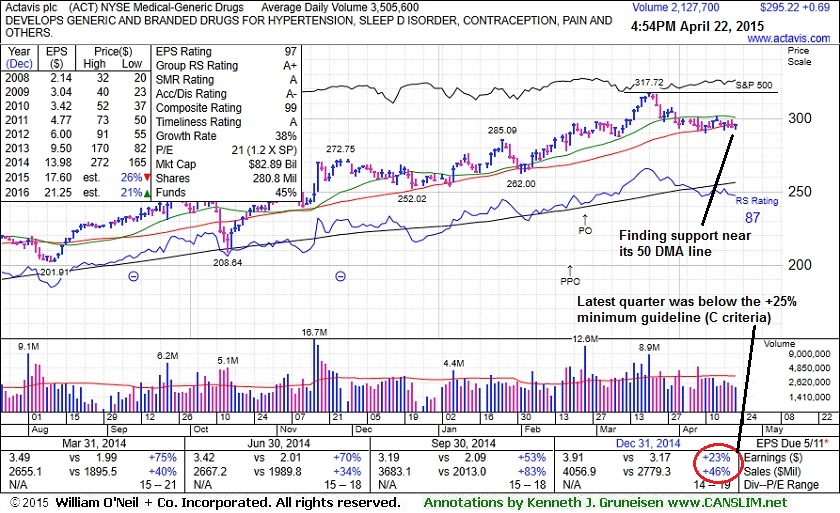

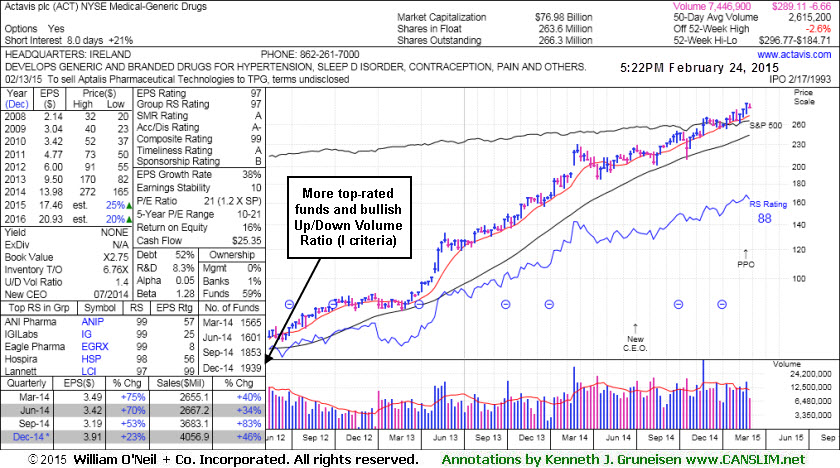

Actavis plc (ACT +$0.69 or +0.40% to $295.22) has been finding support at its 50-day moving average (DMA) line. Subsequent losses leading to a damaging violation of the 50 DMA line and recent lows would raise more serious concerns and trigger technical sell signals.

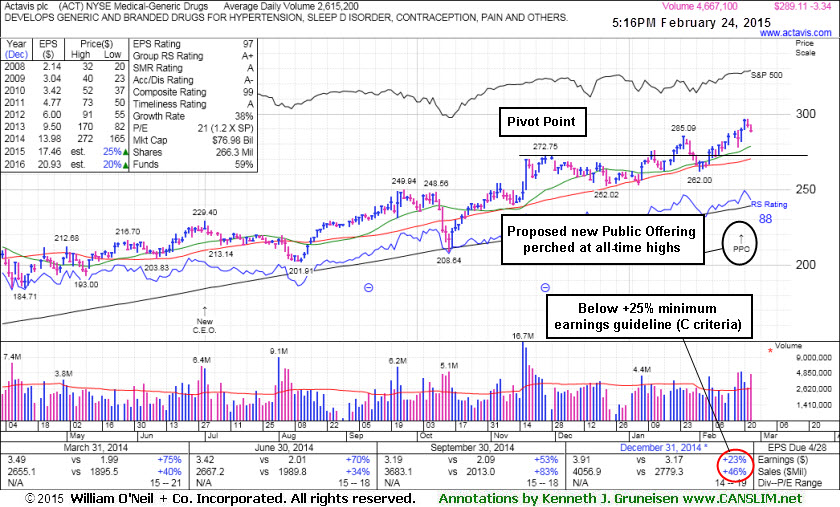

It completed a new Public Offering on 2/25/15. Concerns were raised after it reported Dec '14 earnings +23%, below the +25% minimum guideline (C criteria) of the fact-based investment system. ACT was last shown in this FSU section on 4/01/15 with annotated graphs under the headline, "Pullback With Higher Volume Toward 50-Day Moving Average". The Medical - Generic Drugs industry group currently has a 99 Group Relative Strength Rating. Leadership from other issues in the group is a reassuring sign concerning the L criteria.

