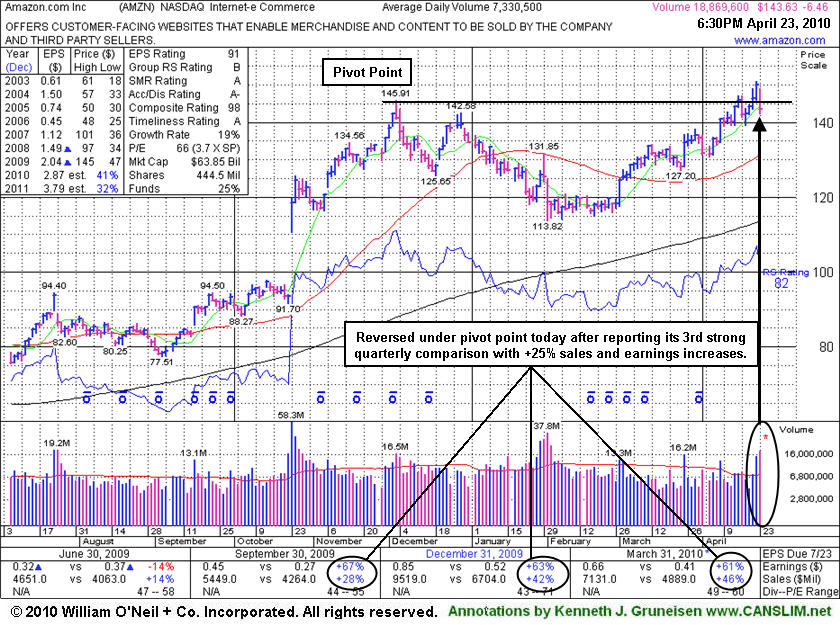

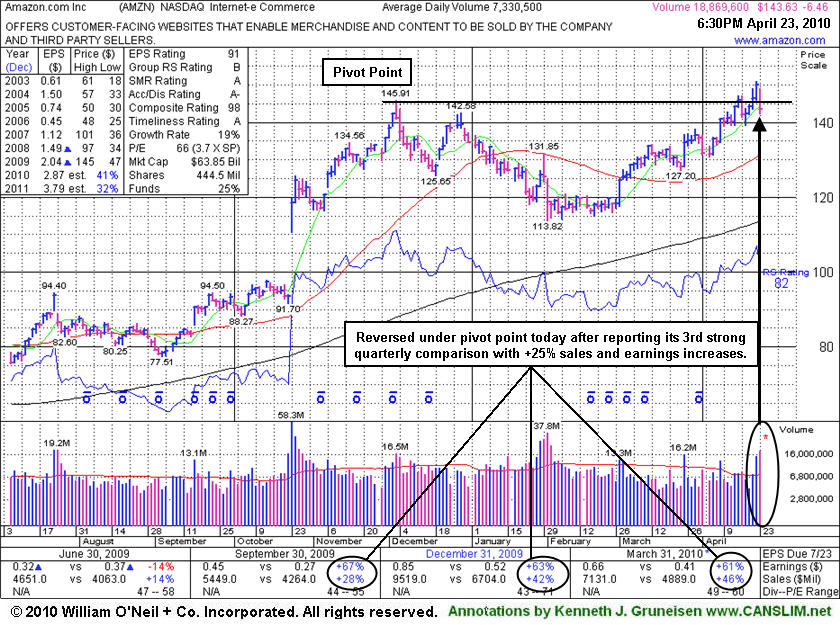

Amazon.Com Inc. (AMZN -$6.46 or -4.30% to $143.63) gapped down today, although results for the March 31, 2010 quarter topped estimates. Technically, in recent weeks it rose from a 4-month cup shaped pattern to new multi-year highs, breaking out with twice average volume behind its 4/22/10 gain. A proper cup-with-handle pattern forms over at least an 8 week period and includes a handle at least one week in length while the stock drifts 10-12% lower on lighter volume. Not all stocks form a proper handle, and sometimes stocks form a high handle. AMZN's prompt reversal and close under its pivot point raised some concerns as it encountered distributional pressure, however increased volume and volatility are common near earnings news. Subsequent confirming gains with heavy volume would be reassuring to see, meanwhile any damaging losses undercutting its old high closes would raise more serious concerns.

AMZN was featured in yellow in the 4/23/10 mid-day report (read here) with its pivot point based on its old high (12/03/09) on the left side of its cup plus ten cents. Recent quarterly comparisons show sales revenues acceleration with 3 consecutive quarterly earnings per share increases in the +60% range, satisfying the C criteria. It also has a strong annual earnings (A criteria) history, improving greatly since FY '07 after a down turn.