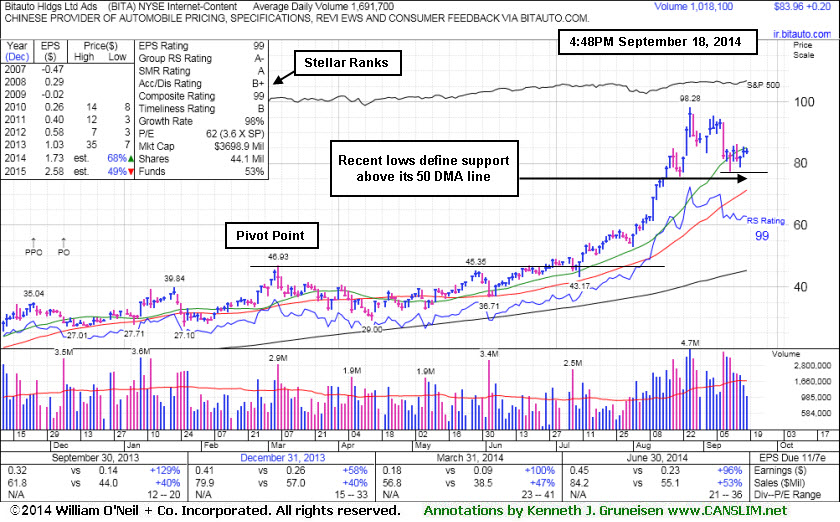

Volume Totals Recently Cooling After Halting Slide - Thursday, September 18, 2014

Biotauto Hldgs Ltd Ads (BITA +$0.20 or +0.24% to $83.96) has seen volume totals cooling since it halted its slide following losses with above average volume. Its current consolidation is too brief in duration to be recognized as a new base. It was noted repeatedly with caution - "Has the look of a 'climax run' with volume-driven gains getting very extended from its prior base." Recently it has endured distributional pressure, yet its fundamentals remain strong.

Recent lows ($77.50 on 9/11/14) define near-term support to watch above its 50-day moving average (DMA) line ($71.40) which is usually an important near-term support level for chart readers. BITA was last shown in this FSU section on 8/27/14 with an annotated graphs under the headline,"Finished Near Session Low - Noted With Look of 'Climax Run'". It has not spent much time base building during its ascent since highlighted in yellow in the 6/26/14 mid-day report (read here) with pivot point cited based on the 3/06/14 high plus 10 cents.

Fundamentals remain strong with respect to the C and A criteria as it reported earnings +96% on +53% sales revenues for the Jun '14 quarter. It was first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here). This China-based Internet-Content firm's quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 15.4 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 104 top-rated mutual funds as of Jun '14 owning an interest in the company, up from 41 in Sep '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio is 1.8, an unbiased indication its shares have been under accumulation over the past 50 days.

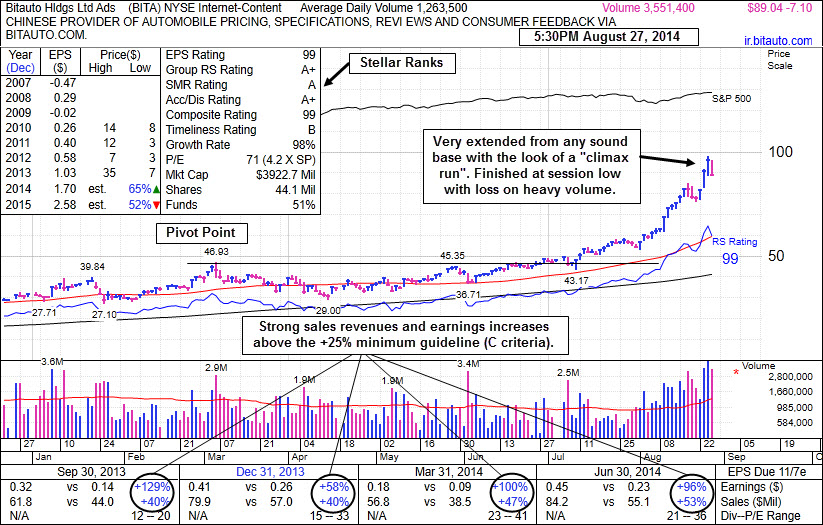

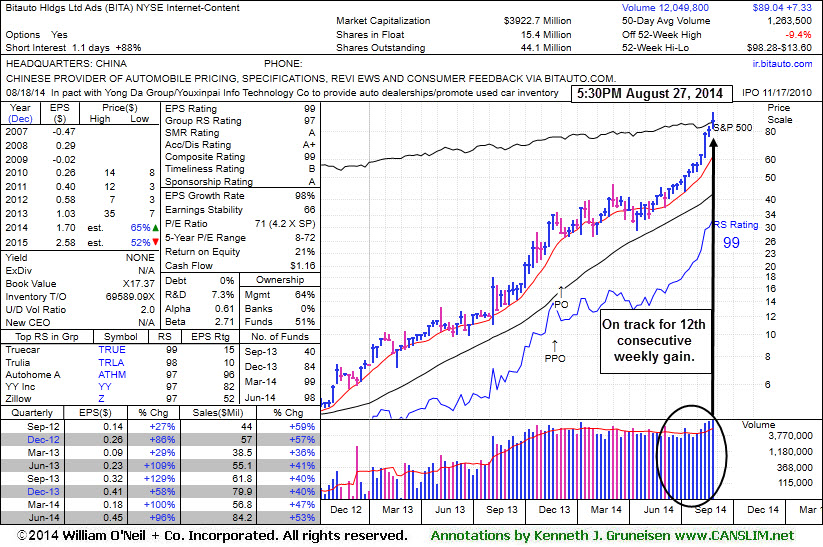

Finished Near Session Low - Noted With Look of "Climax Run" - Wednesday, August 27, 2014

