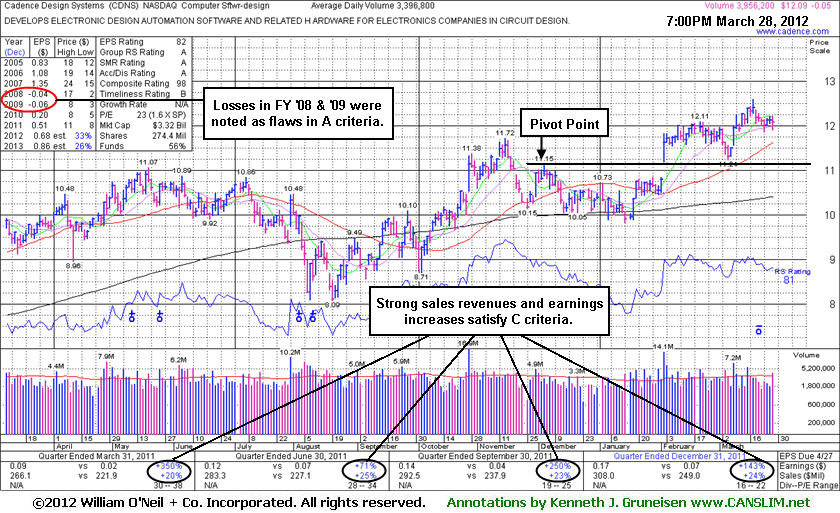

Favorable Trend of Increasing Institutional Ownership - Wednesday, March 28, 2012

Cadence Design Systems Inc's (CDNS -$0.05 or -0.41% to $12.09) finished with a small loss today on slightly above average volume. The volume totals had been cooling while holding its ground and consolidating near its 52-week high. No overhead supply remains to act as resistance. Prior highs and its 50-day moving average (DMA) line define support to watch on pullbacks. Its last appearance in this FSU section was on 2/03/12 with an annotated graph under the headline, "Institutional Accumulation Indicated by Gap Up With Heavy Volume". It was featured in yellow in the 2/03/12 mid-day report with a pivot point based on its 12/05/11 high. A considerable gap up and volume-driven gain on 2/02/12 had just helped it break out from a "double bottom" base and also reach a new 52-week high.

The 4 latest quarterly comparisons through Dec '11 showed strong sales revenues increases and earnings increases well above the +25% guideline, satisfying the C criteria. It has earned high ranks, however previously noted losses in FY '08 and '09 remain a blemish on its annual earnings history (A criteria). The number of top-rated funds owning its shares rose from 402 in Mar '11 to 519 in Dec '11, which is a very reassuring sign concerning the I criteria.

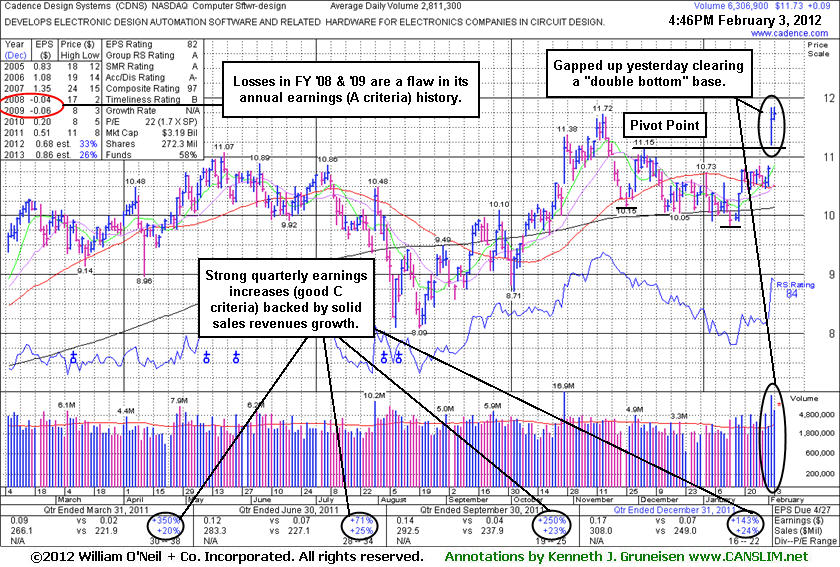

Institutional Accumulation Indicated by Gap Up With Heavy Volume - Friday, February 03, 2012

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. In other cases, stocks may be featured in CANSLIM.net's Mid-Day Breakouts Report.after recent action already triggered technical buy signal. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.Cadence Design Systems Inc (CDNS +$0.09 or +0.77% to $11.73) posted a small gain today with above average volume for a new high close. It was featured in yellow in the earlier mid-day report with a pivot point based on its 12/05/11 high. A considerable gap up and volume-driven gain on 2/02/12 helped it break out from a "double bottom" base and also reach a new 52-week high. No overhead supply remains to act as resistance.

The 4 latest quarterly comparisons through Dec '11 showed strong sales revenues increases and earnings increases well above the +25% guideline, satisfying the C criteria. It has earned high ranks, however previously noted losses in FY '08 and '09 remain a blemish on its annual earnings history (A criteria). The number of top-rated funds owning its shares rose from 402 in Mar '11 to 509 in Dec '11, which is a very reassuring sign concerning the I criteria.