Lagging Communications Firm Falls From Featured Stocks List - Friday, June 01, 2007

A very important technical tool that savvy investors have learned to incorporate in their technical analysis is the 200-day moving average (DMA) line. The 200 DMA line plays a pivotal role relative to a stock's price. If the price of a stock is above its 200 DMA then odds are that its 200 DMA will act as longer term support. Conversely, if the price is below its 200 DMA then the moving average acts as resistance. Obviously, if a technical breakdown or violation takes place on heavy volume it is a more serious concern. Sometimes quiet violations are repaired quickly, without a lot of additional losses. However, the key moving averages are always an important line to watch.

Brocade Communications Systems Inc. (BRCD -$0.75 or -8.17% to $8.44) sliced below its 200 DMA line with a considerable loss on more than double its average daily trading volume after the company earned $0.11 cents a share compared to $0.10 in the quarter ending April 30, 2006, a +10% increase (see red circle in bottom right). That is below the minimum +25% guideline and sharply lower than its past few quarters of huge earnings increases. The stock has flashed several technical sell signals over the past few weeks which should not be taken lightly. First, BRCD sliced below a three month upward trendline in late-April, then quietly fell below its 50 DMA line in early-May. A downgrade prompted a gap down on May 3rd which was a more ominous technical sell signal. It has been unable to repair the damage since these technical violations occurred. Its subsequent rally attempt lacked conviction on the buy side, evidenced by the light volume behind all but one of its gains, and its 50 DMA line acted as an obvious resistance level.

BRCD was first featured at $9.14 on Tuesday, February 27, 2007 in the CANSLIM.net Mid Day Breakouts Report (read here) as it was rallying for solid gains and nearing a breakout above its pivot point. Later, the Monday March 26, 2007 After Market Report (read here) discussed its strong traits, but also cautioned investors, as by that time it was too extended beyond the reasonable guidelines to be considered a smart buy. Then trouble started brewing. It was noted in the April 30th CANSLIM.net After Market Report that BRCD was "trading just above support of its 50 DMA ($9.70) and a breach of that level is a sell signal" (read here). Then the May 1st After Market Report noted that BRCD closed below its 50 DMA line, and referred to the next important support level at its prior chart low follows - "Next test is near $9.42 and a break below there would be a greater concern" (read here). These examples demonstrate how CANSLIM.net reports help members avoid serious trouble and stay informed, since many investors have limited time to study and interpret the day-to-day action in leading stocks. Also, astute CANSLIM.net members who used the "alert me of new notes" feature received timely email copies of the abovementioned notes, which is yet another way CANSLIM.net members stay informed. Today BRCD violated its longer term 200 DMA line, which is a level where support may be expected to step up. However, as a result of all above factors, BRCD will be removed from the CANSLIM.net Featured Stocks List today. It is always important to eliminate weak stocks and replace them with strong leaders, rather than stubbornly sticking to a "buy and hold" strategy.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

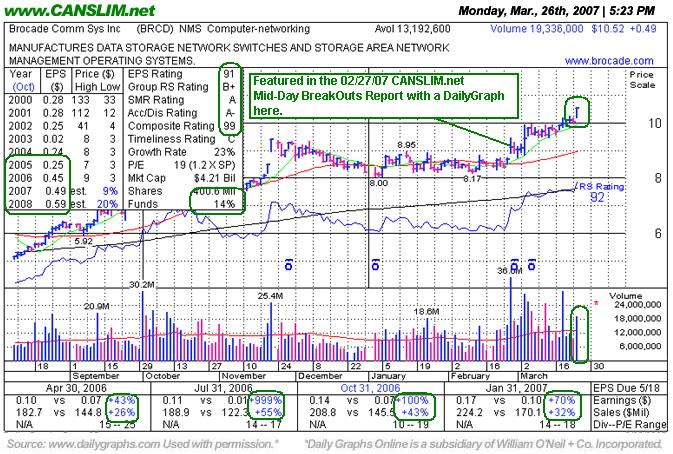

Impressive Action Pushes Stock More Than +5% Above Pivot Point - Monday, March 26, 2007

A classic example of the success enjoyed by many CANSLIM.net readers usually starts when an investor reads a CANSLIM.net report and buys a featured stock before it has risen above the pivot point by greater than 5%. After a stock breaks out above its pivot point, there is only a +5% window that investors have to purchase the stock under the proper guidelines. Once a stock rises above the "maximum buy price" the risk of a shake out balloons, meaning that even a normal retracement in the stock might force you to employ the 7-8% loss cutting rule. Much can be told by the stock's daily action in the weeks and months that follow a breakout. Typically, a light volume and orderly pullback suggests that the bulls remain in control. However, high volume pullbacks that violate support paint a totally different picture.