Biotauto Hldgs Ltd Ads (BITA -$7.10 or -7.39% to $89.04) pulled back for a considerable loss with heavy volume today and it finished near the session low. Disciplined investors may look to protect profits in the event of more damaging losses. It has been noted repeatedly with caution - "Has the look of a "climax run" with volume-driven gains getting very extended from its prior base." It is well above its 50-day moving average (DMA) line ($59.41) which is usually an important near-term support level for chart readers.

BITA was last shown in this FSU section on 8/08/14 with an annotated graphs under the headline," Perched at High After 3 Consecutive Volume-Driven Gains", while rallying well above its "max buy" level with no overhead supply to act as resistance. It was highlighted in yellow in the 6/26/14 mid-day report (read here) with pivot point cited based on the 3/06/14 high plus 10 cents. A gain above its pivot point on 6/30/14 backed by +50% above average volume triggered a technical buy signal. It managed a "positive reversal" on 7/10/14 after trading down considerably, likely prompting disciplined investors to sell if it fell more than -7% from their purchase price. Any stock which is sold can be bought back later if strength returns, however rule number one is to always limit losses while they are small.

Fundamentals remain strong with respect to the C and A criteria as it reported earnings +96% on +53% sales revenues for the Jun '14 quarter. It was first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here). This China-based Internet-Content firm's quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 15.4 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 98 top-rated mutual funds as of Jun '14 owning an interest in the company, up from 41 in Sep '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio is 2.0, an unbiased indication its shares have been under accumulation over the past 50 days.

