Tuesday, August 24, 2010 - CANSLIM.net

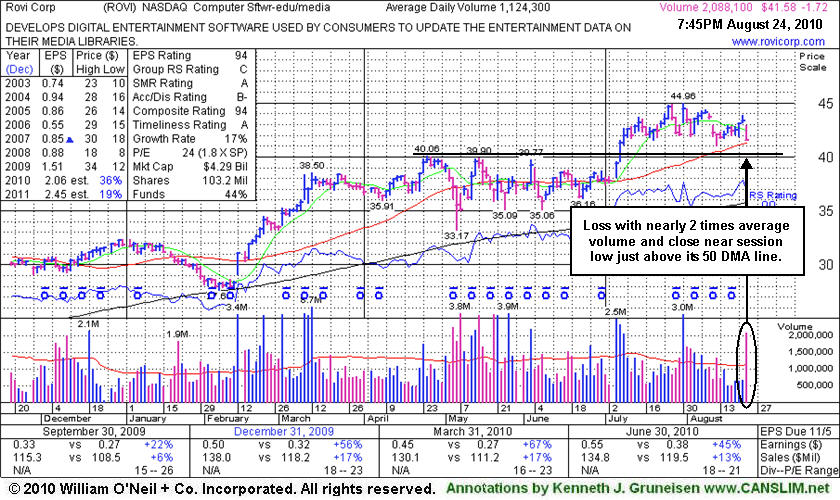

Rovi Corp (ROVI -$1.72 or -3.96% to $41.58) gapped down today for a loss with nearly 2 times average volume, sinking near its 50-day moving average line. Below that important short-term average support is defined by prior chart resistance in the $40 area. Violations may trigger technical sell signals and prompt investors to limit losses or lock in profits, especially with broader market weakness (the M criteria) recently raising concerns. Meanwhile, it is reassuring that its earnings per share increases in 3 of the past 4 quarterly comparisons versus the year ago period showed better than +25% growth and it has a decent annual earnings track record in recent years. However, the M criteria of the investment system argues that 3 out of 4 stocks will follow along with the direction of the broader market averages. Members who are following along with recently published market commentaries have seen numerous reasons cited for increased caution.

http://factbasedinvesting.com/