AsiaInfo Holdings, Inc. (ASIA -$0.08 or -0.33% to $23.90) ended today's session with a small loss on heavy volume after it reported solid results again for the period ended December 31, 2009. Worrisome losses on higher volume have followed its half-hearted stand of 2 small gains on light volume which had halted a streak of 6 consecutive losses on higher volume. It was noted on 1/20/10 - "violating its 50-day moving average (DMA) line and breaching recent chart lows, raising concerns and triggering technical sell signals." Losses on heavy volume are signs of distributional pressure (institutional selling) that have caused greater technical damage since its last appearance in this FSU section on 1/12/10 under the headline "Recent Distributional Action Prompts Caution."

Prior chart lows and some earlier chart highs help to define an area of likely near-term support in the $22-23 area, but gains back above its 50 DMA line are needed for its outlook to improve. ASIA was featured 10/14/09 in the mid-day report (read here) as it gapped up for a new 52-week high with 5 times average volume, triggering a technical buy signal by blasting above its pivot point. It traded up as much as +68.13% since first featured in the August 2009 CANSLIM.net News (read here).

AsiaInfo Holdings, Inc. (ASIA -$0.48 or -1.64% to $28.74) closed with a small loss today on light volume, quietly consolidating above its 50-day moving average (DMA) line (now $27.52) which is the next important support level to watch. A technical buy signal did not occur since an advanced "3 weeks tight" pattern was recently noted. Time is still needed, and a subsequent breakout with heavy volume could confirm a new technical buy signal. But caution is important now, since its large loss on heavy volume on 1/05/10 was a worrisome sign of distributional pressure (previously noted). Meanwhile, its 50 DMA line and prior chart highs in the $26 area are an important support level to watch on pullbacks. An upward trendline defines another support level, but that is well below its current price or earlier support where violations might trigger technical sell signals.

ASIA was featured 10/14/09 in the mid-day report (read here) as it gapped up for a new 52-week high with 5 times average volume, triggering a technical buy signal by blasting above its pivot point. It has traded up as much as +68.13% since first featured in the August 2009 CANSLIM.net News (read here).

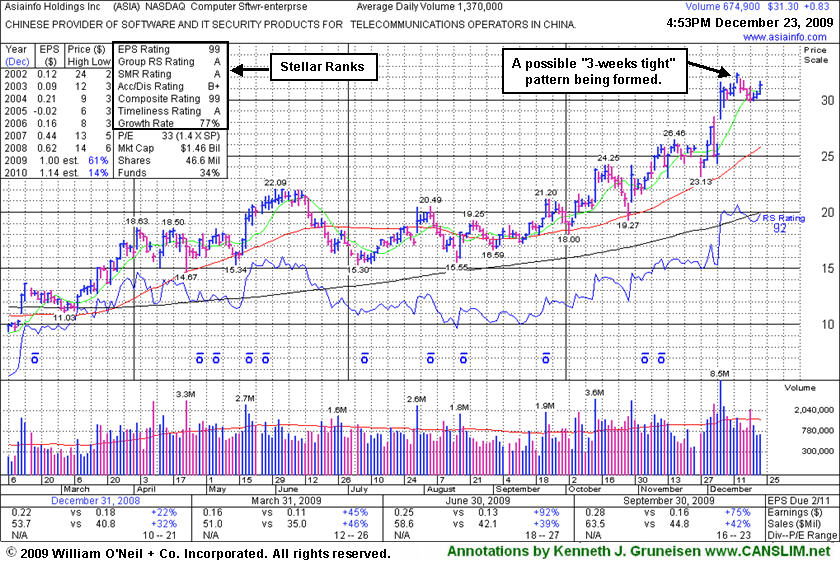

AsiaInfo Holdings, Inc. (ASIA +$0.83 or +2.72% to $31.30) posted a gain today on light volume for its second highest close ever. It is extended from its prior base after its considerable gap up gain on 12/07/09 with almost 8 times average volume. Its tight consolidation could be a possible "3-weeks tight" pattern currently in the making, but time is still needed, and a subsequent breakout with heavy volume is also needed to confirm a new technical buy signal. Meanwhile, its 50-day moving average (DMA) line and prior chart highs in the $26 area are an important support level to watch on pullbacks.

