Friday, March 12, 2010 - CANSLIM.net

| Ulta Salon Cosmetics & Fragrance, Inc. |

CLICK HERE to see the Profile Page for this stock with current details and historic information | |

|

Ticker Symbol: ULTA (NASDAQ) |

Industry Group: Retail - Miscellaneous |

Shares Outstanding: 58,100,000 |

|

Price: $22.80 3/12/2010 2:04PM |

Day's Volume: 1,398,400 2:04PM |

Shares in Float: 28,500,000 |

|

52 Week High: $21.74 3/08/2010 |

50-Day Average Volume: 337,800 |

Up/Down Volume Ratio: 1.4 |

|

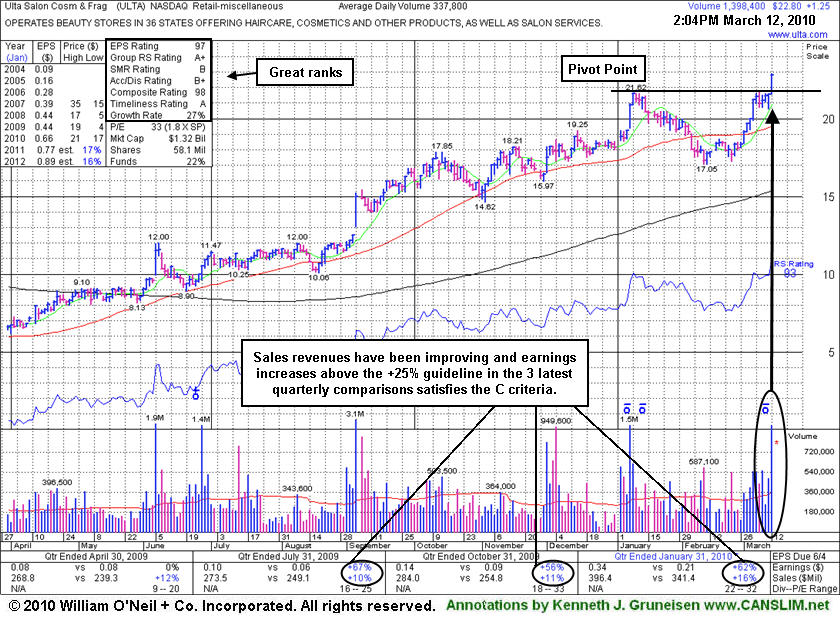

Pivot Point: $21.72 1/08/2010 (high plus $0.10) |

Pivot Point +5% = Max Buy Price: $22.81 |

Web Address: http://www.ulta.com/ |

CANSLIM.net Profile: Ulta Salon Cosmetics & Fragrance, Inc. (ULTA) is a high-ranked leader in the Retail - Misc group which has shown accelerating sales revenues increases. Strong quarterly earnings increases above the +25% guideline in the 3 latest quarterly comparisons satisfies the C criteria. The stock resides in the Retail - Miscellaneous group which has a current Relative Strength rank of 93, indicating leadership that helps satisfy the L criteria. The number of top-rated funds with an ownership interest has grown from 49 funds in March '09 to 72 funds as of Dec '09 which is an encouraging sign of increasing institutional interest (the I criteria). Management's 51% ownership stake keeps the company's directors very motivated to look after and build shareholder value.

What to Look For and What to Look Out For: The stock is currently trading near its "maximum buy" price after a considerable gain today on heavy volume, a strong technical move in response to its improving fundamentals. Patience may allow its shares to be accumulated on light volume pullbacks toward its prior chart highs which are now an important support level to watch. Healthy stocks typically pull back and retest prior chart highs about 40% of the time before finding support and continuing higher. In bull markets they rarely will dip more than 7% below their pivot points. Near earnings news, investors may expect that volume and price action can be very volatile, and any reversal into its prior base would raise concerns. It is important to remain disciplined. Chasing it after it trades above its maximum buy price of $22.80 may not be a prudent move. The bulls remain in control as long as this stock continues trading above its pivot point.

Technical Analysis: It was featured in the mid-day report today (read here) as a considerable gain with heavy volume helped it reach a new 52-week high, rising from an 8-week cup shaped base following strong results for the quarter ended January 31, 2010. It was color coded yellow with a pivot point cited based on its 1/08/10 high plus ten cents. It has rallied from March '09 lows near $4, and it has encountered little distributional pressure during that period. Meanwhile it has shown numerous weekly gains with above average volume, including the 2 latest weeks while rallying from a consolidation below its 50-day moving average. It now faces no resistance due to overhead supply.

http://factbasedinvesting.com/