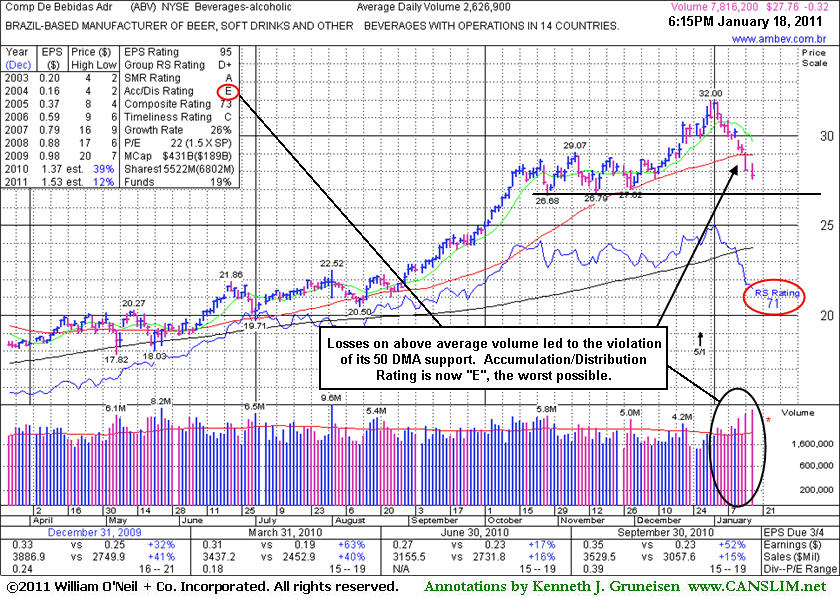

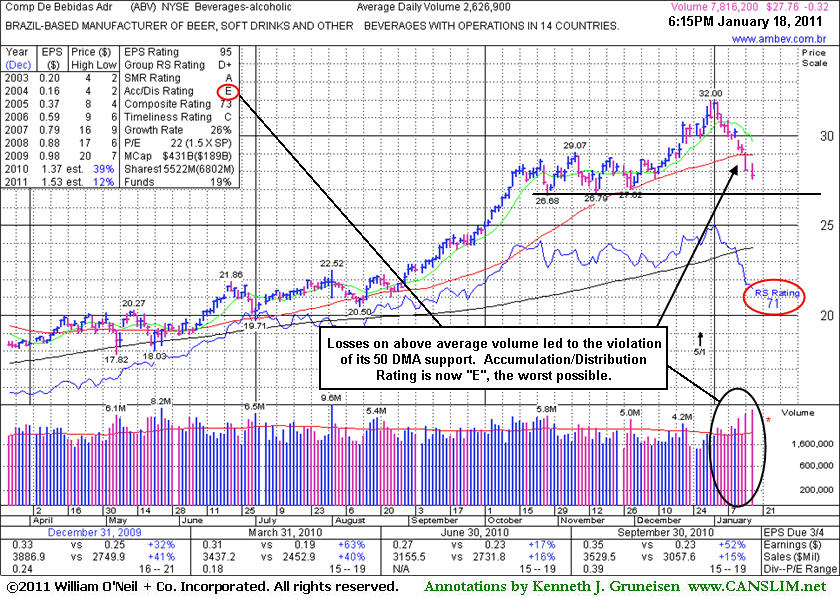

Comp De Bebidas Adr (ABV -$0.32 or -1.14% to $27.76) was down again today with above average volume, closing -13.2% off its 52-week high while slumping near October-December lows in the $27 area that may act as support. Subsequent deterioration below those earlier lows would be a more ominous technical sell signal. Its waning Relative Strength (see red circle, now 71) has recently been noted as a concern, as normally any buy candidates should have an 80+ rank to be seriously considered. Last week ABV violated prior highs in the $29 area and its 50-day moving average (DMA) line with a damaging loss on heavy volume triggering technical sell signals. The Brazil-based beverage firm traded up as much as +52.7% since it was first featured in the 6/29/10 mid-day report (read here). It has a great annual earnings (A criteria) history.

