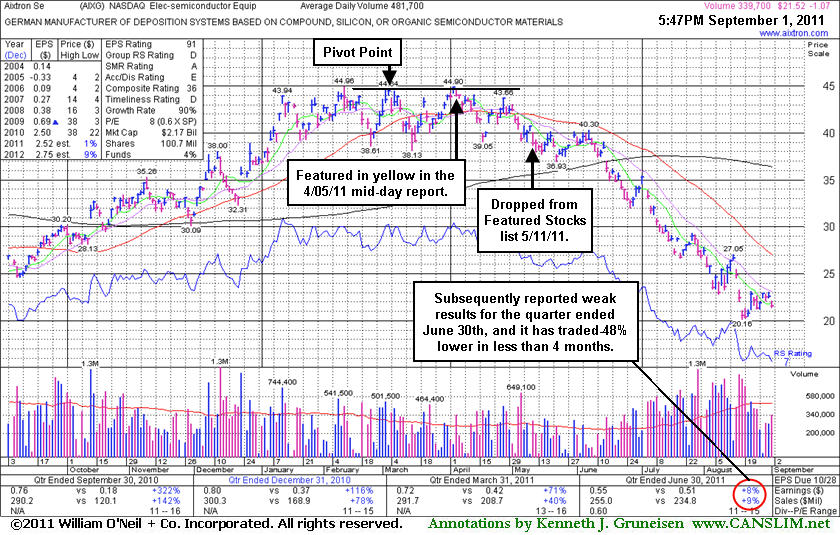

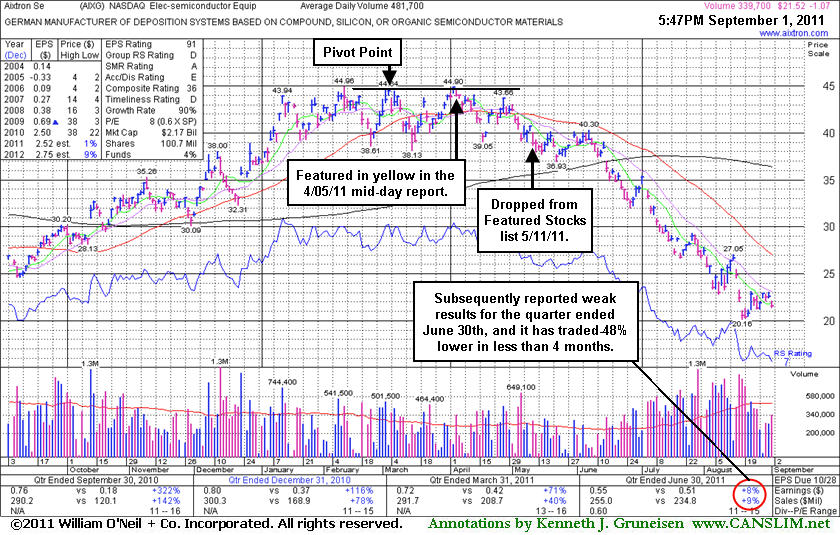

Aixtron Se (AIXG $21.52) failed to produce the necessary volume-driven gains above its pivot point to trigger a proper technical buy signal after it was featured back on 4/05/11. It had some explosive characteristics, but as we have often reminded folks, disciplined investors watch for proof of institutional buying demand and avoid the urge to get in "early". In this case, the stock soon slumped under its 50-day moving average line and prior lows triggering technical sell signals, and concerns were noted before and as it was dropped from the Featured Stocks list on 5/11/11. Its last appearance in this FSU section was on 5/06/11 with an annotated graph under the headline, "Relative Strength Waning; Breakout Never Materialized". Cautionary remarks in that report warned - "Quarterly sales and earnings results in recent comparisons have been strong enough to satisfy the C criteria but showing sequential deceleration. Consensus earnings estimates calling for FY '11 earnings to grow by only +4% are also cause for some concern."

This serves as a reminder to all members to wait for proper buy signals before taking action. Also, recognize sell signals and be sure to limit losses whenever any stock falls 7-8% from your purchase price! After AIXG was dropped from the Featured Stocks list it later reported earnings +8% on +9% sales revenues for the quarter ended June 30, 2011 versus the year ago period. Those results were well below the +25% guidelines of the fact-based investment system. As we have often seen, the technical action revealed a problem well before weaker fundamentals became a problem.

