Wednesday, April 26, 2006 - CANSLIM.net

|

Lifecell Corp |

||

|

Ticker Symbol: LIFC (NASDAQ) |

Industry Group: Biotechnology |

Shares Outstanding: 33,250,000 |

|

Price: $26.64 11:47AM ET |

Day's Volume: 2,850,132 4/26/2006 11:47AM ET |

Shares in Float: 32,510,000 |

|

52 Week High: $25.57 9/12/2005 |

50-Day Average Volume: 633,080 |

Up/Down Volume Ratio: 1.3 |

|

Pivot Point: $25.67 9/12/2005 high plus $0.10 |

Pivot Point +5% = Max Buy Price: $26.95 |

Web Address: http://www.lifecell.com/ |

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports

CANSLIM.net Profile :

LifeCell Corporation (LIFC) engages in the development and marketing of human-derived tissue-based products for use in reconstructive, orthopedic, and urogynecologic surgical procedures to repair soft tissue defects. It produces a regenerative human tissue matrix, a three-dimensional structure that contains vascular channels, proteins, and growth factor binding sites, that provide a template for the regeneration of normal human tissue. The company's products include AlloDerm, Cymetra, GraftJacket and GraftJacket Xpress, AlloCraftDBM, and Repliform. The are sold primarily to plastic surgeons, general surgeons, burn surgeons, as well as ear, nose, and throat surgeons. It operates primarily in the United States and has strategic sales and marketing partnerships with Boston Scientific, Wright Medical Group, Inc., Stryker Corporation and BioHorizons. Percentage earnings increases over the year earlier quarter have been in the triple digits for the past 4 quarterly comparisons (satisfying the "C" criteria) and it has achieved a history of strong annual earnings increases (the "A" criteria). The number of top rated funds owning an interest has risen from 35 funds in March '05 to 66 funds as of December '05, and in general its shares are being accumulated. LIFC is a member of the 68th ranked Medical-Biomed/Biotech sector for relative price performance out of 197 industry groups, however that is down from 10th position six months ago.

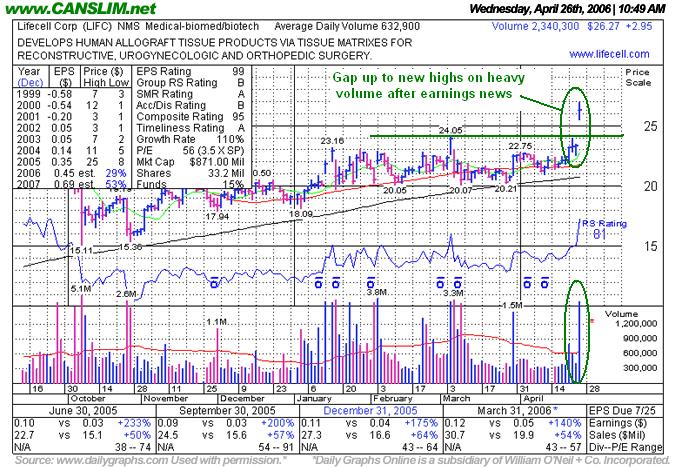

What to Look For and What to Look Out For: For the best results it is often wise to avoid buying stocks extended beyond guidelines, so use some patience. The move above the $24.05 mark (its 03/06/06 high) is significant, and it may be more attractive to buy near that level which would now be considered a key chart support level on any retracement. Had one used that old high to compute the pivot for a more conservative entry price it would have been better. However, in this case, the rise above its September 12th, 2005 high ($25.57) is significant because it is now free of all chart resistance due to overhead supply. Only a serious reversal and technical breakdown beyond 7-8% from one's purchase price would serve as a decisive technical sell signal.

Technical Analysis: Reporting solid quarterly earnings results (see news) and encouraging guidance served as a fundamental catalyst for LIFC to rise today above resistance for a very impressive technical breakout. It gapped up to new highs with a classic sign of heavy institutional buying demand (the "I" criteria), as it is obvious when your volume swells to 3.8 million shares traded near lunchtime on a stock that normally trades about 632,000 shares daily. The breakout to new all-time highs may be the beginning of a substantial and sustained rise, which is why there is always a focus on stocks with very heavy volume behind a meaningful rise in price.

http://factbasedinvesting.com/