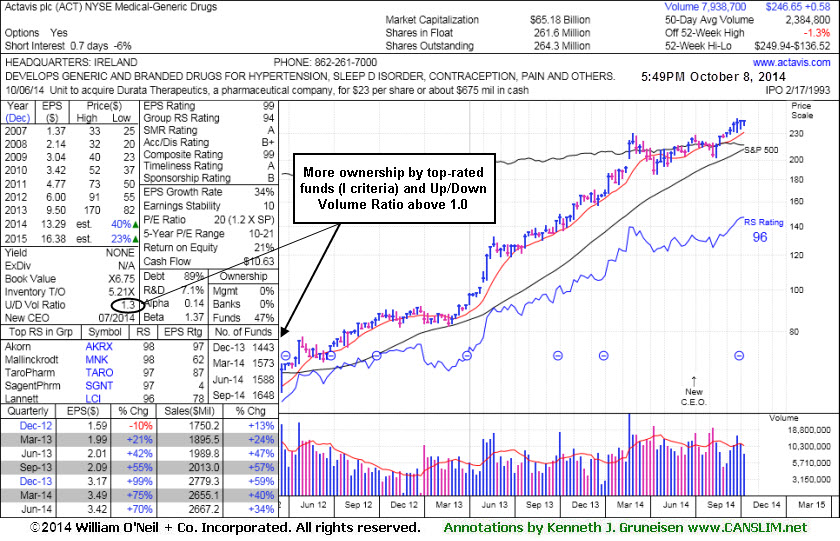

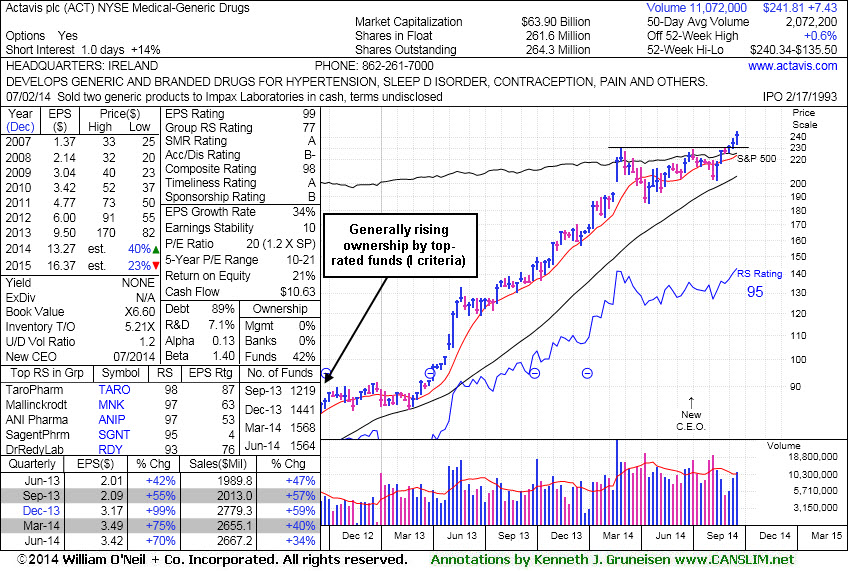

ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here). Its annual earnings (A criteria) history has been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 2,062 in Mar '15, and its Up/Down Volume ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days, reassuring signs concerning the I criteria.

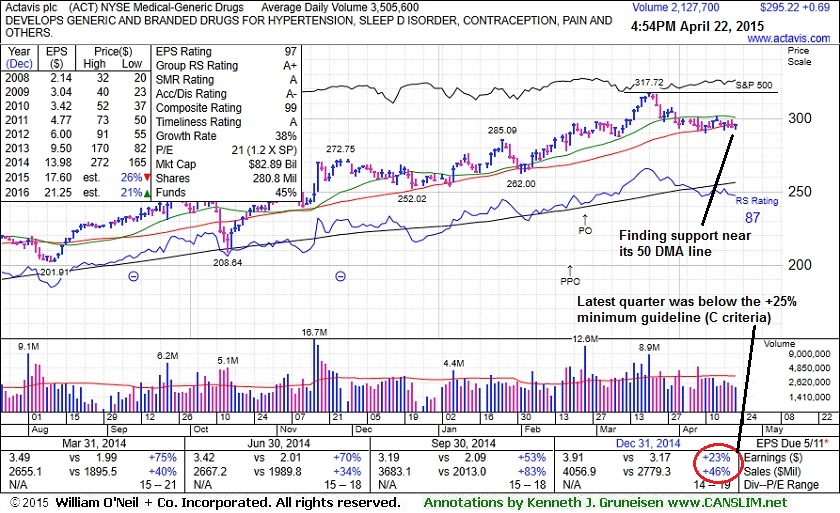

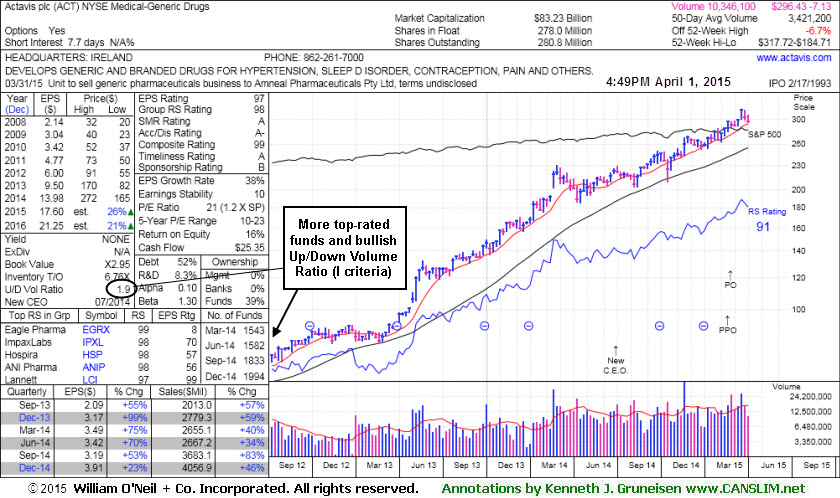

Actavis plc (ACT -$1.19 or -0.40% to $296.43) is consolidating quietly, very extended from any sound base. It completed a new Public Offering on 2/25/15. It recently reported Dec '14 earnings +23%, below the +25% minimum guideline (C criteria) of the fact-based investment system. Like any stock, on pullbacks it is important to watch how it acts near its 50-day moving average (DMA) line. Its 50 DMA line ($290) defines support where violations would raise more serious concerns and trigger a technical sell signal.

ACT was last shown in this FSU section on 3/13/15 with annotated graphs under the headline, "Extended From Base After Completing New Public Offering". The Medical - Generic Drugs industry group currently has a 98 Group Relative Strength Rating. Leadership from other issues in the group is a reassuring sign concerning the L criteria. ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here). Its annual earnings (A criteria) history has been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,994 in Dec '14, and its Up/Down Volume ratio of 1.9 is an unbiased indication its shares have been under accumulation over the past 50 days, reassuring signs concerning the I criteria.