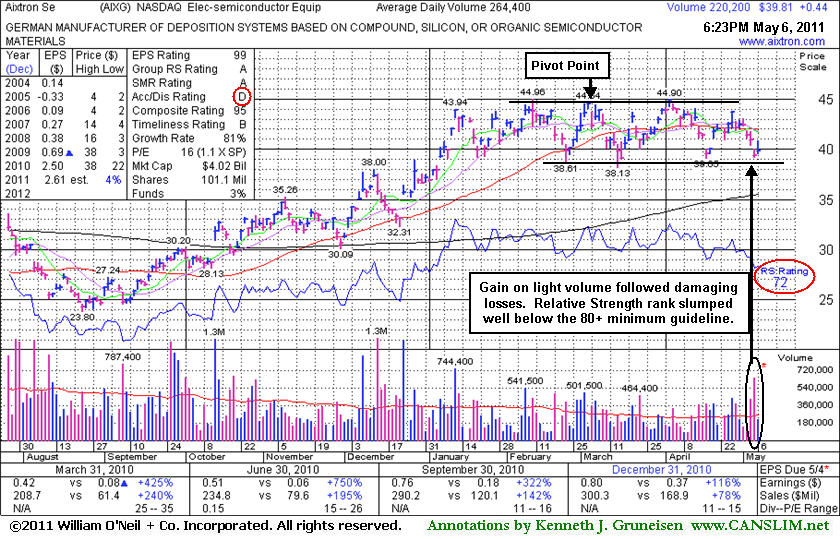

Its Accumulation/Distribution rating has slumped to a D and its Relative Strength rank has slumped to 72, below the 80+ guideline for buy candidates. It is perched -11.5% off its 52-week high and trading near prior lows in the $38 area defining important support well above its 200 DMA line. Prior mid-day reports noted - "This German firm is a high-ranked Electronics - Semiconductor Equipment company that has shown impressive earnings growth in recent years. Quarterly sales and earnings results in recent comparisons have been strong enough to satisfy the C criteria but showing sequential deceleration. Consensus earnings estimates calling for FY '11 earnings to grow by only +4% are also cause for some concern."

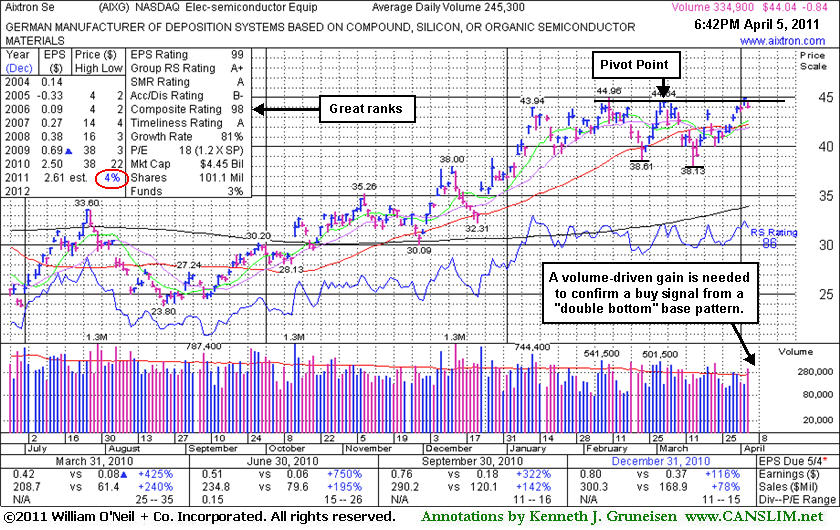

Aixtron Se (AIXG -$0.86 or -1.92% to $44.02) fell today with higher volume. Its color code was changed to yellow as it was featured in the mid-day report today with a pivot point cited based on its 3/03/11 high after an 8-week double bottom base pattern. Volume driven gains above its pivot point may trigger a technical buy signal, but disciplined investors will watch for proof of institutional buying demand and avoid the urge to get in "early". It is perched near its 52-week high after building a base above prior resistance in the $38 area.

Its 1.4 Up/Down Volume Ratio is an unbiased indication of recent accumulation, and it has earned high ranks. Prior mid-day reports noted - "This German firm is a high-ranked Electronics - Semiconductor Equipment company that has shown impressive earnings growth in recent years. Quarterly sales and earnings results in recent comparisons have been strong enough to satisfy the C criteria but showing sequential deceleration. Consensus earnings estimates calling for FY '11 earnings to grow by only +4% are also cause for some concern." (see red circle).