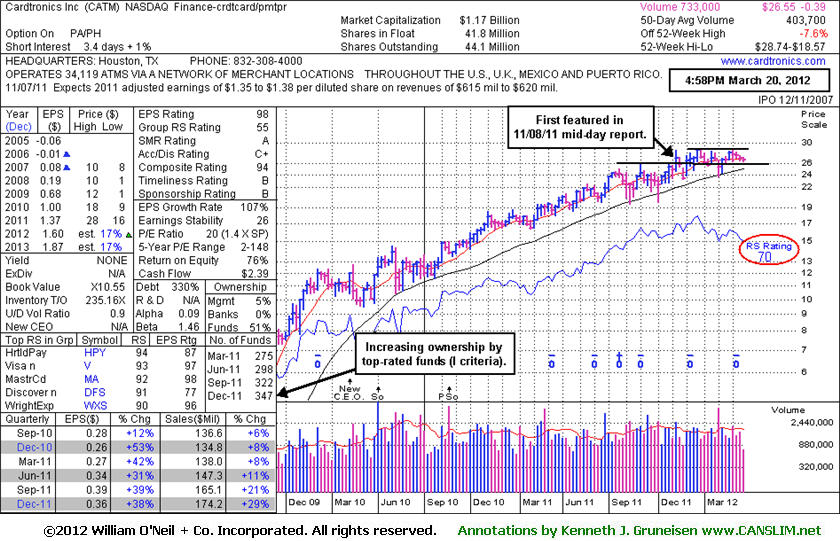

Waning Relative Strength After Not Triggering Proper Buy Signal - Tuesday, March 20, 2012

Cardtronics Inc (CATM -$0.18 or -0.67% to $26.55) has seen its Relative Strength rating slump to 70, below the 80+ guideline for buy candidates. Meanwhile, it has been sputtering below its latest pivot point cited without triggering a proper technical buy signal. Confirming gains are still needed before any new buying efforts would be justified under the fact-based investment system. Meanwhile, its 200-day moving (DMA) line defines the next important support level. Subsequent deterioration below its 200 DMA line and an earlier chart low ($23.26 on 11/25/11) would raise more serious concerns and trigger more worrisome technical sell signals.

Its lack of progress since featured in yellow in the 11/08/11 mid-day report (read here) has resulted in a waning Relative Strength rating (see red circle), yet it remains only -7.6% off its all-time high and near its 50 DMA line without a great deal of overhead supply to hinder its progress. Its last appearance in this FSU section was on 1/30/11 with an annotated graph under the headline, "50-Day Moving Average Violation Triggered Sell Signal". Financial results for the quarter ended December 31, 2011 remained strong as earning were +38% on +29% sales revenues, continuing the streak of reports showing sales revenues growth acceleration. Strong earnings increases above the +25% guideline in quarterly comparisons and strong annual earnings satisfy the C and A criteria. Sales revenues increases in recent comparisons (Mar, Jun, Sep '11) were noted for showing encouraging sequential acceleration from +8%, +11%, to +21%.

In prior reports it was observed - "Its close today actually left it just short of triggering a convincing technical buy signal. Confirming gains into new high territory with above average volume would be a welcome reassurance of accumulation by the institutional crowd." Subsequent gains did not materialize, and cautionary notes repeatedly reiterated concerns. Members may use the "view all notes" link to view prior notes on any stock.

The number of top-rated funds owning its shares rose from 221 in Dec '10 to 347 in Dec '11, a reassuring sign concerning the I criteria. However, the Finance - Credit card/Payment Processing group had the best possible 99 Group RS Rating at the time of its 12/23/11 appearance in this FSU section. Today it has a 55 Group RS Rating while it and other stocks in the industry group have sputtered.