ABV was last analyzed in this FSU section on 12/0310 with an annotated graph under the headline "Gains Did Not Yet Trigger Recent New Or Add-On Buy Signal." It had subsequently posted a considerable gain on for a new 52-week high with above average volume on 12/21/10 and rallied as high as $32. However, any disciplined investors who may have bought would have already been prompted to sell if it fell -7% from their purchase price. It has endured a lot of technical damage following that proof of institutional buying demand. Its Accumulation/Distribution Rating is now a lowest possible "E" (see red circle). The number of top-rated funds owning its shares fell from 494 in Sep '10 to 479 in Dec '10, a discouraging sign concerning the I criteria of the fact-based system.

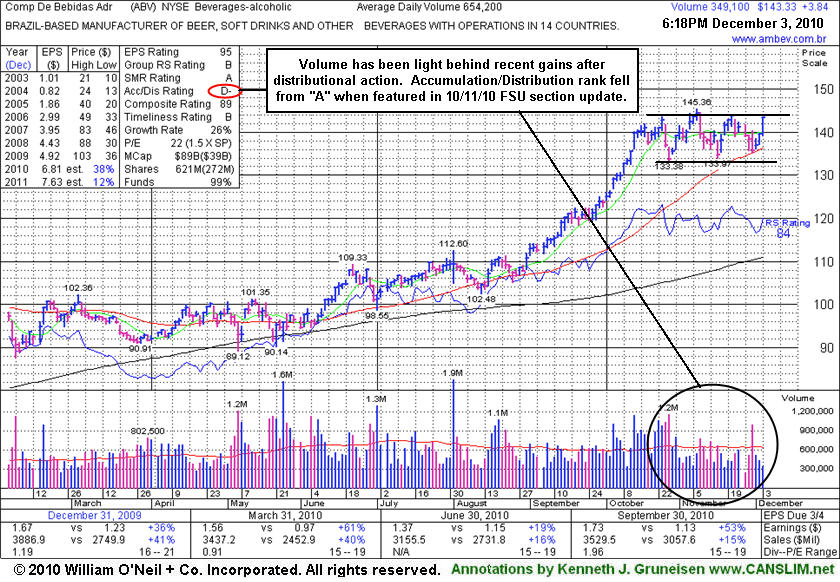

Comp De Bebidas Adr (ABV +$3.84 or +2.50% to $143.33) posted a considerable gain on light volume today, rallying near its 52-week high. A convincing gain with above average volume has not been seen since October, and recent distributional pressure remains a concern until proof of fresh institutional buying demand is shown. When it was last analyzed in this FSU section on 10/11/10 with an annotated graph under the headline "Brazilian Beverage Firm Too Extended Now For Disciplined Investors" it had hit a new all-time high with a 7th consecutive gain. Then its Accumulation/Distribution Rating was an A, however it has subsequently slumped to a D- Rating (see red circle) after the recently noted distributional action (losses on higher volume) raised concerns. Its 50-day moving average (DMA) line ($134 now) defines important support near recent chart lows. After a "3-weeks tight" pattern was recently noted it has only continued basing, and did not yet trigger a new (or add-on) technical buy signal. Confirming gains into new high ground with heavy volume would be a reassuring sign that it could be capable of another significant leg up.

The Brazil-based beverage firm has traded up as much as +38.8% since it was first featured in the 6/29/10 mid-day report (read here). It has a great annual earnings (A criteria) history. Fundamental concerns were raised after its results for the quarter ended June 30, 2010 showed only a +19% earnings increase on +16% sales revenues, below the +25% guideline, however it followed that with +53% earnings on +15% sales revenues in the quarter ended September 30, 2010. The number of top-rated funds owning its shares rose from 396 in Dec '09 to 475 in Sept '10, a welcome sign concerning the I criteria of the fact based system.

