Outlook Better For High-Ranked Computer Software Firm

Monday, June 28, 2010 CANSLIM.net

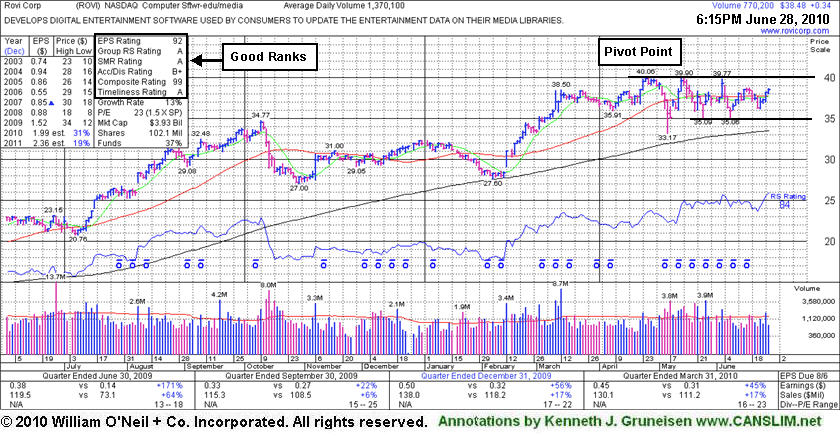

Rovi Corp (ROVI +$0.34 or +0.89% to $38.48) posted a 4th consecutive gain today that helped it climb further above its 50-day moving average (DMA) line to finish the session less than -4% off its 52-week high. Its rebound above its short-term average line helped its outlook improve, and its color code was changed to yellow again. There is not a great deal of resistance due to overhead supply. Disciplined investors will await a convincing gain above its pivot point with heavy volume to trigger a new buy signal. It makes a good candidate to have on investors' watch list, meanwhile the broader market (M criteria) action has been recently lacking leadership and enduring distributional pressure after the latest follow-through day confirmed a new rally. If the rally resumes, odds may favor this high-ranked leader continuing higher after another breakout might offer an ideal point for new or add-on buying efforts.

Its 4/23/10 gain for a new all-time high helped it clear a fresh base but was noted as it lacked sufficient volume to trigger a proper new technical buy signal. Earlier, ROVI had triggered a technical buy signal with a high-volume gain on 3/02/10 that may have signaled the beginning of a substantial advance, but thus far it made limited progress. Earnings per share increases in 3 of the past 4 quarterly comparisons versus the year ago period showed better than +25% growth.