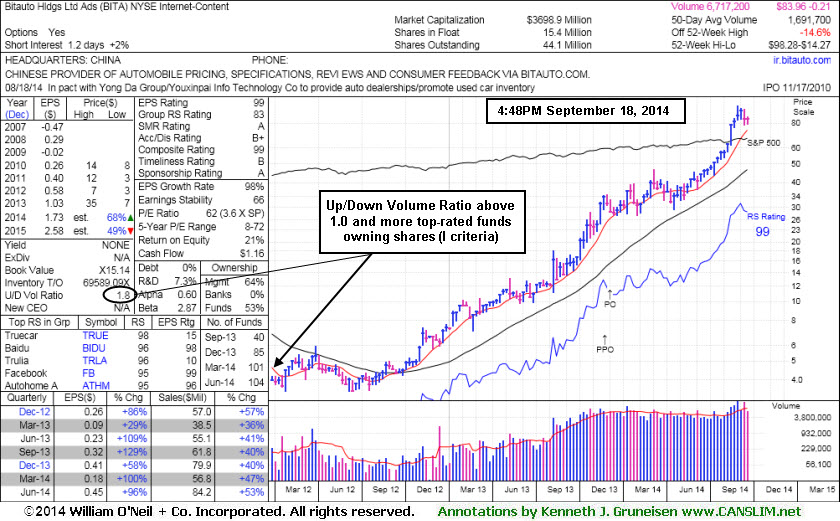

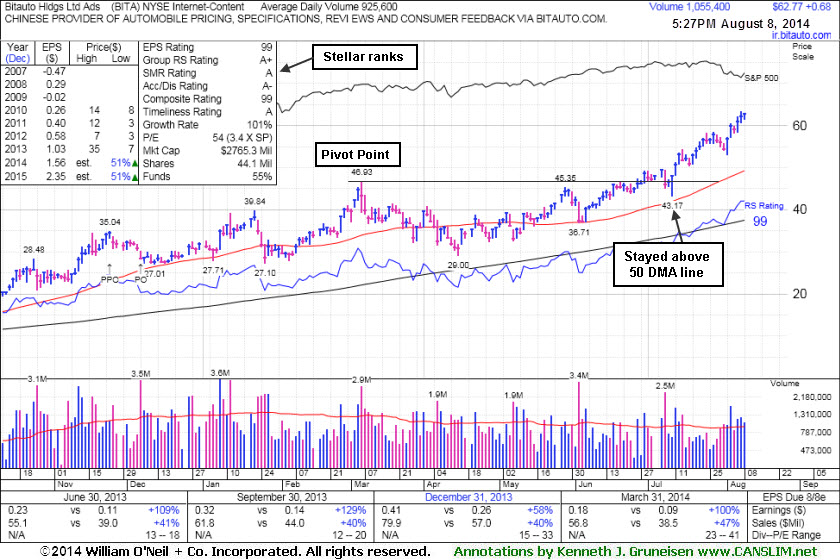

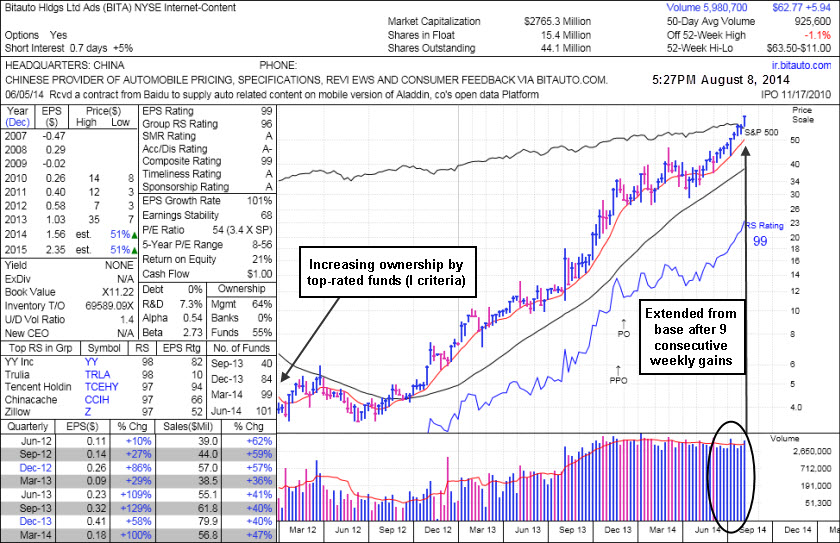

Perched at High After 3 Consecutive Volume-Driven Gains - Friday, August 08, 2014

Biotauto Hldgs Ltd Ads (BITA +$0.68 +1.10% to $62.77) is perched at its 52-week high after today's 3rd consecutive gain, getting more extended from its prior base. It is well above its "max buy" level, extended from its prior base, rallying with no overhead supply to act as resistance. Its 50-day moving average (DMA) line ($49.28) defines important near-term support to watch on pullbacks.

BITA was last shown in this FSU section on 7/21/14 with an annotated graphs under the headline,"Strength Returned After Shake-Out and Positive Reversal". It was highlighted in yellow in the 6/26/14 mid-day report (read here) with pivot point cited based on the 3/06/14 high plus 10 cents. A gain above its pivot point on 6/30/14 backed by +50% above average volume triggered a technical buy signal. It managed a "positive reversal" on 7/10/14 after trading down considerably, likely prompting disciplined investors to sell if it fell more than -7% from their purchase price. Any stock which is sold can be bought back later if strength returns, however rule number one is to always limit losses while they are small. Note that it stayed well above its 50-day moving average (DMA) line which defines important support for chart readers.

Fundamentals remain strong with respect to the C and A criteria as it reported earnings +100% on +47% sales revenues for the Mar '14 quarter. It was first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here). This China-based Internet-Content firm's quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 15.4 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 101 top-rated mutual funds as of Jun '14 owning an interest in the company, up from 41 in Sep '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio is 1.4, an unbiased indication its shares have been under accumulation over the past 50 days.

