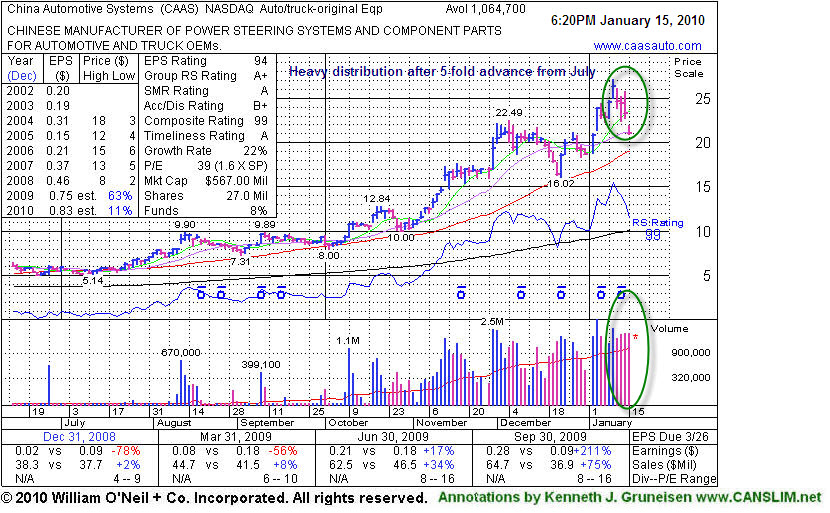

China Automotive Systems (CAAS -$2.21 or -9.51% to $21.03) gapped down today after an analyst downgrade, suffering its 4th consecutive loss on above average volume. It is heavy distributional pressure after a 5-fold run up since July 2009. Perhaps its ugly action is a hint it could be a wise time to be locking in profits rather than accumulating. CAAS was actually rather late-stage at $18.84 when first featured in the 11/30/09 mid-day report (read here). It is now extended from an ideal buy point and considered "damaged goods" although some might be watching for it to find support near previous resistance. It is usually best to avoid the temptation to buy apparent "bargains", and instead buy on signs of strength.

The daily chart below shows recent quarters with sales revenues accelerating greatly and earnings increases getting bigger, and it has a good annual earnings history (A criteria). Increasing ownership from a handful top-rated funds is encouraging news concerning the I criteria of the investment system, as the number of top-rated funds rose from 4 in Dec '09 to 9 in Sept '09. Meanwhile, the small supply of shares (S criteria) in its publicly traded float could contribute to great volatility in the event of more abrupt maneuvering by large and highly influential fund managers.

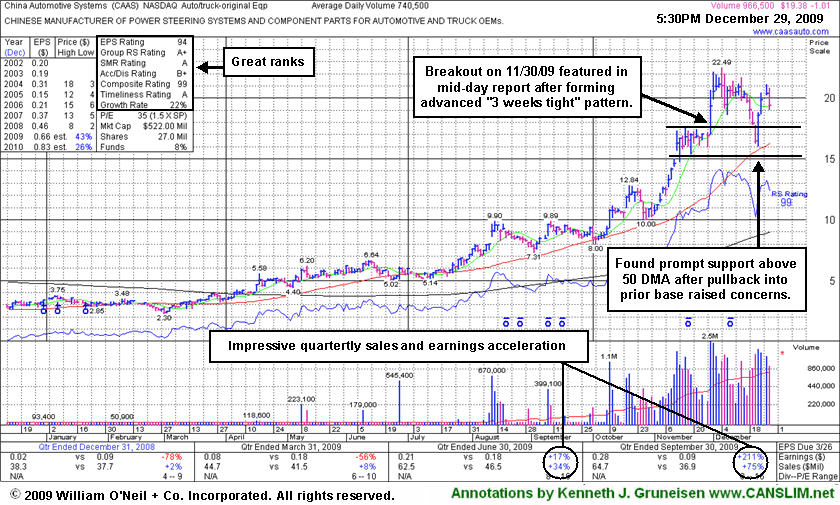

China Automotive Systems (CAAS -$1.01 or -4.95% to $19.38) fell today on lighter volume (but still above average) after 3 consecutive considerable gains backed by heavier above average volume indicated accumulation. The Chinese maker of power steering systems had briefly negated all of its bullish action since rising from an advanced "3-weeks tight" type of chart pattern. However, it found prompt support near its short-term average line and positively reversed on 12/23/09 after a gap down and pullback near support at its 50-day moving average (DMA) line. It is now extended from an ideal buy point CAAS was featured in yellow in the 11/30/09 mid-day report (read here) while it also cleared its 2004 all-time high and quickly traded more than +5% above its prior highs. The stock's prior appearance in this Featured Stock Update section on 12/11/09 under the headline "Volume Drying Up While Hovering Near All-Time Highs" warned that "it may be risky and unwise to be undisciplined about buying and chase it, yet the high-ranked leader may go on to produce more climactic gains. Caution and discipline are especially critical for investors since this stock is already up more than 8-fold from its March lows."

