Hovering At New Highs Ahead Of Earnings News

Monday, August 02, 2010 CANSLIM.net

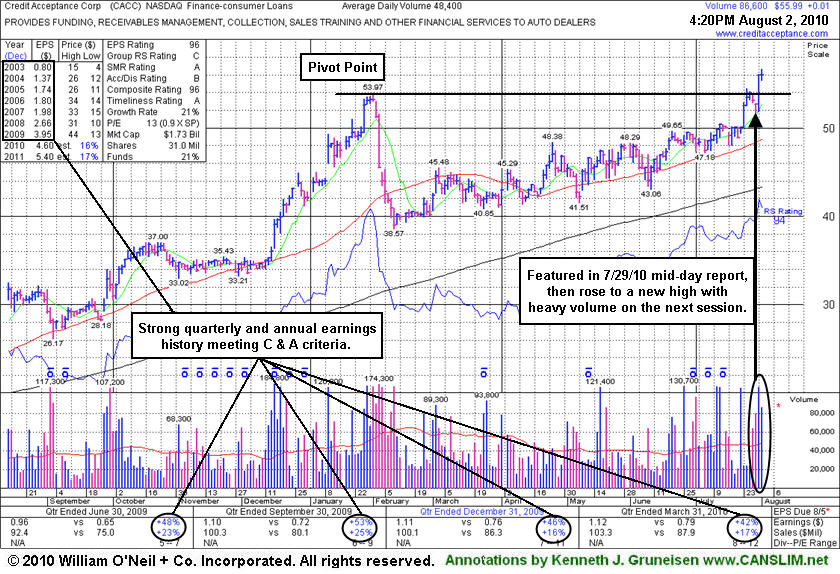

Credit Acceptance Corp (CACC -$0.12 or -0.21% to $55.86) held its ground today perched at all-time highs after its 7/30/10 gain with more than twice average volume helped it trade above its pivot point and trigger a technical buy signal. Keep in mind that volume and volatility often increase near earnings news and the high-ranked Finance - Consumer/Commercial Loans firm is due to report earnings on Tuesday, August 3rd after the close. New buying efforts may be justifiable under the investment system's strict technical buying discipline as long is not extended more than +5% above its prior chart high or pivot point. Its small supply (S criteria) of only 5.89 million shares in the public float could contribute to greater volatility in the event of any new institutional posturing. Disciplined investors remember to always limit losses if a stock falls -7-8% from their buy point.

It has steadily risen since subsequently finding support above the $38 area cited as a support level to watch, and CACC was featured in the 7/29/10 mid-day report (read here) after quietly reaching new high territory. The pivot point cited was based on its 2/01/10 high plus ten cents. It maintained a great track record of annual and quarterly sales revenues and earnings increases satisfying the C and A criteria of the fact-based investment system's fundamental guidelines. That cannot be said for its peer in the same industry group, Americredit Corp (ACF), which recently bankrupted GM made a bid to acquire the day immediately after President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Credit Acceptance Corp produced gains of as much as +61.2% since it was first featured in yellow at $33.48 in the 9/29/09 mid-day report (read here). The FSU section appearance on 2/09/10 included an annotated graph under the headline "Damaging Losses Prompted Profit Taking" and it was later dropped from the Featured Stocks list.