Met Resistance at 50-Day Averages After Violation - Monday, June 15, 2015

Akamai Technologies Inc (AKAM -$0.94 or -1.28% to $72.50) slumped further below its 50-day moving average (DMA) line today. It met resistance at that important short-term average when trying to rebound following a damaging gap down and volume-driven loss on 6/09/15 which triggered a technical sell signal. It currently has a Timeliness rating of C and its Relative Strength rating has slumped to 79, below the 80+ minimum guideline for buy candidates. It will be dropped from the Featured Stocks list tonight.

The Internet - Network Solutions firm was last shown in this FSU section on 5/21/15 with annotated graphs under the headline, "Fundamental Flaw Raised Recent Concerns". Prior reports repeatedly cautioned members - "Reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), a fundamental flaw making it a less favorable buy candidate. It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal." AKAM was first highlighted in yellow with pivot point based on its 11/28/14 high plus 10 cents in the 2/13/15 mid-day report (read here).

Fundamental Flaw Raised Recent Concerns - Thursday, May 21, 2015

Fundamental Flaw Arose After Sub Par Earnings News - Wednesday, May 06, 2015

Akamai Technologies Inc (AKAM -$0.32 or -0.42% to $75.04) held its ground today, ending with a small loss on lighter (near average) volume. It recently reported earnings +5% on +16% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria), raising concerns. The new fundamental flaw makes it a less favorable buy candidate under the fact-based investment system's guidelines. The 3 prior quarterly comparisons were near or above the +25% minimum guideline (C criteria).

AKAM churned heavy volume last week while retreating from its 52-week high. Prior reports cautioned - "It did not produce gains above the pivot point backed by at least the +40% above average volume necessary to trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support to watch."

The high-ranked Internet - Network Solutions firm was last shown in this FSU section on 4/13/15 with annotated graphs under the headline, "Quietly Consolidating Above 50-Day Moving Average Line", Now it is consolidating well above its 50-day moving average (DMA) line ($72.23) defining near-term support to watch on pullbacks. It was first highlighted in yellow with pivot point based on its 11/28/14 high plus 10 cents in the 2/13/15 mid-day report (read here). Its annual earnings (A criteria) history has been steady. The number of top-rated funds owning its shares rose from 941 in Mar '14 to 1,094 in Mar '15, a reassuring sign concerning the I criteria.

