Pullback Testing Previously Noted Chart Support Area - Thursday, September 29, 2011

Athenahealth Inc (ATHN +$0.44 or +0.70% to $63.09) has been quietly consolidating above prior highs in the $61 area previously noted as initial support on pullbacks. Its 50-day moving average (DMA) line is the next nearest support level. It was last shown in this FSU section with an annotated graph on 9/08/11 under the headline, "Secondary Buy Point After Choppy Consolidation ", as its solid gain backed nearly 2 times average volume helped it rally above its pivot point to a new 52-week and all-time high. Strength and leadership (L criteria) in the other Computer Software - Medical issues has been a very reassuring sign contributing to its stellar ranks. The broader market's (M criteria) tentative action of late remains an overhanging concern, while an expansion in leadership (new highs) would be a welcome improvement to watch for in the near-term.The daily graph below illustrates how ATHN endured heavy distributional pressure with a streak of volume-driven losses after recently peaking, but volume totals have cooled while staying above critical support levels. It had recently been highlighted in yellow in the 7/22/11 mid-day report (read here), a session marked by 11 times average volume as its considerable "breakaway gap" cleared previously noted resistance in the $50 area. It reported earnings +83% on +33% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The C criteria is satisfied by the past 4 quarterly comparisons showing solid sales and earnings increases above the +25% guideline. Its strong annual earnings satisfies the A criteria. Always limit losses if a stock falls -7% from your buy price. You may be wise to be willing to buy the stock back later when strength returns, but you should never leave yourself open to greater losses.