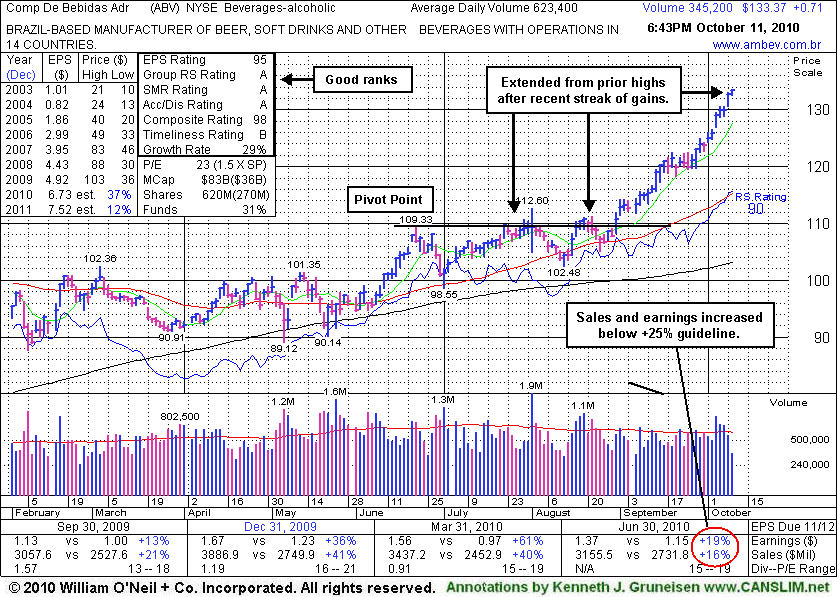

Comp De Bebidas Adr (ABV +$0.71 or +0.54% to $133.37) hit yet another new all-time high today with 7th consecutive gain. It is very extended from a sound base, and its 50-day moving average (DMA) line ($113.76 now) defines support. The Brazil-based beverage firm has traded up as much as +27.33% since it was first featured in the 6/29/10 mid-day report (read here). It found impressive support near its 200 DMA line in prior months.

It has a great annual earnings (A criteria) history. however, fundamental concerns were raised after its results for the quarter ended June 30, 2010 showed only a +19% earnings increase on +16% sales revenues, below the +25% guideline. Ideal buy candidates under the fact-based system historically showed stronger increases in the latest quarter reported. With concerns over ABV's fundamentals and its current technical shape, disciplined investors may look at other high-ranked leaders on the Featured Stocks page as more ideal buy candidates.

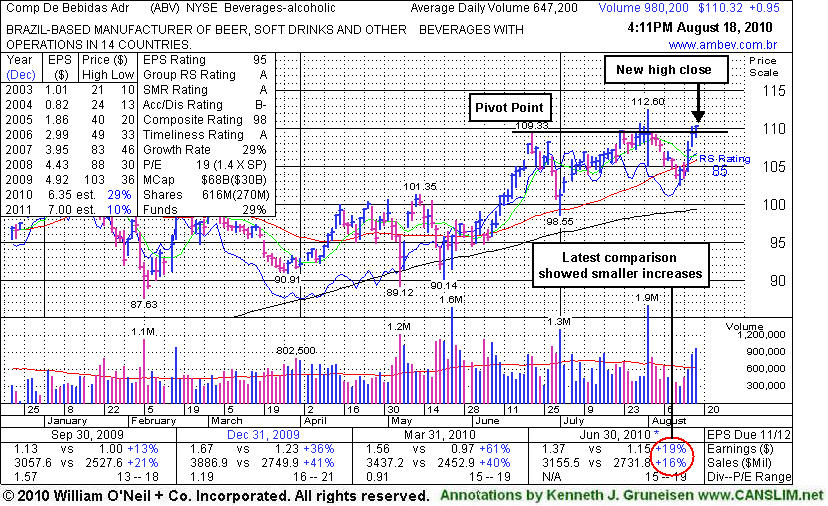

Comp De Bebidas Adr (ABV +$0.95 or +0.87% to $110.32) posted another gain with above average volume and finished at its highest ever close. It faces no resistance due to overhead supply after having impressively rebounded near its all-time high following a recent slump under its 50 DMA line. Its color code was changed to green despite its resilience, as fundamental concerns were raised after it results for the quarter ended June 30, 2010 showed +19% earnings on +16% sales revenues, below the +25% guideline. Ideal buy candidates under the fact-based system historically showed stronger increases in the latest quarter reported.

The Brazil-based beverage firm briefly hit an all-time high and churned a lot of volume on 8/02/10, however distributional pressure led it to close the session virtually unchanged and below its pivot point cited when featured in the 6/29/10 mid-day report (read here). It found impressive support near its 200 DMA line in recent months. It has a great annual earnings (A criteria) history.

