When the number of stocks included on the Featured Stocks page is low, and those currently listed have all received recent analysis in this FSU section, we occasionally go back to revisit a previously featured stock that was dropped. Today we will have another look at a stock that was dropped from the Featured Stocks list back on January 31, 2011.

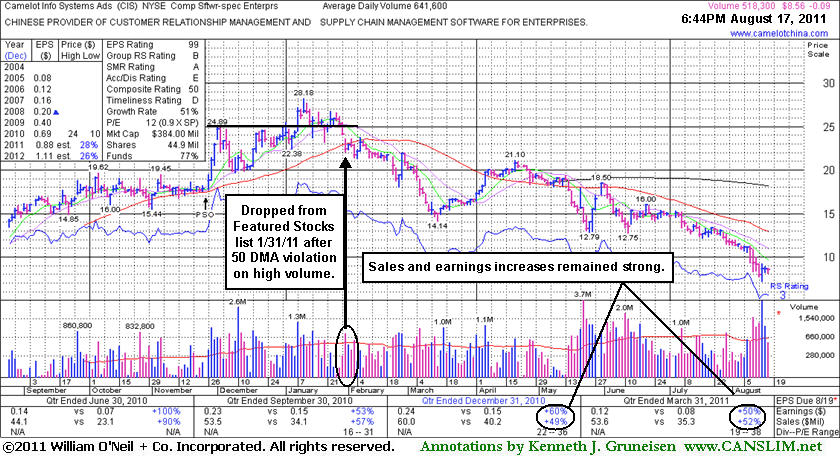

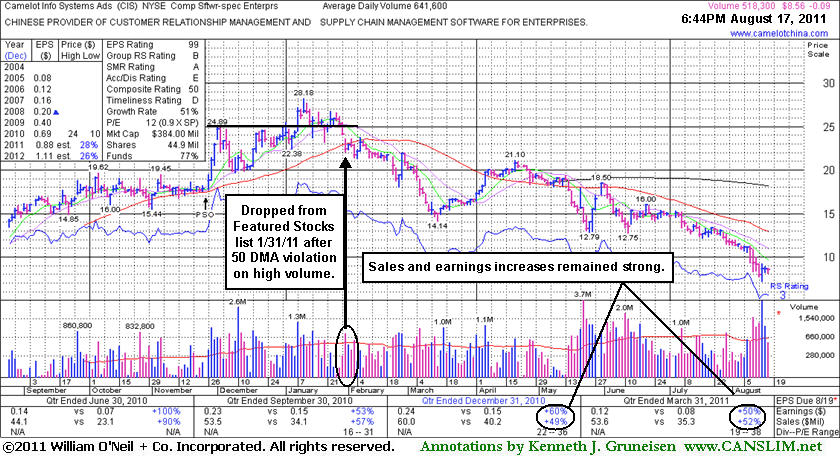

Camelot Info Systems Ads (CIS) was last noted 1/31/2011 5:32 PM "Gapped down today and closed below its 50 DMA line in the lower half of its intra-day range with a considerable loss on above average volume, triggering a technical sell signal. Based on technical damage it will be dropped from the Featured Stocks list tonight." It subsequently reported strong earnings for the period ended March 31, 2011, and it is due to report earnings for the period ended June 30, 2011 in the morning. Disciplined investors know, however, that even if earnings are good, there is a large amount of overhead supply that will act as resistance. Its apparently strong fundamentals failed to prevent a slide from $22.40 to as low as $7.17 this week, a -68% decline from when it was dropped less than 7 months ago. This serves as a vivid reminder to all members that cutting losses whenever any stock falls 7-8% from your purchase price is the best way investors can prevent larger, more damaging losses!

From the stock's Company Profile page members can review all prior notes and analysis, in this case going back to when this Chinese Computer Software firm was first featured at $18.93 in the 11/26/10 mid-day report (read here).