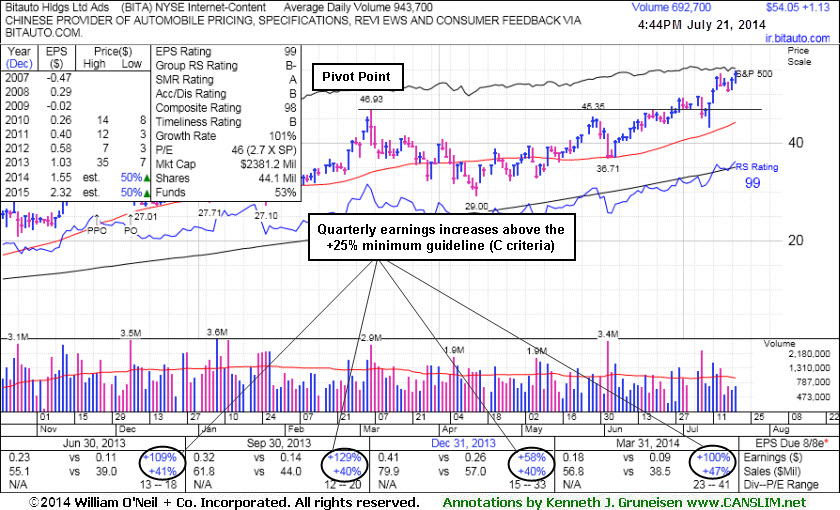

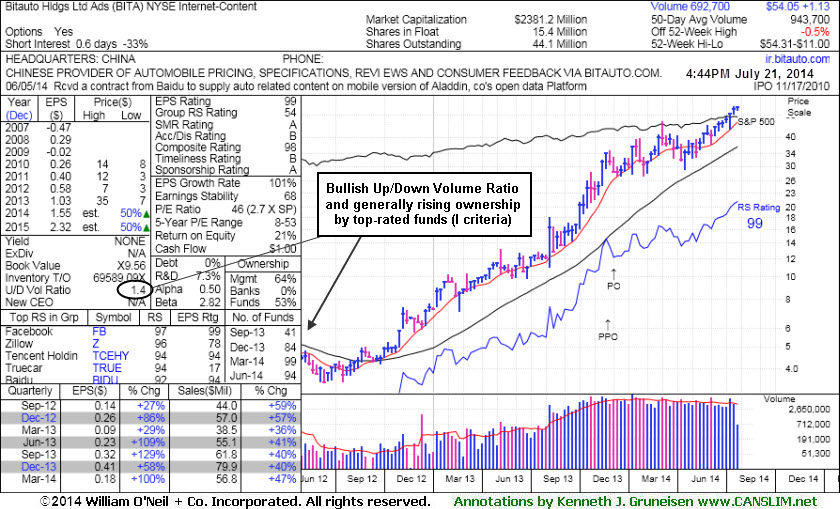

Strength Returned After Shake-Out and Positive Reversal - Monday, July 21, 2014

Biotauto Hldgs Ltd Ads (BITA +$1.27 +2.40% to $54.19) posted a small gain today on lighter than average volume and hit a new 52-week high. It is well above its "max buy" level, extended from its prior base. Now it faces no overhead supply to act as resistance. BITA was last shown in this FSU section on 6/27/14 with an annotated graphs under the headline,"Perched At High With No Resistance Remaining Due to Overhead Supply", after highlighted in yellow in the 6/26/14 mid-day report (read here) with pivot point cited based on the 3/06/14 high plus 10 cents.

A gain above its pivot point on 6/30/14 backed by +50% above average volume triggered a technical buy signal. It managed a "positive reversal" on 7/10/14 after trading down considerably, likely prompting disciplined investors to sell if it fell more than -7% from their purchase price. Any stock which is sold can be bought back later if strength returns, however rule number one is to always limit losses while they are small. Note that it stayed well above its 50-day moving average (DMA) line which defines important support for chart readers.

Fundamentals remain strong with respect to the C and A criteria as it reported earnings +100% on +47% sales revenues for the Mar '14 quarter since dropped from the Featured Stocks list on 1/27/14. BITA was shown in this FSU section on 1/08/14 with an annotated graphs under the headline,"Finished Strong and Challenged Pivot Point After Highlighted in Mid-Day Report". Members were previously - "Like any stock that is dropped from the Featured Stocks list, if fundamentals remain strong while a new base forms, and strength eventually returns, it may one day return to the Featured Stocks list." It was first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here).

This China-based Internet-Content firm's quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 15.4 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 94 top-rated mutual funds as of Jun '14 owning an interest in the company, up from 41 in Sep '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio is 1.4, an unbiased indication its shares have been under accumulation over the past 50 days.

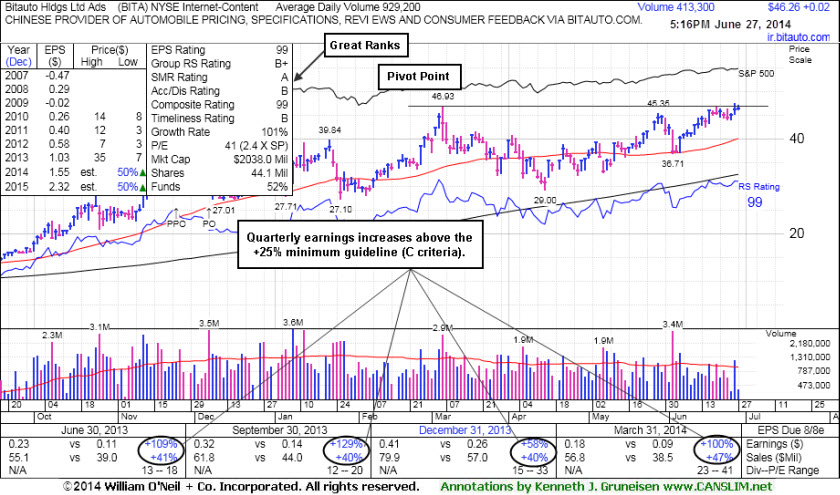

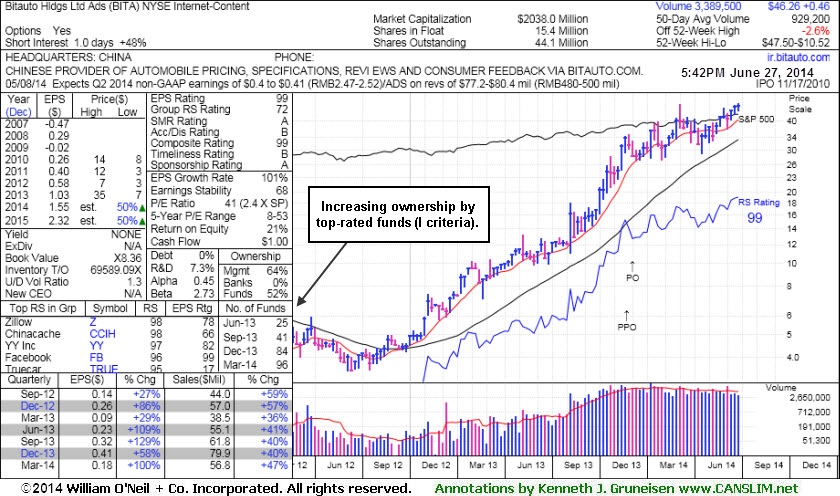

Perched At High With No Resistance Remaining Due to Overhead Supply - Friday, June 27, 2014

Biotauto Hldgs Ltd Ads (BITA +$0.02 +0.04% to $46.26) highlighted in yellow in the 6/26/14 mid-day report (read here) with pivot point cited based on the 3/06/14 high plus 10 cents while noted - "A gain above the pivot point backed by at least +40% above average volume could trigger a technical buy signal. Fundamentals remain strong with respect to the C and A criteria as it reported earnings +100% on +47% sales revenues for the Mar '14 quarter since dropped from the Featured Stocks list on 1/27/14.