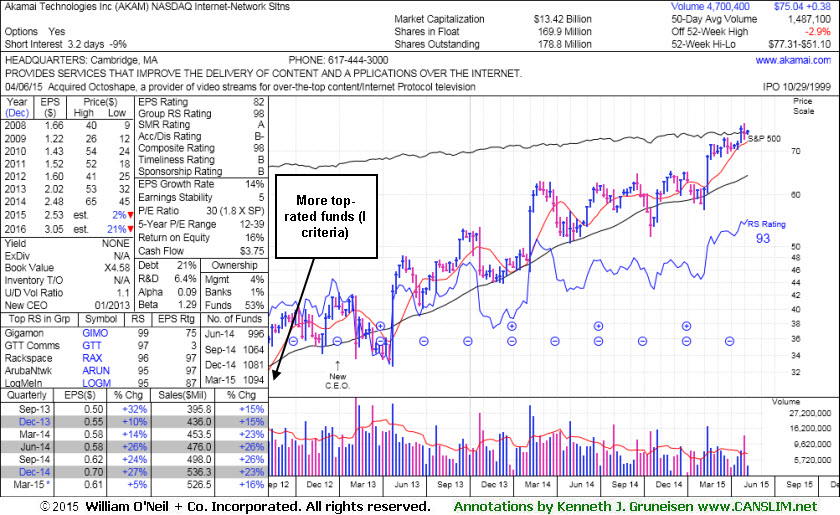

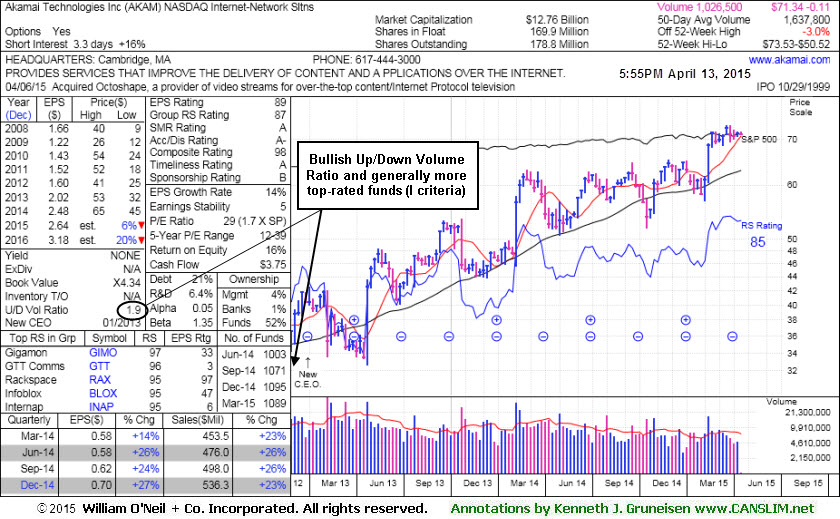

Quietly Consolidating Above 50-Day Moving Average Line - Monday, April 13, 2015

Akamai Technologies Inc (AKAM -$0.11 or -0.15% to $71.34) has been holding its ground while volume totals have been cooling, a sign few investors have headed for the exit. It recently wedged into new 52-week high territory with gains lacking great volume conviction. Now it is consolidating above its 50-day moving average (DMA) line ($69.03) and recent lows in the $68 area defining near-term support to watch on pullbacks.

The high-ranked Internet - Network Solutions firm was last shown in this FSU section on 3/23/15 with annotated graphs under the headline, "Wedging Gains Have Followed Brief Consolidation". It was first highlighted in yellow with pivot point based on its 11/28/14 high plus 10 cents in the 2/13/15 mid-day report (read here).

It reported earnings +27% on +23% sales revenues for the Dec '14 quarter, and the 2 prior quarterly comparisons were very near the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been steady, and it has an 89 Earnings Per Share Rating. The number of top-rated funds owning its shares rose from 941 in Mar '14 to 1,089 in Mar '15, and its Up/Down Volume Ratio of 1.9 is an unbiased indication its shares have been under accumulation over the past 50 days (I criteria).

