You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Tuesday, February 20, 2024.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, FEBRUARY 21ST, 2020

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-227.57 |

28,992.41 |

-0.78% |

|

Volume |

1,055,772,300 |

+14% |

|

Volume |

2,729,728,700 |

+1% |

|

NASDAQ |

-174.37 |

9,576.59 |

-1.79% |

|

Advancers |

852 |

30% |

|

Advancers |

989 |

31% |

|

S&P 500 |

-35.48 |

3,337.75 |

-1.05% |

|

Decliners |

1,999 |

70% |

|

Decliners |

2,157 |

69% |

|

Russell 2000 |

-17.46 |

1,678.61 |

-1.03% |

|

52 Wk Highs |

176 |

|

|

52 Wk Highs |

129 |

|

|

S&P 600 |

-11.34 |

1,009.62 |

-1.11% |

|

52 Wk Lows |

87 |

|

|

52 Wk Lows |

67 |

|

|

|

Breadth Turned Negative as Major Indices Fell and Leadership Waned

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The S&P 500 fell 1.1% as the index posted its first weekly decline since January, down 1.3%. The Dow dropped 227 points to close below the 29,000 level, while the Nasdaq Composite slipped 1.8%. For the week, the Dow and Nasdaq Composite lost 1.4% and 1.6%, respectively. Breadth on Friday was negative as decliners led advancers by more than a 2-1 margin on the NYSE and on the Nasdaq exchange. The reported volume totals were higher than the prior session totals on the NYSE and on the Nasdaq exchange, inflated by options expirations. There were only 39 high-ranked companies from the Leaders List that hit a new 52-week high and were listed on the BreakOuts Page, down from the 139 on Wednesday's session. New 52-week highs totals contracted yet solidly outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange. The major indices' (M criteria) remain in a confirmed uptrend. Disciplined investors buy individual stocks on a case-by-case basis only if all key criteria are met. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

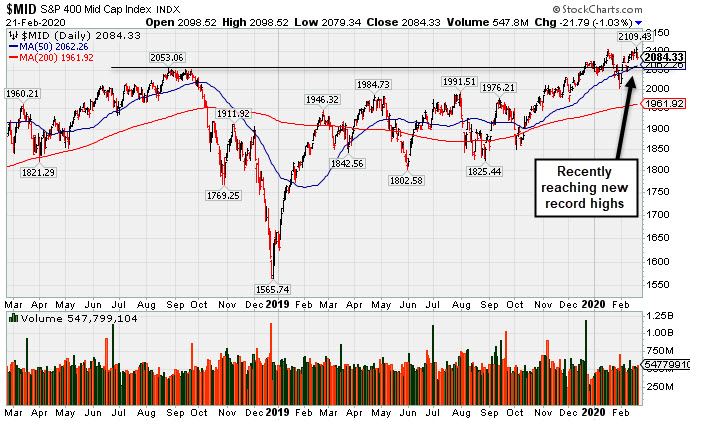

PICTURED: The S&P 400 Mid-cap Index recently has been reaching new all-time highs.

U.S. stocks finished firmly lower, while perceived safe haven assets extended their recent rally on Friday. Investors digested disappointing economic data updates and continued to weigh the global impact of the coronavirus.

On the data front, flash readings of U.S. manufacturing and services purchasing manager’s Index (PMI) from IHS Markit garnered attention. The report showed the services sector slipped into contractionary territory, while the manufacturing print came in below forecasts at a six-month low. Overseas, Japanese PMI figures also weighed on sentiment, as respondents cited the coronavirus as a primary factor weighing on travel and tourism.

Treasuries climbed, with the 10-year yield down five basis points to 1.47%. The yield on the 30-year bond declined by the same amount to 1.91%, modestly rebounding from a record low of 1.89% reached earlier in the session. In commodities, COMEX gold jumped 1.7% to $1,644.50/ounce, capping a weekly gain of nearly 4%, its best in more than six months. WTI crude shed 0.9% to $53.38/barrel, but still notched its second-straight weekly advance.