Now it faces little overhead supply to act as resistance. Its 50-day moving average (DMA) line acted as support during its recent consolidation before rebounding.

BITA was last shown in this FSU section on 1/08/14 with an annotated graphs under the headline,"

Finished Strong and Challenged Pivot Point After Highlighted in Mid-Day Report". Members were previously - "Like any stock that is dropped from the Featured Stocks list, if fundamentals remain strong while a new base forms, and strength eventually returns, it may one day return to the Featured Stocks list." It was first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here).This China-based Internet-Content firm's quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 15.4 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 96 top-rated mutual funds as of Mar '14 owning an interest in the company, up from 25 in Jun '13, a reassuring sign concerning the I criteria.

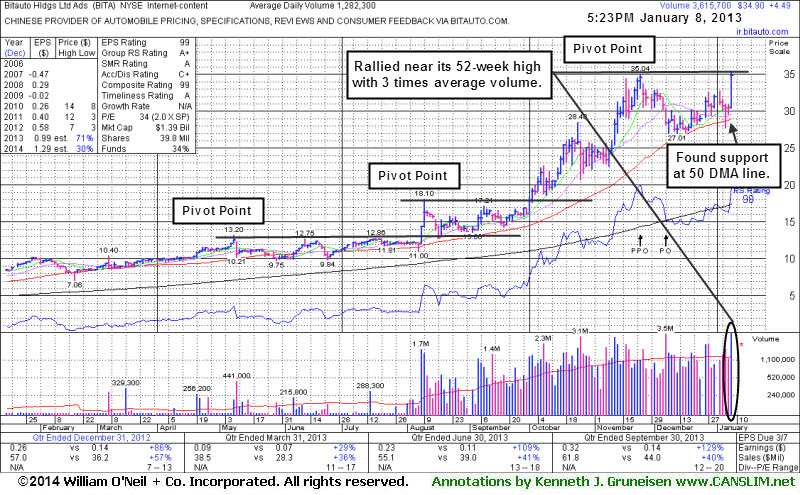

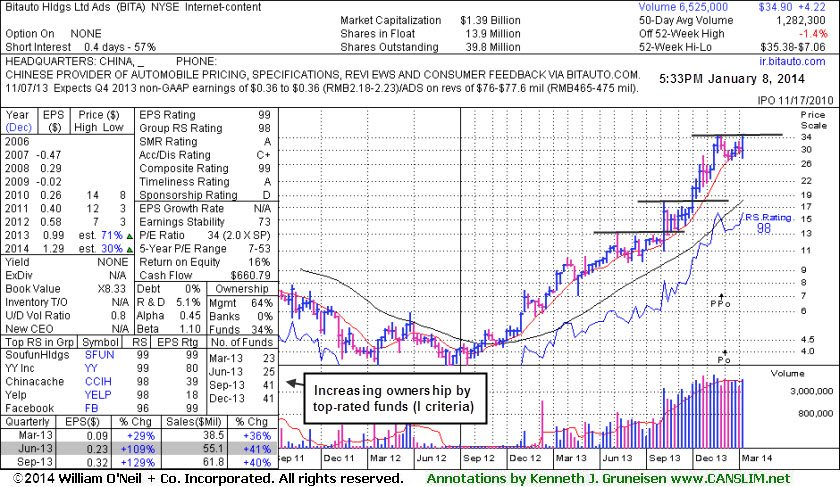

Finished Strong and Challenged Pivot Point After Highlighted in Mid-Day Report - Wednesday, January 08, 2014

Biotauto Hldgs Ltd Ads (BITA +$4.49 +14.76% to $34.90) finished strong with a solid gain on nearly 3 times average volume after it was highlighted in yellow in the earlier mid-day report (read here) with new pivot point cited based on its 11/25/13 high plus 10 cents. Subsequent volume-driven gains to new highs may trigger a new technical buy signal. It found support above its 50-day moving average (DMA) line during its consolidation since completing a Public Offering on 12/06/13. Now it faces little overhead supply to act as resistance. A 50 DMA line violation would be a more worrisome technical sell signal.BITA was last shown in this FSU section on 12/11/13 with an annotated graphs under the headline, "Dropped Due to Weakness Following +191% Gain Since Featured", as it was dropped from the Featured Stocks list after finishing the session near its low and -21.5% off its 52-week high. Members were reminded at the time - "Like any stock that is dropped from the Featured Stocks list, if fundamentals remain strong while a new base forms, and strength eventually returns, it may one day return to the Featured Stocks list." It was first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here).

This China-based Internet-Content firm reported financial results +129% on +40% sales revenues for the Sep '13 quarter. Its quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 13.9 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 41 top-rated mutual funds as of Sep '13 that currently own an interest in the company, up from 25 in June, a reassuring sign concerning the I criteria.