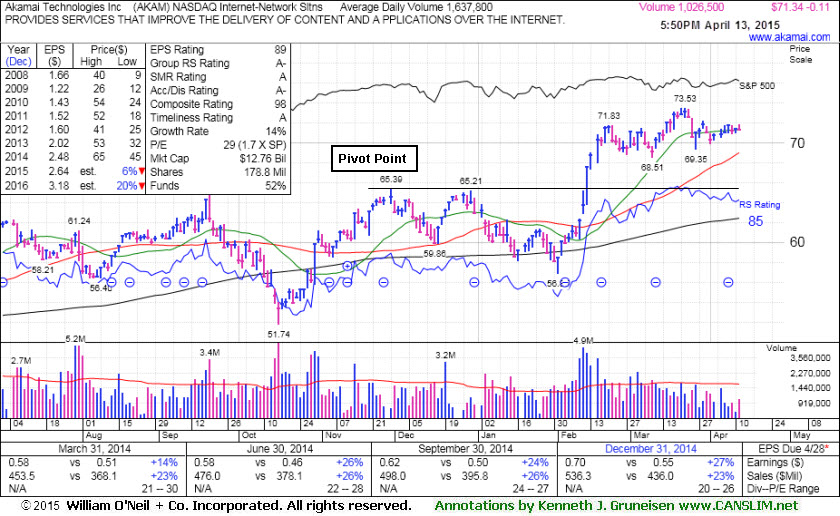

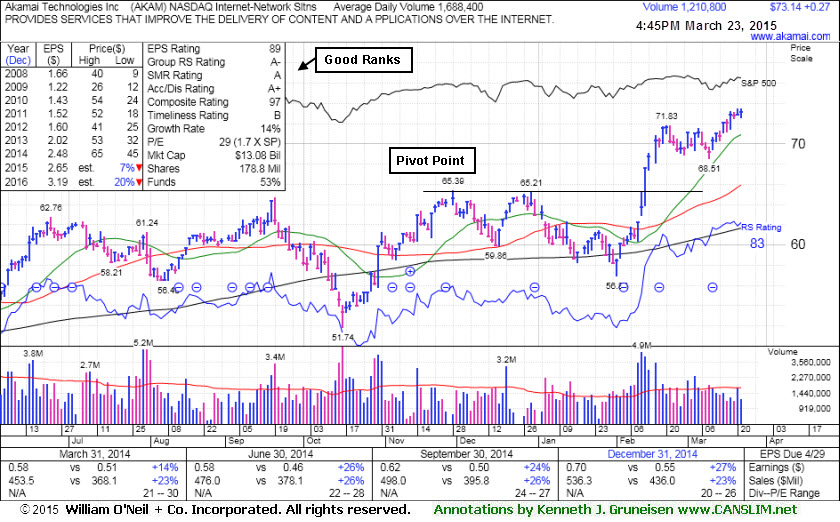

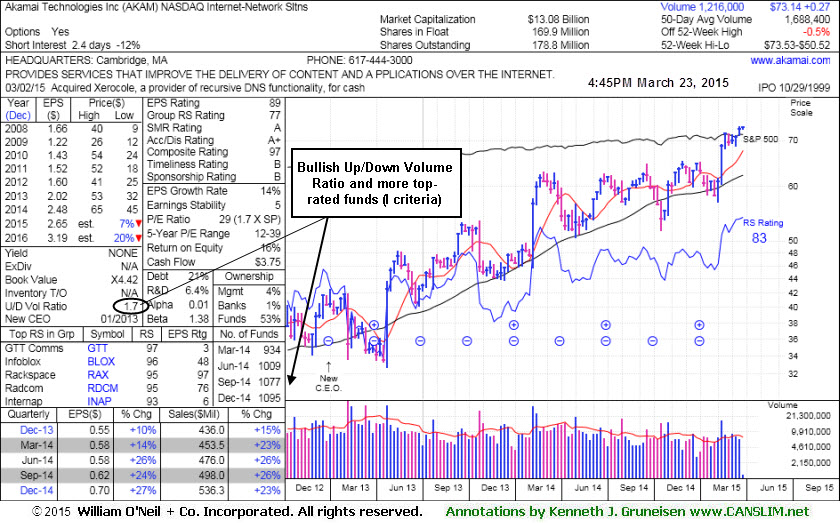

Wedging Gains Have Followed Brief Consolidation - Monday, March 23, 2015

Akamai Technologies Inc (AKAM +$0.27 or +0.37% to $73.14) recently wedged into new 52-week high territory with gains lacking great volume conviction. The high-ranked Internet - Network Solutions firm was last shown in this FSU section on 3/04/15 with annotated graphs under the headline, "Holding Ground Extended From Prior Base". Following its breakout and spurt of volume-driven gains it held its ground well above prior highs in the $65 area and its 50-day moving average (DMA) line defining important support to watch on pullbacks.AKAM was first highlighted in yellow with pivot point based on its 11/28/14 high plus 10 cents in the 2/13/15 mid-day report (read here). Disciplined investors avoid chasing stocks more than +5% above prior highs. It reported earnings +27% on +23% sales revenues for the Dec '14 quarter, and the 2 prior quarterly comparisons were very near the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been steady, and it has an 89 Earnings Per Share Rating. The number of top-rated funds owning its shares rose from 941 in Mar '14 to 1,095 in Dec '14, and its Up/Down Volume Ratio of 1.7 is an unbiased indication its shares have been under accumulation over the past 50 days (I criteria).

