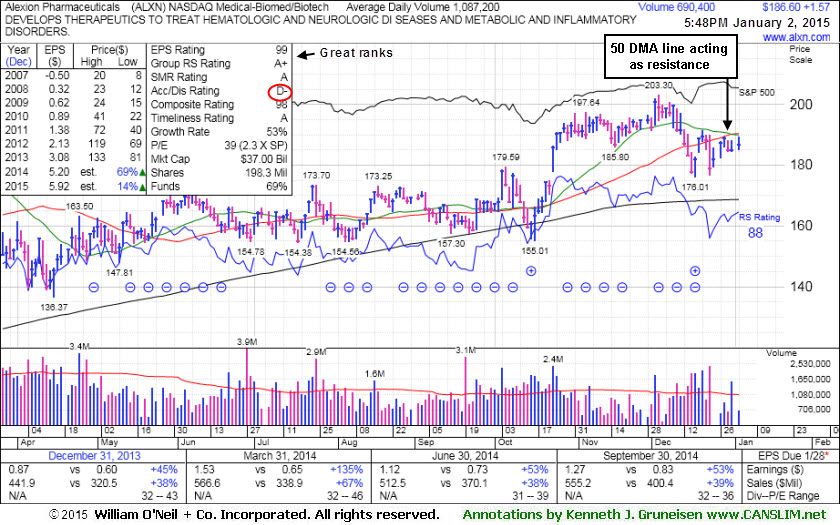

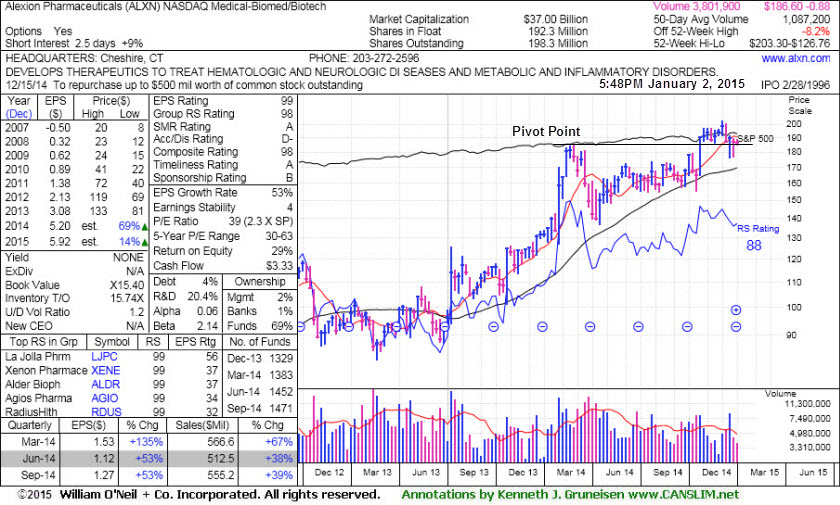

50-Day Moving Average Acted as Resistance After Damaging Losses - Friday, January 02, 2015

Alexion Pharmaceuticals Inc (ALXN +1.57 or +0.85% to $186.60) has been sputtering below its 50-day moving average (DMA) line which recently acted as resistance, plus it faces resistance due to overhead supply up through $203. Its Accumulation/Distribution rating has slumped to a D- (see red circle). The recent low ($176.01 on 12/17/14) defines the next important support level. Disciplined investors limit losses by selling if any stock falls more than -7% from their purchase price.

It was last shown in this FSU section on 12/17/14 with annotated graphs under the headline, "Recent 50-Day Moving Average Violation Triggered Sell Signal", following a damaging volume-driven loss. The weekly graph below shows the pivot point based on its 2/25/14 high, at it has been finding support near those old highs which were resistance.

The Medical - Biomed/Biotech industry group has demonstrated leadership and earned a 98 for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. ALXN reported earnings +53% on +39% sales revenues for the Sep '14 quarter, continuing its strong earnings history. Its Relative Strength Rank (88) remains high. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 1,325 in Dec '13 to 1,471 in Sep '14, a reassuring sign concerning the I criteria of the fact-based investment system. ALXN completed a new Public Offering on 5/25/12.

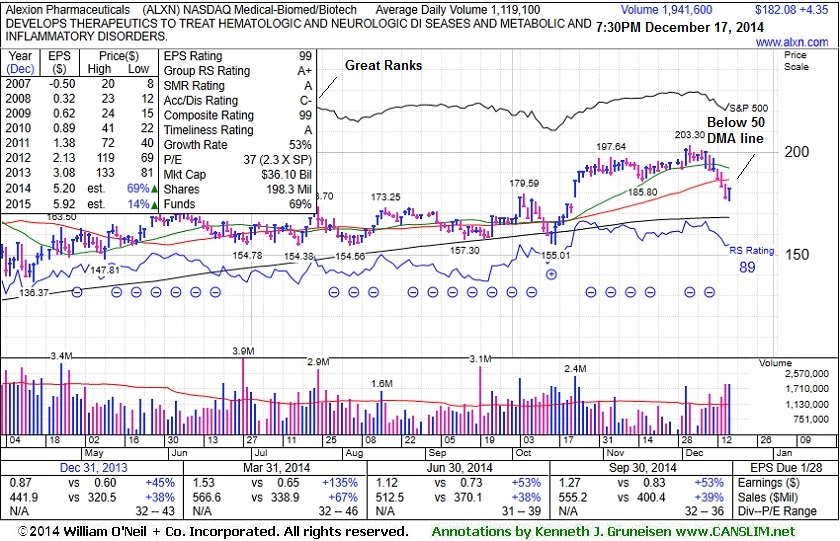

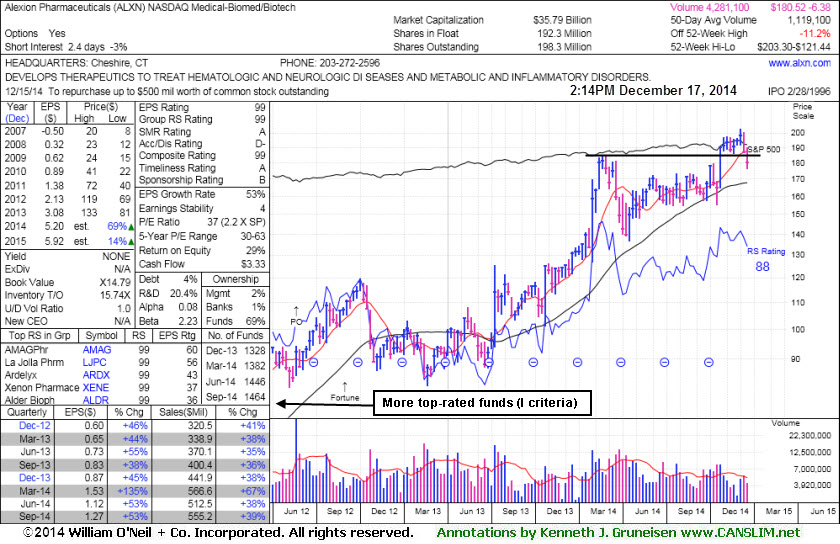

Recent 50-Day Moving Average Violation Triggered Sell Signal - Wednesday, December 17, 2014

Alexion Pharmaceuticals Inc (ALXN +$4.35 or +2.45% to $182.08) rebounded from earlier lows following a damaging volume-driven loss. The recent violation of its 50-day moving average (DMA) line triggered a technical sell signal. Prior highs in the $180 area may serve as support, but a subsequent rebound above its 50 DMA line is needed to help its outlook improve. It was last shown in this FSU section on 11/28/14 with annotated graphs under the headline, "Quietly Consolidating Near All-Time High", hovering just above its "max buy" level. Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock which falls more than -7% from its purchase price.