ASIA was featured 10/14/09 in the mid-day report (read here) as it gapped up for a new 52-week high with 5 times average volume, triggering a technical buy signal by blasting above its pivot point. It has traded up as much as +68.13% since first featured in the August 2009 CANSLIM.net News (read here).

AsiaInfo Holdings, Inc. (ASIA +$5.61 or +22.35% to $30.71) gapped up today for a considerable gain on almost 8 times average volume for a new 52-week high after announcing a merger with Linkage Technologies International Holdings Limited, leading providers of software solutions and IT services for the telecommunications industry in China. It is extended from its latest sound base now, and disciplined investors would avoid chasing it more than +5% above its pivot point.

Gains with above average volume helped it rally to new 2009 highs following a 10/29/09 gap up for a big gain after reporting solid earnings for the period ended Sept 30, 2009 that beat expectations as it also raised guidance. It found prompt support near its 50-day moving average (DMA) line, a textbook chart support level, after a 7 session losing streak with losses on high volume triggered technical sell signals and briefly negated its latest breakout.

ASIA was featured 10/14/09 in the mid-day report (read here) as it gapped up for a new 52-week high with 5 times average volume, triggering a technical buy signal by blasting above its pivot point. Disciplined entries and exits are critical to investors' success with the investment system. ASIA was first featured in the August 2009 CANSLIM.net News (read here).

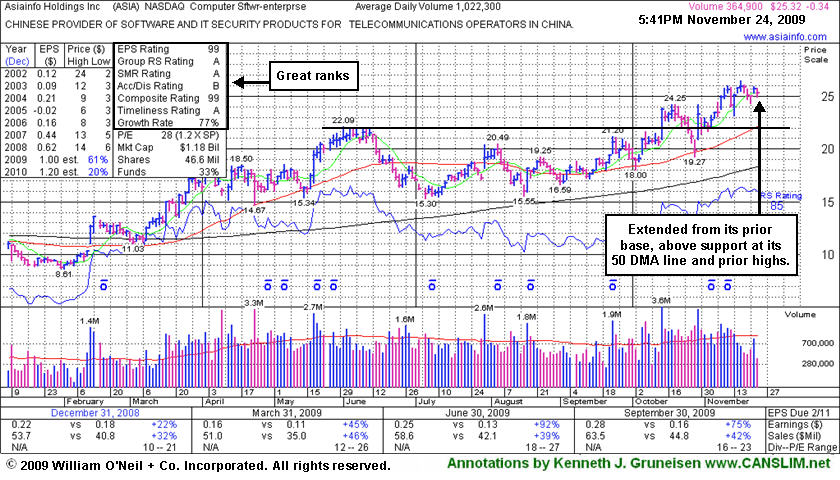

AsiaInfo Holdings, Inc. (ASIA -$0.34 or -1.33% to $25.32) suffered a small loss today with lighter than average volume. It is still extended from its latest sound base. Gains with above average volume helped it rally to new 2009 highs following a 10/29/09 gap up for a big gain after reporting solid earnings for the period ended Sept 30, 2009 that beat expectations as it also raised guidance. It found prompt support near its 50-day moving average (DMA) line, a textbook chart support level, after a 7 session losing streak with losses on high volume triggered technical sell signals and briefly negated its latest breakout.

ASIA was featured 10/14/09 in the mid-day report (read here) as it gapped up for a new 52-week high with 5 times average volume, triggering a technical buy signal by blasting above its pivot point. Disciplined entries and exits are critical to investors' success with the investment system. ASIA was first featured in the August 2009 CANSLIM.net News (read here).

