Friday, October 01, 2010 - CANSLIM.net

Netflix Inc (NFLX -$7.50 or -4.63% to $154.66) was down today for a second consecutive loss with above average volume following a negative reversal at its all-time high. The latest action is a sign of distributional pressure. It is extended from a sound base pattern and may need to spend more time consolidating. It may also go on to produce more climactic gains, however disciplined investors would avoid chasing a stock that is so extended from a sound base. An upward trendline comes into play well above its 50-day moving average (DMA) line as an initial support level to watch, where a violation may be considered an "early" sell signal.

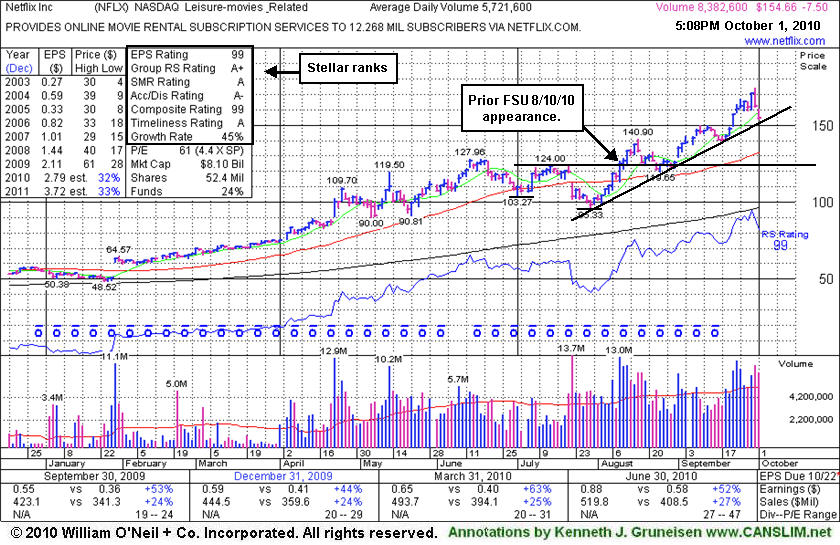

On 8/10/10 it was last shown in this FSU section under the deadline "Heavy Volume Breakout From Double Bottom Base" as it posted a solid gain with more than 3 times average volume as it rallied above the pivot point after an 8-week "double bottom" base. Technically it met the guidelines to trigger a proper buy signal as it closed strong after it was featured in that day's mid-day report (read here). Prior reports had stated that it had the "look of a possible 'climax run' in the making" and it has been repeatedly noted as "very strong in terms of key investment criteria." The annotated graph below shows its stellar ranks and shows where it was at the time of its prior FSU section appearance.

http://factbasedinvesting.com/