ALXN was highlighted in yellow with a pivot point based on its 2/25/14 high plus 10 cents in the 10/23/14 mid-day report (read here). The Medical - Biomed/Biotech industry group has demonstrated leadership and earned a 99 for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. It reported earnings +53% on +39% sales revenues for the Sep '14 quarter, continuing its strong earnings history. Its Relative Strength Rank (88) remains high. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 1,325 in Dec '13 to 1,464 in Sep '14, a reassuring sign concerning the I criteria of the fact-based investment system. ALXN completed a new Public Offering on 5/25/12.

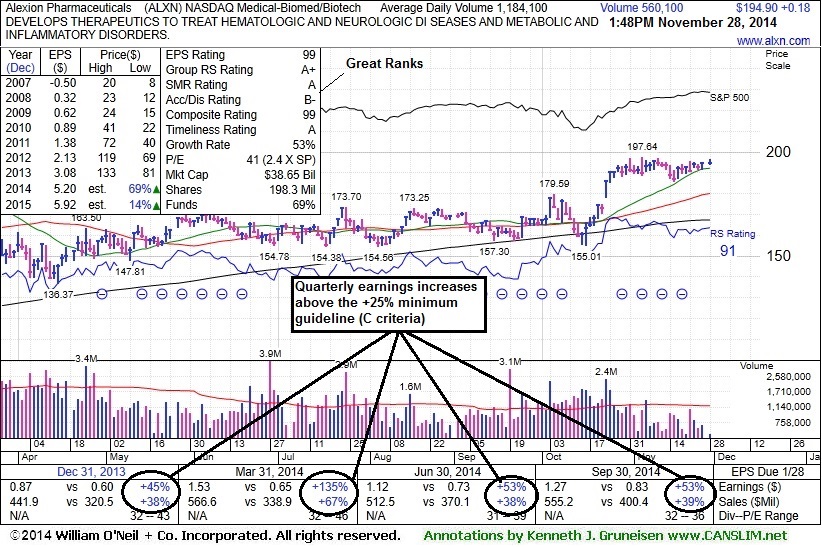

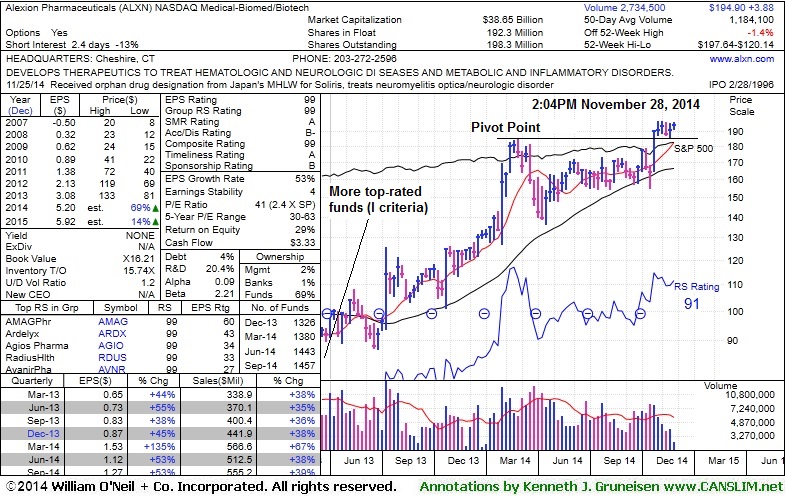

Quietly Consolidating Near All-Time High - Friday, November 28, 2014

Alexion Pharmaceuticals Inc (ALXN +$0.18 or +0.09% to $194.90) is hovering just above its "max buy" level and perched only -1.4% off its 52-week and all-time highs. Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock which falls more than -7% from its purchase price. Recent lows near $185 define initial support to watch above its 50-day moving average (DMA) line. It was last shown in this FSU section on 11/10/14 with annotated graphs under the headline, "New High Close With Gain on Light Volume", as it wedged higher for its best-ever close.

No resistance remains due to overhead supply. Prior highs in the $180 area define initial support to watch on pullbacks. It was highlighted in yellow with a pivot point based on its 2/25/14 high plus 10 cents in the 10/23/14 mid-day report (read here). The Medical - Biomed/Biotech industry group has demonstrated leadership and earned a 99 for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. It reported earnings +53% on +38% sales revenues for the Sep '14 quarter, continuing its strong earnings history. Its Relative Strength Rank (93) remains high. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 1,325 in Dec '13 to 1,457 in Sep '14, a reassuring sign concerning the I criteria of the fact-based investment system. ALXN completed a new Public Offering on 5/25/12.