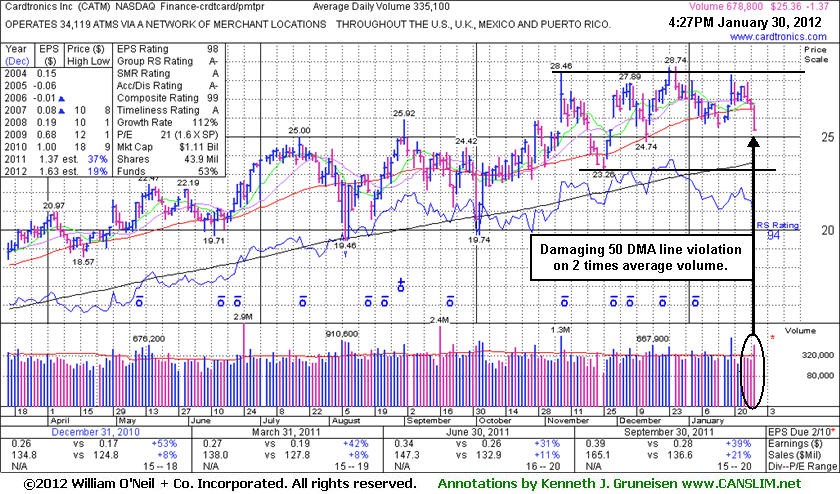

50-Day Moving Average Violation Triggered Sell Signal - Monday, January 30, 2012

Cardtronics Inc (CATM -$1.37 or -5.13% to $25.36) violated its 50-day moving average (DMA) line with a damaging loss on twice its daily average volume triggering a technical sell signal. Subsequent deterioration below its 200 DMA line and an earlier chart low ($23.26 on 11/25/11) would raise more serious concerns and trigger more worrisome technical sell signals.

After the close on Thursday, February 2, 2012 it is due to report financial results for the quarter and year ended December 31, 2011. Volume and volatility often increase near earnings news. It reported earnings +39% on +21% sales revenues for the quarter ended September 30, 2011 versus the year ago period. Strong earnings increases above the +25% guideline in quarterly comparisons and strong annual earnings satisfy the C and A criteria. Sales revenues increases in recent comparisons (Mar, Jun, Sep '11) show encouraging sequential acceleration from +8%, +11%, to +21% in the latest report.

Its last appearance in this FSU section was on 12/23/11 with an annotated graph under the headline, "Resilient Leader Reached New High Today", as we observed - "Its close today actually left it just short of triggering a convincing technical buy signal. Confirming gains into new high territory with above average volume would be a welcome reassurance of accumulation by the institutional crowd." Subsequent gains did not materialize, and cautionary notes repeatedly reiterated concerns. Members may use the "view all notes" link to view prior notes on any stock.

The number of top-rated funds owning its shares rose from 221 in Dec '10 to 327 in Dec '11, a reassuring sign concerning the I criteria. However, the Finance - Credit card/Payment Processing group had the best possible 99 Group RS Rating at the time of its last appearance in this FSU section. Today it has a 77 Group RS Rating while it and other stocks in the industry group have sputtered.

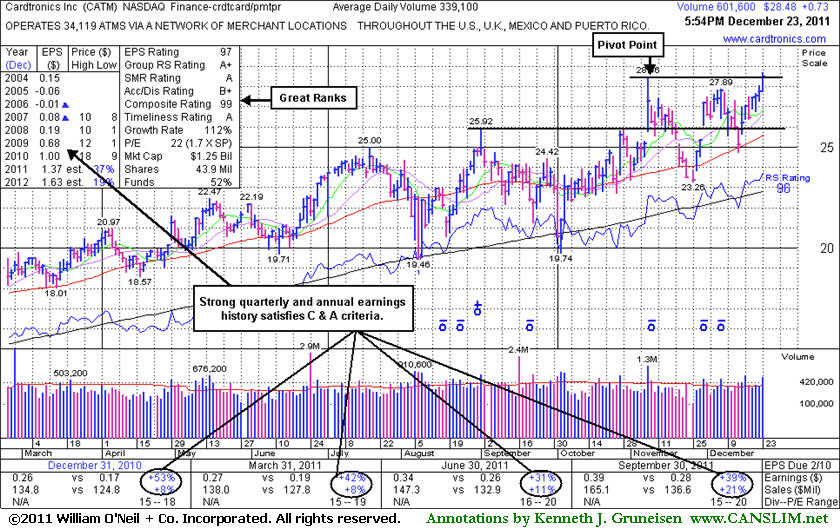

Resilient Leader Reached New High Today - Friday, December 23, 2011

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. In other cases, stocks may be featured in CANSLIM.net's Mid-Day Breakouts Report.after recent action already triggered technical buy signal. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Cardtronics Inc (CATM +$0.73 or +2.63% to $28.48) was featured in yellow in the mid-day report (read here). Today's 4th consecutive gain was backed by +77% above average volume as it hit a new 52-week high. Its new pivot point cited was based on its 11/08/11 high plus 10 cents, so its close today actually left it just short of triggering a convincing technical buy signal. Confirming gains into new high territory with above average volume would be a welcome reassurance of accumulation by the institutional crowd. Disciplined investors who might look to accumulate shares could be wise to use a tactic called pyramiding.

