Gap Down and Waning EPS Rank Raise Concerns

Thursday, February 04, 2010 CANSLIM.net

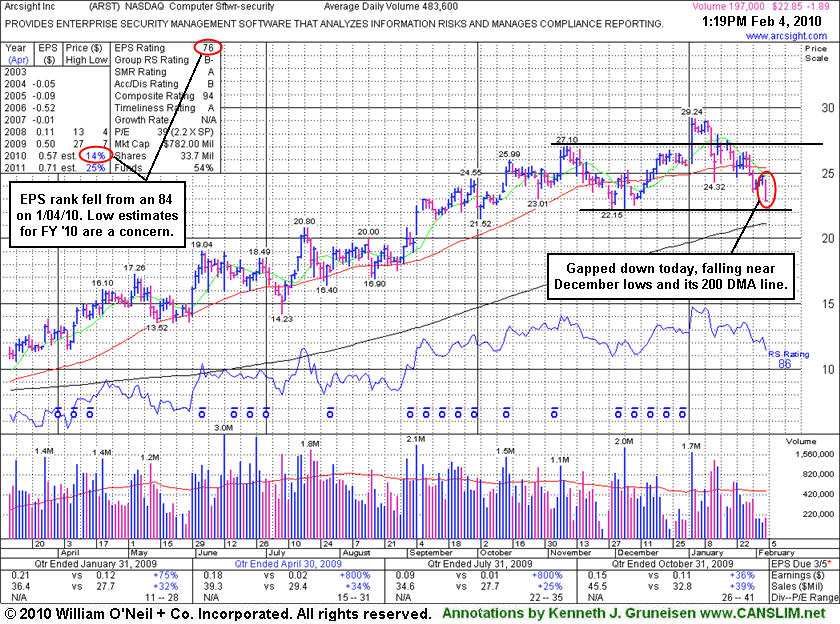

ArcSight, Inc. (ARST -$1.81 or -7.32% to $22.93) gapped down today, trading near its December lows and sinking toward its 200-day moving average (DMA) line. It would need to rebound above its 50 DMA line for its outlook to improve. Meanwhile, further deterioration below its prior lows or 200 DMA line would trigger additional sell signals. Distributional pressure negated its latest breakout. In the 1/21/10 Featured Stock Update (FSU) section (read here) we cautioned that its "close under its 12/31/09 close could prove to be a more ominous sign."

On January 4, 2010 it had gapped up and triggered a technical buy signal as it blasted above its latest pivot point. However, it failed to follow through with additional gains, then losses with above average volume negated its breakout and led to a close back in its prior base, raising concerns. In addition to the recent technical weakness, its Earnings Per Share (EPS) rank has fallen to 76 from 84 when it appeared in this FSU section on 1/04/10 under the headline "Breakout With Triple Average Volume Triggers Fresh Buy Signal." The Computer Software - Security firm has continued putting up solid sales revenues and earnings results since first featured in yellow at $19.91 in the 9/01/09 mid-day report with an annotated daily graph (read here). However, its waning EPS rank of late suggests that on a relative basis it has been lagging while other companies have been showing more explosive earnings growth during the current earnings season. ARST needs more time to potentially form a new sound base. Meanwhile, its weak action and market conditions (M criteria) leave disciplined investors waiting for a follow through day before any new buying efforts are justifiable under the investment system guidelines.