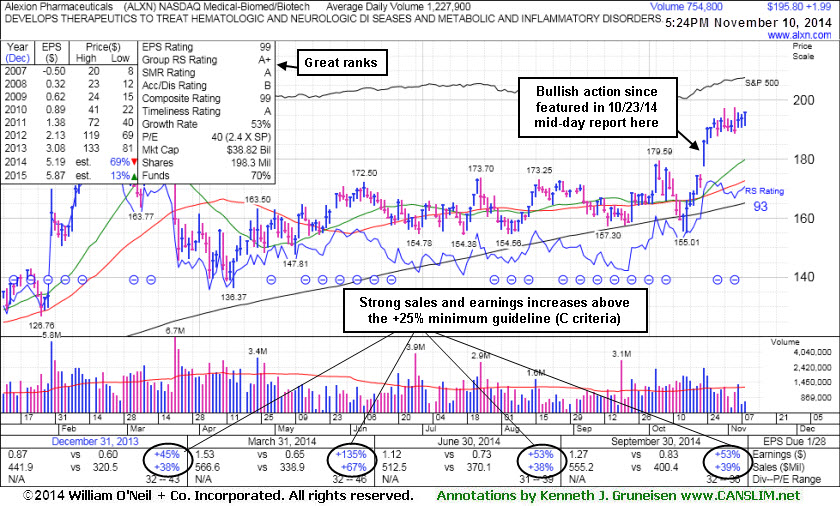

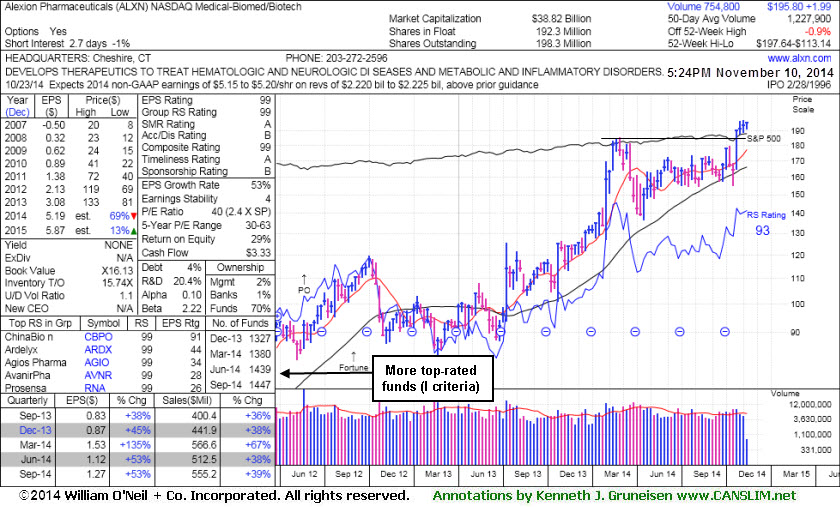

New High Close With Gain on Light Volume - Monday, November 10, 2014

Alexion Pharmaceuticals Inc (ALXN +$1.99 or +1.03% to $195.80) wedged higher for its best-ever close with today's gain on lighter than average volume. No resistance remains due to overhead supply. Prior highs in the $180 area define initial support to watch on pullbacks. It was last shown in this FSU section on 10/23/14 with annotated graphs under the headline, "Finished Strong After Gapping Up Above Prior High", after finishing strong when highlighted in yellow with a pivot point based on its 2/25/14 high plus 10 cents in the earlier mid-day report (read here). The big gain for a new 52-week high was backed by +106% above average volume and triggered a technical buy signal following a gap up clearing a recent high. Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock which falls more than -7% from its purchase price.

The Medical - Biomed/Biotech industry group has demonstrated leadership and earned a 99 for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. It reported earnings +53% on +38% sales revenues for the Sep '14 quarter, continuing its strong earnings history. It found support at its 200 DMA line during its long consolidation since noted in the 3/21/14 mid-day report - "Patient investors may watch for a new base or secondary buy point to possibly develop and be noted in the weeks ahead. Fundamentals remain strong with respect to the quarterly and annual earnings (C and A criteria) history."

ALXN's Relative Strength Rank (93) remains high. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 1,325 in Dec '13 to 1,430 in Sep '14, a reassuring sign concerning the I criteria of the fact-based investment system. ALXN completed a new Public Offering on 5/25/12.

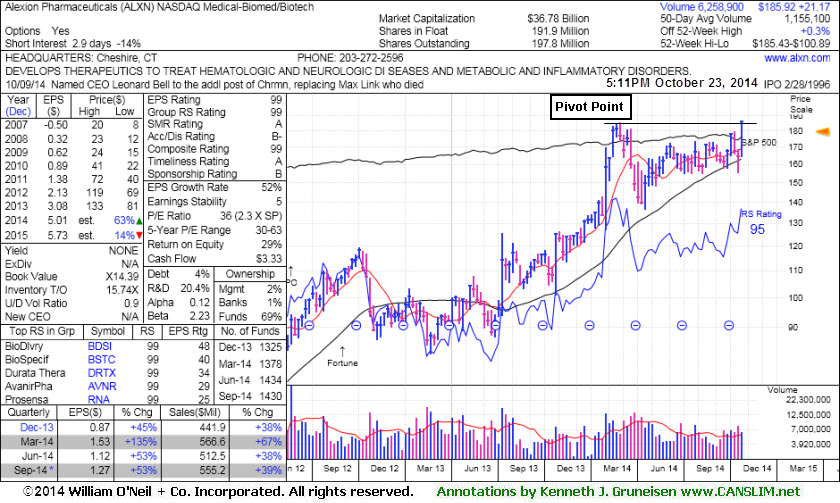

Finished Strong After Gapping Up Above Prior High - Thursday, October 23, 2014

Alexion Pharmaceuticals Inc (ALXN +$12.65 or +7.30% to $185.96) finished strong today after highlighted in yellow with a pivot point based on its 2/25/14 high plus 10 cents in the earlier mid-day report (read here). The big gain for a new 52-week high was backed by +106% above average volume and triggered a technical buy signal following a gap up clearing a recent high. No resistance remains due to overhead supply. Prior highs in the $179 area define the important chart support to watch on pullbacks. Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock which falls more than -7% from its purchase price.

It reported earnings +53% on +38% sales revenues for the Sep '14 quarter, continuing its strong earnings history. It found support at its 200 DMA line during its long consolidation since noted in the 3/21/14 mid-day report - "Patient investors may watch for a new base or secondary buy point to possibly develop and be noted in the weeks ahead. Fundamentals remain strong with respect to the quarterly and annual earnings (C and A criteria) history."

ALXN's Relative Strength Rank (95) remains high. It reported earnings +53% on +39% sales revenues for the quarter ended September 30, 2014 versus the year ago period. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 1,325 in Dec '13 to 1,430 in Sep '14, a reassuring sign concerning the I criteria of the fact-based investment system. ALXN completed a new Public Offering on 5/25/12.

The Medical - Biomed/Biotech industry group has demonstrated leadership and earned a 99 for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. The stock went through a deep consolidation below its 200 DMA line then rebounded impressively since last shown in this FSU section with an annotated graph on 9/26/12 under the headline, "Consolidating Above Prior Highs Defining Chart Support".

Consolidating Above Prior Highs Defining Chart Support - Wednesday, September 26, 2012

Alexion Pharmaceuticals Inc's (ALXN -$1.94 or -1.70 to $111.96) pulled back from its 52 week high today. Its color code was changed to yellow after retreating below its "max buy" level. Gains above its pivot point backed by +69% above average volume on 9/21/12 confirmed a technical buy signal. The stock was last shown in this FSU section with an annotated graph on 8/23/12 under the headline, "New Pivot Point Cited While Building Orderly Flat Base", while consolidating above support defined by its 50-day moving average (DMA) line.No resistance remains due to overhead supply. Prior highs in the $110 area near its pivot point define the important chart support above its 50 DMA line. ALXN's Relative Strength Rank (92) remains high. It reported earnings +62% on +48% sales revenues for the quarter ended June 30, 2012 versus the year ago period. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 842 in Mar '11 to 1,206 in Jun '12, a reassuring sign concerning the I criteria of the fact-based investment system. With the help of underwriters, its latest Public Offering may very likely have helped it attract additional ownership interest from the institutional crowd. ALXN completed a new Public Offering on 5/25/12. The Medical - Biomed/Biotech industry group has demonstrated leadership and earned a 97 for its Group Relative Strength Rating, a reassuring sign concerning the L criteria.

