 8 times average volume today, trading within a penny of its 52-week high following its latest earnings report for the quarter ended Dec 31, 2009, rising from a 20-week double bottom base. It was featured in the mid-day report (read here) color coded yellow with pivot point cited based on its 11/18/09 high. This China-based insurance broker has shown strong earnings and sales growth above the +25% guideline but generally decelerating over the course of recent years. The lack of leadership in the Insurance-Brokers industry group also remains a concern with respect to the investment system's L criteria.