Earlier it found prompt support at its 200-day moving average (DMA) line. Its last appearance in this FSU section was on 11/08/11 with an annotated graph under the headline, "Sales Revenues Increases Show Accelerating Growth." It was noted and dropped from the Featured Stocks list on 11/25/11 due to weak action, then it promptly repaired its 50-day moving average (DMA) violation. Later it found support at that important short-term average line during a subsequent pullback.

It reported earnings +39% on +21% sales revenues for the quarter ended September 30, 2011 versus the year ago period. Strong earnings increases above the +25% guideline in quarterly comparisons and strong annual earnings satisfy the C and A criteria. Sales revenues increases in recent comparisons (Mar, Jun, Sep '11) show encouraging sequential acceleration from +8%, +11%, to +21% in the latest report.

The number of top-rated funds owning its shares rose from 221 in Dec '10 to 318 in Sep '11, a reassuring sign concerning the I criteria. The Finance - Credit card/Payment Processing group has the best possible 99 Group RS Rating and leadership in other stocks in the industry group satisfies the L criteria.

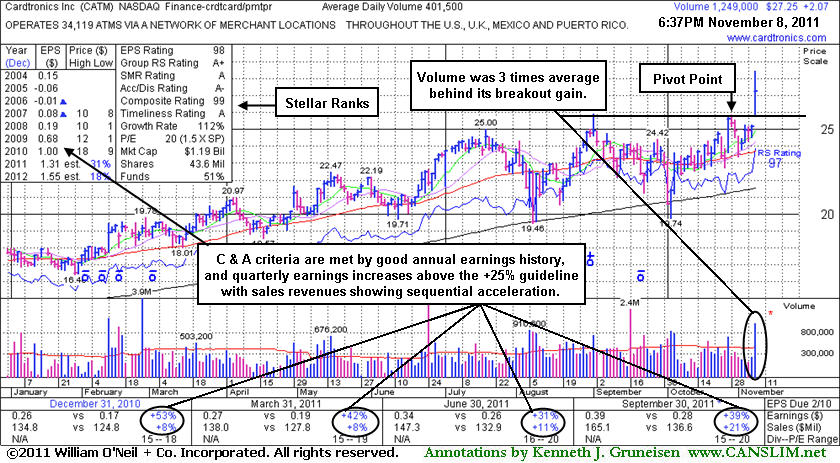

Sales Revenues Increases Show Accelerating Growth - Tuesday, November 08, 2011

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. In other cases, stocks may be featured in CANSLIM.net's Mid-Day Breakouts Report.after recent action already triggered technical buy signal. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

Cardtronics Inc (CATM +$2.07 or +8.22% to $27.25) was featured in yellow in the mid-day report (read here) after a gap up today. It finished the session with 3 times average volume while hitting new highs (N criteria) and breaking out of an orderly base pattern after reporting earnings +39% on +21% sales revenues for the quarter ended September 30, 2011 versus the year ago period. Strong earnings increases above the +25% guideline in quarterly comparisons and strong annual earnings satisfy the C and A criteria. Sales revenues increases in recent comparisons (Mar, Jun, Sep '11) show encouraging sequential acceleration from +8%, +11%, to +21% in the latest report.

Recently it found prompt support at its 200-day moving average (DMA) line. The number of top-rated funds owning its shares rose from 245 in Dec '10 to 342 in Sep '11, a reassuring sign concerning the I criteria. The Finance - Credit card/Payment Processing group has a 98 Group RS Rating and leadership in other stocks in the industry group satisfies the L criteria. Prior chart highs define important initial support to watch on pullbacks, and any slump back into its prior base would not bode well.