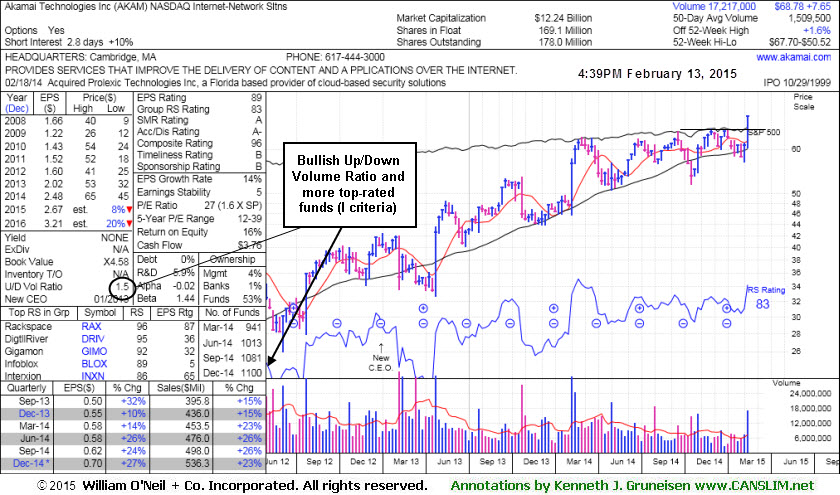

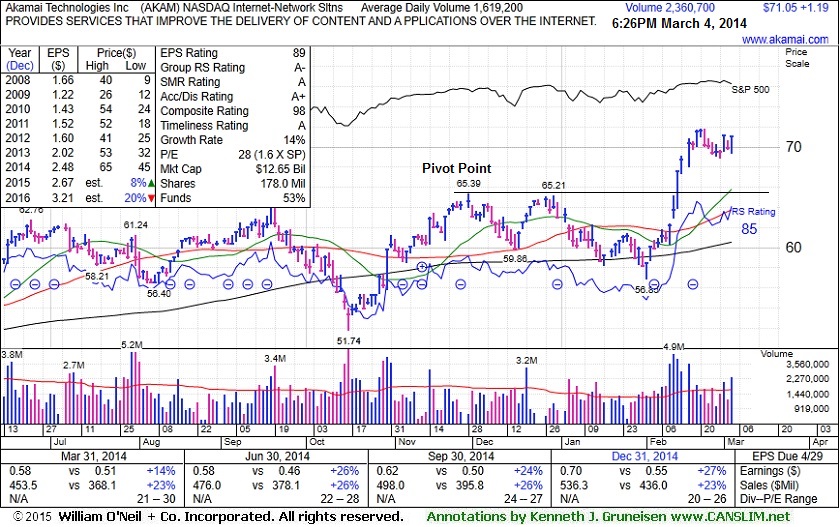

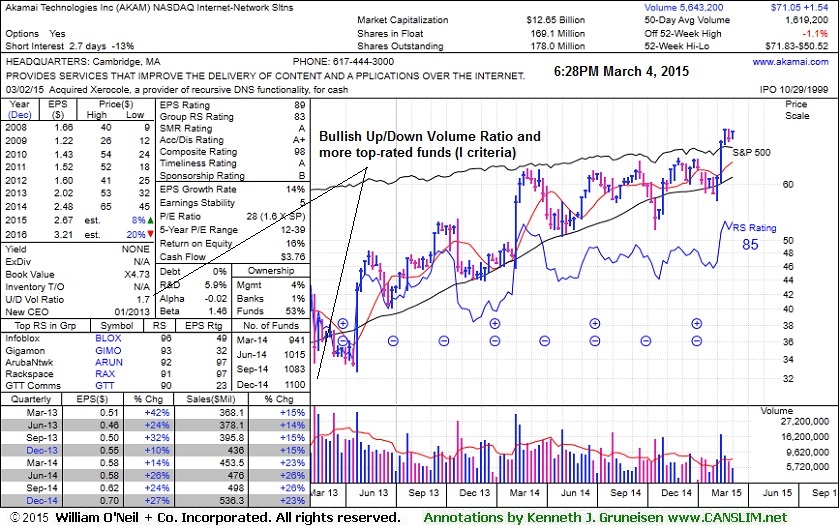

Holding Ground Extended From Prior Base - Wednesday, March 04, 2015

Akamai Technologies Inc (AKAM +$1.19 or +1.70% to $71.05) is holding its ground extended from its prior base. Prior highs in the $65 area define initial support to watch on pullbacks. It was last shown in this FSU section on 2/13/15 with annotated graphs under the headline, "Hitting New Highs With Four Consecutive Volume-Driven Gains", after highlighted in yellow with pivot point based on its 11/28/14 high plus 10 cents in the earlier mid-day report (read here). Disciplined investors avoid chasing stocks more than +5% above prior highs.

AKAM reported earnings +27% on +23% sales revenues for the Dec '14 quarter, and the 2 prior quarterly comparisons were very near the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been steady, and it has an 89 Earnings Per Share Rating. The number of top-rated funds owning its shares rose from 941 in Mar '14 to 1,100 in Dec '14, and its Up/Down Volume Ratio of 1.7 is an unbiased indication its shares have been under accumulation over the past 50 days (I criteria).