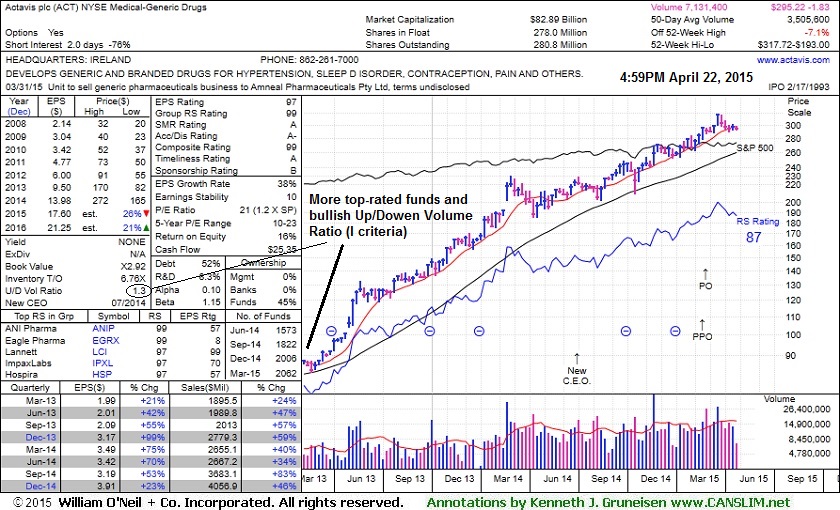

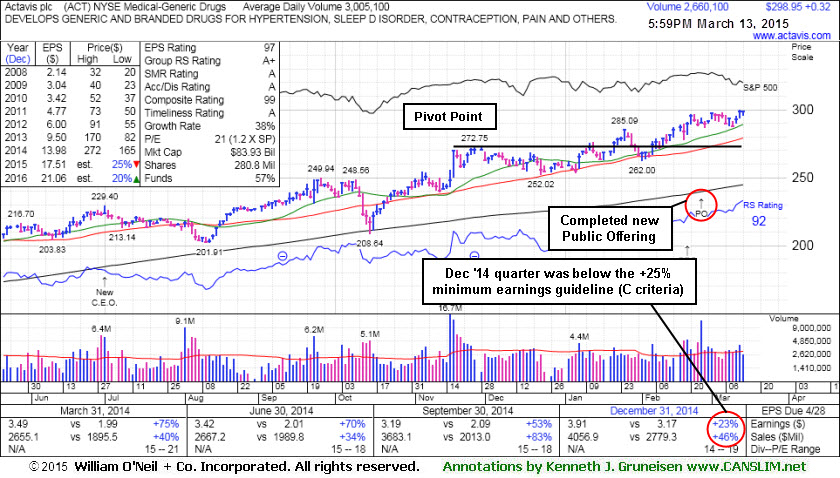

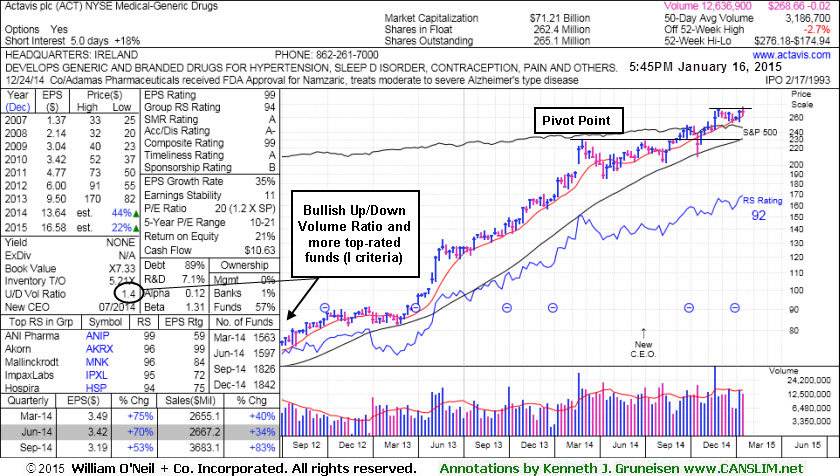

Actavis plc (ACT +$0.32 or +0.11% to $298.95) is perched at its all-time high, extended from its prior base. It completed a new Public Offering on 2/25/15. Recently it reported Dec '14 earnings +23%, below the +25% minimum guideline (C criteria) of the fact-based investment system, raising some fundamental concerns.

Like any stock, on pullbacks it is important to watch how it acts near its 50-day moving average (DMA) line ($279.18). It found prompt support near its 50 DMA line earlier. More damaging losses leading to a violation could trigger a technical sell signal. It was last shown in this FSU section on 2/24/15 with annotated graphs under the headline, "Perched At High it Proposed a New Public Offering".

The Medical - Generic Drugs industry group currently has a 99 Group Relative Strength Rating. Leadership from other issues in the group is a reassuring sign concerning the L criteria. The group had an 81 rating when it was shown in this FSU section on 12/29/14 with annotated graphs under the headline, "Formed New Base Above Prior Highs and 50-Day Moving Average". ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,984 in Dec '14, and its Up/Down Volume ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days, reassuring signs concerning the I criteria.

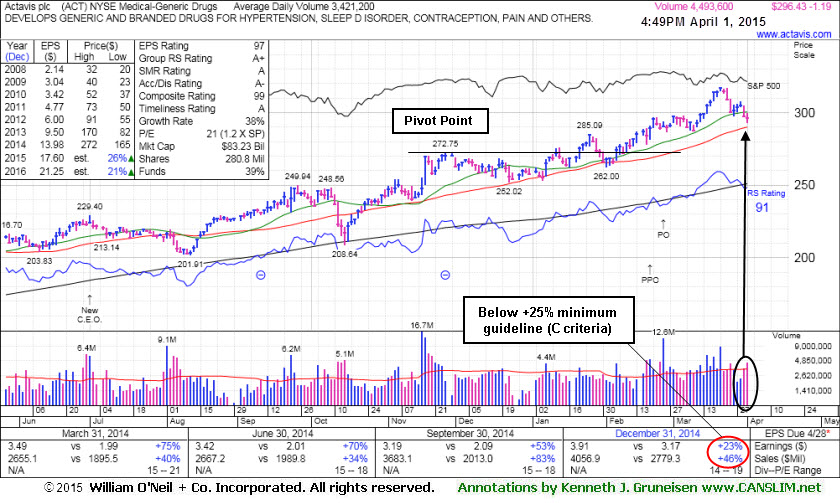

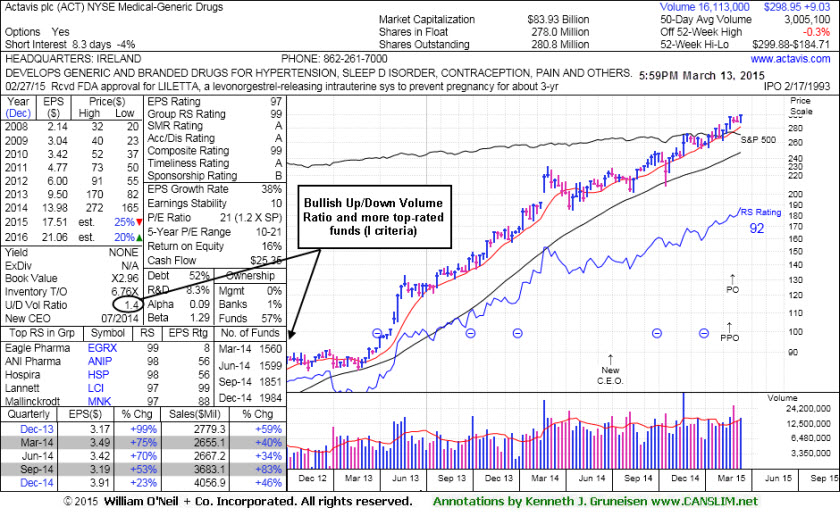

Actavis plc (ACT -$3.34 or -1.14% to $289.11) is perched at its 52-week high. Its color code was changed to green after rising above its "max buy" level. It recently proposed a new public offering while perched at its all-time high. It reported better than expected Dec '14 earnings and gave encouraging guidance, however the +23% earnings increase was below the +25% minimum guideline (C criteria) of the fact-based investment system. The recent low ($262.00 on 2/02/15) defines important near-term support below its 50-day moving average (DMA) line where violations would raise more serious concerns. Like any stock, it is important to watch how it acts near its 50-day moving average line. It found prompt support near its 50 DMA line earlier. More damaging losses could trigger a technical sell signal.

