Profit Taking Pressures Mount As Distribution Troubles Market

Tuesday, October 27, 2009 CANSLIM.net

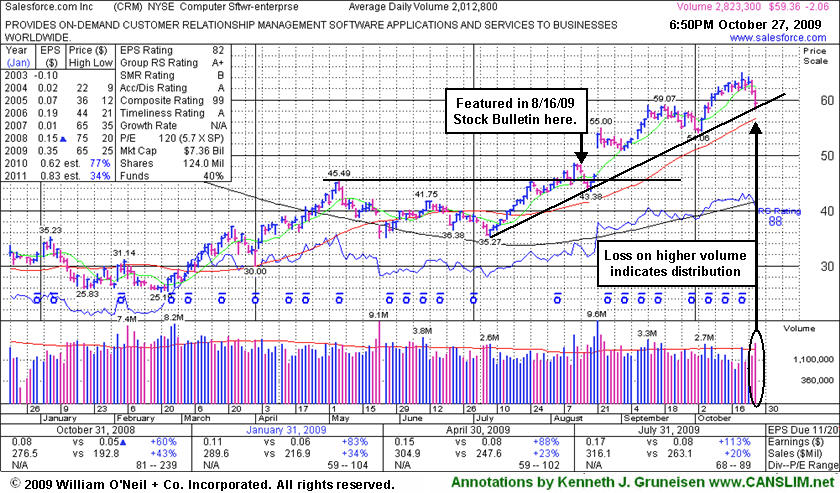

Salesforce.com, Inc. (CRM -$2.06 or -3.47% to $59.36) suffered a loss today with above average volume, raising some concerns. Prior chart highs in the $59 area coincide with an upward trendline connecting its July, August and October chart lows, helping define an important technical support level currently being tested. Its 50-day moving average (DMA) line is the next important support level to watch. The weak action in the stock coupled with the broader market deterioration (M criteria) suggests that it might be appropriate for investors to lock in profits under the investment system guidelines, especially if more worrisome losses lead to violations at the above mentioned levels.

CRM stubbornly held its ground and stayed well above its important short-term average since its "breakaway gap" for a considerable gain on 8/21/09 with more than 5 times average volume. The number of top-rated funds owning its shares rose from 269 in Sept '08 to 294 in Jun '09, which is reassuring news concerning the I criteria. Additional weakness may lead to more definitive technical sell signals, while it otherwise needs more time to possibly form a new sound base. Market action will largely dictate the outcome, since 3 out of 4 stocks typically follow the direction of the broader market averages.