The daily chart below shows recent quarters with sales revenues accelerating greatly and earnings increases getting bigger, and it has a good annual earnings history (A criteria). Increasing ownership from a handful top-rated funds is encouraging news concerning the I criteria of the investment system, as the number of top-rated funds rose from 4 in Dec '09 to 9 in Sept '09. Meanwhile, the small supply of shares (S criteria) in its publicly traded float could contribute to great volatility in the event of more abrupt maneuvering by large and highly influential fund managers.

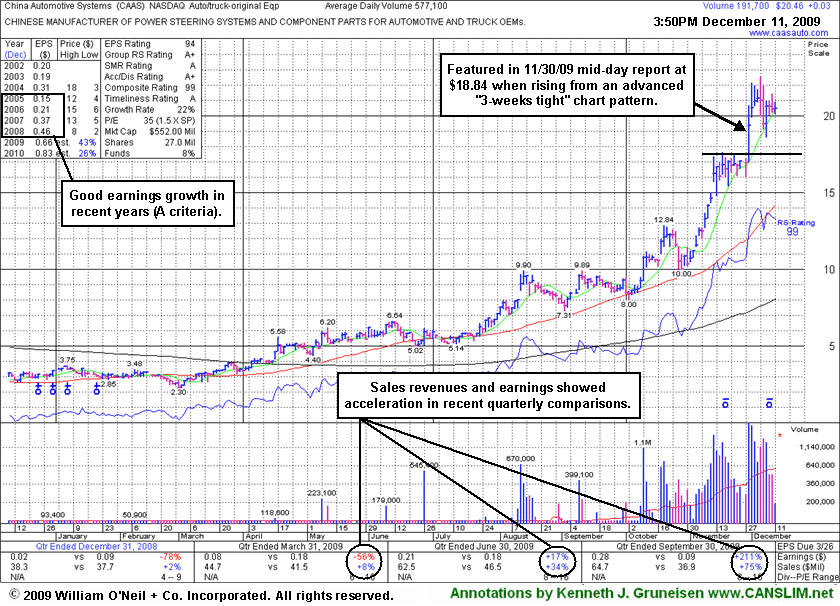

China Automotive Systems (CAAS +$0.03 or +0.15% to $20.46) finished the session with a small gain on light volume. Volume totals have dried up in recent days while it has been consolidating near all-time highs. The Chinese maker of power steering systems was rising from an advanced "3-weeks tight" type of chart pattern as it showed up in yellow in the 11/30/09 mid-day report (read here) while it also cleared its 2004 all-time high and quickly traded more than +5% above its prior highs. It is now more than +16% above its pivot point, so it may be risky and unwise to be undisciplined about buying and chase it, yet the high-ranked leader may go on to produce more climactic gains. Caution and discipline are especially critical for investors since this stock is already up more than 8-fold from its March lows.

The daily chart below shows recent quarters with sales revenues accelerating greatly and earnings increases getting bigger, and it has a good annual earnings history (A criteria). Increasing ownership from a handful top-rated funds is encouraging news concerning the I criteria of the investment system, as the number of top-rated funds rose from 4 in Dec '09 to 10 in Sept '09. Meanwhile, the small supply of shares (S criteria) in its publicly traded float could contribute to great volatility in the event of more abrupt maneuvering by large and highly influential fund managers.

China Automotive Systems (CAAS +$2.42 or +14.29% to $19.35) finished the session with a considerable gain on heavy volume. The Chinese maker of power steering systems was rising from an advanced "3-weeks tight" type of chart pattern as it showed up in yellow in today's mid-day report (read here). Today it is also cleared its 2004 all-time high while quickly trading more than +5% above its recent highs. It may be considered risky and unwise to be undisciplined about buying and chase it, yet the high-ranked leader may go on to produce more climactic gains. Caution and discipline are especially critical for investors since it is already up more than 8-fold from its March lows.

Recent quarters show accelerating sales revenues and earnings increases, and it has a good annual earnings history (A criteria). The weekly chart below shows a small number, but increasing ownership from a handful top-rated funds. That is encouraging news concerning the I criteria of the investment system. Meanwhile, the small supply of shares (S criteria) in its publicly traded float could contribute to great volatility in the event of more abrupt maneuvering by large and highly influential fund managers.