The Medical - Generic Drugs industry group currently has a 97 Group Relative Strength Rating. Leadership from other issues in the group is a reassuring sign concerning the L criteria. The group had an 81 rating when it was shown in this FSU section on 12/29/14 with annotated graphs under the headline, "Formed New Base Above Prior Highs and 50-Day Moving Average". ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,939 in Dec '14, and its Up/Down Volume ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days, reassuring signs concerning the I criteria.

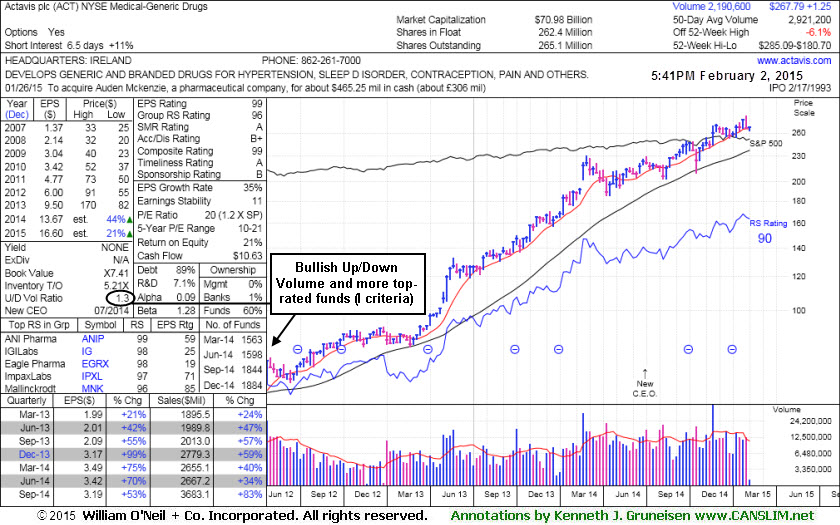

Actavis plc (ACT +$1.25 or +0.47% to $267.79) halted its slide with a gain today on light volume following 4 consecutive losses. Like any stock, it is important to watch how it acts near its 50-day moving average line. It found prompt support near its 50 DMA line earlier. More damaging losses could trigger a technical sell signal.

Recent gains helped it hit a new 52-week high, but light volume of late reflects a lack of true conviction in either direction. Keep in mind that gains above a stock's pivot point must have at least +40% above average volume to trigger a proper technical buy signal. Volume also did not meet that threshold after ACT was last shown in this FSU section on 1/16/15 with annotated graphs under the headline, "Perched Near High Again With No Resistance".

The Medical - Generic Drugs industry group currently has a 96 Group Relative Strength Rating. Leadership from other issues in the group is a reassuring sign concerning the L criteria. The group had an 81 rating when it was shown in this FSU section on 12/29/14 with annotated graphs under the headline, "Formed New Base Above Prior Highs and 50-Day Moving Average". ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. It reported earnings +53% on +83% sales revenues for the Sep '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong.

The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,884 in Dec '14, and its Up/Down Volume ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days, reassuring signs concerning the I criteria.

It rallied to new 52-week highs with volume-driven gains following mid-December news it would acquire Allergan (AGN) for $66 Billion. ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. It reported earnings +53% on +83% sales revenues for the Sep '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,842 in Dec '14, and its Up/Down Volume ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days, reassuring signs concerning the I criteria.

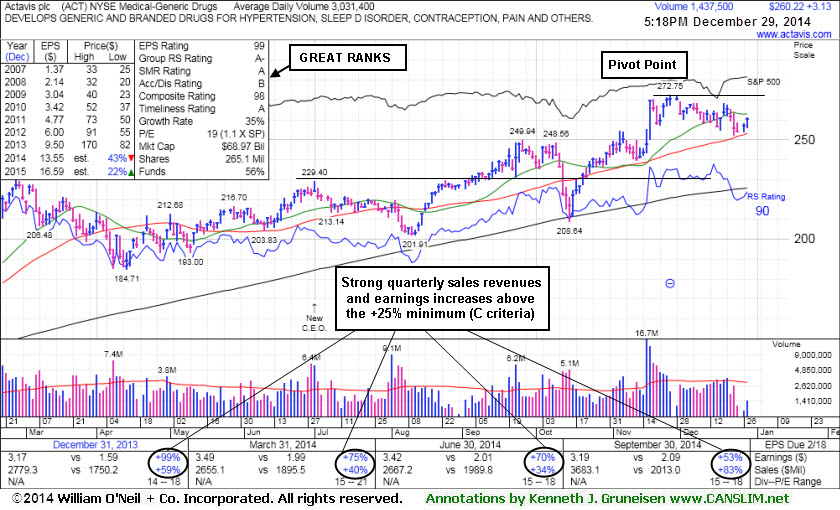

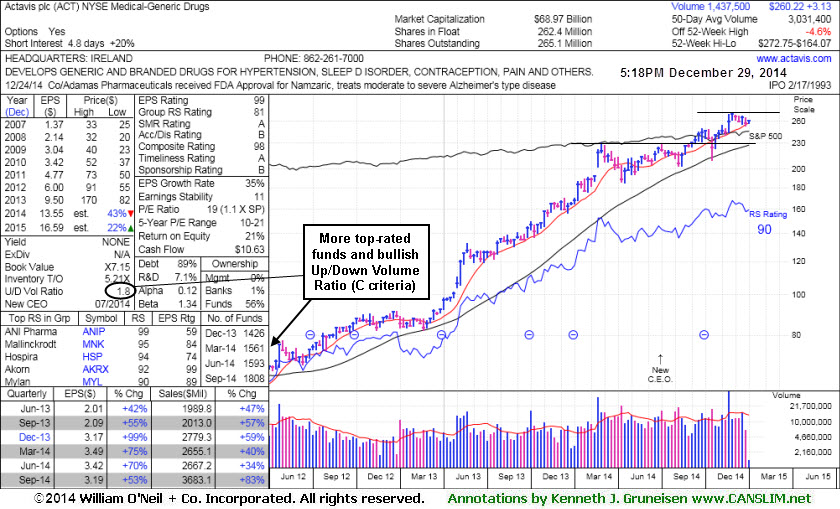

Actavis plc (ACT +$3.13 or +1.22% to $260.22) found support above prior highs in the $249 area and above its 50-day moving average (DMA) line defining near-term support. A new pivot point was cited based on its high plus 10 cents. Subsequent volume -driven gains for new highs may trigger a new (or add-on) technical buy signal. It was last shown in this FSU section on 12/12/14 with annotated graphs under the headline, "Consolidating After Rally on Acquisition Plans", after spiking to new 52-week highs with volume-driven gains following news it plans to acquire Allergan (AGN) for $66 Billion.

ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. The Medical - Generic Drugs industry group currently has an 81 Group Relative Strength Rating. Leadership from other issues in the group is also a reassuring sign concerning the L criteria. It reported earnings +53% on +83% sales revenues for the Sep '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,808 in Sep '14, and its Up/Down Volume ratio of 1.8 is an unbiased indication its shares have been under accumulation over the past 50 days, reassuring signs concerning the I criteria.

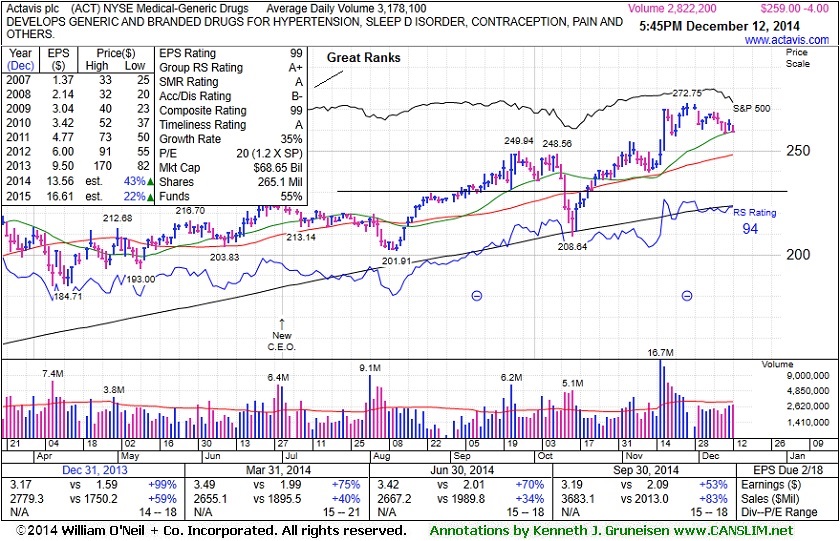

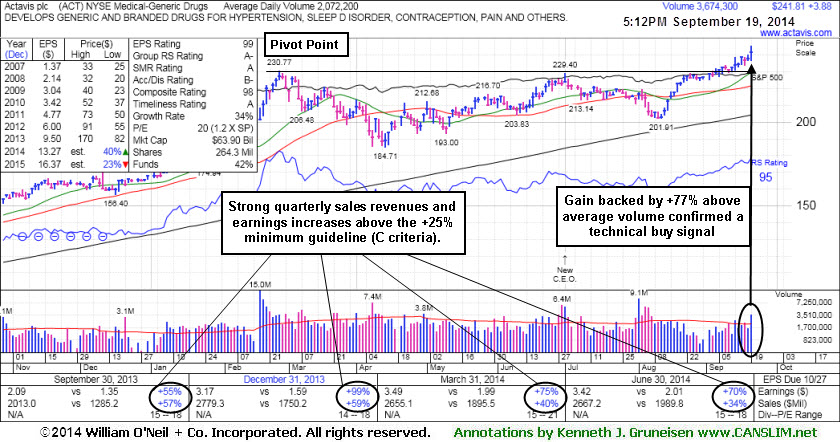

ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. The Medical - Generic Drugs industry group currently has a 98 Group Relative Strength Rating. Leadership from other issues in the group is also a reassuring sign concerning the L criteria. It reported earnings +53% on +83% sales revenues for the Sep '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,783 in Sep '14, a reassuring sign concerning the I criteria.

Actavis plc (ACT +7.13 or +2.74% to $266.88) is consolidating after spiking to new 52-week highs with volume-driven gains following news it plans to acquire Allergan (AGN) for $66 Billion. Its 50-day moving average (DMA) line and prior highs define support where violations would raise concerns. It is extended from prior highs and it was last shown in this FSU section on 11/06/14 with annotated graphs under the headline, "New Highs Following Deep "V" Shaped Pullback - Not a Sound Base". It did not form a sound base pattern, but there was a deep "V" shaped pullback and recovery. It found prompt support at its 200 DMA line after the damaging streak of 5 consecutive losses marked by volume triggered technical sell signals.

ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. The Medical - Generic Drugs industry group currently has a 97 Group Relative Strength Rating. Leadership from other issues in the group is also a reassuring sign concerning the L criteria. It reported earnings +53% on +83% sales revenues for the Sep '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,710 in Sep '14, a reassuring sign concerning the I criteria.

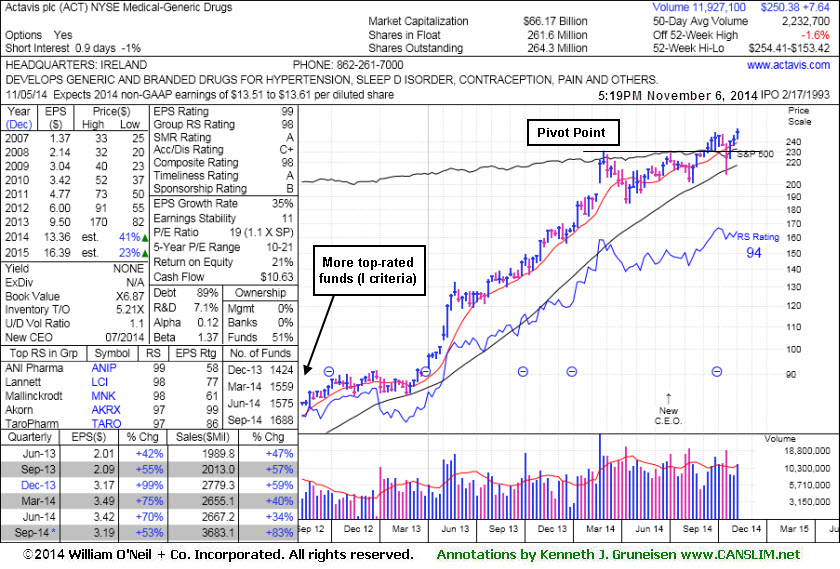

Actavis plc (ACT +$2.47 or +1.00% to $250.38) is perched at its 52-week high after today's 2nd consecutive volume-driven gain. It did not form a sound base pattern, but there was a deep "V" shaped pullback and recovery, and now it is extended from its prior base. Recent lows near $208 define initial support to watch below its 50-day moving average (DMA) line ($236.59) on pullbacks.