Brocade Communications Systems Inc. (BRCD +$0.49 or +4.89% to $10.52) jumped to yet another new 52-week high today with gains on above average volume. This stock was first featured on Tuesday, February 27, 2007 in the CANSLIM.net Mid Day Breakouts Report (read here) as it was setting up. Then it appeared in the Wednesday February 28, 2007 After Market Report (read here) discussing its strong traits. A few days later, BRCD blasted above its $9.52 pivot point with gains backed by the necessary volume to trigger a proper technical buy signal. It was very impressive to see BRCD hold onto its gains afterward, as the major averages went through a steep "correction." After a brief 2-week consolidation, lingering below its "maximum buy" price of $10, the bulls returned in force as gains on above average volume sent this stock to another new 52-week high. Now that BRCD is trading above its pivot point by more than 5% it is considered to be too extended from a sound base pattern to be bought under the guidelines. Instead of chasing a stock above its maximum buy price, disciplined investors follow the proper guidelines.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

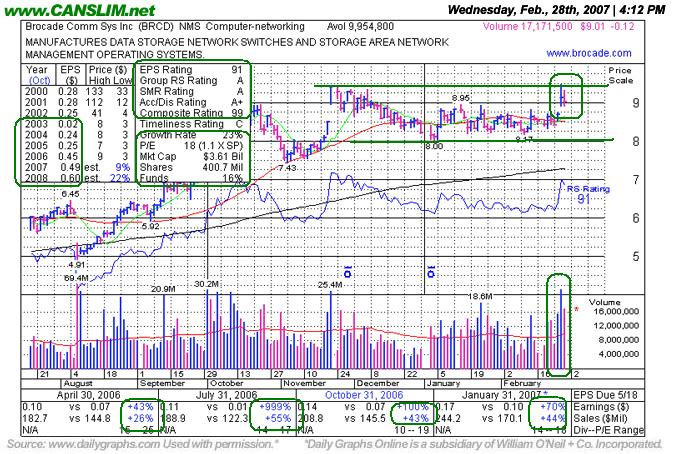

Networking Stock Yet To Trigger Proper Buy Signal - Wednesday, February 28, 2007

Group action plays a very important role, and experienced investors learn that they can increase their odds of picking a great winner by always focusing their buying efforts in the market's leading groups. The "L" criteria in CAN SLIM(R) tells us to choose leading companies in leading industry groups, thus it is suggested that investors choose from the top quartile of the 197 Industry Groups (listed in the paper most days on page B4). A classic example of the success enjoyed by many CANSLIM.net readers usually starts when an investor reads a CANSLIM.net report and buys a featured stock before it has risen above the pivot point by greater than 5%. After a stock breaks out above its pivot point, there is only a +5% window that investors have to purchase the stock under the proper guidelines. Once a stock rises above the "maximum buy price" the risk of a shake out balloons, meaning that even a normal retracement in the stock might force you to employ the 7-8% loss cutting rule. Much can be told by the stock's daily action in the weeks and months that follow a breakout. Typically, a light volume and orderly pullback suggests that the bulls remain in control. However, high volume pullbacks that violate support paint a totally different picture.

Brocade Communications Systems Inc. (BRCD -$0.12 or -1.31% to $9.01) managed to end higher on Tuesday, even as the major averages pulled back severely. This stock was first featured on Tuesday, February 27, 2007 in the CANSLIM.net Mid Day Breakouts Report (read here) with a $9.52 pivot point. BRCD sports a very healthy Earnings Per Share (EPS) rating of 91. It is also encouraging to see the company earn a very healthy Relative Strength (RS) rating of 91. The company has managed to increase its earnings by above the +25% guideline in each of the past four quarterly comparisons versus the year earlier, satisfying the "C" criteria. BRCD resides in the Computer-networking group which is currently ranked 31st of out the 197 Industry Groups covered in the paper, placing it in the much preferred top quartile and satisfying the "L" criteria. Despite BRCD's high ranks and solid performance on Tuesday it has yet to trade above its pivot point. Disciplined investors wait for a stock to trade above its pivot point with gains on the necessary volume (at least +50% above average) to trigger a proper technical buy signal. Doing so is crucial in the successful CAN SLIM(R) investment system. Investors who try to get a head start by buying stocks "early", before a proper technical buy signal is triggered, are not following the guidelines. Lower priced stocks (under $10) are usually riskier buy candidates that require extra caution. Those who do not follow the guidelines are more prone to failure. Furthermore, when market conditions are hurting investors' odds, the "M" criteria in CANSLIM is considered to be questionable, arguing against making any new buying efforts.

C A N S L I M | StockTalk | News | Chart | ![]() DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile