Often, when a leading stock is setting up to breakout of a solid base, it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

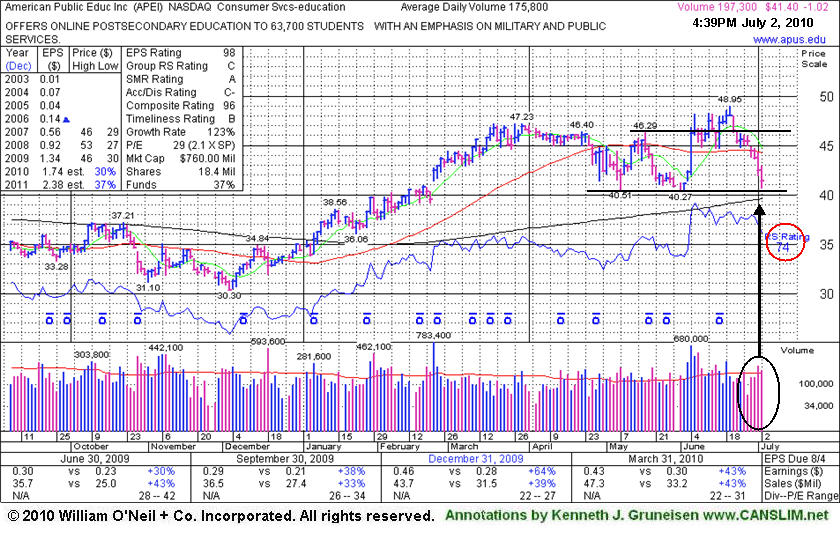

American Public Education Inc. (APEI -$1.02 or -1.81% to $41.40) suffered its 6th consecutive loss and slumped toward the next important support level near its 200-day moving average (DMA) line and prior chart lows in the $40 area. Its Relative Strength rank has slumped under the investment system's 80+ guideline to a 74 (see red circle), raising concerns. Its color code was changed to green as it slumped under its 50 DMA line this week amid broad market (M criteria) weakness. It made limited progress after its 6/07/10 gain and close above its pivot point with above average volume triggered a technical buy signal. Since its appearance in the 6/07/10 mid-day report with an annotated graph (read here), for-profit educators recently stalled as proposed regulatory changes have been feared to have a negative impact. Additional technical deterioration may trigger more worrisome sell signals and prompt its removal from the Featured Stocks list.

Often, when a leading stock is setting up to breakout of a solid base, it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

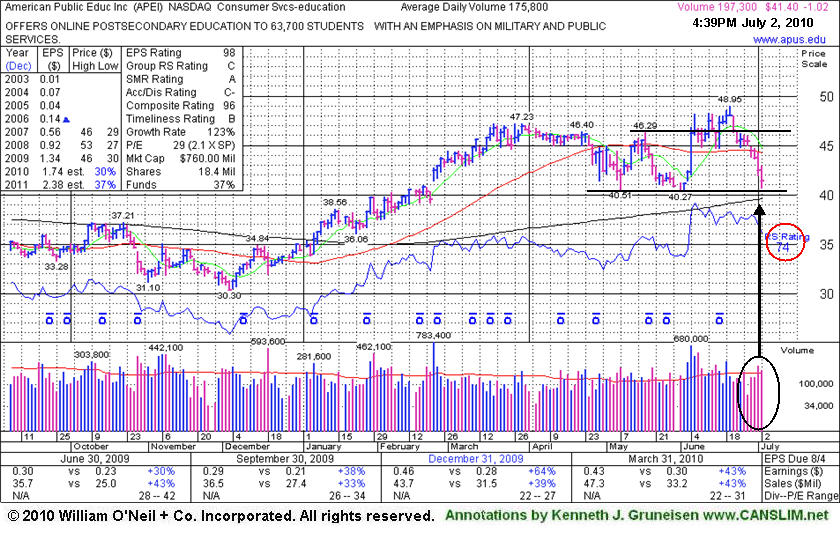

American Public Education Inc. (APEI -$0.86 or -1.81% to $46.62) gapped up today and then reversed into the red for the session, encountering mild distributional pressure as it fell on slightly higher volume. Its 6/07/10 gain and close above its pivot point with above average volume triggered a technical buy signal, although it finished in the lower half of its intra-day range. It was featured in yellow in the 6/07/10 mid-day report with an annotated graph (read here). Other for-profit educators recently stalled as proposed regulatory changes have been feared to have a negative impact. However, little resistance remains due to overhead supply, so the bias is generally positive while it hovers near its 52-week high.

Often, when a leading stock is setting up to breakout of a solid base, it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

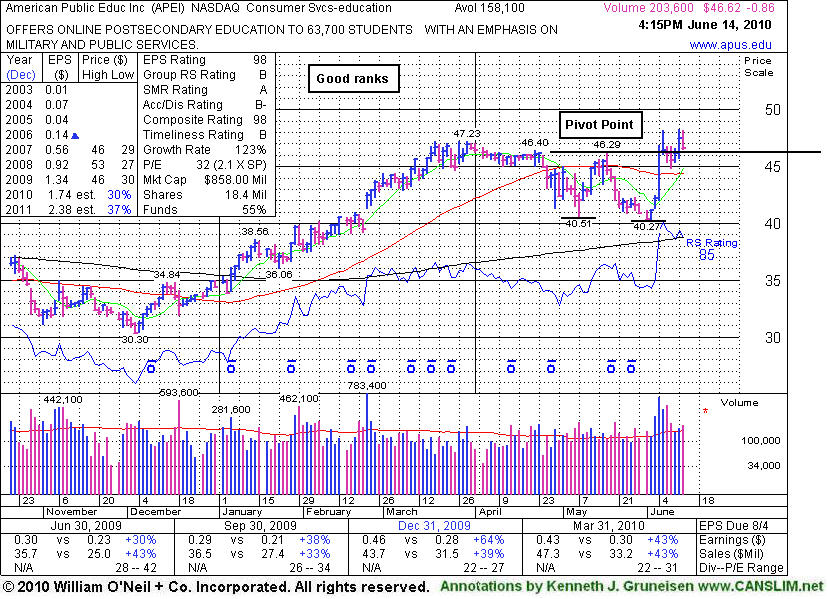

American Public Education Inc. (APEI -$1.66 or -3.71% to $46.46) ended near its session low today with a loss on light volume. This high-ranked online school operator has a history of reporting solid quarterly sales revenues and earnings (the C criteria) increases. It has encountered some distributional pressure in recent weeks, yet it has held up above its 50-day moving average (DMA) line (the red line), where healthy stocks normally find support. It is trading within close striking distance of all-time highs and has little resistance remaining due to overhead supply, making it still a great candidate for an active watch list. The small supply of outstanding shares (the S criteria) could contribute to greater volatility, especially in the event institutional investors rush in or out. APEI was first featured on Wednesday, July 30, 2008 in the CANSLIM.net Mid Day Breakouts Report (read here).

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile

Group action plays a very important role, and experienced investors learn that they can increase their odds of picking a great winner by always focusing their buying efforts in the market's leading groups. The "L" criteria of the investment system tells us to choose leading companies in leading industry groups, thus it is suggested that investors choose from the top quartile of the 197 Industry Groups (listed in the paper most days on page B4). A classic example of the success enjoyed by many CANSLIM.net readers usually starts when an investor reads a CANSLIM.net report and buys a featured stock before it has risen above the pivot point by greater than 5%. After a stock breaks out above its pivot point, there is only a +5% window that investors have to purchase the stock under the proper guidelines. Once a stock rises above the "maximum buy price", the risk of a shake out balloons, meaning that even a normal retracement in the stock might force you to employ the 7-8% loss cutting rule. Much can be told by the stock's daily action in the weeks and months that follow a breakout. Typically, a light volume and orderly pullback suggests that the bulls remain in control. However, high volume pullbacks that violate support paint a totally different picture.

American Public Education (APEI +$2.13 or +4.76% to $46.88) rallied to a new all-time high close with a solid gain on +87% above average volume on Friday. This stock was first featured on Wednesday, July 30, 2008 in the CANSLIM.net Mid Day Breakouts Report (read here) with a $45.04 pivot point, $47.29 maximum buy price and the following note: "Y - Trading near 52-week highs on the right side of a 6-month cup shaped pattern. High-ranked leader showing strong quarterly sales revenues and earnings growth." APEI sports strong ranks; an Earnings Per Share (EPS) rating of 99, and a Relative Strength (RS) rating of 94. The stock resides in the Comml Svcs-Schools group which is presently ranked 11th out of the 197 groups listed in the paper, easily satisfying the L criteria. Its Return on Equity is reported at a solid +36%, which is well above the +17% guideline. American Public Education closed below its maximum buy price which means that prudent investor can still accumulate this high ranked leader within the proper guidelines. Remember to always limit losses per the 7-8% sell rule, and never hold a stock if it falls more than that from your purchase price.

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports | ![]()

![]()

![]()

View all notes | Alert me of new notes | CANSLIM.net Company Profile