Its current Accumulation/Distribution Rating is C+, up from a D- when last shown in this FSU section on 10/21/14 with annotated graphs under the headline, "Quiet Gains Help Generic Drug Firm Rise Above 50-Day Average". It found prompt support at its 200 DMA line after a damaging streak of 5 consecutive losses marked by volume triggered technical sell signals.

ACT was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. The Medical - Generic Drugs industry group currently has a 98 Group Relative Strength Rating, up from a 66 when shown on 8/28/14. Leadership from other issues in the group is also a reassuring sign concerning the L criteria. It reported earnings +53% on +83% sales revenues for the Sep '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,688 in Sep '14, a reassuring sign concerning the I criteria.

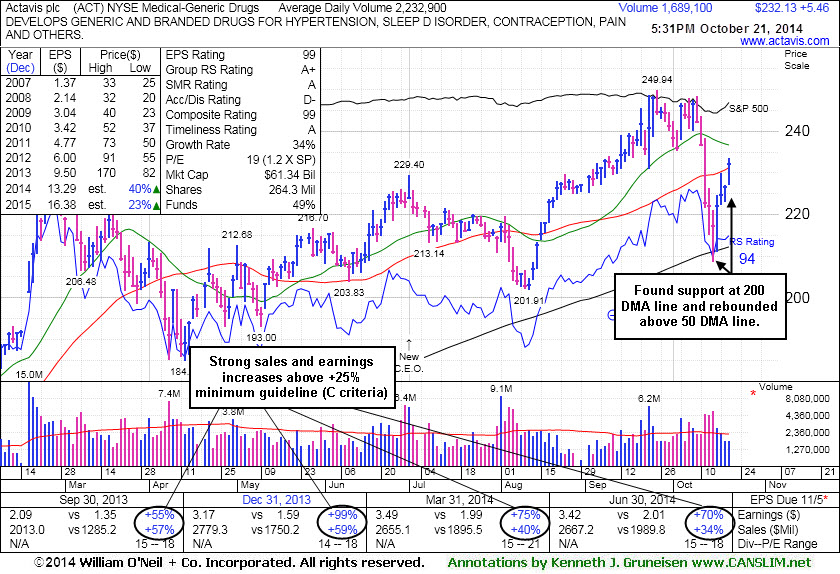

Actavis plc (ACT +$5.46 or +2.41% to $232.13) quietly rebounded above its 50-day moving average (DMA) line today helping its outlook improve. It found support at its 200 DMA line after a damaging streak of 5 consecutive losses marked by volume triggered technical sell signals. It was last shown in this FSU section on 10/08/14 with annotated graphs under the headline, "Held Ground Above Prior Highs Defining Near-Term Support".

Its current Accumulation/Distribution Rating is D- which is not a reassuring sign. Its streak of gains and rebound above its 50-day moving average (DMA) line lacked great volume conviction versus that of prior losses.

It was first highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. The Medical - Generic Drugs industry group currently has a 96 Group Relative Strength Rating, up from a 66 when shown on 8/28/14. Leadership from other issues in the group is also a reassuring sign concerning the L criteria. It reported earnings +70% on +34% sales revenues for the Jun '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,649 in Sep '14, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

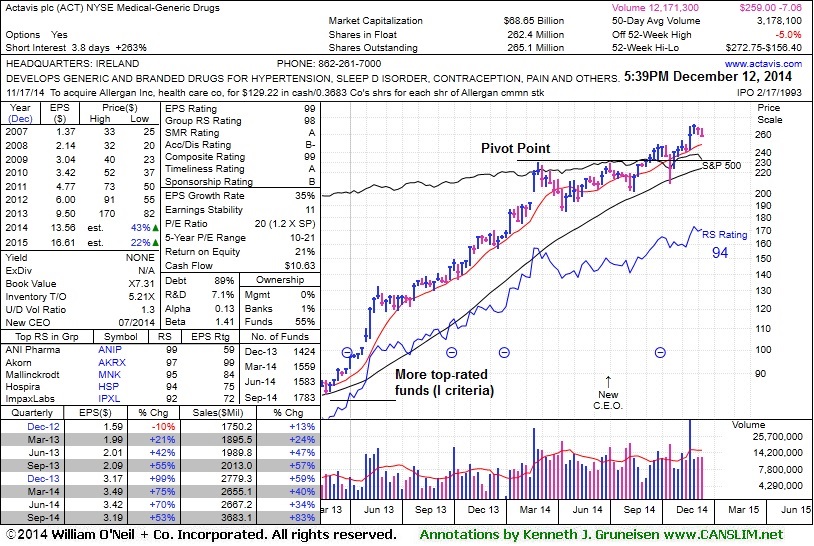

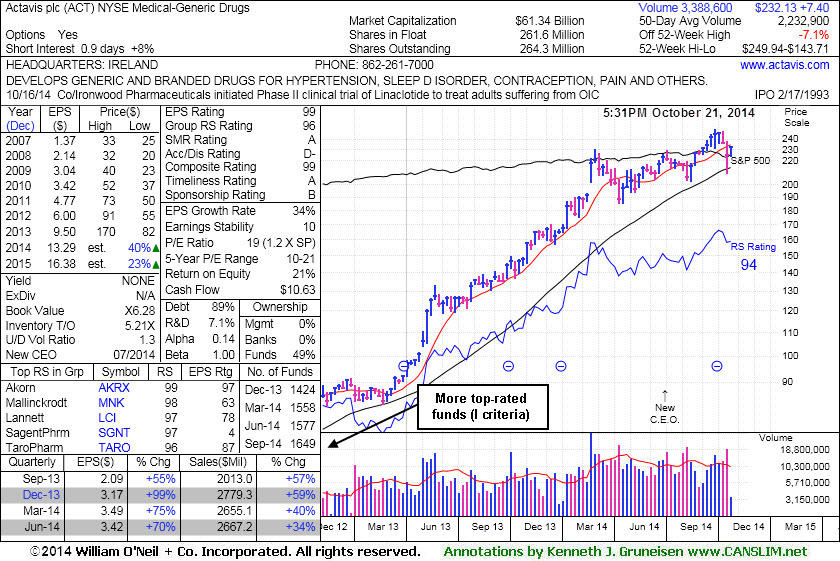

Actavis plc (ACT +$3.26 or +1.34% to $246.65) has been stubbornly holding its ground near its 52-week high. Prior highs near $230 define near-term support to watch on pullbacks. It stayed above prior highs since last shown in this FSU section on 9/21/14 with annotated graphs under the headline, "Finally Volume-backed Gains Confirmed a Technical Buy Signal", hitting new 52-week and all-time highs as it rose with +77% above average volume behind its gain. The bullish session helped to confirm a technical buy signal.