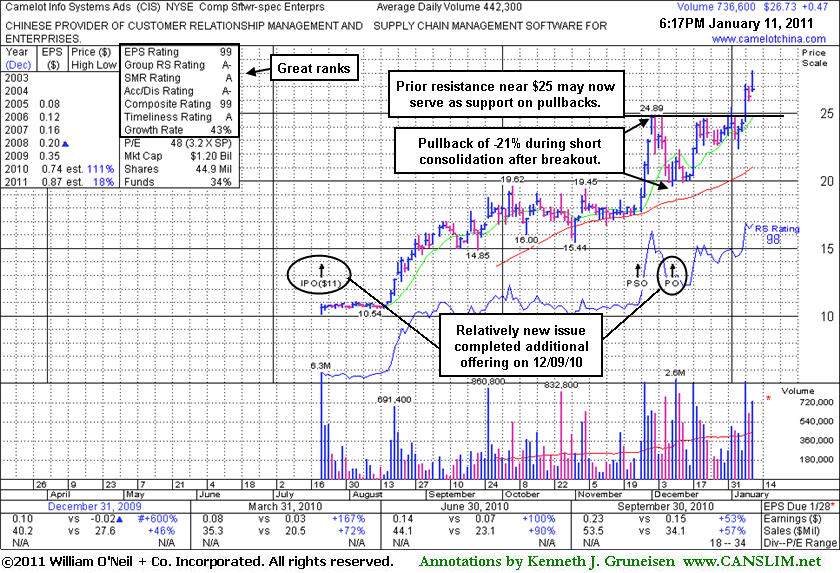

Camelot Info Systems Ads (CIS +0.47 or +1.79% to $26.737) gapped up today and hit another new all-time high but erased much of its gain and closed near the session low. Its latest consolidation was just over 5-weeks, but its pullback of greater than -20% was considered a flaw, which is why it was called a "choppy" consolidation and it was not labeled an orderly new base with a new pivot point identified. Additionally, it completed a Secondary Offering on 12/09/10, and was already up considerably from its July 2010 IPO at $11. Patient investors may watch for a better base to form in the future, while new buying efforts on light volume pullbacks near prior resistance in the $25 may be justified if one were to consider the 1/07/11 gain an otherwise compelling technical breakout. Disciplined investors always limit losses by selling if a stock falls 7-8% from their purchase price.

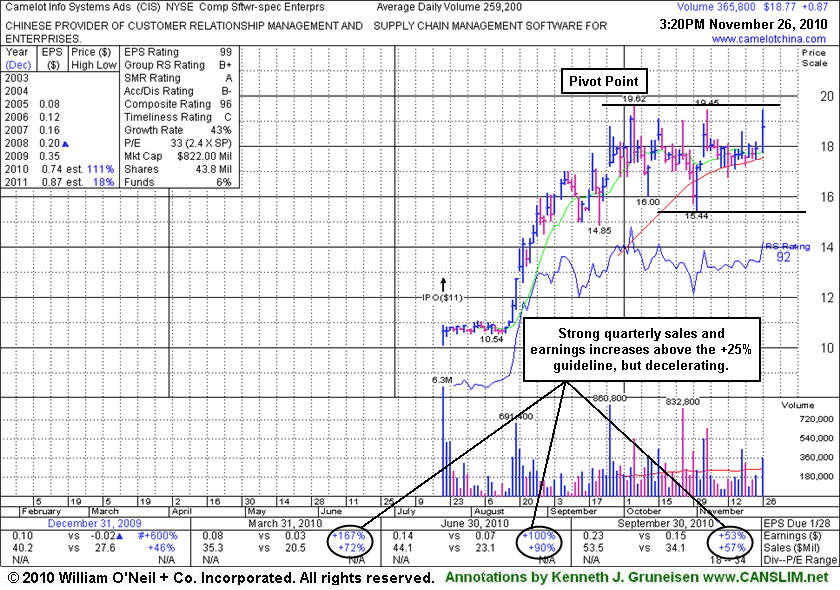

CIS broke out convincingly immediately after this Chinese Computer Software firm was first featured in the 11/26/10 mid-day report (read here) as its color code was changed to yellow with a pivot point cited base on its 52-week high plus ten cents. In the Featured Stock Update section an annotated graph appeared on 11/26/2010 under the headline "High-Ranked Computer Software Firm Perched Near Pivot Point" as it then posted a solid gain with above average volume, nearly challenging its 52-week high after a choppy 8-week base during which it found prompt support after a 50-day moving average (DMA) violation. Its sales revenues and earnings history appears to be very strong, and it has earned high ranks. Recent quarterly comparisons showed strong sales revenues and earnings increases above the +25% guideline, but decelerating sequentially.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

Camelot Info Systems Ads (CIS +0.87 or +4.86% to $18.77) posted a solid gain today with above average volume, nearly challenging its 52-week high after a choppy 8-week base during which it found prompt support after a 50-day moving average (DMA) violation. This Chinese Computer Software firm was featured in the 11/26/10 mid-day report (read here) as its color code was changed to yellow with a pivot point cited base on its 52-week high plus ten cents. Its sales revenues and earnings history appears to be very strong, and it has earned high ranks. Recent quarterly comparisons showed strong sales revenues and earnings increases above the +25% guideline, but decelerating sequentially. Disciplined investors resist the temptation to get in "early" while watching for a convincing breakout and a follow-through day (FTD) from at least one of the major averages (M criteria) as critical reassurances before new buying efforts are justified under the investment system guidelines.