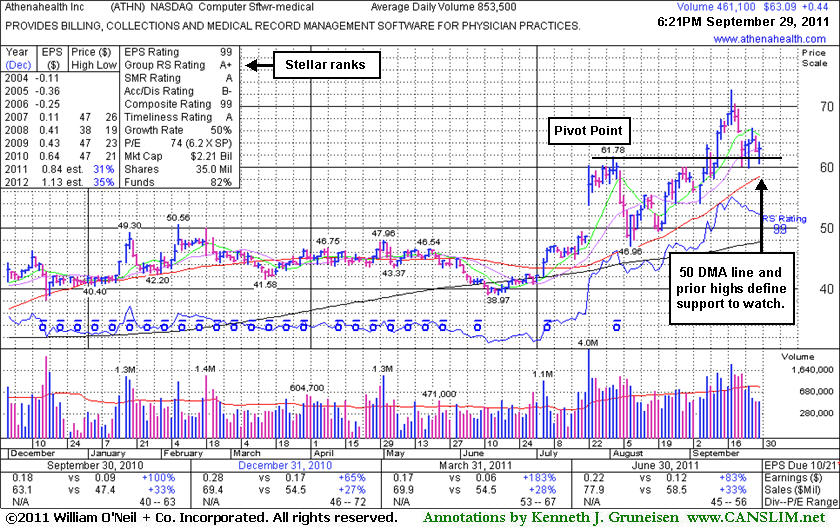

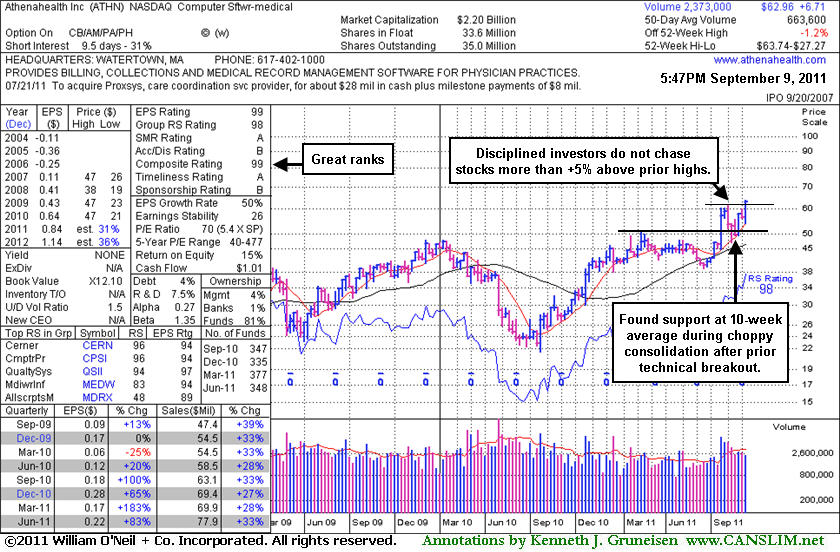

Secondary Buy Point After Choppy Consolidation - Thursday, September 08, 2011

Athenahealth Inc (ATHN +$3.88 or +6.57% to $62.96) finished strong with a solid gain today backed nearly 2 times average volume as it rallied to a new 52-week and all-time high. While rising from a choppy 5-week consolidation, in the mid-day report earlier today its color code was changed to yellow while it was noted - "It may be accumulated under the investment system guidelines up to +5% above its prior high after finding support near its 10-week moving average following an earlier breakout." In the Certification program they teach followers of the fact-based investment system that following a technical breakout, a secondary buy point can be considered valid anywhere between a stock's first successful test of its 10-week moving average and up to +5% above its latest chart high. The recent consolidation was slightly too deep to be recognized as a very ideal or orderly base pattern, however, the stock's resilience after its earlier breakaway gap could warrant giving it consideration again now. Strength and leadership (L criteria) in the other Computer Software - Medical issues is also a very reassuring sign. The broader market's (M criteria) tentative action of late remains an overhanging concern, while an expansion in leadership (new highs) would be a welcome improvement to watch for in the near-term.

The weekly graph below illustrates how ATHN found support near prior highs in the $50 area and its 50 -day moving average (DMA) line after it was dropped from the Featured Stocks list on 8/08/11. Its last appearance in this FSU section was on 7/27/11 with an annotated graph under the headline, "Holding Gains Following Breakaway Gap". It had recently been highlighted in yellow in the 7/22/11 mid-day report (read here), a session marked by 11 times average volume as its considerable "breakaway gap" cleared previously noted resistance in the $50 area. It reported earnings +83% on +33% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The C criteria is satisfied by the past 4 quarterly comparisons showing solid sales and earnings increases above the +25% guideline. Its strong annual earnings satisfies the A criteria. Always limit losses if a stock falls -7% from your buy price. You may be wise to be willing to buy the stock back later when strength returns, but you should never leave yourself open to greater losses.

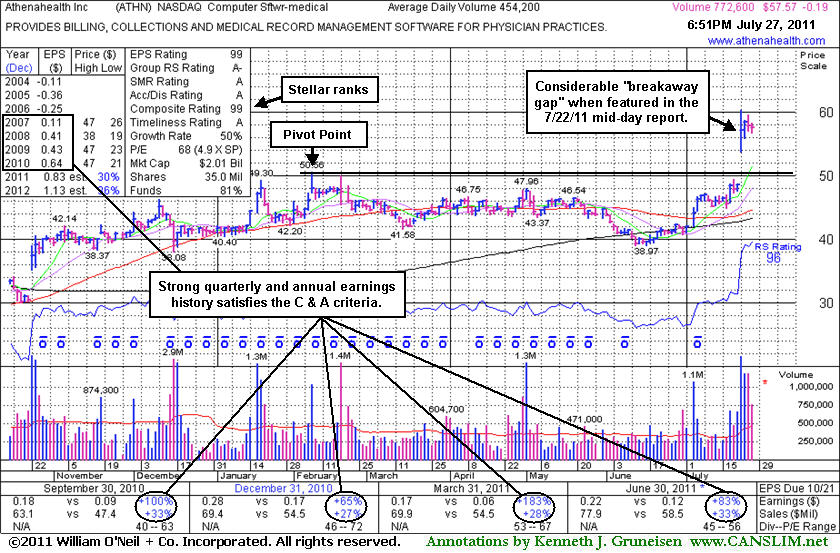

Holding Gains Following Breakaway Gap - Wednesday, July 27, 2011

Athenahealth Inc (ATHN -$0.19 or -0.33% to $57.57) has been holding its ground stubbornly at all-time highs since highlighted in yellow in the 7/22/11 mid-day report (read here), a session marked by 11 times average volume as its considerable "breakaway gap" cleared previously noted resistance in the $50 area. It reported earnings +83% on +33% sales revenues for the quarter ended June 30, 2011 versus the year ago period. The C criteria is satisfied by the past 4 quarterly comparisons showing solid sales and earnings increases above the +25% guideline. Its strong annual earnings satisfies the A criteria. It rallied above its 50 and 200 DMA lines with considerable volume-driven gains in recent weeks during its long base pattern.

Color code was quickly changed to green. Disciplined investors are careful to not chase extended stocks, however a breakaway gap is one noted exception to the regular guidelines for buying stocks no more than 5% above a prior high or pivot point. Always limit losses if a stock falls -7% from your buy price. Considering the broader market's deterioration (M criteria) of late, the poor environment is not likely to offer gutsy investors many great rewards for the near term.