Its Accumulation/Distribution Rating has recently been improving and it has earned stellar ranks overall. Its streak of gains and rebound above its 50-day moving average (DMA) line helped its outlook improve after it had sputtered since highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents.

The Medical - Generic Drugs industry group currently has a 94 Group Relative Strength Rating, up from a 66 when shown on 8/28/14. Leadership from other issues in the group is also a reassuring sign concerning the L criteria. It reported earnings +70% on +34% sales revenues for the Jun '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has been on the rise, up from 1,219 in Sep '13 to 1,648 in Sep '14, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

Its Accumulation/Distribution Rating has improved from a D to a B- since last shown in this FSU section on 8/28/14 with annotated graphs under the headline, "Quietly Perched Within Striking Distance of 52-Week High". Its streak of gains and rebound above its 50-day moving average (DMA) line helped its outlook improve after it had sputtered since highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents.

The Medical - Generic Drugs industry group currently has a 77 Group Relative Strength Rating, up from a 66 when shown on 8/28/14. Leadership from other issues in the group is also a reassuring sign concerning the L criteria. It reported earnings +70% on +34% sales revenues for the Jun '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares has generally been on the rise, up from 1,219 in Sep '13 to 1,564 in Jun '14, a reassuring sign concerning the I criteria.

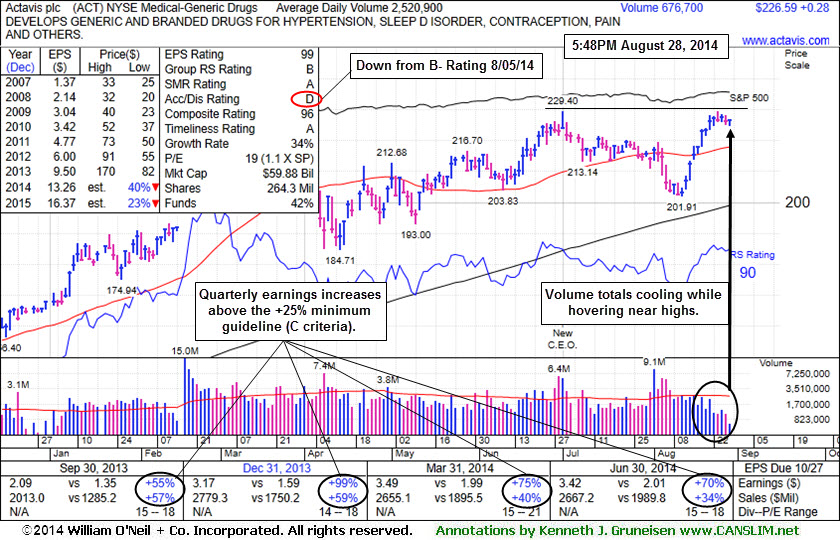

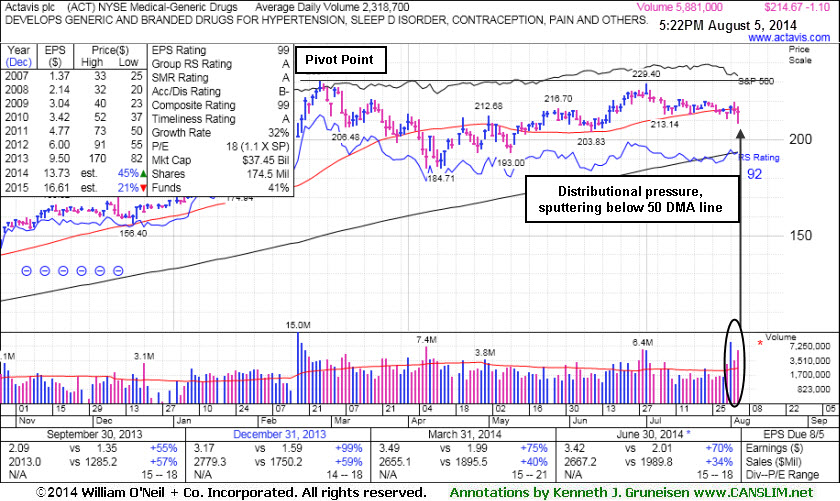

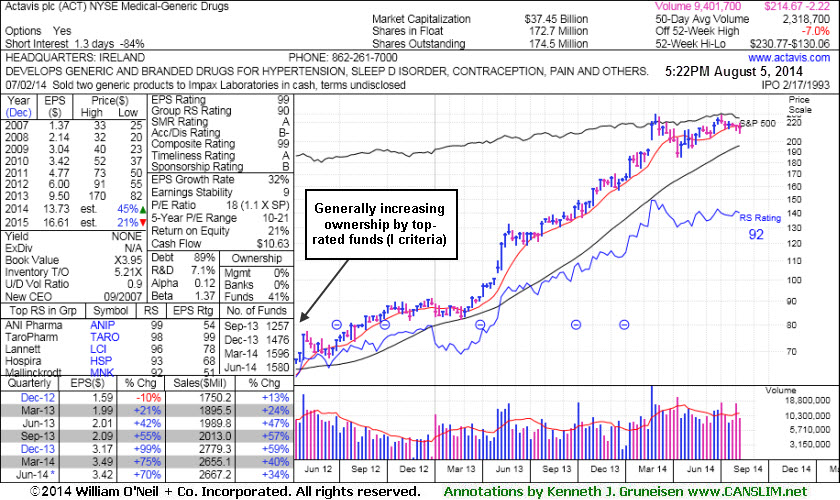

Atavis plc (ACT +$0.28 or +0.12% to $226.59) is perched within close striking distance of prior highs and its 52-week high, and volume totals have been quiet indicating that very few investors have been headed for the exit. However, its Accumulation/Distribution Rating has slumped to a D from a B- when last shown in this FSU section on 8/05/14 with annotated graphs under the headline, "Enduring Distributional Pressure While Sputtering Near 50-Day Average". Its streak of gains and rebound above its 50-day moving average (DMA) line helped its outlook improve.

ACT was highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents (not shown on the daily graph below - it is covered by the data block). Subsequent volume-driven gains should be backed by at least +40% above average volume as it hits new highs to trigger a proper technical buy signal.