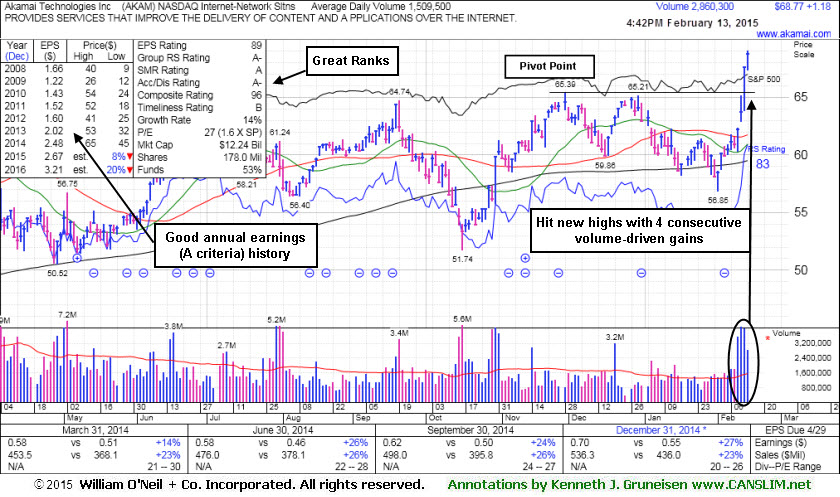

Hitting New Highs With Four Consecutive Volume-Driven Gains - Friday, February 13, 2015

Akamai Technologies Inc (AKAM +$1.14 or +1.68% to $68.73) was highlighted in yellow with pivot point based on its 11/28/14 high plus 10 cents in the earlier mid-day report (read here). It spiked to a new 52-week high (N criteria) with +89% above average volume behind today's 4th consecutive gain and finished near its "max buy" level. Technically, it broke out on the prior session and it is quickly getting extended from the prior base. Disciplined investors avoid chasing stocks more than +5% above prior highs.

AKAM reported earnings +27% on +23% sales revenues for the Dec '14 quarter, and the 2 prior quarterly comparisons were very near the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has been steady, and it has an 89 Earnings Per Share Rating. The number of top-rated funds owning its shares rose from 941 in Mar '14 to 1,100 in Dec '14, and its Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days (I criteria).