Tuesday, December 28, 2010 - CANSLIM.net

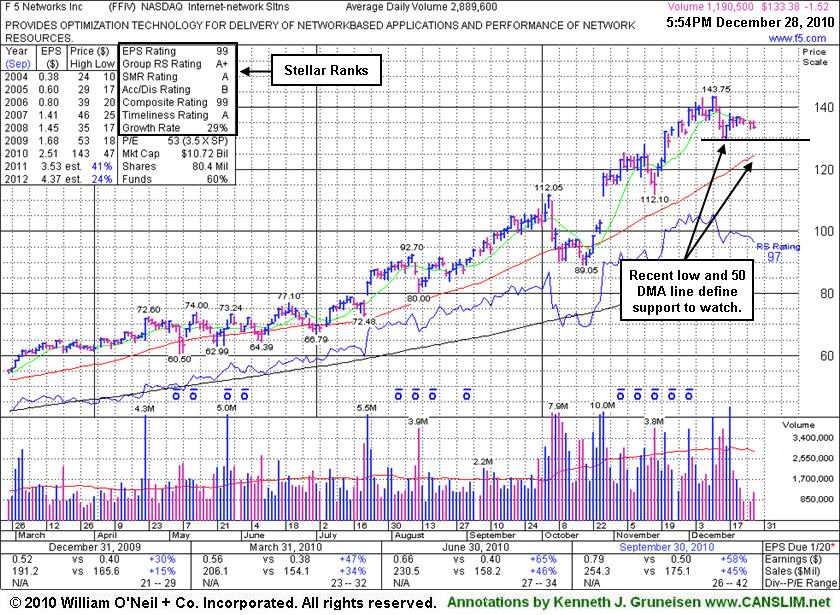

F5 Networks Inc.'s (FFIV -$1.52 or -1.13% to $133.38) volume totals have been cooling while consolidating in a tight range, and it finished today's session only -7% off its all-time high. Its recent low ($129.59 on 12/16/10) defines initial chart support well above its 50-day moving average (DMA) line. Violations leading to technical damage may trigger technical sell signals prompting investors to lock in profits. It is extended from any sound base and disciplined investors would avoid chasing it, while it still could go on to produce more climactic gains, or it might eventually form a new base we can identify.

The number of top-rated funds owning its shares rose from 900 in Dec '09 to 957 as of Sept '10, a reassuring sign with respect to the I criteria. The company currently sports a very healthy Earnings Per Share (EPS) rating of 99 and a Relative Strength (RS) rating of 97. It resides in the Internet- Networking Solutions group which is an Industry Group showing lots of leadership, satisfying the "L" criteria. Its quarterly sales and earnings results showed impressive growth satisfying the C criteria. The company has maintained a good annual earnings (A criteria) history. This stock was first featured in the January 2004 edition of CANSLIM.net News (read here) with a $26.85 pivot point. During the past 6 years, FFIV has built several bases, and it has also been through some tough consolidation periods. It has rallied up as much as +94% since returning to the Featured Stocks list when it was highlighted in yellow in the June 16th, 2010 mid-day report and its breakout above $74 was shown that evening (read here).

http://factbasedinvesting.com/