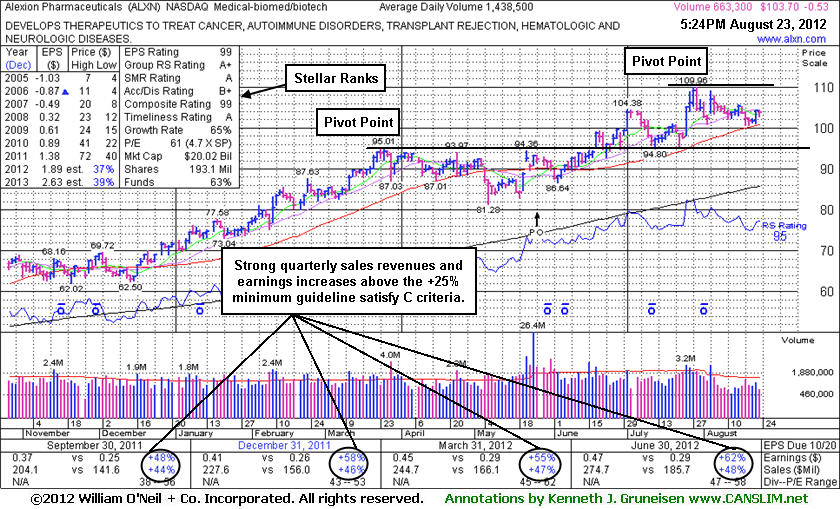

New Pivot Point Cited While Building Orderly Flat Base - Thursday, August 23, 2012

Alexion Pharmaceuticals Inc's (ALXN -$0.53 or -0.51 to $103.70) volume totals have been cooling in recent weeks while consolidating above support defined by its 50-day moving average (DMA) line (now $100.91). Its color code was changed to yellow with a new pivot point cited based on its 7/27/12 high plus 10 cents. It is still building on an orderly flat base pattern. No resistance remains due to overhead supply. Disciplined investors will watch for subsequent volume-driven gains to trigger a new (or add-on) technical buy signal, meanwhile any violation of its 50 DMA line would raise concerns and trigger technical sell signals. Prior highs in the $95 area near its old pivot point define the next important chart support below its 50 DMA line.The stock was last shown in this FSU section with an annotated graph on 7/25/12 under the headline, "Gain to New High With +40% Above Average Volume on Earnings News" as it tallied a confirming gain with above average volume. ALXN's Relative Strength Rank (95) remains high. It reported earnings +62% on +48% sales revenues for the quarter ended June 30, 2012 versus the year ago period. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 842 in Mar '11 to 1,175 in Jun '12, a reassuring sign concerning the I criteria of the fact-based investment system. With the help of underwriters, its latest Public Offering may very likely have helped it attract additional ownership interest from the institutional crowd. ALXN completed a new Public Offering on 5/25/12. The Medical - Biomed/Biotech industry group has demonstrated leadership and still earns the best possible rank, 99, for its Group Relative Strength Rating, a reassuring sign concerning the L criteria.

Gain to New High With +40% Above Average Volume on Earnings News - Wednesday, July 25, 2012

Alexion Pharmaceuticals (ALXN +$7.51 or +7.69% to $105.13) hit a new all-time high with a considerable gain today backed by +40% above average volume, getting extended from its prior base. It reported earnings +62% on +48% sales revenues for the quarter ended June 30, 2012 versus the year ago period. It had recently been consolidating above prior highs in the $95 area and its 50-day moving average (DMA) line defining important chart support. No resistance remains due to overhead supply.

The stock was last shown in this FSU section with an annotated graph on 6/29/12 under the headline, "Confirming Gains With Volume Would Be Reassuring Sign". A gain with the bare minimum +40% above average volume meets the threshold to trigger a technical buy signal, and its rally after earnings news may be considered a confirming gain and welcome reassurance. However, 3 out of 4 stocks tend to go in the direction of the major averages and they recently entered another correction (as noted in the Market Commentary portion of the After Market Update. The M criteria argues against all new buying efforts again until there is a solid follow-through day from at least one of the major averages.

ALXN completed a new Public Offering on 5/25/12. The Medical - Biomed/Biotech industry group has demonstrated leadership and still earns the best possible rank, 99, for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. ALXN's Relative Strength Rank (95) remains high. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 842 in Mar '11 to 1,156 in Jun '12, a reassuring sign concerning the I criteria of the fact-based investment system. With the help of underwriters, its latest Public Offering may very likely have helped it attract additional ownership interest from the institutional crowd.

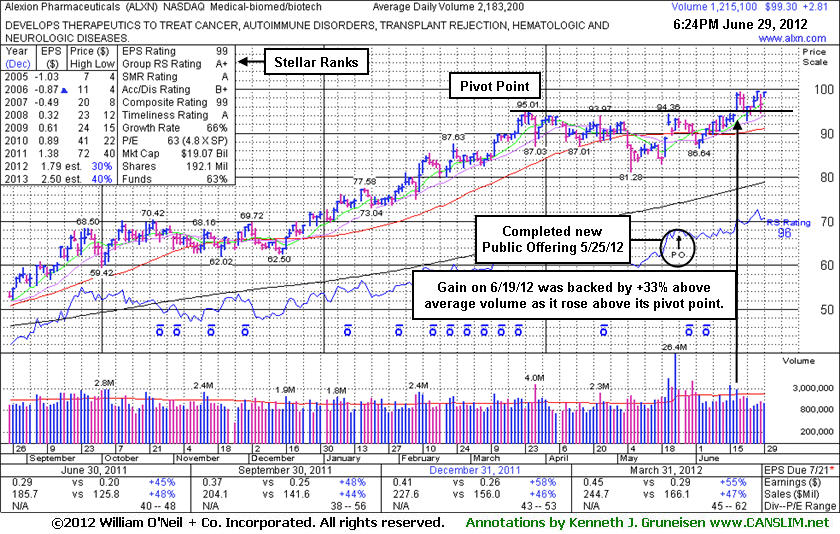

Confirming Gains With Volume Would Be Reassuring Sign - Friday, June 29, 2012

Alexion Pharmaceuticals (ALXN +$2.81 or +2.91% to $99.30) gapped up today for a gain with below average volume. It remains consolidating above its pivot point but below its "max buy" level following its 6/19/12 technical breakout with +33% above average volume, below the +40% above average volume threshold which is the bare minimum necessary to trigger a proper technical buy signal. Confirming volume-driven gains would be a welcome reassurance, however disciplined investors also know to avoid chasing stocks that get too extended from prior highs. A tactic called pyramiding which is taught in the Certification may be used to allow investors to let the market action dictate how heavily a stocks shares are accumulated while it is in the ideal range.