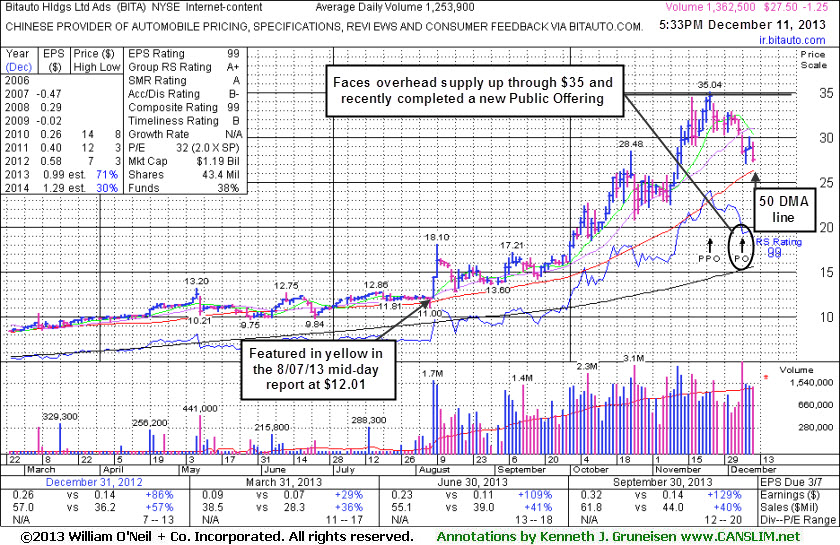

Dropped Due to Weakness Following +191% Gain Since Featured - Wednesday, December 11, 2013

Biotauto Hldgs Ltd Ads (BITA -$1.25 -4.35% to $27.50) will be dropped from the Featured Stocks list tonight after finishing the session near its low and -21.5% off its 52-week high. It Completed a new Public Offering on 12/06/13, and it faces overhead supply that may act as resistance up through the $35 level. It gas been retreating and may test support at its 50-day moving average (DMA) line, where a violation would be a more worrisome sign. Like any stock that is dropped from the Featured Stocks list, if fundamentals remain strong while a new base forms, and strength eventually returns, it may one day return to the Featured Stocks list.

BITA was last shown in this FSU section on 11/11/13 with an annotated graph under the headline, "Consolidating After Getting Extended From Prior Base". It traded up as much as +191.7% since first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here).

This China-based Internet-Content firm reported financial results +129% on +40% sales revenues for the Sep '13 quarter. Its quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 13.9 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 39 top-rated mutual funds as of Sep '13 that currently own an interest in the company, up from 25 in June, a reassuring sign concerning the I criteria. Its Up/Down Volume Ratio of 1.2 is an unbiased indication that its shares have been under slight accumulation over the past 50 days.

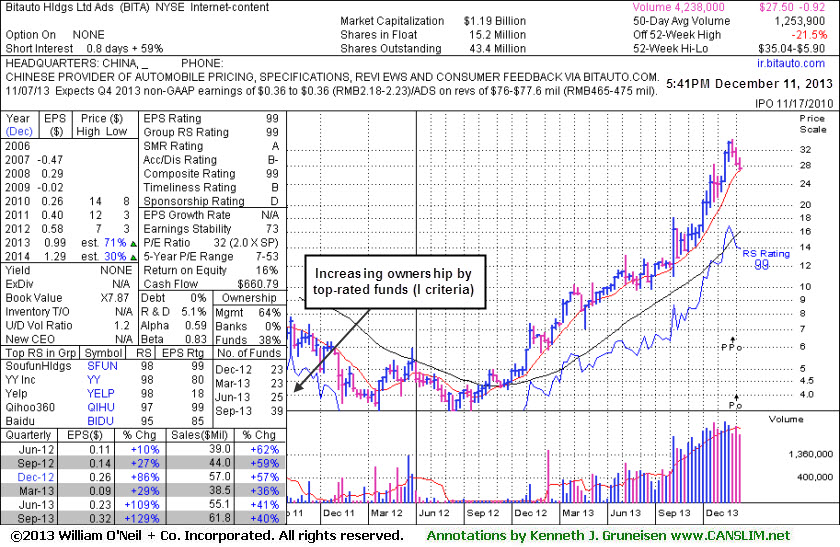

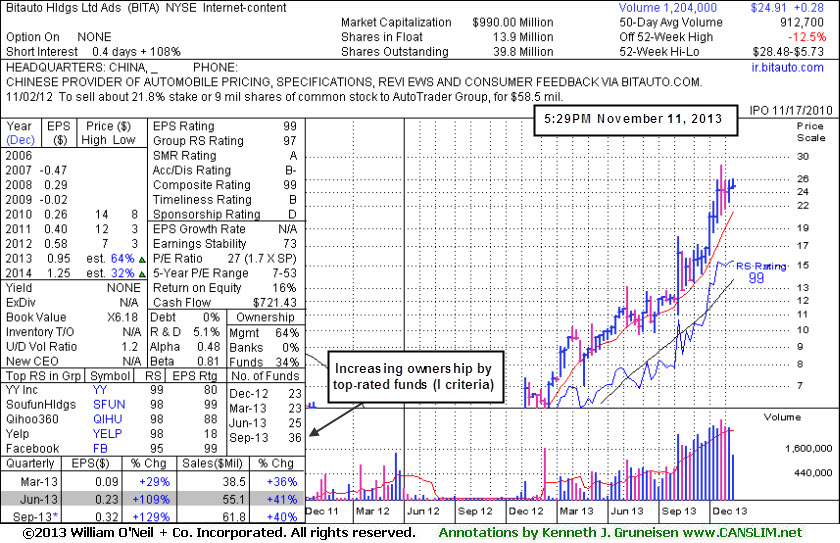

Consolidating After Getting Extended From Prior Base - Monday, November 11, 2013

Biotauto Hldgs Ltd Ads (BITA +$0.28 +1.14% to $24.91) posted a small gain with near average volume. It has not formed a sound new base. Its 50-day moving average (DMA) line defines important near-term support to watch on pullbacks. BITA was last shown in this FSU section on 10/02/13 with an annotated graph under the headline, "Volume-Driven Gains Cleared Latest Pivot Point". It has traded up as much as +137% since first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here).

