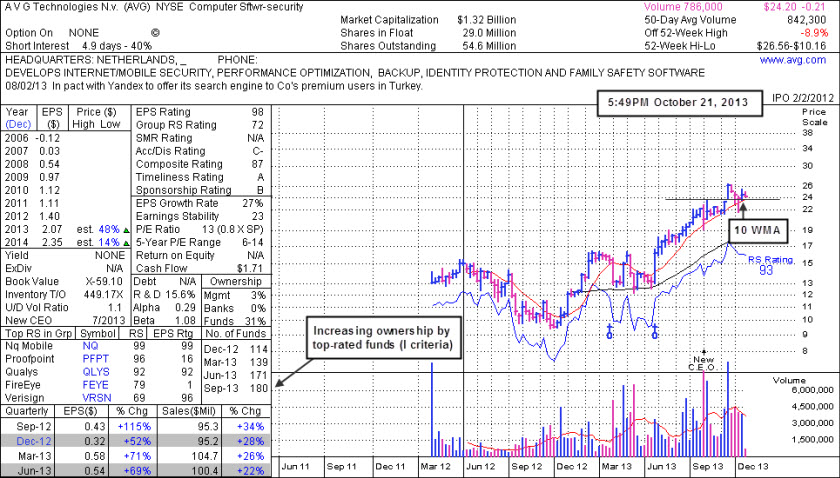

The annotated weekly graph shows how the high-ranked Computer Software - security firm avoided finishing any week below its 10-week moving average (WMA) line. In the Certification they teach that if you miss an initial breakout from a sound base pattern, a secondary buy point exists between a stock's first successful test of its 10 WMA up to +5% above its latest highs. In this case, one may consider a valid secondary entry point anywhere up to +5% above the $26.56 high hit on 9/20/13. Remember, any stock which has been sold can be bought again if strength returns and, as always, disciplined investors would sell if the stock again falls more than -7% from their purchase price.

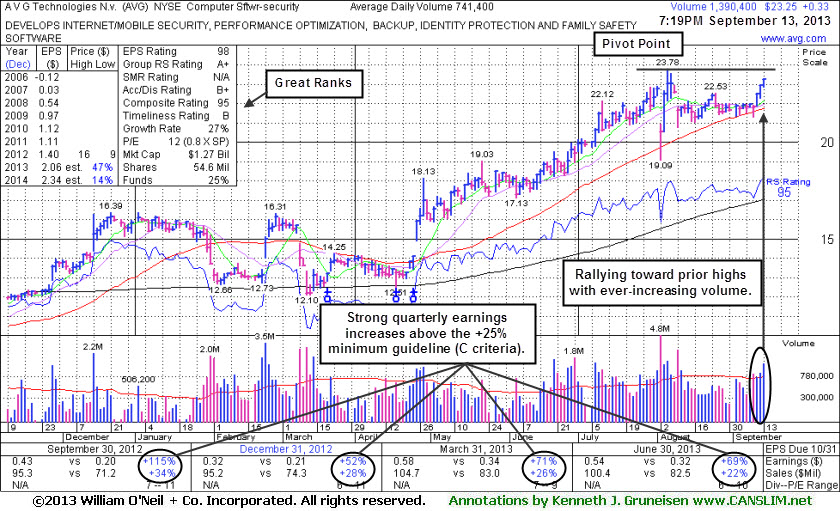

AVG showed strong sales revenues growth with earnings increases well above the +25% minimum guideline (C criteria) in the 4 latest quarterly comparisons through Jun '13. However, there is a sequential deceleration in its quarterly sales revenues increases. Earnings in FY '11 were flat versus the prior year, which is of some concern with respect to the A criteria. The number of top-rated funds owning its shares rose from 89 in Sep '12 to 180 in Sep '13, a reassuring sign concerning the I criteria. There is a small supply (S criteria) of only 29 million shares outstanding which can contribute to greater price volatility in the event of any institutional buying or selling.