Following Mid-Day Report Appearance Action Turned Uglier - Wednesday, October 17, 2012

Often, when a leading stock is setting up with a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price. In the event the stock fails to trigger a technical buy signal no harm is done, and it would simply be dropped from investors' watchlists.

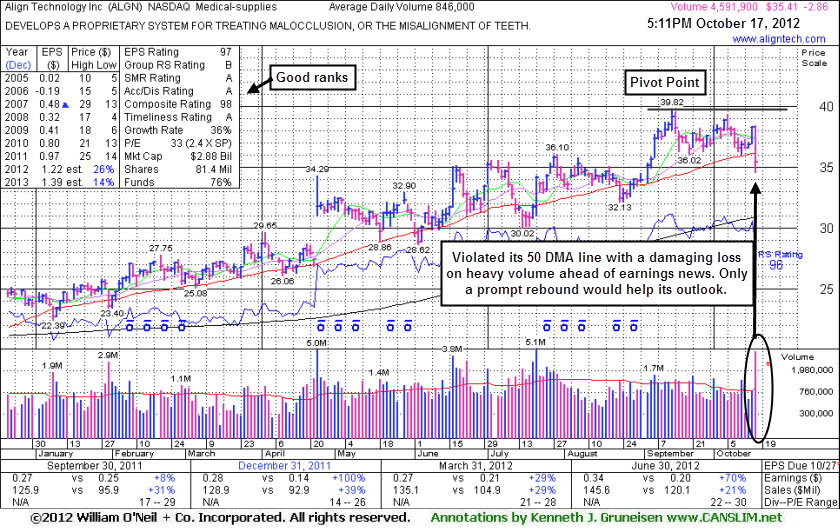

Align Technology Inc (ALGN -$2.86 or -7.47% to $35.41) had built an orderly base above its 50-day moving average (DMA) line and above prior highs in the $36 area. However, it slumped under its 50-day moving average (DMA) line and finished weak after it was highlighted in yellow with pivot point cited based on its 9/13/12 high plus 10 cents in today's earlier mid-day report (read here) while noted - "Disciplined investors may watch for volume-driven gains above its pivot point which are needed to trigger a new technical buy signal. Last noted in the 7/27/12 mid-day report - 'Earnings rose +70% on +21% sales revenues for the quarter ended June 30, 2012 versus the year ago period, marking a 3rd consecutive quarterly earnings increase above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been good following a downturn in FY '08. Patient and disciplined investors may watch for a proper base to form while it continues consolidating.'"

This high-ranked Medical - Supplies firm traded lower in the after-hours. It reported preliminary earnings after the close for the quarter ended September 30, 2012 versus the year ago period, and volume and volatility often increase near earnings news. It also announced the discontinuation of a distribution relationship with Straumann in Europe and North America in a separate press release. It said a decline in results of operations of the company's Scanner and CAD/CAM Services reporting unit triggered the risk of impairment of goodwill associated with the acquisition of Cadent. As a result, Align is in the process of conducting step one of a goodwill impairment test as prescribed by GAAP.

The action in this stock again demonstrates an important point we have seen illustrated numerous times before, that there is no advantage in getting in "early" before a stock has triggered a technical buy signal. Disciplined investors know their odds are only considered favorable when a stock is demonstrating proof of fresh institutional buying demand.