Positive Reversal Near Important Chart Support

Monday, January 30, 2006 CANSLIM.net

Recognizing reversal days is a great way to stay ahead of potential changes to a stock's recent trend. A positive reversal occurs when a stock opens the session heading lower, then reverses and ultimately closes the day higher. Positive reversals are often considered more significant if the stock's initial losses drive it to a new low, but it then reverses and closes the day higher on heavier than average volume and ends near the session's utmost highs. Reversals can occur on a daily, weekly or a monthly chart. In general, when a longer time frame is involved, greater implications may be given as to the severity or significance of the reversal. Volume is directly correlated with the severity of the action as well. Negative reversals are the exact opposite, and they can commonly be spotted on the chart as a stock is in the process of topping after a enjoying a considerable rise.

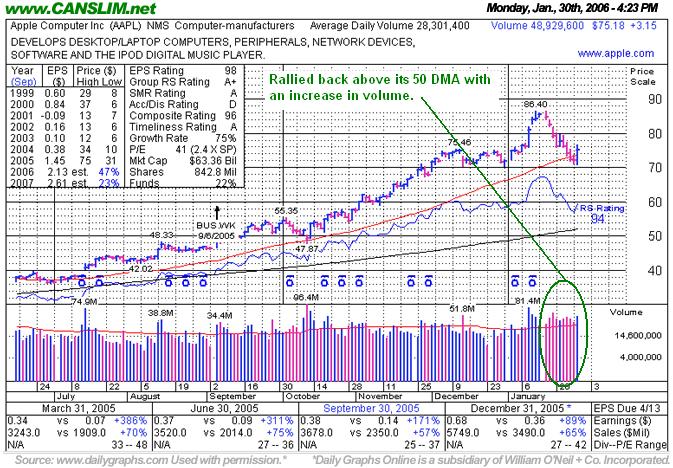

Apple Computer Inc. (AAPL 2.97 or 3.81% to $75.00) has spent the past two weeks pulling back, with a steady string of losses on above average volume definitely prompting some concern. It had a hard time making any further headway after printing a fresh all time high at $86.40 on January 12th, 2006. Of course, it bears mentioning that this issue had rallied an impressive +82% since appearing

on August 24th, 2005 in the CANSLIM.net's Mid-Day Breakouts Report (read here). After a rally of that magnitude a consolidation was in order. It spent the past two weeks pulling back, and it briefly violated its 50-day moving average (DMA) line. Today's positive reversal came just above an important chart support level ($70), and the gain on massive volume is a convincing indication that the bulls are regaining control. As long as volume continues to swell on up days then this issue is likely to continue advancing, however any subsequent losses on heavy volume leading to a close back under the recent chart lows and a violation of its 50 DMA would be considered worrisome technical sell signals.