ALXN completed a new Public Offering on 5/25/12 and it is consolidating above its prior highs only -0.4% off its 52-week high. Prior resistance in the $94-95 area now defines initial chart support to watch. ALXN was last shown in this FSU section with an annotated graph on 5/31/12 under the headline, "Perched Near All-Time High Following Recent Share Offering". Its color code was changed to green after a subsequent loss on higher volume was a sign of distributional pressure as it violated important support at its 50-day moving average (DMA) line raising concerns and triggering a technical sell signal. However its resilience and prompt ability to rebound improved its outlook and its color code was changed to yellow again while continuing to build on its base.

The Medical - Biomed/Biotech industry group has demonstrated leadership and earned the best possible rank, 99, for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. ALXN's Relative Strength Rank (96) remains high. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 842 in Mar '11 to 1,067 in Mar '12, a reassuring sign concerning the I criteria of the fact-based investment system. With the help of underwriters, its latest Public Offering may very likely have helped it attract additional ownership interest from the institutional crowd.

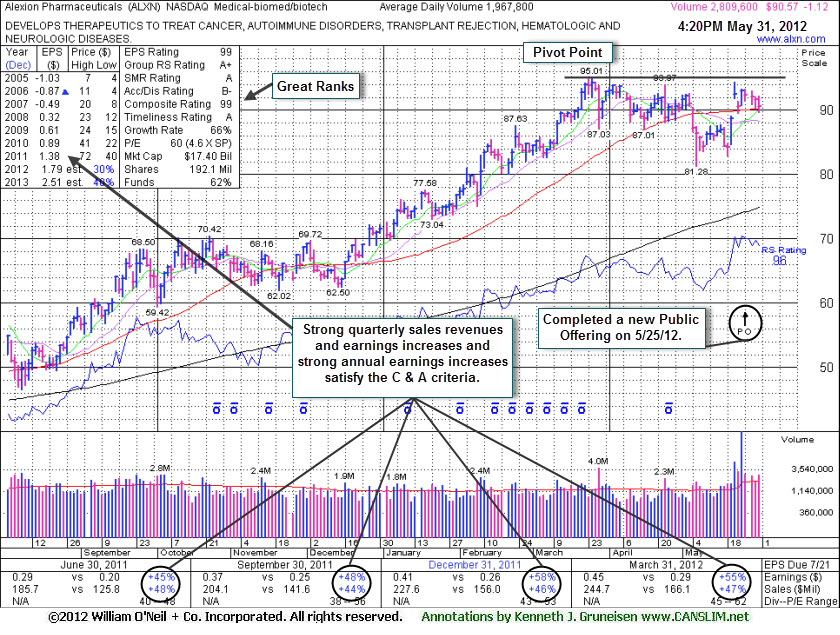

Perched Near All-Time High Following Recent Share Offering - Thursday, May 31, 2012

Alexion Pharmaceuticals (ALXN -$1.12 or -1.22% to $90.57) completed a new Public Offering on 5/25/12 and it is consolidating above its 50--day moving average (DMA) line perched within -4.7% of its 52-week high. Its faces little resistance in the $94-95 area. Volume-driven gains to new highs may trigger a new technical buy signal. Without fresh signs of heavier buying demand most disciplined investors would remain cautious. The M criteria remains an overriding concern until a confirmed rally with follow-through day from at least one of the major averages.

ALXN was last shown in this FSU section with an annotated graph on 4/16/12 under the headline, "Support at 50-Day Average Also Near Last Pivot Point Cited". Subsequent losses on higher volume were a sign of distributional pressure as it violated important support at its 50 DMA line raising concerns and triggering a technical sell signal. It had traded as high as $95.01, or +56% above its pivot point cited back when first featured in yellow on September 15, 2011.

The Medical - Biomed/Biotech industry group has demonstrated leadership and earned the best possible rank, 99, for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. ALXN's Relative Strength Rank (96) remains high. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 842 in Mar '11 to 1,072 in Mar '12, a reassuring sign concerning the I criteria of the fact-based investment system. With the help of underwriters, its latest Public Offering may very likely have helped it attract additional ownership interest from the institutional crowd.

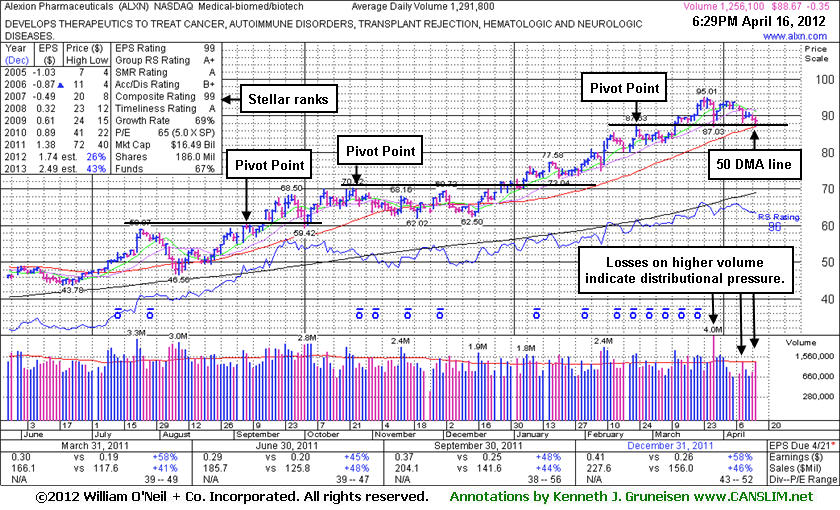

Support at 50-Day Average Also Near Last Pivot Point Cited - Monday, April 16, 2012

Alexion Pharmaceuticals (ALXN -$0.35 or -0.39% to $88.67) has traded down on several recent sessions marked by clearly higher volume than the immediately prior sessions. Such losses on higher volume are a sign of distributional pressure. It is now near important support at its 50-day moving average (DMA) line ($87.02) where a damaging violation may raise concerns and trigger a technical sell signal. That short-term average also coincides with its latest pivot point. It may be forming a new base, but without signs of fresh buying demand most disciplined investors would remain cautious. Should it continue finding support near its short-term average another new pivot point may soon be cited, above which any subsequent volume-driven gains may eventually trigger a new (or add-on) technical buy signal.

The Medical - Biomed/Biotech industry group has demonstrated leadership and earned the best possible rank, 99, for its Group Relative Strength Rating, a reassuring sign concerning the L criteria. ALXN's Relative Strength Rank (96) remains high. It easily satisfies the C and A criteria with a very strong quarterly and annual earnings history which has earned it a highest possible 99 Earnings Per Share rank. The number of top-rated funds owning its shares rose from 842 in Mar '11 to 1,058 in Mar '12, a reassuring sign concerning the I criteria of the fact-based investment system. ALXN was last shown in this FSU section with an annotated graph on 2/24/12 under the headline, "Strong Medical - Biomed/Biotech Group Leader Extended From Base", as volume-driven gains had lifted it to new all-time highs. It traded as high as $95.01, or +56% above its pivot point cited back when first featured in yellow on September 15, 2011.