This China-based Internet-Content firm reported financial results +129% on +40% sales revenues for the Sep '13 quarter. Its quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 13.9 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 36 top-rated mutual funds as of Sep '13 that currently own an interest in the company, up from 25 in June, a reassuring sign concerning the I criteria. Its Up/Down Volume Ratio of 1.2 is an unbiased indication that its shares have been under slight accumulation over the past 50 days.

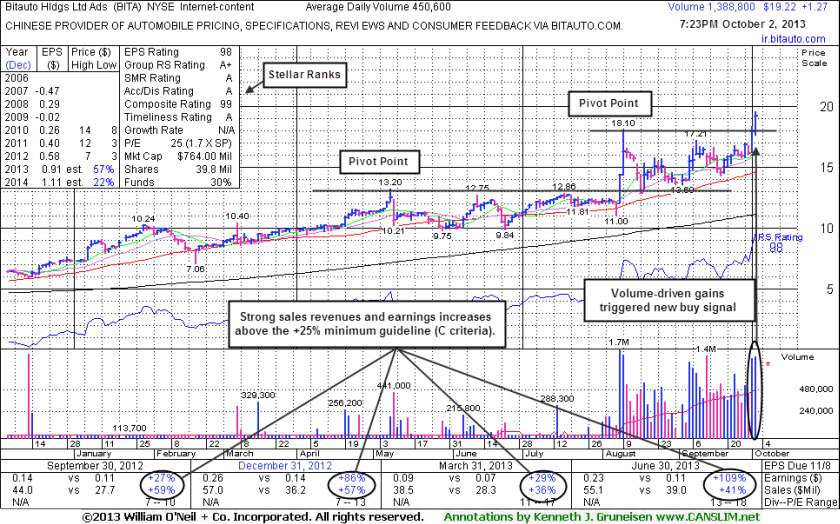

Volume-Driven Gains Cleared Latest Pivot Point - Wednesday, October 02, 2013

Biotauto Hldgs Ltd Ads (BITA +$1.27 +7.08% to $19.22) tallied a 2nd consecutive gain with above average volume as it rallied further above its latest pivot point to new 52-week highs. Its gain with 3 times average volume on the prior session triggered a new (or add-on) technical buy signal. BITA was last shown in this FSU section on 9/03/13 with an annotated graph under the headline, "Consolidating Above Prior Highs and 50-Day Moving Average". It has traded up as much as +60% since first highlighted in the 8/07/13 mid-day report in yellow at $12.01 with the prior pivot point based on its 5/08/13 high plus 10 cents (read here). It blasted higher the next two sessions with heavy volume while hitting the high which became the latest pivot point.This China-based Internet-Content firm reported Second Quarter 2013 financial results +109% on +41% sales revenues. Its quarterly and annual earnings (C and A criteria) history has been strong. Its small supply (S criteria) of only 13.9 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 26 top-rated mutual funds that currently own an interest in the company, a reassuring sign concerning the I criteria. Its Up/Down Volume Ratio of 1.6 is an unbiased indication that its shares have been under accumulation over the past 50 days.

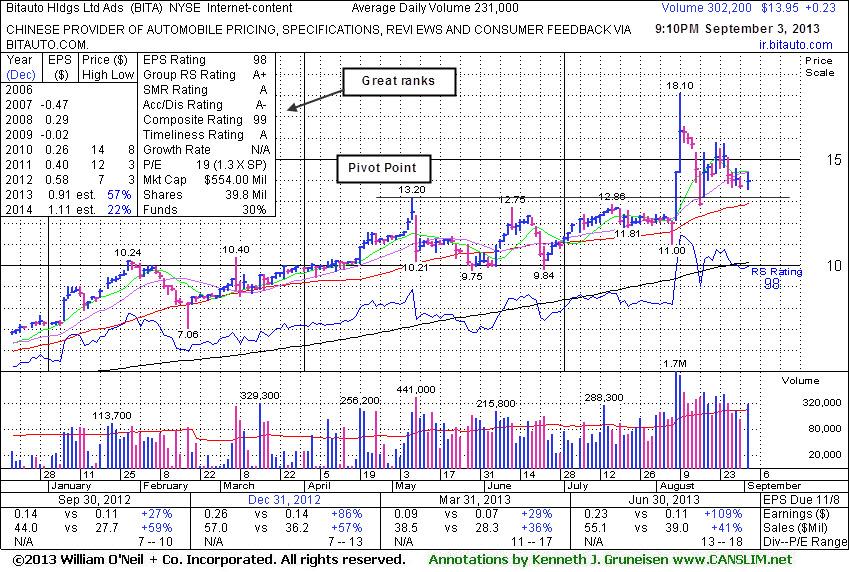

Consolidating Above Prior Highs and 50-Day Moving Average - Tuesday, September 03, 2013