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

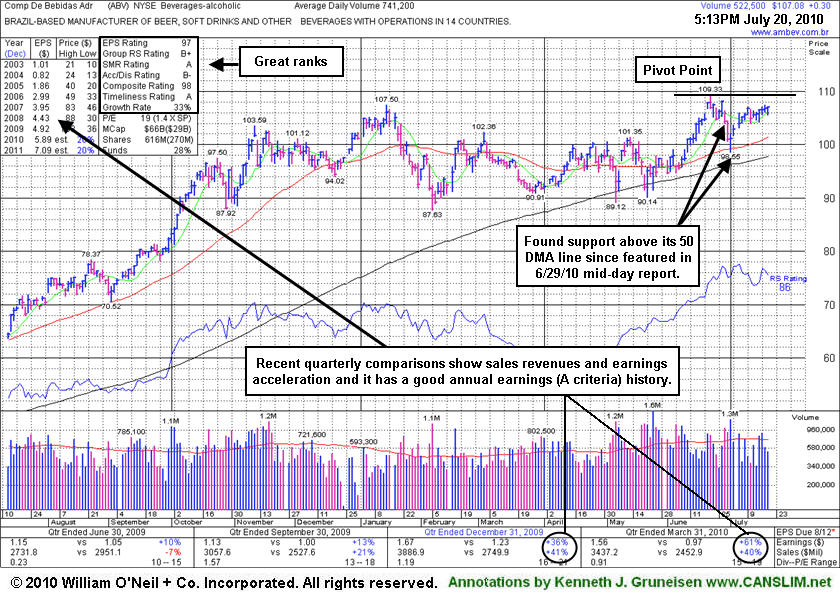

Comp De Bebidas Adr (ABV +$0.30 or +0.28% to $107.08) is a Brazil-based beverage firm trading in a tight range, quietly perched within close striking distance of its 52-week high. It found support near its 50 DMA line recently and has not yet traded above its pivot point cited when featured in the 6/29/10 mid-day report (read here). That evening an annotated graph showed its cup-with-handle type pattern being formed under the headline "High-Ranked Beverage Firm From Brazil Perched Near High" with notes while - "perched near all-time highs after building an orderly base pattern and finding impressive support near its 200 DMA line in recent months. It has a great annual earnings (A criteria) history and its recent quarterly earnings and sales revenues increases have shown acceleration. A gain above its pivot point with heavy volume still needed to confirm a proper new technical buy signal."

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which allows prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act if and when the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover). In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list.

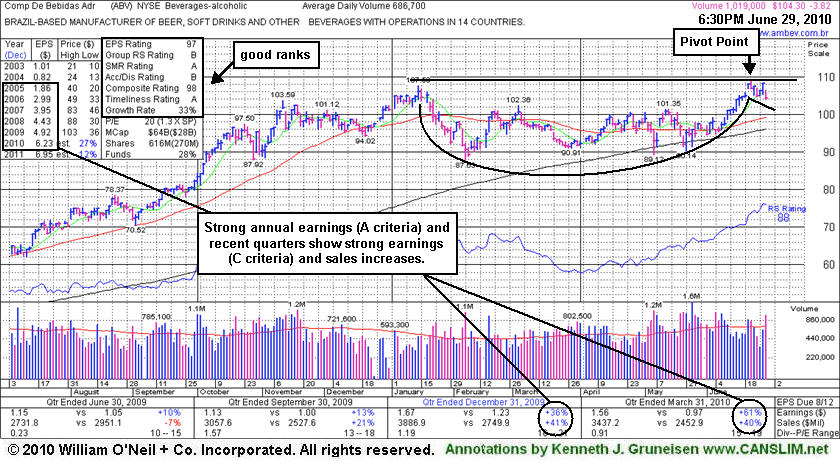

Comp De Bebidas Adr (ABV -$3.82 or -3.53% to $104.30) is a Brazil-based beverage firm that gapped down today. It was featured in yellow in the mid-day report (read here) with a note while - "perched near all-time highs after building an orderly base pattern and finding impressive support near its 200 DMA line in recent months. It has a great annual earnings (A criteria) history and its recent quarterly earnings and sales revenues increases have shown acceleration. A gain above its pivot point with heavy volume still needed to confirm a proper new technical buy signal."

The stock ended with a loss on above average volume amid broader market (M criteria) weakness. By the end of the session the market again fell into a "correction", which means a new FTD is needed before any buying efforts may be justifiable under the investment system's guidelines.