AsiaInfo Holdings, Inc. (ASIA -$1.50 or -5.86% to $24.11) suffered a considerable loss today with above average volume, yet it is still extended from its latest sound base. Gains with above average volume helped it rally to new 2009 highs following a 10/29/09 gap up for a big gain after reporting solid earnings for the period ended Sept 30, 2009 that beat expectations as it also raised guidance. It found prompt support near its 50-day moving average (DMA) line, a textbook chart support level, after a 7 session losing streak with losses on high volume triggered technical sell signals and briefly negated its latest breakout.

Featured 10/14/09 in the mid-day report (read here) as it gapped up for a new 52-week high with 5 times average volume, triggering a technical buy signal by blasting above its pivot point. Disciplined entries and exits are critical to investors' success with the investment system. ASIA was first featured in the August 2009 CANSLIM.net News (read here).

AsiaInfo Holdings, Inc. (ASIA -$1.23 or -5.28% to $22.06) fell for another considerable loss with above average volume today, consolidating following a 10/29/09 gap up for a big gain after reporting solid earnings for the period ended Sept 30, 2009 that beat expectations as it also raised guidance. It found prompt support near its 50-day moving average (DMA) line, a textbook chart support level, after a 7 session losing streak with losses on high volume triggered technical sell signals and briefly negated its latest breakout. Its color code was changed to yellow based on its impressive fundamentals and technical strength. However, market conditions (M criteria) are arguing against new buying efforts, and an overriding concern for disciplined investors until a new follow-through-day occurs.

Disciplined entries and exits are critical to investors' success with the investment system. ASIA was featured in the August 2009 CANSLIM.net News (read here).

AsiaInfo Holdings, Inc. (ASIA +$3.15 or +13.25% to $23.77) showed up earlier today in yellow in the mid-day report (read here) as it blasted to a new 52-week high (the N criteria). It closed with a considerable gain backed by 5 times average volume, triggering a technical buy signal. Strong sales and earnings growth is indicative of great demand for the goods and services offered by this Chinese provider of software and IT security products.

Concerning the L criteria, now 7 of the 12 current Featured Stocks hail from Computer-Software or Internet industry groups. Its Relative Strength rank has improved to above the minimum 80+ guideline for buyable candidates and it has proven resilient since its last appearance in this FSU section under the headline "Weak Action Never Offered Proper Buy Signal" on 8/17/09. Based on its inability to make progress above its pivot point back then, we observed that "disciplined investors avoided taking action that would have exposed them to any losses." Disciplined entries and exits are critical to investors' success with the investment system. ASIA was featured in the August 2009 CANSLIM.net News (read here). At the time it was dropped from the Featured Stocks list we suggested that, "Technically, it would have to rally above its 50 DMA and rally above recent chart highs in the $20 area for its outlook to improve." Bullish action in recent weeks helped it do just that, and its outlook now is very favorable. Pullbacks near prior chart highs in the $21-22 area might offer patient investors another chance to accumulate shares without chasing it more than +5% above its pivot point.

AsiaInfo Holdings, Inc. (ASIA -$1.03 or to $15.95) gapped down today for a loss on below average volume. Since the stock slumped below its 50-day moving average (DMA) line in early August it was hit with a distribution day on 8/11/09 as it suffered a considerable decline on high volume. Now it is consolidating near its prior chart lows and its 200 DMA line which may act as support. However, based on its weak action and its Relative Strength rank has slumped to 68, well below the usual minimum 80+ guideline for buyable candidates. Technically, it would have to rally above its 50 DMA and rally above recent chart highs in the $20 area for its outlook to improve. ASIA was recently featured in the August 2009 CANSLIM.net News (read here). Based on its inability to make progress above its pivot point since, disciplined investors avoided taking action that would have exposed them to any losses. Disciplined entries and exits are critical to investors' success with the investment system.