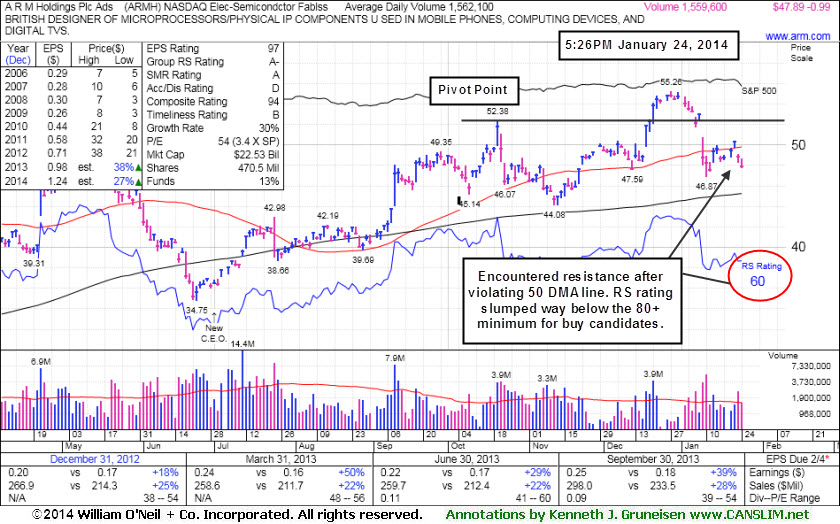

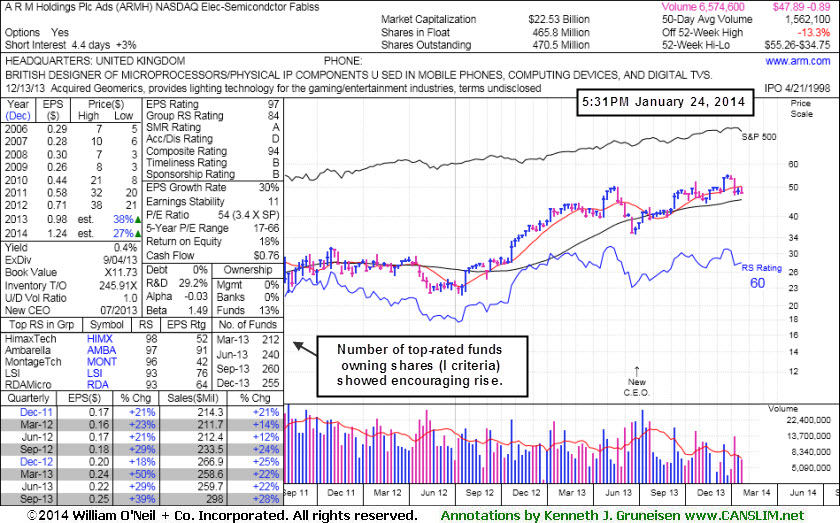

Relative Strength Waned and 50-Day Average Acted as Resistance - Friday, January 24, 2014

A R M Holdings Plc Ads (ARMH -$0.99 or -2.03% to $47.89) is below its 50-day moving average (DMA) line which has acted as resistance following damaging losses which triggered technical sell signals. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price. Its Relative Strength Rating has slumped to 60, well below the 80+ minimum necessary for buy candidates under the fact-based system, so it faces important technical hurdles before it might have the look of a serious buy candidate again. The market correction (M criteria) is also an overriding concern for the near term.

It was last shown in this FSU section on 12/23/13 with annotated graphs under the headline, "No Overhead Supply Remains Following Volume-Driven Breakout". after highlighted in yellow in the mid-day report (read here) with pivot point cited based on its 10/21/13 high plus 10 cents. It hit a new 52-week high with above average volume behind gains, however it stalled soon after flashing signs of great buying demand coming from the institutional crowd. Disciplined investors avoid chasing stocks extended more than +5% above their prior high or pivot point, and they always limit losses be selling if any stock falls more than -7% from their purchase price. Any stock that is sold can always be bought back later if strength returns.