Technology shares led decliners, shedding 2.3%. In earnings, Deere & Co (DE +7.00%) rose after the company easily topped consensus profit and revenue estimates, citing stabilization in the U.S. farming business on the heels of last month’s U.S.-China trade deal. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Gold & Silver Index Rose Amid Widespread Group Losses

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX -1.24%) and the Broker/Dealer Index ($XBD -2.23%) lost ground along with the Retail Index ($RLX -1.71%). The Semiconductor Index ($SOX -2.99%) and the Networking Index ($NWX -1.29%) both fell while the Biotech Index ($BTK -0.20%) did a better job of holding its ground. The Oil Services Index ($OSX -2.63%) and the Integrated Oil Index ($XOI -1.33%) also lost ground, meanwhile, the Gold & Silver Index ($XAU +2.93%) was a standout gainer.

PICTURED: The Bank Index ($BKX -1.24%) has been sputtering below its 50-day moving average (DMA) line, a recent divergence from the Broker/Dealer Index shown on Thursday hitting a new record high (see here).

| Oil Services |

$OSX |

62.56 |

-1.69 |

-2.63% |

-20.09% |

| Integrated Oil |

$XOI |

1,120.60 |

-15.07 |

-1.33% |

-11.80% |

| Semiconductor |

$SOX |

1,891.05 |

-58.20 |

-2.99% |

+2.24% |

| Networking |

$NWX |

552.05 |

-7.21 |

-1.29% |

-5.38% |

| Broker/Dealer |

$XBD |

302.30 |

-6.89 |

-2.23% |

+4.10% |

| Retail |

$RLX |

2,644.90 |

-46.13 |

-1.71% |

+7.99% |

| Gold & Silver |

$XAU |

111.06 |

+3.16 |

+2.93% |

+3.87% |

| Bank |

$BKX |

108.01 |

-1.35 |

-1.23% |

-4.72% |

| Biotech |

$BTK |

5,302.60 |

-10.46 |

-0.20% |

+4.64% |

|

|

|

|

Featured Stocks

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

See the Featured Stocks with most recent note below. Feel free to contact us if you have a need for any additional information. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

FTNT

-

NASDAQ

FTNT

-

NASDAQ

Fortinet Inc

Computer Sftwr-Security

|

$114.48

|

-3.52

-2.98% |

$117.81

|

889,856

78.47% of 50 DAV

50 DAV is 1,134,000

|

$121.82

-6.03%

|

12/9/2019

|

$103.85

|

PP = $106.10

|

|

MB = $111.41

|

Most Recent Note - 2/19/2020 2:52:04 PM

G - It is extended from any sound base and the 50 DMA line ($113) and prior low ($112.06) define important near-term support to watch. Reported earnings +29% on +21% sales revenues for the Dec '19 quarter, continuing its strong earnings track record above the +25% minimum guideline (C criteria).

>>> FEATURED STOCK ARTICLE : Fortinet Posted Gain for Best-Ever Close - 2/4/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

SPSC

-

NASDAQ

SPSC

-

NASDAQ

S P S Commerce Inc

COMPUTER SOFTWARE and SERVICES - Application Software

|

$56.25

|

-1.52

-2.63% |

$57.78

|

129,429

76.86% of 50 DAV

50 DAV is 168,400

|

$62.26

-9.65%

|

11/29/2019

|

$56.59

|

PP = $59.24

|

|

MB = $62.20

|

Most Recent Note - 2/19/2020 2:57:11 PM

Y - Pulling back today following 4 consecutive gains for new all-time highs. Volume-driven gains above its pivot point triggered a new technical buy signal. Reported earnings +30% on +12% sales revenues for the Dec '19 quarter versus the year ago period. Found support near its 50 DMA line ($57) during its recent consolidation. Its current Relative Strength Rating of 77 is below the 80+ minimum guideline for buy candidates.

>>> FEATURED STOCK ARTICLE : Perched Near High Finding Support at 50-Day Average - 2/3/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

AUDC

-

NASDAQ

AUDC

-

NASDAQ

Audiocodes Ltd

ELECTRONICS - Scientific and Technical Instrum

|

$25.12

|

+0.11

0.44% |

$25.30

|

271,159

77.03% of 50 DAV

50 DAV is 352,000

|

$28.73

-12.57%

|

9/13/2019

|

$19.68

|

PP = $19.84

|

|

MB = $20.83

|

Most Recent Note - 2/20/2020 5:09:15 PM

G - Rebounded above its 50 DMA line ($24.95) with today's gain. Still faces resistance due to overhead supply up to the $28 level. Fundamentals remain strong after it reported earnings +30% on +15% sales revenues for the Dec '19 quarter.