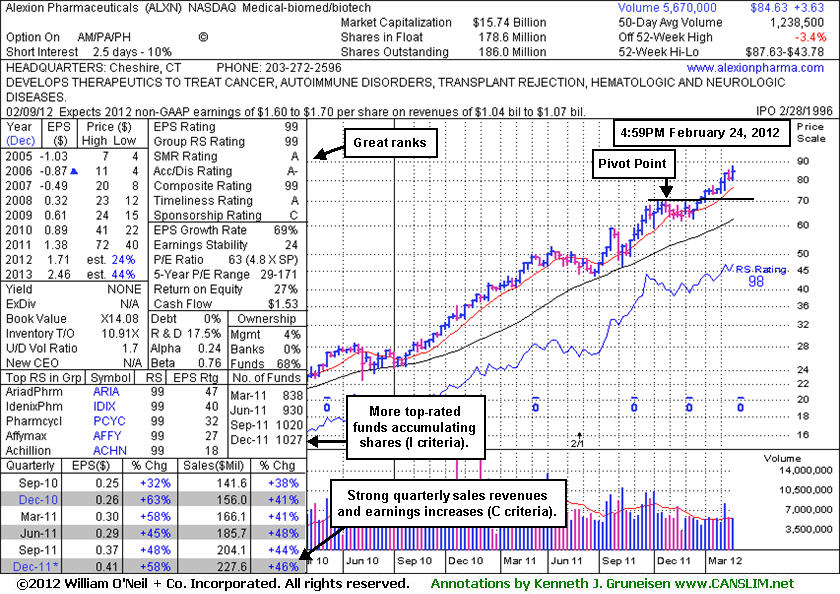

Strong Medical - Biomed/Biotech Group Leader Extended From Base - Friday, February 24, 2012

Alexion Pharmaceuticals (ALXN -$1.28 or -1.49% to $84.63) is extended from its prior base after more volume-driven gains for new all-time highs this week. Support to watch on pullbacks is its 50-day moving average (DMA) line. Disciplined investors know not to chase extended stocks. Patience may allow for secondary buy points to develop and be noted.The high-ranked Medical - Biomed/Biotech firm was last shown in this FSU section on 1/13/12 with an annotated graph under the headline, "Holding Its Ground After Breakout With Volume Driven Gains". The Medical - Biomed/Biotech industry group has demonstrated leadership and earned the best possible rank, 99, for its Group Relative Strength Rating, a reassuring sign concerning the L criteria.

ALXN's Relative Strength Rank (90) remains high. Its strong quarterly and annual earnings history satisfies the C and A criteria. The number of top-rated funds owning its shares rose from 842 in Mar '11 to 1,027 in Dec '11, a reassuring sign concerning the I criteria of the fact-based investment system. Bullish action has continued since its 1/06/12 gain above its pivot point had +53% above average volume, meeting the investment system guidelines for a technical buy signal.

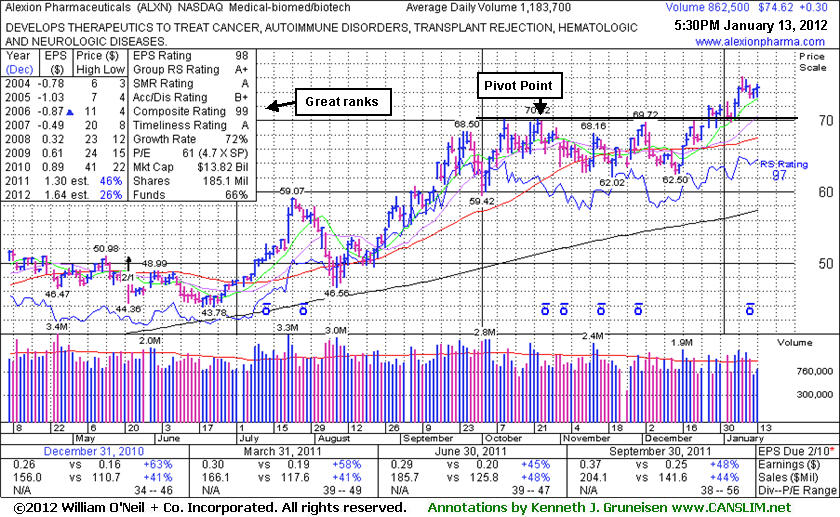

Holding Its Ground After Breakout With Volume Driven Gains - Friday, January 13, 2012

Alexion Pharmaceuticals (ALXN +$0.30 or +0.40% to $74.62) is stubbornly holding its ground after rallying with volume-driven gains and getting extended from its prior base. Prior resistance in the $70 area defines initial chart support above its 50-day moving average (DMA) line. It was last shown in this FSU section on 12/12/11 with an annotated graph under the headline, "Prior Low Defines Near-Term Support Level", while sputtering below its 50-day moving average (DMA) line. It rebounded above that short-term average and rallied to new high territory with the help of several volume-driven gains in recent weeks. Its 1/06/12 gain above its pivot point had +53% above average volume, meeting the investment system guidelines for a technical buy signal.Its Relative Strength Rank (97) remains high. ALXN has good ranks, and its strong quarterly and annual earnings history satisfies the C and A criteria. In prior months it found support well above its 200 DMA line. It rose from a previously noted "cup-with-high-handle" pattern as it gapped up on 9/15/11 and hit a new all-time high. The number of top-rated funds owning its shares rose from 842 in Mar '11 to 1,009 in Dec '11, a reassuring sign concerning the I criteria of the fact-based investment system.

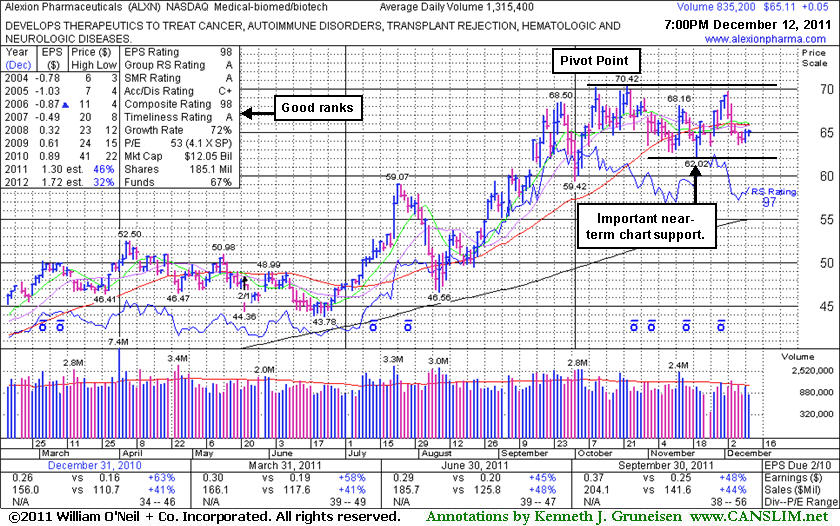

Prior Low Defines Near-Term Support Level - Monday, December 12, 2011

Alexion Pharmaceuticals (ALXN +$0.05 or +0.08% to $65.11) has recently been sputtering below its 50-day moving average (DMA) line. Its prior low ($62.02 on 11/21/11) defines the next important near-term support level to watch. Any subsequent violation of its recent chart lows would trigger a more worrisome technical sell signal. Disciplined investors always limit losses by selling if a stock falls more than -7% from their buy point. Meanwhile, a repair of its 50 DMA violation and volume-driven gains are needed to trigger a new (or add-on) technical buy signal.