This high-ranked UK-based Electronics - Semiconductor firm reported earnings +39% on +28% sales in the Sep '13 quarter, marking 3 consecutive quarterly comparisons with an earnings increase above the +25% minimum earnings guideline (C criteria). It followed a downturn in FY '09 earnings with strong annual earnings increases (A criteria). It has a large supply of 470 million shares outstanding, however the number of top-rated funds owning its shares rose from 206 in Sep '12 to 255 in Dec '13, a reassuring sign concerning the I criteria.

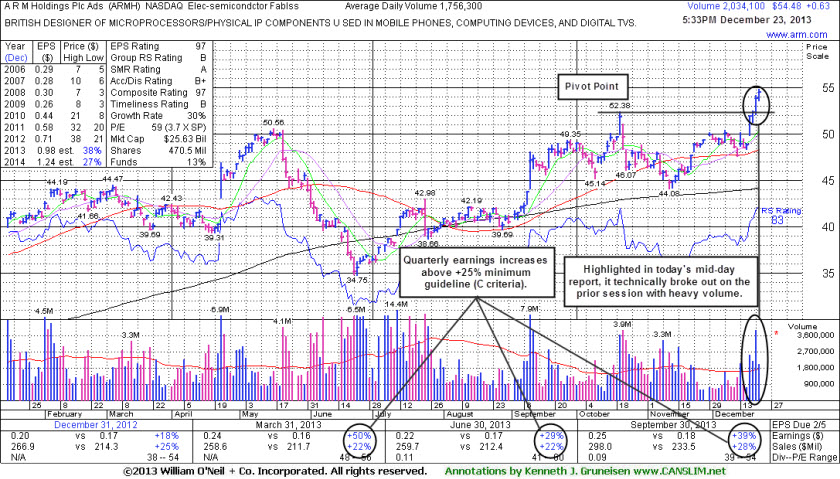

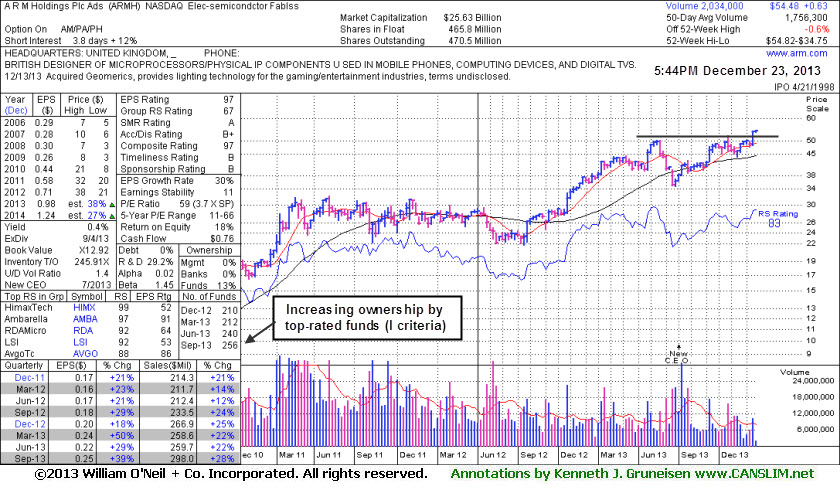

No Overhead Supply Remains Following Volume-Driven Breakout - Monday, December 23, 2013

A R M Holdings Plc Ads (ARMH +$0.63 or +1.17% to $54.48) was highlighted in yellow in the earlier mid-day report (read here) with pivot point cited based on its 10/21/13 high plus 10 cents. It hit a new 52-week high with above average volume behind today's 5th consecutive gain. Technically, it broke out with a volume-driven gain on the prior session. Disciplined investors avoid chasing stocks extended more than +5% above their prior high or pivot point, and they always limit losses be selling if any stock falls more than -7% from their purchase price.

This high-ranked UK-based Electronics - Semiconductor firm reported earnings +39% on +28% sales in the Sep '13 quarter, marking 3 consecutive quarterly comparisons with an earnings increase above the +25% minimum earnings guideline (C criteria). It followed a downturn in FY '09 earnings with strong annual earnings increases (A criteria). It has a large supply of 470 million shares outstanding, however the number of top-rated funds owning its shares rose from 206 in Sep '12 to 256 in Sep '13, a reassuring sign concerning the I criteria.