You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Sunday, February 25, 2024.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, NOVEMBER 12TH, 2019

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+0.00 |

27,691.49 |

+0.00% |

|

Volume |

790,575,270 |

+4% |

|

Volume |

1,985,205,000 |

+16% |

|

NASDAQ |

+21.81 |

8,486.09 |

+0.26% |

|

Advancers |

1,364 |

48% |

|

Advancers |

1,544 |

50% |

|

S&P 500 |

+4.83 |

3,091.84 |

+0.16% |

|

Decliners |

1,475 |

52% |

|

Decliners |

1,523 |

50% |

|

Russell 2000 |

+0.35 |

1,595.12 |

+0.02% |

|

52 Wk Highs |

119 |

|

|

52 Wk Highs |

152 |

|

|

S&P 600 |

-0.15 |

985.47 |

-0.02% |

|

52 Wk Lows |

71 |

|

|

52 Wk Lows |

107 |

|

|

|

Major Indices Hit Record Highs With Better Leadership

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

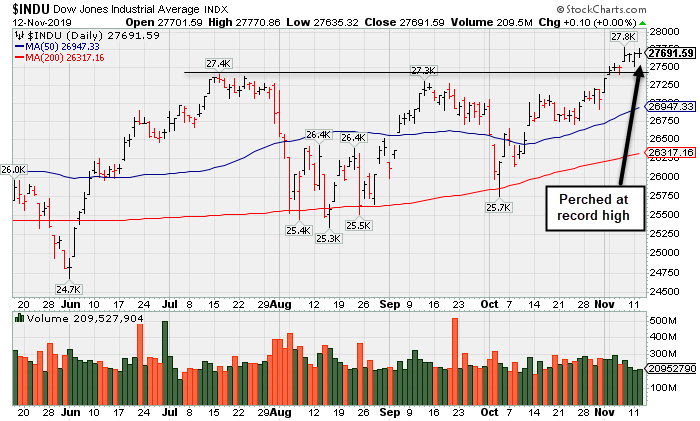

The S&P 500 added 0.2%, posting a new closing high after exceeding 3,100 for the first time during the session. The Dow ended the day unchanged, while the Nasdaq Composite closed up 0.3%, notching a fresh record level.. Decliners led advancers by a narrow margin on the NYSE while the mix was near even on the Nasdaq exchange. Volume totals reported were slightly higher than the prior session on both major exchanges. There were 64 high-ranked companies from the Leaders List that hit a new 52-week high and were listed on the BreakOuts Page, versus the total of 44 on the prior session. New 52-week highs totals solidly outnumbered new 52-week lows totals on the NYSE and on the Nasdaq exchange . The major indices (M criteria) are in a "confirmed uptrend" after enduring distributional pressure in recent weeks. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The Dow Jones Industrial Average is perched at its record high.

Stocks finished mostly higher Tuesday as investors digested comments from President Trump and weighed corporate earnings results. In a lunchtime speech to the Economic Club of New York, President Trump noted that the initial part of a broader trade deal with Beijing could be finalized soon, but he also suggested that tariffs on Chinese goods would be increased substantially if no agreement is reached.

On the earnings front, D.R. Horton (DHI +3.08%) rose after the home construction company topped Wall Street profit forecasts and projected higher 2020 sales, citing strong demand and lower mortgage rates. Rockwell Automation (ROK +10.50%) rose following positive quarterly figures from the factory equipment maker. Advance Auto Parts (AAP -7.51%) fell after its same-store sales figure missed consensus estimates. CBS Corp. (CBS -3.62%) fell after delivering disappointing revenue figures amid a sharp decline in advertisement sales. Tyson Foods (TSN +7.43%) rose following positive remarks concerning the company’s move into alternative meats. In other corporate news, Disney (DIS +1.35%) rose following the launch of its new Disney+ streaming service.

Treasuries strengthened with the yield on the 10-year note down three basis points to 1.91%. On the data front, the NFIB reported that small business optimism improved in October. In commodities, WTI crude slipped 0.1% to $56.80/barrel, while COMEX gold rose 0.1% to $1,458.80/ounce, still near its lowest level since August.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Tech Sector and Gold & Silver Index Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX -0.15%), Broker/Dealer Index ($XBD +0.13%), and the Retail Index ($RLX -0.05%) each ended the session little changed. The Networking Index ($NWX +0.21%), | | | |