It was last shown in this FSU section on 11/14/11 with an annotated graph under the headline, "Support Found at 50-Day Moving Average; Secondary Buy Point," as it was finding good support near its 50-day moving average (DMA) line. It had been weeks since volume indicated any great decisiveness in direction. Its Relative Strength Rank (97) remains high, however the Relative Strength line (jagged blue line) has been recently slumping. When buying stocks, it is preferred to see the Relative Strength rank hitting new highs prior to the share price hitting new highs. ALXN has good ranks, and its strong quarterly and annual earnings history satisfies the C and A criteria. In prior months it found support well above its 200 DMA line. It rose from a previously noted "cup-with-high-handle" pattern as it gapped up on 9/15/11 and hit a new all-time high. The number of top-rated funds owning its shares rose from 843 in Mar '11 to 1,003 in Sep '11, a reassuring sign concerning the I criteria of the fact-based investment system.

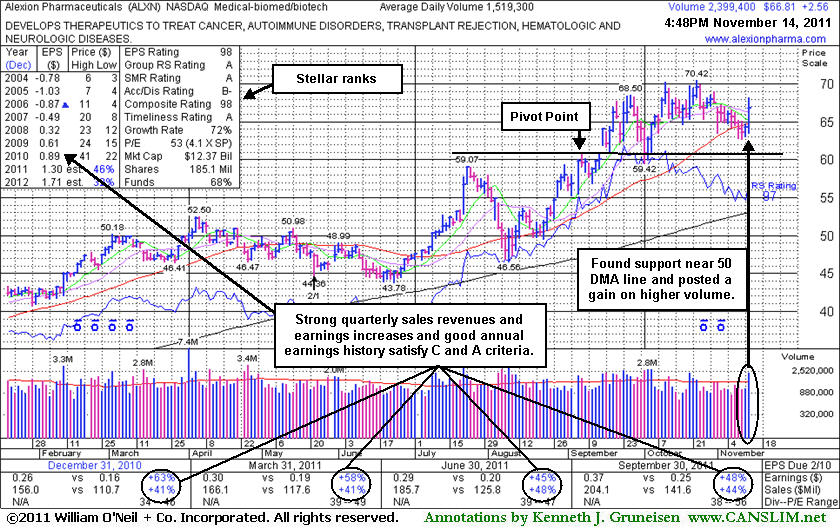

Support Found at 50-Day Moving Average; Secondary Buy Point - Monday, November 14, 2011

Alexion Pharmaceuticals (ALXN +$2.56 or +3.98% to $66.81) posted a solid gain today with higher volume, finding good support near its 50-day moving average (DMA) line. It had been weeks since volume indicated any great decisiveness in direction. It was last shown in this FSU section on 10/18/11 with an annotated graph under the headline, "Pullback Provided Opportunity for Patient Investors." Its Relative Strength Rank (97) remains high, however the Relative Strength line (jagged blue line) has been recently slumping. When buying stocks, it is preferred to see the Relative Strength rank hitting new highs prior to the share price hitting new highs. Any subsequent violation of its recent chart lows and its 50 DMA line would trigger technical sell signals.

Another secondary buy point that the experts teach in the Certification is that if you missed an earlier breakout and idea entry point you may accumulate shares from the stock's first successful test of its 50 DMA line on up to as much as +5% above the latest high (in this case that would be $70.42 X 1.05 or $73.94). The color code is changed to yellow, however a new pivot point is not being cited because it has not formed a sound new base pattern of sufficient length. Its pullback appears to have offered patient investors another opportunity to accumulate shares without chasing them beyond the ideal buying range. Approximately 40% of successful breakouts tend to pull back and test support near prior highs before going on to produce greater gains. Prior resistance in the $59 area already acted as support following its breakout. Disciplined investors always limit losses by selling if a stock falls more than -7% from their buy point.

ALXN has stellar ranks, and its strong quarterly and annual earnings history satisfies the C and A criteria. In prior months it found support well above its 200 DMA line. It rose from a previously noted "cup-with-high-handle" pattern as it gapped up on 9/15/11 and hit a new all-time high. The number of top-rated funds owning its shares rose from 883 in Dec '10 to 1,086 in Sep '11, a reassuring sign concerning the I criteria of the fact-based investment system.

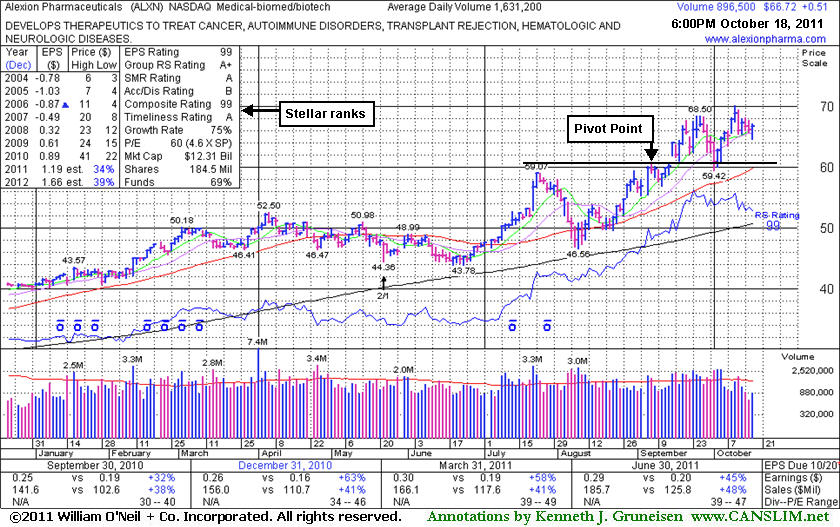

Pullback Provided Opportunity for Patient Investors - Tuesday, October 18, 2011

Alexion Pharmaceuticals (ALXN +$0.51 or +0.77% to $66.72) is still hovering in a tight range near its all-time high with volume totals recently cooling. This high-ranked Medical - Biomed/Biotech group leader is extended from its prior base. Volume totals have been mostly below average since it was last shown in this FSU section on 10/05/11 with an annotated graph under the headline, "Leader's Pullback Looks Normal, However Market Needs Confirmation", yet it wedged to another new all-time high and has been stubbornly holding its ground.

