Monday, June 21, 2010 - CANSLIM.net

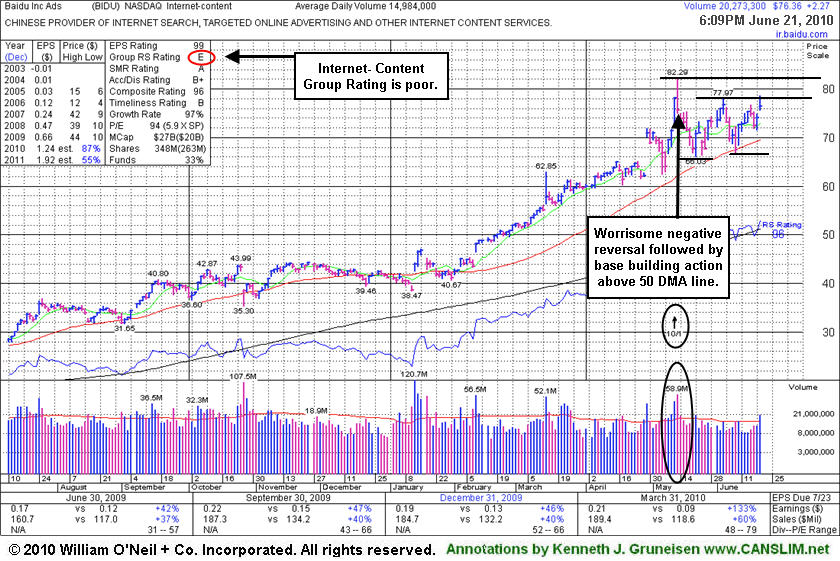

The current market (M criteria) conditions have improved since a follow-through-day recently confirmed a new rally. That is not a reason to select stocks with flaws in their bases, and it is not a guarantee that perfect-looking leaders will go on to rally substantially either. Investors usually have the best odds when they remain disciplined and trade based upon the long-standing guidelines of the fact-based investment system. High-ranked Internet - Content firm Baidu.com, Inc. (

BIDU has a stellar sales and earnings history that satisfies the C & A criteria, in fact, the quarter ended March 31, 2010 showed sales revenues and earnings growth accelerating impressively. However, it saw a slight decline in the number of top-rated funds owning shares from being reported at 204 in Dec '09 to 201 in Mar '10. Another concern that makes it a less favorable candidate under the system guidelines is the lack of leadership (L criteria) in the group, with the Internet - Content group currently ranked very low. Yet, a reassuring characteristic to its consolidation is that it has found support at its 50-day moving average (DMA) line. Volume totals have also cooled behind recent distribution days since its worrisome negative reversal from its all-time high on 5/13/10. Its share price was impacted by a 10:1 stock split as of 5/12/10, and the split reduced the share price while it greatly increased the supply of shares (S criteria) outstanding. The best market winners typically has smaller supplies closer to its pre-split levels.

Keep in mind that BIDU has traded up more than 8-fold, and it has not been a smooth ride since it first featured on Monday, October 30, 2006 in the CANSLIM.net Mid Day Breakouts Report (read here). After making great progress it went through a multi-month consolidation under its 50 and 20 DMA lines, then later returned as a noteworthy leader featured in CANSLIM.net reports. An annotated graph showed a vivid picture at the beginning of the stock's period of greatest weakness back on January 11, 2008 under the headline, "Weakness Hurting Chances For Featured Favorite" (read here). Take a look back at that now! Remember that a dropped stock can be featured again in a future CANSLIM.net report if it repairs its technical damage and forms a new pivot point.

http://factbasedinvesting.com/