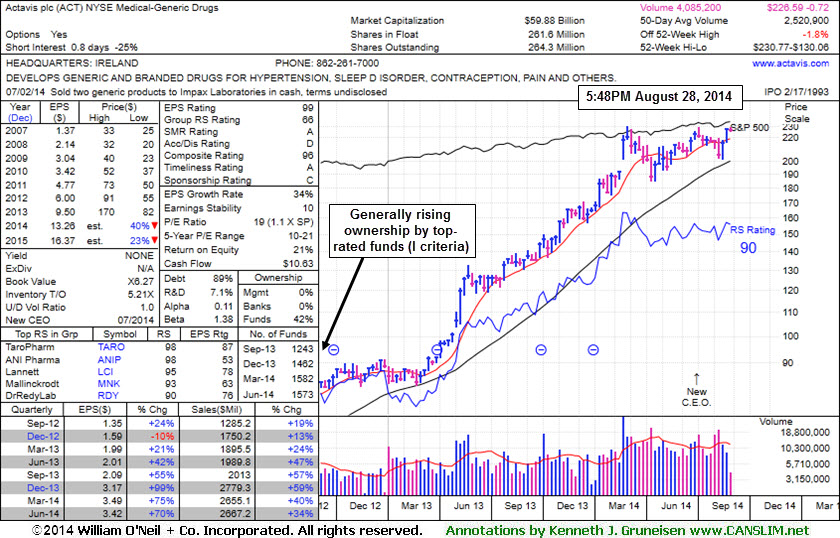

The Medical - Generic Drugs industry group currently has a 66 Group Relative Strength Rating, down from a 90 when shown on 8/05/14. However leadership from other issues is still a reassuring sign concerning the L criteria. It reported earnings +70% on +34% sales revenues for the Jun '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares rose from 1,236 in Jun '13 to 1,573 in Jun '14, a reassuring sign concerning the I criteria.

The Medical - Generic Drugs industry group currently has a 90 Group Relative Strength Rating and leadership from other issues is a reassuring sign concerning the L criteria. It reported earnings +70% on +34% sales revenues for the Jun '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares rose from 1,236 in Jun '13 to 1,580 in Jun '14, a reassuring sign concerning the I criteria.

Atavis plc (ACT -$1.04 or -0.47% to $217.93) is still consolidating above its 50-day moving average (DMA) line, still hovering within close striking distance of its 52-week high. It was last shown in this FSU section on 6/24/14 wit annotated graphs under the headline, "Volume Above Average as Generic Drug Firm Approaches Highs". It was highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents. Subsequent volume-driven gains should be backed by at least +40% above average volume as it hits new highs to trigger a proper technical buy signal.

The Medical - Generic Drugs industry group currently has a 93 Group Relative Strength Rating and leadership from other issues is a reassuring sign concerning the L criteria. It reported earnings +75% on +40% sales revenues for the Mar '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares rose from 1,236 in Jun '13 to 1,568 in Jun '14, a reassuring sign concerning the I criteria.

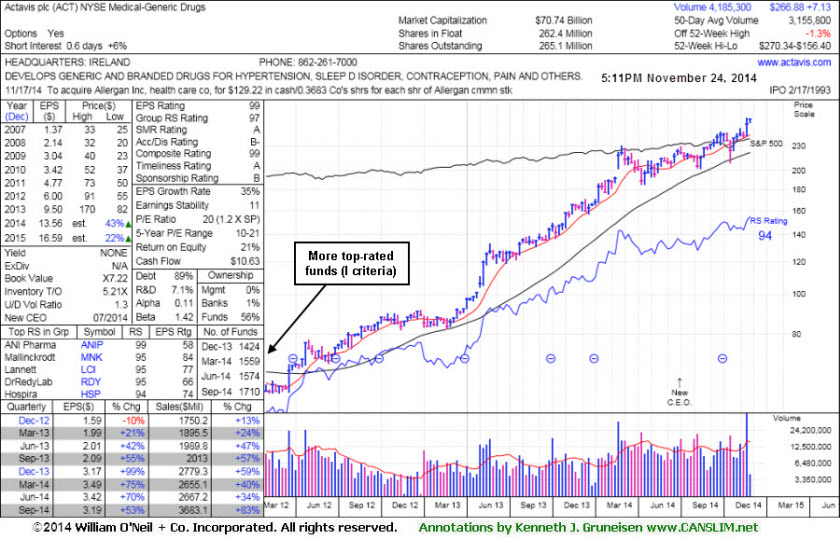

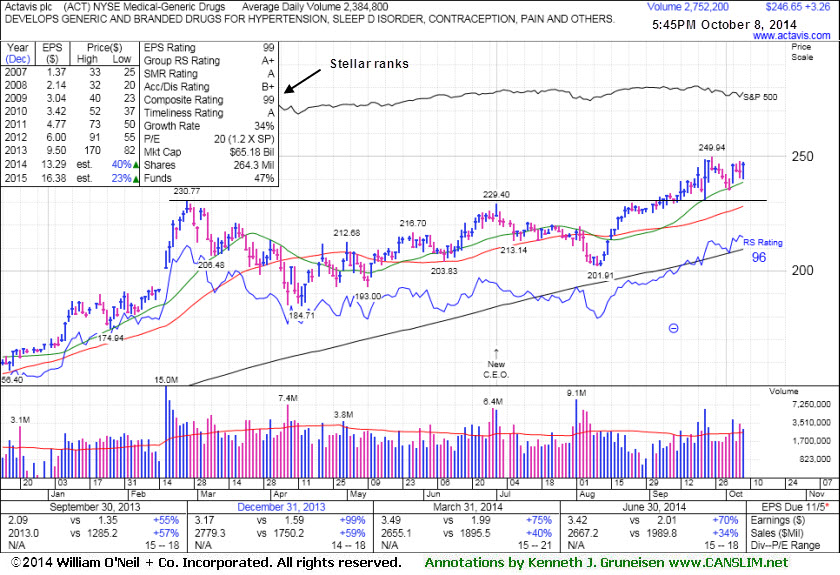

Atavis plc (ACT +$2.86 or +1.29% to $224.21) traded +47% above average volume as it rallied for a 3rd consecutive gain today, approaching its pivot point. It was highlighted in yellow in the 6/20/14 mid-day report (read here) with a pivot point based on its 2/26/14 high plus 10 cents Subsequent volume-driven gains should be backed by at least +40% above average volume as it hits new highs to trigger a proper technical buy signal.

The Medical - Generic Drugs industry group currently has a 94 Group Relative Strength Rating and leadership from other issues is a reassuring sign concerning the L criteria. It reported earnings +75% on +40% sales revenues for the Mar '14 quarter, and its strong record satisfies the C criteria. Its annual earnings (A criteria) history has also been strong. The number of top-rated funds owning its shares rose from 1,236 in Jun '13 to 1,583 in Mar '14, a very reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.