Although a bumpy market gave investors reasons to be cautious, its pullback appears to have offered patient investors the opportunity to accumulate shares without chasing them beyond the ideal buying range. Approximately 40% of successful breakouts tend to pull back and test support near prior highs before going on to produce greater gains. Prior resistance in the $59 area acted as support, and its recent lows and its 50-day moving average (DMA) line now define important near-term support to watch.

ALXN has stellar ranks, and its strong quarterly and annual earnings history satisfies the C and A criteria. In prior months it found support well above its 200 DMA line. It rose from a previously noted "cup-with-high-handle" pattern as it gapped up on 9/15/11 and hit a new all-time high. The number of top-rated funds owning its shares rose from 882 in Dec '10 to 1,052 in Sep '11, a reassuring sign concerning the I criteria of the fact-based investment system. Patient investors may wait for any secondary buy points or new bases to develop and be noted, or they may otherwise be better off watching for another fresh breakout that can be acted upon without chasing it too far above its pivot point.

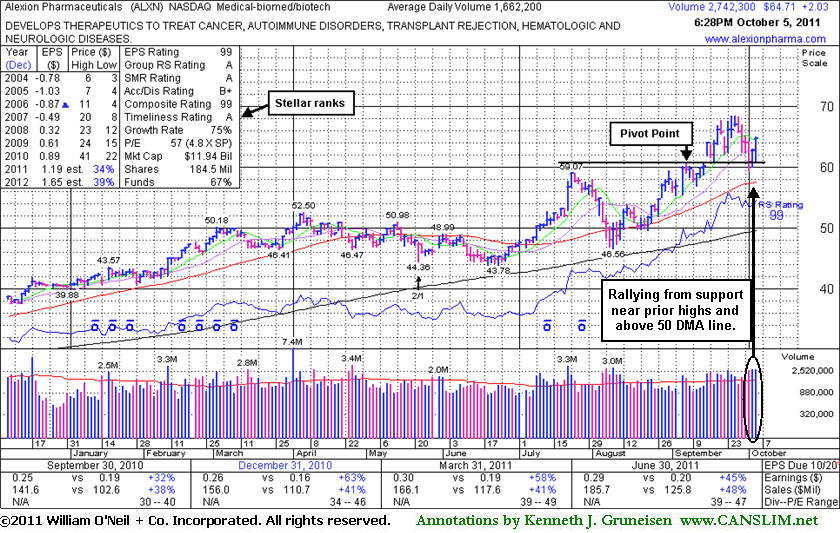

Leader's Pullback Looks Normal, However Market Needs Confirmation - Wednesday, October 05, 2011

Alexion Pharmaceuticals (ALXN +$2.03 or +3.24% to $64.71) found support and has been rallying up with volume-driven gains after consolidating above prior resistance in the $59-60 area. Recent lows and its 50-day moving average (DMA) line define important near-term support to watch. It was last shown in this FSU section on 9/15/11 with an annotated graph under the headline, "Fundamentally Strong Leader Rises From Cup-With-High-Handle" after featured in yellow in the earlier mid-day report (read here). In that summary members were reminded - "Disciplined investors avoid chasing stocks more than +5% above their prior highs and always limit losses by selling if any stock falls more than -7% from their purchase price. Patience may allow investors to accumulate shares on pullbacks near prior highs rather than chasing it beyond the "max buy" level ($63.85)." Although its pullback appears to be offering patient investors the opportunity they may have been waiting for, the M criteria is now a bigger concern which argues against any new buying efforts until a follow-through day from at least one of the major averages has confirmed a new rally.

Its has stellar ranks, and its strong quarterly and annual earnings history satisfies the C and A criteria. It recently found support above its 200 DMA line. It rose from a cup-with-high-handle pattern as it gapped up on 9/15/11 and hit a new all-time high. Its strong finish above the new pivot point ($60.81) cited was backed by +43% above average volume that confirmed a technical buy signal. The number of top-rated funds owning its shares rose from 882 in Dec '10 to 1,058 in Jun '11, a reassuring sign concerning the I criteria of the fact-based investment system.

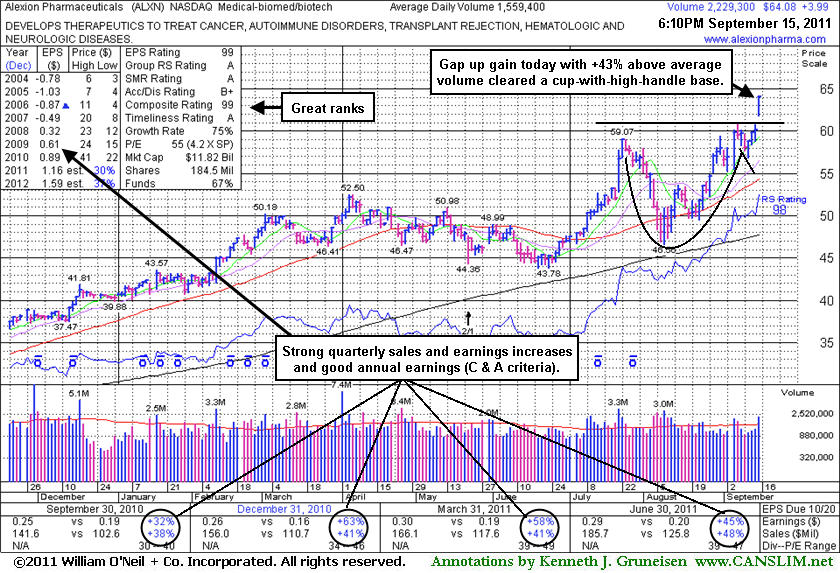

Fundamentally Strong Leader Rises From Cup-With-High-Handle - Thursday, September 15, 2011

Alexion Pharmaceuticals (ALXN +$3.99 or +5.18% to $63.98 ) was featured in yellow in the earlier mid-day report (read here). Its strong quarterly and annual earnings history satisfies the C and A criteria. It recently found support above its 200 DMA line and rose from a consolidation resembling a cup-with-high-handle as it gapped up today and hit a new all-time high. Its strong finish above the new pivot point ($60.81) cited was backed by +43% above average volume that confirmed a technical buy signal. The number of top-rated funds owning its shares rose from 881 in Dec '10 to 1,051 in Jun '11, a reassuring sign concerning the I criteria of the fact-based investment system. Its current Up/Down Volume Ratio of 1.5 is a reassuring unbiased sign of institutional accumulation. Disciplined investors avoid chasing stocks more than +5% above their prior highs and always limit losses by selling if any stock falls more than -7% from their purchase price. Patience may allow investors to accumulate shares on pullbacks near prior highs rather than chasing it beyond the "max buy" level ($63.85).