Bridgepoint Education (BPI -$0.64 or -2.81% to $22.12) gapped down today, diving below recent lows previously mentioned as "a very important support level to watch" and trading below its Aug 2009 highs for the first time sine 3/16/10. When it was last shown in this Featured Stock Update section on 5/07/10 under the headline "Leadership In Group Waning Under Threat Of Regulations" we observed that - "prompt sign of support near its 50 DMA line would be encouraging, while any further deterioration leading to a slump below its August 2009 highs would raise more serious concerns."

BPI would need to rally back above its 50-day moving average (DMA) line for its outlook to improve. Based on weakness it will be dropped from the Featured Stocks list tonight. Leadership in the Commercial Services - Schools group recently waned as many for-profit schools have encountered distributional pressure in the wake of proposed regulatory changes. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally. BPI was featured in yellow in the 4/13/10 mid-day report (read here) as rose from a cup-with-high-handle hit a new 52 week high after a brief consolidation above its old chart high ($21.90). It has an impressive history of very strong annual and quarterly increases in sales revenues and earnings above the +25% guideline which is good concerning the C & A criteria.

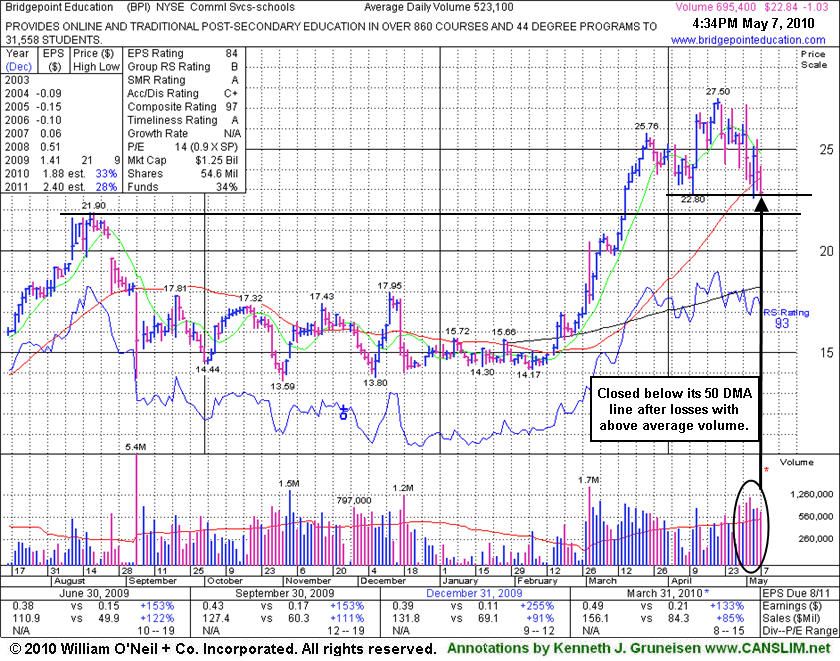

Bridgepoint Education (BPI -$1.03 or -4.32% to $22.84) suffered another loss today with above average volume and closed below its 50-day moving average (DMA) line. Leadership in the Commercial Services - Schools group has waned as many for-profit schools have encountered distributional pressure in the wake of recently proposed regulatory changes. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally. BPI was featured in yellow in the 4/13/10 mid-day report (read here) as rose from a cup-with-high-handle hit a new 52 week high after a brief consolidation above its old chart high ($21.90). It has an impressive history of very strong annual and quarterly increases in sales revenues and earnings above the +25% guideline which is good concerning the C & A criteria.

A prompt sign of support near its 50 DMA line would be encouraging, while any further deterioration leading to a slump below its August 2009 highs would raise more serious concerns.

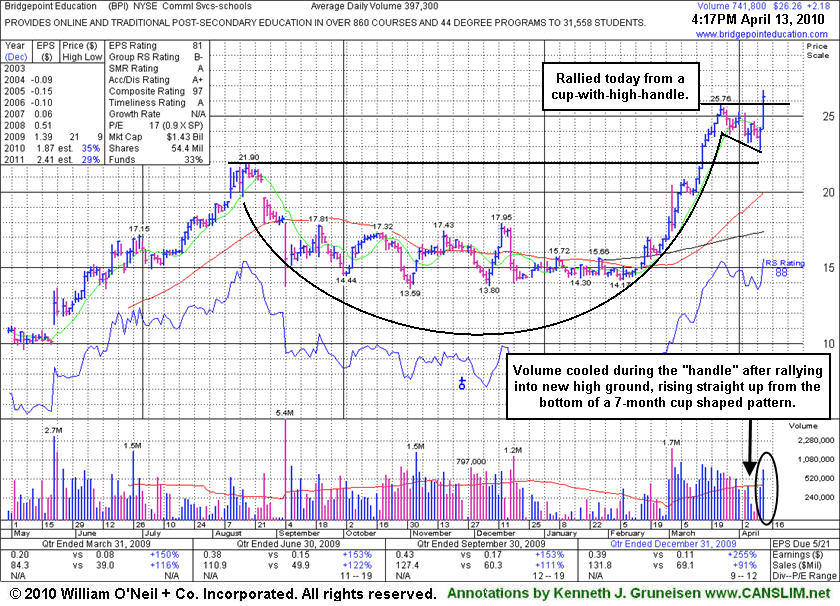

Bridgepoint Education (BPI +$2.26 or +9.39% to $26.34) hit a new 52 week high today after a brief consolidation above its old chart high ($21.90). It finished the session strong, rising above its pivot point with about 2 times average volume, triggering a technical buy signal. It has an impressive history of very strong annual and quarterly increases in sales revenues and earnings above the +25% guideline which is good concerning the C & A criteria. The Commercial Services - Schools firm was last noted in the mid-day report on 3/24/10 after it had rallied straight up from the bottom of a 7-month cup shaped pattern -"Patient investors may watch for future buy points near a sound base or wait for the opportunity to accumulate shares on light volume pullbacks."

Volume totals cooled as it pulled back -11.5% during the "handle" formed after rallying into new high ground without looking back. Its pattern resembles a cup-with-high-handle, with its pivot point based upon the 3/24/10 high cited in today's mid-day breakouts report (read here). Grand Canyon Education (LOPE) also appeared in yellow in today's mid-day breakouts report. Leadership in the Commercial Services - Schools group includes CPLA and LINC, which is a nice reassurance concerning the L criteria.