Biotauto Hldgs Ltd Ads (BITA +$0.23 +1.68% to $13.95) is consolidating above its 50-day moving average (DMA) line and prior highs. Disciplined investors always limit losses if any stock falls more than -7-8% from their purchase price. BITA was last shown in this FSU section on 8/07/13 with an annotated graph under the headline, "Found Prompt Support After Undercutting 50-Day Average", after highlighted in yellow with pivot point based on its 5/08/13 high plus 10 cents in the earlier mid-day report (read here).This China-based Internet-Content firm reported Second Quarter 2013 financial results +109% on +41% sales revenues. Its quarterly and annual earnings (C and A criteria) history has been strong. It spiked to new highs with above average volume gains clearing its choppy 13-week base pattern on 8/08 and 8/09. The volume-driven gains triggered a technical buy signal and it quickly got extended.

Its small supply (S criteria) of only 13.9 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 25 top-rated mutual funds that currently own an interest in the company, a reassuring sign concerning the I criteria. Its Up/Down Volume Ratio of 1.6 is an unbiased indication that its shares have been under accumulation over the past 50 days.

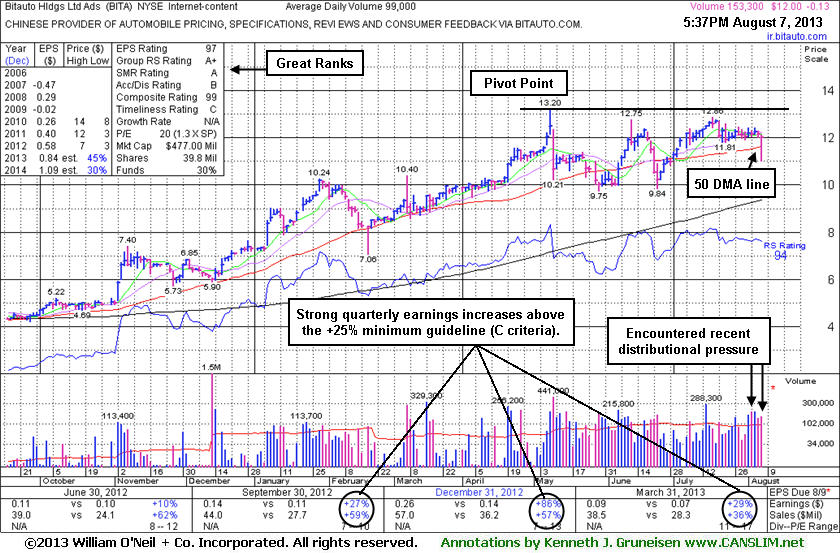

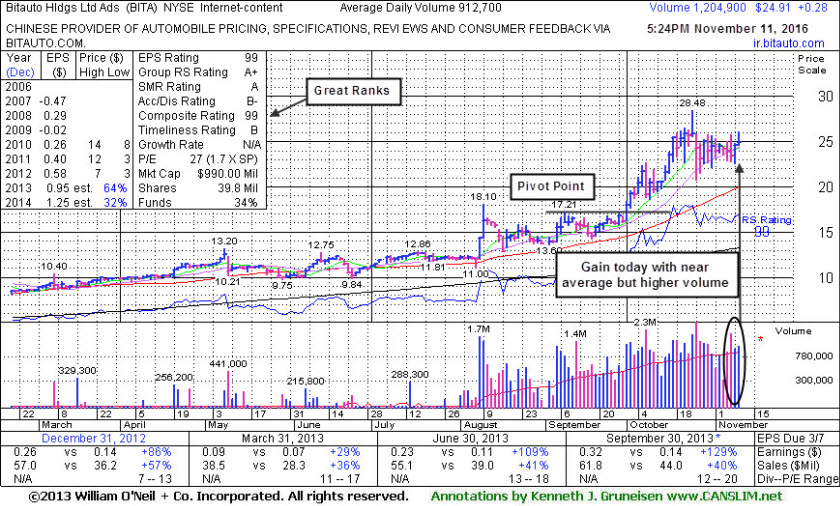

Found Prompt Support After Undercutting 50-Day Average - Wednesday, August 07, 2013

Bitauto Hldgs Ltd Ads (BITA -$0.13 or -1.07% to $12.00) was highlighted in yellow with pivot point based on its 5/08/13 high plus 10 cents in the earlier mid-day report (read here). It found prompt support after undercutting its 50-day moving average (DMA) line following today's gap down. This China-based Internet-Content firm is due to report Second Quarter 2013 financial results before the open on Thursday, August 8, 2013. Volume and volatility often increase near earnings news.

BITA churned above average volume without making price progress on the right side of its choppy 13-week base pattern, a sign of distributional pressure. Volume driven gains are needed to to trigger a technical buy signal.

Quarterly and annual earnings (C and A criteria) history through Mar '13 has been strong. Its small supply (S criteria) of only 13.9 million shares in the public float can contribute to great volatility in the event of institutional buying or selling. There are 23 top-rated mutual funds that currently own an interest in the company, a reassuring sign concerning the I criteria. Its Up/Down Volume Ratio of 1.5 is an unbiased indication that its shares have been under accumulation over the past 50 days.