Friday, August 20, 2010 - CANSLIM.net

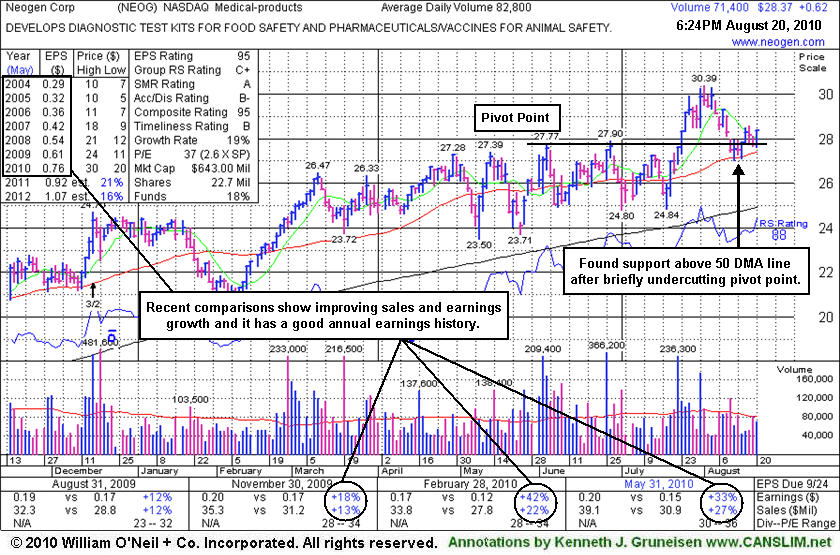

Neogen Corp.'s (NEOG +$0.62 or +2.23% to $28.37) color code was changed to yellow while consolidating in a healthy fashion just above its 50 DMA line and prior highs in the $27 area defining important technical support. Disciplined investors might consider accumulating shares on its pullback as a secondary buy point. However, weakening market conditions (M criteria) are a current concern and would argue against new buying efforts if further technical damage occurs to the major indices and this stock specifically, or both.

Its solid gain on nearly 2 times average volume resulted in it being featured in yellow the 7/22/10 mid-day report (read here) and its FSU section appearance under the headline Medical - Products Firm Returns To Featured Stocks List when it was noted - "Now it faces no resistance due to overhead supply." It went on to get extended from its prior highs and later endured some mild distributional pressure.

NEOG has a history of steady annual earnings growth (A criteria). The 2 most recent quarterly comparisons have shown improving sales revenues growth with earnings per share increases above the investment system's +25% guideline. Remember to always limit losses per the 7-8% sell rule, and never hold a stock if it falls more than that much from your purchase price. Years ago, this stock was first featured on Thursday, February 21, 2008 in the CANSLIM.net Mid Day Breakouts Report (read here) and it was later dropped from the Featured Stocks list.

http://factbasedinvesting.com/