>>> FEATURED STOCK ARTICLE : Rebounding After Damaging Losses Triggered Sell Signals - 2/14/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

CHDN

-

NASDAQ

CHDN

-

NASDAQ

Churchill Downs Inc

LEISURE - Gaming Activities

|

$161.24

|

-2.20

-1.35% |

$163.46

|

117,560

59.68% of 50 DAV

50 DAV is 197,000

|

$167.53

-3.75%

|

10/8/2019

|

$129.77

|

PP = $132.83

|

|

MB = $139.47

|

Most Recent Note - 2/18/2020 12:16:54 PM

G - Perched at its 52-week high following a streak of gains. Its 50 DMA line ($141.79) defines near-term support above the prior low ($132.55 on 1/03/19) The Jun and Sep '19 quarterly earnings versus the year ago periods were both below the +25% minimum guideline (C criteria) and raised fundamental concerns.

>>> FEATURED STOCK ARTICLE : Perched at New Record High After Recent Gains on Average Volume - 2/7/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LULU

-

NASDAQ

LULU

-

NASDAQ

Lululemon Athletica

MANUFACTURING - Textile Manufacturing

|

$255.90

|

-7.78

-2.95% |

$265.10

|

1,564,724

85.64% of 50 DAV

50 DAV is 1,827,000

|

$266.20

-3.87%

|

9/6/2019

|

$201.25

|

PP = $194.35

|

|

MB = $204.07

|

Most Recent Note - 2/18/2020 5:21:44 PM

G - Extended from any sound base and it hit yet another new all-time high with today's gain backed by light volume. Its 50 DMA line ($237.81) and prior low ($231.84 on 1/27/20) define important near-term support to watch. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Perched at Record High After 4th Consecutive Gain on Light Volume - 2/20/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

CPRT

-

NASDAQ

CPRT

-

NASDAQ

Copart Inc

SPECIALTY RETAIL - Auto Dealerships

|

$95.25

|

-2.05

-2.11% |

$98.40

|

3,057,386

180.70% of 50 DAV

50 DAV is 1,692,000

|

$104.88

-9.18%

|

1/2/2020

|

$92.80

|

PP = $92.51

|

|

MB = $97.14

|

Most Recent Note - 2/21/2020 5:07:28 PM

Most Recent Note - 2/21/2020 5:07:28 PM

G - Slumped to a close below its 50 DMA line ($96.35) with today's 2nd consecutive volume-driven loss triggering a technical sell signal. Reported earnings +25% on +19% sales revenues for the Jan '20 quarter. Prior highs in the $91-92 area define the next important support level.

>>> FEATURED STOCK ARTICLE : Perched at Record High With Earnings News Due - 2/18/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

SPLK

-

NASDAQ

SPLK

-

NASDAQ

Splunk Inc

Computer Sftwr-Database

|

$167.07

|

-6.34

-3.66% |

$172.00

|

1,737,609

114.92% of 50 DAV

50 DAV is 1,512,000

|

$176.31

-5.24%

|

11/25/2019

|

$147.79

|

PP = $142.16

|

|

MB = $149.27

|

Most Recent Note - 2/21/2020 5:05:23 PM

Most Recent Note - 2/21/2020 5:05:23 PM

G - Pulled back for a big loss today with higher volume, retreating from its all-time high. It is extended from the previously noted base. Its 50 DMA line ($157) defines important support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Perched at Record High After 7th Consecutive Gain - 2/19/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PAYC

-

NYSE

PAYC

-

NYSE

Paycom Software Inc

COMPUTER SOFTWARE and SERVICES - Application Software

|

$300.39

|

-9.94

-3.20% |

$309.51

|

772,209

86.28% of 50 DAV

50 DAV is 895,000

|

$342.00

-12.17%

|

11/20/2019

|

$252.97

|

PP = $259.81

|

|

MB = $272.80

|

Most Recent Note - 2/20/2020 5:12:26 PM

G - Pulled back today with near average volume after 5 consecutive gains. Its 50 DMA line ($289.56) and prior low ($288.10 on 2/06/20) define near-term support. More damaging losses would raise concerns and trigger a technical sell signal. Fundamentals remain strong after it reported earnings +41% on +29% for the Dec '19 quarter.

>>> FEATURED STOCK ARTICLE : Pulled Back Near 50-Day Average Following Strong Earnings Report - 2/11/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

BLD

-

NYSE

BLD

-

NYSE

Topbuild Corp

Bldg-Constr Prds/Misc

|

$123.01

|

-0.82

-0.66% |

$125.62

|

258,239

90.61% of 50 DAV

50 DAV is 285,000

|

$125.66

-2.11%

|

12/9/2019

|

$109.71

|

PP = $113.84

|

|

MB = $119.53

|

Most Recent Note - 2/19/2020 3:00:03 PM

G - Hitting another new 52-week high today rallying further above its "max buy" level. Prior high ($113.74) defines near-term support above its 50 DMA line ($110).

>>> FEATURED STOCK ARTICLE : Volume Totals Cooling While Consolidating Near All-Time High - 2/6/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

TEAM

-

NASDAQ

TEAM

-

NASDAQ

Atlassian Corp Plc Cl A

Comp Sftwr-Spec Enterprs

|

$145.93

|

-3.05

-2.05% |

$148.38

|

965,578

61.74% of 50 DAV

50 DAV is 1,564,000

|

$156.12

-6.53%

|

1/24/2020

|

$144.66

|

PP = $140.49

|

|

MB = $147.51

|

Most Recent Note - 2/18/2020 5:26:54 PM

G - Extended from the prior base and perched above its "max buy" level. Rallied from a cup-with-handle base pattern with volume +514% above average behind the considerable gain on 1/24/20 triggering a technical buy signal. Bullish action came after it reported earnings +48% on +37% sales revenues for the Dec '19 quarter.

>>> FEATURED STOCK ARTICLE : Atlassian Has Been Hovering Near its All-Time High - 2/12/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

GLOB

-

NYSE

GLOB

-

NYSE

Globant SA

Computer-Tech Services

|

$134.82

|

+8.83

7.01% |

$141.67

|

817,286

334.95% of 50 DAV

50 DAV is 244,000

|

$134.60

0.16%

|

11/14/2019

|

$106.87

|

PP = $112.43

|

|

MB = $118.05

|

Most Recent Note - 2/21/2020 12:30:27 PM

Most Recent Note - 2/21/2020 12:30:27 PM

G - Gapped up today hitting a new all-time high. Reported earnings +28% on +32% sales revenues for the Dec '19 quarter, continuing its strong earnings track record. It is extended from any sound base. Its prior high ($112.33) and 50 DMA line ($115.93) define important near-term support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Encountering Distributional Pressure After Wedging to New Highs - 2/5/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

STNE

-

NASDAQ

STNE

-

NASDAQ

Stoneco Ltd Cl A

Finance-CrdtCard/PmtPr

|

$43.48

|

-0.25

-0.57% |

$43.99

|

1,426,503

83.52% of 50 DAV

50 DAV is 1,708,000

|

$45.72

-4.90%

|

1/22/2020

|

$43.94

|

PP = $45.72

|

|

MB = $48.01

|

Most Recent Note - 2/19/2020 2:58:57 PM

Y - Posting a 5th gain in the span of 6 sessions. Recently found support near its 50 DMA line ($41). Subsequent gains above the pivot point backed by at least +40% above average volume are needed to trigger a technical buy signal.

>>> FEATURED STOCK ARTICLE : 50-Day Moving Average Line Violation Hurts Outlook - 2/10/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

DAVA

-

NYSE

DAVA

-

NYSE

Endava Plc Cl A Ads

Computer-Tech Services

|

$55.50

|

+0.07

0.13% |

$55.71

|

245,407

229.35% of 50 DAV

50 DAV is 107,000

|

$55.75

-0.45%

|

2/13/2020

|

$53.71

|

PP = $49.86

|

|

MB = $52.35

|

Most Recent Note - 2/21/2020 5:09:43 PM

Most Recent Note - 2/21/2020 5:09:43 PM

G - Managed a best-ever close with today's 4th consecutive volume-driven gain. Prior highs in the $49 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Breakout Gain Backed By +462% Above Average Volme - 2/13/2020 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|